You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

2014-06-23 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

if actual > forecast = good for currency (for EUR in our case)

[EUR - French Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

==========

French manufacturing PMI falls to 6-month low of 47.8 in June

Manufacturing activity in France contracted at the fastest pace in six months in June, underlining concerns over the economic outlook of the euro zone’s second-largest economy, preliminary data showed on Monday.

In a report, market research group Markit said that its preliminary French manufacturing purchasing managers’ index fell to a seasonally adjusted 47.8 this month from a reading of 49.6 in May. Analysts had expected the index to dip to 49.5 in June.

Meanwhile, the preliminary services purchasing managers’ index weakened to a seasonally adjusted 48.2 this month from 49.1 in May and worse than expectations for a reading of 49.4.

A reading above 50.0 on the index indicates industry expansion, below indicates contraction.

Commenting on the report, Paul Smith, Senior Economist at Markit said, “The data are consistent with another disappointing GDP outturn for Q2 following stagnation in the first quarter.”

Following the release of the data, the euro turned lower against the U.S. dollar, with EUR/USD shedding 0.03% to trade at 1.3596, compared to 1.3610 ahead of the data.

Meanwhile, European stock markets were modestly lower after the open. The Euro Stoxx 50 dipped 0.2%, France’s CAC 40 declined 0.1%, London’s FTSE 100 slumped 0.1%, while Germany's DAX fell 0.1%.

US Stocks Make A New High, Euro Defies Reality And The Aussie Rejects The Top Of The Box

It's tough to be a bear in US stocks at the moment and equally almost boring to be announcing marginal new highs almost every other day.

Such was the case as the Dow and S&P 500 set new all-time closing highs again on Friday. However marginal this new highs might be the reality is that Janet Yellen by saying this week that she didn't believe the data has made a remarkable departure from the central banker rule book and given sellers just another poke in the eye.

But that is not to say that there are not plenty of voices and views out there that the Fed Chair is wrong and will,be caught behind the curve Yellen seems to have signalled that she and her colleagues on the FOMC are comfortable with that notion.

So at the close of play Saturday morning and with no data out the Dow was 0.2% higher at 16,947, the Nasdaq rose a similar amount and the S&P 500 was also 0.2% higher closing at 1,962.

The S&P 500 rally is unrelenting but when you look at in on a monthly basis there is one easy question to ask yourself – is it sustainable? I would refer you to a chart of Gold or Bitcoin.

In my best John Wayne voice – Is that a Bubble I see before me???

In Europe the FTSE closed higher, up 0.25% to 6,825, but on the continent it was a sea of red with the DAX down 0.17%, the CAC fell 0.48% while in Madrid stocks fell 0.29%.Stocks in Milan however crashed more than 1%.

Bonds in the US were unchanged with the 10′s closing at 2.61% while rates in Europe were up a little with Gilts at 2.76% up 2 while Spanish and Italian rates up 4 points.German 10 year bunds rose 1 point. Now if you want a bit of anecdotal evidence of Central banker induced market excess then don't miss this article from BI US about investors investing in a classic credit bull market bond.

On the ASX the September SPI 200 futures rose 10 points to 5,391 after a really poor and somewhat unexpected hosing that we saw on the ASX on Friday when the physical finished down 0.9%. Iron ore ripped $2.50 higher on Friday so this should help the tone today.

Turning to currency markets and the US dollar came under some pressure before recovering to 102.06 against the Yen. Sterling closed at 1.7010 and the Aussie is back below 94 cents at 0.9387. Euro closed just under 1.36 even though German PPI fell 0.2% in May to 0.8% year on year. Go figure!

The Aussie has opened up weaker this morning trading at 0.9374, perhaps a little worried about Chinese flash PMI or perhaps its just sellers who reckon it can't hold above 94 so they will sell.

Darvas would be proud!

On commodity markets iron ore was really strong Friday as noted above closing relatively strongly at $93.00 for the September contract. Newcastle coal was down 30 cents tonne to $71.10 for September. Nymex June crude was up 0.78% as things in Iraq get ugly and it closed at $107.30. Gold finished at $1314 down a little on the high in Asia on Friday while silver closed at $20.86 oz. Copper was really strong up 4 cents to $3.12 lb. It was mixed on the ags with corn up 0.61% while wheat fell 1.39% and soybeans dropped 0.35%.

On the data front we kick off today This week in Asia kicks off with the Chinese and Japanese flash PMI's today but in another cracking story from BI US (Friday was one of their best day/nights in ages) is this story on the hard landing that isn't. Tonight we have a raft of PMI's in Europe and the US.

-----

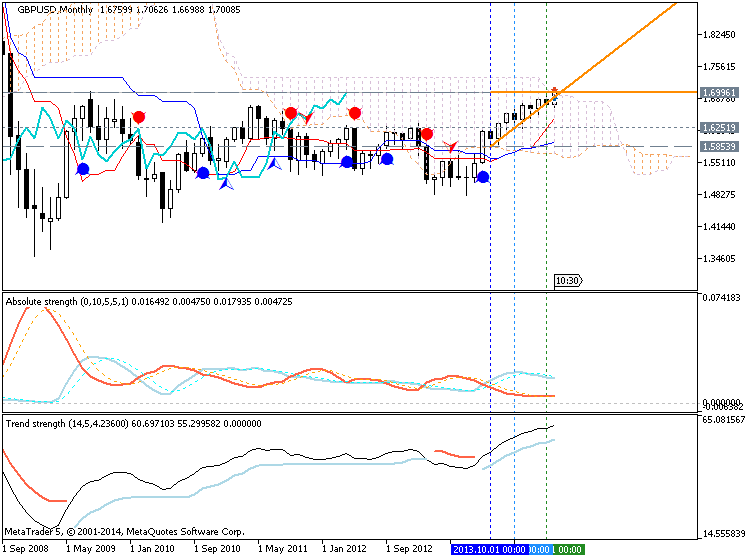

GBP/USD holds near 6-year highs

The GBP/USD remains near 6-year highs, having managed to close last week above the 1.7000 mark and underpinned by solid manufacturing data from China.

The greenback trades a tad softer across the board amid better sentiment after China’s HSBC PMI came in at a 7-month high of 50.8, first time above the 50 mark this year. The dollar also continues to suffer after a FOMC meeting last week, which offered little indication the Fed will hike rates anytime soon, contrasting BoE's recent comments.

The GBP/USD rose to a daily high of 1.7048 and it is currently trading at the 1.7040 zone, 0.18% above its opening price.

GBP/USD levels to watch

Immediate resistance levels for the Cable line up at 1.7062 (2014 high Jun 19), 1.7100 (psychological level) and 1.7180 (Oct 10 2008 high). On the flip side, supports are now seen at 1.7000 (psychological level), 1.6947 (10-day SMA) and 1.6920 (Jun 18 low).

Banks speed up shift to forex automation

Banks including Barclays and UBS are accelerating a shift towards automation in foreign exchange and rates trading as they move to slash costs and reduce the risk of further price manipulation scandals.

Senior bankers are aiming to minimise human intervention because traditional trading over the phone has come under an intense regulatory spotlight. Authorities around the globe are investigating alleged manipulation of benchmarks such as currency fixes and interbank lending rates.

“We already have around 90 per cent of spot foreign exchange going from trade to settlement via automated processes and we expect that to increase,” Antony Jenkins, chief executive of Barclays, told the Financial Times.

“There is going to be further and faster automation of much of what is considered investment banking today.”

Swiss rival UBS, like Barclays one of the four biggest traders in the foreign exchange market, is also seeing more volume migrating to electronic means over the next three years, people close to the situation said.

About two-thirds of UBS’s forex business is conducted through its Neo platform. This is in line with overall markets where 65 per cent of the $2tn a day in spot trading is electronic, according to data from the Bank for International Settlements.

The push towards digital trading underlines how probes into potential benchmark rigging are speeding up a reshaping of once opaque but lucrative businesses to become more heavily regulated and less risky.

The shift to automation of many areas of investment banking is expected to lead to thousands more job losses in an industry that is already under pressure to rein in costs.

Bankers say the flipside is that margins in automated trading are much lower, a factor that plays into the hands of those banks with the largest scale.

Some bankers warn that equity markets tell a cautionary tale about the unforeseen consequences of automation. “The debate about high-frequency trading shows that [a high degree of digital trading] can cause problems. You may get more volatility because machines will just do things,” a top executive at a European bank said.

Barclays has been one of the fastest to automate its forex trading through its Barx platform. It had the fourth-largest market share in electronic trading last year, according to Euromoney data.

Mr Jenkins said the lender was planning to increase the switch to automation across much of its macro business, which includes rates and commodities trading.

“For much of the more vanilla types of trading activities we will see increased automation, and we’re leading the way on that, particularly in our macro business,” he said. “And we’re doing that because automation leads to a better client experience, at lower cost, with stronger control.”

The move away from old-fashioned trading over the phone coincides with an exodus of “voice” traders from banks, as some are fired or suspended amid internal probes and others leave voluntarily in disillusionment over heightened regulatory scrutiny and a sharp drop in revenues.

Sassan Danesh, managing partner at Etrading Software, a consultancy group, said: “The days of voice trading are numbered, even for larger orders.

“But there is a difference between electronic trading and zero touch. There will still be sales people talking to clients.”

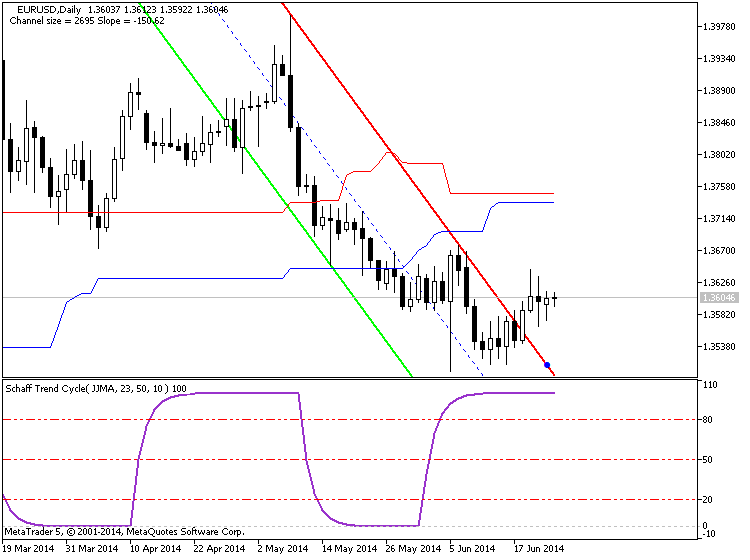

EUR/USD: Euro Steady As PMIs Disappoint

The EUR/USD is stable on Monday, as the pair trades slightly below the 1.36 line in the European session. On the release front, the week started off on a sour note as Eurozone, German and French PMIs all softened in May. In the US, today's highlight is Existing Home Sales, a key event.

Eurozone PMIs are key indicators of growth in the services and manufacturing sectors, and across the board, the May data was worse than a month earlier. The German and Eurozone numbers remained above the 50-point level, pointing to expansion. However, the French figures remained below the 50 mark, pointing to continuing contraction in the manufacturing and services sectors of the Eurozone's second largest economy. A worrying trend is that with the exception of Eurozone Services PMI, all of the PMIs posted their weakest reading in 2014.

Unlike his peers at the BOE and Federal Reserve, ECB head Mario Darghi is not being coy about possible interest rate hikes. On the weekend, Draghi stated flat out that he did not foresee the ECB raising rates before 2017. Draghi noted that the ECB had extended access by European banks to unlimited liquidity until that time, and that the Eurozone recovery was still weak. However, traders should not treat Draghi's remarks as etched in stone, as the ECB will likely have to raise rates if the economy recovers faster than anticipated.

There was positive economic news out of the US on Thursday, as Unemployment Claims dipped to 312 thousand last week, beating the estimate of 316 thousand. As well, the Philly Fed Manufacturing Index, which has been on the upswing for most of 2014, continued the trend and improved to 17.8 points, crushing the estimate of 14.3. This was the index's strongest reading since last August, and points to a manufacturing sector which is expanding in order to keep up with increasing demand. The ECB lowered interest rates to record levels earlier in June, so we'll have to wait for the June PMI numbers to see if the ECB moves lead to an improvement in PMI figures.

On Wednesday, the Federal Reserve continued to taper to its QE program, reducing the scheme by $10 billion, to $35 billion/month. If all goes as planned, the Fed could wind up QE in the fall. The Fed also hinted that interest rates will continue to stay low for the foreseeable future, which likely means that we won't see any rate hikes before the first quarter of 2015. With regard to economic activity, the Fed noted that the recovery is continuing, but it reduced its forecast of economic growth to 2.1-2.3%, down from an earlier forecast of around 2.9 percent. The bottom line? There were no dramatic items in the Fed statement, with one analyst describing current Fed policy as "steady as she goes". The perception that US interest rates will remain at ultra-low levels weighed on the US dollar last week.

Topping the list of stocks with abnormal volume in yesterday’s trading is Cimarex Energy (NYSE: XEC), with 12.8x normal volume. In the prior session, XEC traded 13.38 million shares, versus normal volume of about 1.05 million. On Friday, S&P MidCap 400 constituent Cimarex Energy replaced International Game Technology in the S&P 500, and International Game Technology replaced Cimarex Energy in the S&P MidCap 400.

Coming in at #2, Washington Federal (NASD: WAFD) saw 10.7x normal trading volume, with volume of 4.19 million shares versus the usual 391,073.

Looking for abnormal volume stand-outs, we comb through the closing trading data for the Russell 1000 components, to find these stand-outs that traders will be interested to watch during Monday’s upcoming session. To compile the list (see below), we first calculate “normal” volume for each stock by computing the average over the trailing three month period, and then we compare that figure against the volume seen during the session.

Coming in at #3, Carmax (NYSE: KMX) saw 7.4x normal trading volume, with volume of 12.15 million shares versus the usual 1.64 million. CarMax reported record results for the first quarter ended May 31, 2014. Net sales and operating revenues increased 13.3% to $3.75 billion. Net earnings grew 15.7% to $169.7 million. Net earnings per diluted share rose 18.8% to $0.76.

Coming in at #4, ITC Holdings (NYSE: ITC) saw 6.7x normal trading volume, with volume of 5.31 million shares versus the usual 792,377. ITC Holdings announced that it has entered into an accelerated share repurchase program (ASR) with JPMorgan Chase Bank, National Association for up to $150 million of the company’s common stock. The ASR is part of ITC’s board-approved share repurchase program authorizing the repurchase of up to $250 million through December 31, 2015, as originally announced on April 15, 2014.

And finally, Apple (NASD: AAPL) ranked #5 on the list, with 6.3x normal volume, seeing about 100.81 million shares change hands, compared to normal volume of 15.88 million. Apple introduced a new 21.5-inch iMac. The new 21.5-inch iMac features a 1.4 GHz dual-core Intel Core i5 processor with Turbo Boost Speeds up to 2.7 GHz, Intel HD 5000 graphics, 8GB of memory and a 500GB hard drive.

Comparing these stocks on a trailing twelve month basis, below is a relative stock price performance chart, with each of the symbols shown in a different color as labeled in the legend at the bottom:

Here’s a table of the full top 10 stocks with abnormal volume:

Trading Video: EURUSD a Better Trade Opportunity Despite GBPUSD Event Risk?

There are high-profile and long-term trade patterns shaping up in the FX market, but the more probable opportunities are the shorter-term range and breakouts. Market Conditions - as a third dimension to trade and systemic analysis - still favors short-term developments. That means a wedge formation from the EURUSD on the two-hour chart carries better potential than the high-profile GBPUSD break above 1.7000 or the pent up pressure for USDJPY in a multi-year technical pattern. With that in mind, we head into noteworthy event risk from the UK and key technical levels for a range of currencies with expectations for what is reasonable from the markets. We discuss this and more in today's Trading Video.

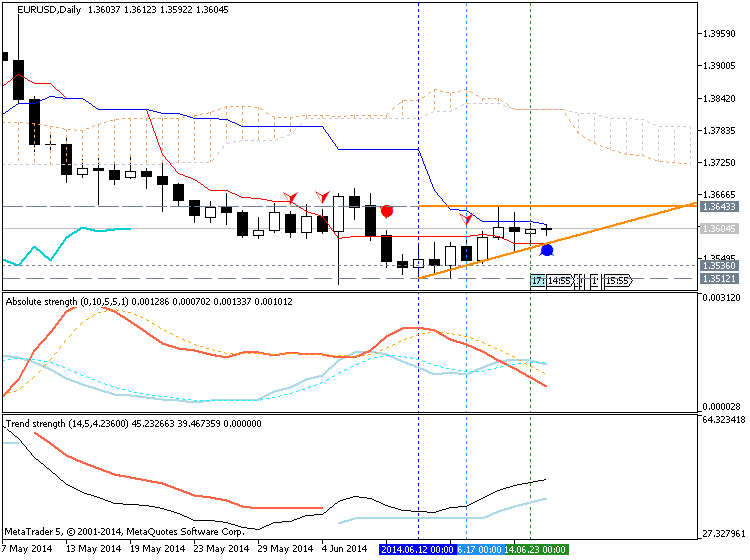

EUR/USD: Break above 1.3650 may neutralize heavy bias - OCBC

Emmanuel Ng, FX Strategist at OCBC Bank, shares his view on the EUR/USD, noting that 1.3650 needs to be re-taken to ease the selling pressure.

Key Quotes

"German June Ifo numbers are scheduled for release later today and the EUR-USD may continue to mark time in the 1.3600 neighborhood in the interim . As noted yesterday, a sustained break above the 1.3600-1.3650 neighborhood may neutralize our inherent heavy bias for the pair. On a more structural note, the pair’s eventual direction is expected to be determined by the tussle between ECB-inspired dovishness and prevailing broad based USD vulnerability."

2014-06-24 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

if actual > forecast = good for currency (for EUR in our case)

[EUR - German Ifo Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers. It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment.

Acro Expand : Information and Forschung (Ifo).

==========

German IFO disappoints with 109.7 – EUR/USD follows

IFO follows ZEW in showing worse than expected German business sentiment: IFO Business Climate drops to 109.7 points. Current Assessment dropped to 114.8 points and Expectations all the way from 106.2 to 104.8 points. The German IFO Business Climate for June was expected to tick down from 110.4 to 110.2 points. The Current Assessment component was predicted to tick up from 114.8 to 115 points and the “Expectations” figure carried estimations for a drop from 106.2 to 105.9 points.

EUR/USD managed to retake the 1.36 level before the publication and is now falling below this line. So far, there seems to be no danger to the 1.3585 support line. Nevertheless, the publication shows that Germany isn’t strong enough to pull the euro-zone forward.

Update: After the initial dip, EUR/USD recovers. Has the “buy the dips” mentality returned?

IFO is considered to be Germany’s No. 1 Think-Tank. However, the ZEW institute publishes its business sentiment before IFO. Yesterday’s purchasing managers’ indices weren’t too kind to the euro-zone economies.

EUR/USD managed to rise after the dovish FOMC stance from the US, but it is important to note that the euro was unable to fully capitalize on the weakness of the US dollar.

Support awaits at 1.3585, which is a clear separator of ranges. Resistance is at 1.3650.