You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The U.S. dollar edged higher against the yen on Friday, to eke out a small weekly gain after the Federal Reserve indicated that rates would remain on hold despite the improving U.S. economic outlook.

USD/JPY edged up to 102.07 late Friday from 101.93 on Thursday. For the week, the pair eked out a gain of 0.10%.

The pair is likely to find support at 101.60 and resistance at 102.40.

The greenback came under pressure after the Fed gave no indication of when interest rates could start to rise at the conclusion of its two-day meeting on Wednesday. In addition, the Fed’s forecast of where interest rates might reach in the long term fell from 4% to 3.75%.

The central bank cut its bond purchases by $10 billion a month, to $35 billion, saying there was "sufficient underlying strength" in the U.S. economy to continue tapering.

Despite this, the Fed lowered its forecast for growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously, due to "unexpected contractions" in the first quarter as a result of the unusually harsh winter.

The Fed acknowledged the recent increases in inflation and drop in unemployment, but Chair Janet Yellen said no formula was in place for when interest rates would start to rise.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, edged up to 80.41 late Friday from lows of 80.24 on Thursday. For the week, the index lost almost 0.3%.

Elsewhere, the yen ended the week lower against the firmer euro, with EUR/JPY ending Friday’s session at 138.84, for a weekly gain of 0.59%.

In the coming week, the U.S. is to release what will be closely watched data on consumer confidence, durable goods orders and home sales. Friday’s Japanese data on retail sales and inflation will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 23

- Bank of Japan Governor Haruhiko Kuroda is to speak at an event in Tokyo; his comments will be closely watched.

- The U.S. is to release preliminary data on manufacturing activity and private sector data on existing home sales.

Tuesday, June 24- The U.S. is to release private sector data on consumer confidence, as well as a report on new home sales.

Wednesday, June 25- The U.S. is to publish data on durable goods orders, as well as revised data on first quarter growth.

Thursday, June 26- The U.S. is to release data on personal income and expenditure, as well as data on inflation linked to personal spending.

Friday, June 27The dollar pushed higher against the Swiss franc on Friday, trimming the week’s losses after the Federal Reserve signaled that interest rates will remain low for a considerable time after the bank’s asset purchase program ends.

USD/CHF eased up 0.12% to 0.8949 late Friday, paring the week’s losses to 0.58%.

The pair is likely to find support at 0.8909, Thursday’s low and resistance at 0.8998, Wednesday’s high.

The greenback weakened broadly after the Fed gave no indication of when interest rates could start to rise at the conclusion of its two-day meeting on Wednesday. In addition, the Fed’s forecast of where interest rates might reach in the long term fell from 4% to 3.75%.

The central bank cut its bond purchases by $10 billion a month, to $35 billion, saying there was "sufficient underlying strength" in the U.S. economy to continue tapering.

Despite this, the Fed lowered its forecast for growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously, due to "unexpected contractions" in the first quarter as a result of the unusually harsh winter.

The Fed acknowledged the recent increases in inflation and drop in unemployment, but Chair Janet Yellen said no formula was in place for when interest rates would start to rise.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, edged up to 80.41 late Friday from lows of 80.24 on Thursday. For the week, the index lost almost 0.3%.

The Swiss National Bank kept its benchmark interest rate unchanged close to zero on Thursday and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro.

The accompanying rate statement released after the announcement said the Swiss franc is “still high.”

The SNB said it would continue to enforce the minimum exchange rate of 1.20 per euro with the utmost determination and reiterated that it is prepared to purchase foreign currency in “unlimited quantities” and take further measures if required.

In the coming week, the U.S. is to release data on consumer confidence, durable goods orders and home sales, while Switzerland is set to release its latest trade data.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 23

- The U.S. is to release preliminary data on manufacturing activity and private sector data on existing home sales.

Tuesday, June 24- Switzerland is to publish data on the trade balance, the difference in value between imports and exports.

- The U.S. is to release private sector data on consumer confidence, as well as a report on new home sales.

Wednesday, June 25- The U.S. is to publish data on durable goods orders, as well as revised data on first quarter growth.

Thursday, June 26- The U.S. is to release data on personal income and expenditure, as well as data on inflation linked to personal spending.

Friday, June 27The U.S. dollar slumped to five-and-a-half month lows against the Canadian dollar on Friday, following the release of stronger-than-forecast data on Canadian inflation and retail sales.

USD/CAD was down 0.56% to 1.0757 late Friday, the weakest level since January 7. For the week, the pair lost 0.93%.

The pair is likely to find support at 1.0725 and resistance at 1.0825, Friday’s high.

The Canadian dollar surged after Statistics Canada reported that the annual rate of inflation rose to 2.3% in May, ahead of forecasts of 2.1%.

It was the first time in more than two years that the annual inflation rate exceeded the Bank of Canada’s 2% target, fuelling optimism over the economic recovery.

The BoC kept its benchmark interest rate on hold at 1% earlier this month, reiterating concerns that low inflation and weak exports are acting as a drag on growth.

Consumer prices were 0.5% higher in May from a month earlier, beating forecasts for 0.2%.

The loonie, as the Canadian dollar is also known, received an additional boost after a separate report showed that domestic retail sales jumped 1.1% in April, easily outstripping forecasts of 0.4%.

The greenback remained under pressure after the Federal Reserve indicated that rates would remain on hold despite the improving U.S. economic outlook.

At the conclusion of its two-day policy meeting on Wednesday the central bank cut its bond purchases by $10 billion, to $35 billion a month, saying there was "sufficient underlying strength" in the U.S. economy to continue tapering.

Despite this, the Fed lowered its forecast for growth this year due to "unexpected contractions" in the first quarter as a result of the unusually harsh winter.

The Fed acknowledged the recent increases in inflation and drop in unemployment, but Chair Janet Yellen said no formula was in place for when interest rates would start to rise.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, edged up to 80.41 late Friday from lows of 80.24 on Thursday. For the week, the index lost almost 0.3%.

In the coming week, the U.S. is to release data on consumer confidence, durable goods orders and home sales, while Canada is not scheduled to release any major economic reports.

Ahead of the coming week, Investing.com has compiled a list of significant events likely to affect the markets.

Monday, June 23

- The U.S. is to release a preliminary report on manufacturing activity and private sector data on existing home sales.

Tuesday, June 24- The U.S. is to release private sector data on consumer confidence, as well as a report on new home sales.

Wednesday, June 25- The U.S. is to publish data on durable goods orders, in addition to revised data on first quarter growth.

Thursday, June 26- The U.S. is to release data on personal income and expenditure, as well as data on inflation linked to personal spending.

Friday, June 27The New Zealand dollar ended Friday’s session close to a six-week high against its U.S. counterpart, amid indications the Federal Reserve will keep interest rates at record-low levels for a considerable time.

NZD/USD hit 0.8734 on Wednesday, the pair’s highest since May 6, before subsequently consolidating at 0.8696 by close of trade on Friday, down 0.24% for the day but 0.35% higher for the week.

The pair is likely to find support at 0.8653, the low from June 18 and resistance at 0.8731, the high from June 19.

Concerns over the ongoing Sunni insurgency in Iraq hit market sentiment on Friday, as government forces fought with Sunni militants for control of a 300,000 barrel-per-day refinery in the northeast part of the country, fuelling concerns over a disruption to global supplies.

U.S. President Barack Obama said Thursday he would send 300 members of the special-operations forces to Iraq and added he was prepared to take "targeted" military action later if deemed necessary.

The kiwi rallied to a six-week high against the greenback after the Federal Reserve gave no indication of when interest rates could start to rise at the conclusion of its two-day meeting on Wednesday. In addition, the Fed’s forecast of where interest rates might reach in the long term fell from 4% to 3.75%.

The central bank cut its bond purchases by $10 billion a month, to $35 billion, saying there was "sufficient underlying strength" in the U.S. economy to continue tapering.

Despite this, the Fed lowered its forecast for growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously, due to "unexpected contractions" in the first quarter as a result of the unusually harsh winter.

The Fed acknowledged the recent increases in inflation and drop in unemployment, but Chair Janet Yellen said no formula was in place for when interest rates would start to rise.

Elsewhere, in New Zealand, data released earlier in the week showed that New Zealand's economy grew by 1% in the first quarter, compared to expectations for an expansion of 1.2%.

In the coming week, market players will focus on U.S. consumer confidence, durable goods orders and home sales data for further indications on the strength of the economy.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 23

- China is to publish the preliminary reading of the HSBC manufacturing index.

- The U.S. is to release preliminary data on manufacturing activity and private sector data on existing home sales.

Tuesday, June 24- The U.S. is to release private sector data on consumer confidence, as well as a report on new home sales.

Wednesday, June 25- The U.S. is to publish data on durable goods orders, as well as revised data on first quarter growth.

Thursday, June 26- The U.S. is to release data on personal income and expenditure, as well as data on inflation linked to personal spending.

Friday, June 27The Australian dollar fell from a one-week high against its U.S. counterpart on Friday, as concerns over escalating violence in Iraq dampened demand for riskier assets.

AUD/USD hit 0.9430 on Thursday, the pair’s highest since June 12, before subsequently consolidating at 0.9390 by close of trade on Friday, down 0.09% for the day and 0.12% lower for the week.

The pair is likely to find support at 0.9320, the low from June 18 and resistance at 0.9430, the high from June 19.

Market players continued to monitor events in Iraq, as government forces fought with Sunni militants for control of a 300,000 barrel-per-day refinery in the northeast part of the country, fuelling concerns over a disruption to global supplies.

U.S. President Barack Obama said Thursday he would send 300 members of the special-operations forces to Iraq and added he was prepared to take "targeted" military action later if deemed necessary.

The Aussie rallied to a one-week high against the greenback on Thursday after the Federal Reserve gave no indication of when interest rates could start to rise at the conclusion of its two-day meeting on Wednesday. In addition, the Fed’s forecast of where interest rates might reach in the long term fell from 4% to 3.75%.

The central bank cut its bond purchases by $10 billion a month, to $35 billion, saying there was "sufficient underlying strength" in the U.S. economy to continue tapering.

Despite this, the Fed lowered its forecast for growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously, due to "unexpected contractions" in the first quarter as a result of the unusually harsh winter.

The Fed acknowledged the recent increases in inflation and drop in unemployment, but Chair Janet Yellen said no formula was in place for when interest rates would start to rise.

In the coming week, market players will focus on U.S. consumer confidence, durable goods orders and home sales data for further indications on the strength of the economy.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 23

- China is to publish the preliminary reading of the HSBC manufacturing index.

- The U.S. is to release preliminary data on manufacturing activity and private sector data on existing home sales.

Tuesday, June 24- The U.S. is to release private sector data on consumer confidence, as well as a report on new home sales.

Wednesday, June 25- The U.S. is to publish data on durable goods orders, as well as revised data on first quarter growth.

Thursday, June 26- The U.S. is to release data on personal income and expenditure, as well as data on inflation linked to personal spending.

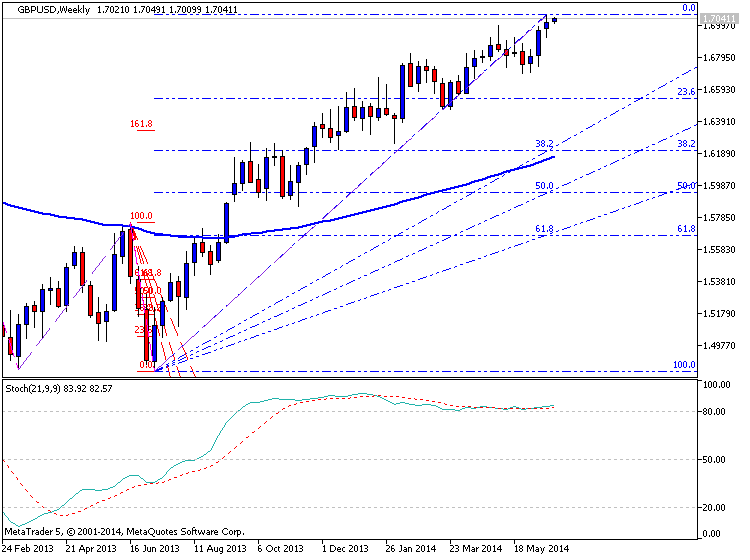

Friday, June 27The pound pulled back from more than five year highs against the dollar on Friday but remained supported above the 1.70 level by expectations that the Bank of England will raise interest rates ahead of its major peers.

GBP/USD slipped 0.15% to 1.7014 late Friday, down from highs of 1.7062 reached on Thursday, the strongest level since October 21, 2008. For the week, the pair gained 0.22%.

Cable was likely to find support at 1.6950 and resistance at 1.7064.

Sterling has strengthened this year amid expectations that the accelerating economic recovery will prompt the BoE to raise interest rates sooner than other central banks.

Wednesday’s minutes of the BoE’s June meeting showed that the bank was "somewhat surprised" that the financial markets were pricing in a low probability of interest rates rising this year.

Some monetary policy committee members believe the question of whether enough spare capacity has been absorbed has become "more balanced" since last month the minutes said.

BoE Governor Mark Carney said earlier this month that rates could rise sooner than investors expect. The remarks prompted investors to bring forward expectations for a rate hike to the end of this year from the first quarter of 2015.

The greenback remained under pressure after the Federal Reserve indicated Wednesday that rates would remain on hold for longer, despite the improving U.S. economic outlook.

At the conclusion of its two-day policy meeting, the central bank cut its bond purchases by $10 billion, to $35 billion a month, saying there was "sufficient underlying strength" in the U.S. economy to continue tapering.

Despite this, the Fed lowered its forecast for growth this year due to "unexpected contractions" in the first quarter as a result of the unusually harsh winter.

The Fed acknowledged the recent increases in inflation and drop in unemployment, but Chair Janet Yellen said no formula was in place for when interest rates would start to rise.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, edged up to 80.41 late Friday from lows of 80.24 on Thursday. For the week, the index lost almost 0.3%.

In the coming week, the U.S. is to release data on consumer confidence, durable goods orders and home sales, while the BoE is to publish its financial stability report.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 23

- The U.S. is to release preliminary data on manufacturing activity and private sector data on existing home sales.

Tuesday, June 24- The U.S. is to release private sector data on consumer confidence, as well as a report on new home sales.

Wednesday, June 25- The U.K. is to release private sector data on retail sales.

- The U.S. is to publish data on durable goods orders, as well as revised data on first quarter growth.

Thursday, June 26- The BoE is to publish its financial stability report

and Governor Mark Carney is to hold a press conference to discuss the

report.

- The U.S. is to release data on personal income and expenditure, as well as data on inflation linked to personal spending.

Friday, June 27The dollar inched higher against the euro on Friday, but still ended the week lower after the Federal Reserve indicated that its isn’t going to raise interest rates for a long period of time.

EUR/USD dipped 0.06% to 1.3598 late Friday, but posted a weekly gain of 0.47%.

The pair is likely to find support at 1.3540 and resistance at 1.3650.

The greenback remained under pressure after the Fed gave no indication of when interest rates could start to rise at the conclusion of its two-day meeting on Wednesday. In addition, the Fed’s forecast of where interest rates might reach in the long term fell from 4% to 3.75%.

The central bank cut its bond purchases by $10 billion a month, to $35 billion, saying there was "sufficient underlying strength" in the U.S. economy to continue tapering.

Despite this, the Fed also lowered its forecast for growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously, due to "unexpected contractions" in the first quarter as a result of the unusually harsh winter.

The Fed acknowledged the recent increases in inflation and drop in unemployment, but Chair Janet Yellen said no formula was in place for when interest rates would start to rise.

Elsewhere, the euro ended the week higher against the yen, with EUR/JPY ending Friday’s session at 138.84, for a weekly gain of 0.59%.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, edged up to 80.41 late Friday from lows of 80.24 on Thursday. For the week, the index lost almost 0.3%.

In the coming week, the U.S. is to release data on consumer confidence, durable goods orders and home sales. Flash estimates on euro zone private sector activity will also be closely watched.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 23

- The euro zone is to release data on manufacturing and

service sector activity, while Germany and France are to release

individual reports.

- The U.S. is to release preliminary data on manufacturing activity and private sector data on existing home sales.

Tuesday, June 24- In the euro zone, the Ifo Institute is to publish data on German business climate.

- The U.S. is to release private sector data on consumer confidence, as well as a report on new home sales.

Wednesday, June 25- Market research group Gfk is to publish a report on German consumer climate.

- The U.S. is to publish data on durable goods orders, as well as revised data on first quarter growth.

Thursday, June 26- The U.S. is to release data on personal income and expenditure, as well as data on inflation linked to personal spending.

Friday, June 27A Range Affair In Forex?

There were three important price developments among the major currencies in the past week.

First, encouraged by more hawkish signals from the Bank of England, in contrast to the Federal Reserve, Bank of Japan and the European Central Bank, sterling was bid to new multi-year highs. The Commitment of Traders data show the continued building of gross long sterling positions, and this was prior to the pound sustaining the move above $1.70.

Still, sterling was not the strongest of the major currencies and the euro actually narrowly outperformed it (0.4% vs. 0.3%). The market appears stretched as sterling approached the upper Bollinger Band. Although sterling closed two consecutive sessions above $1.70, including on a weekly basis, its foothold is precarious near-term. Pullbacks will likely be bought. The key issue is how shallow of a dip. A break of $1.6975 would signal a deeper pullback and the next objective would be closer to $1.6920.

The second important price development was the euro itself. Although a week ago, the euro had appeared poised to fall through the $1.3500 level, the bears ran into a wall of buyers, including, market talk suggested, reserve managers. The euro's upside though seems to be capped at the bearish underlying sentiment and the expected divergence of monetary policy.

This leaves the single currency in a range. The immediate near-term range is roughly $1.3560 to $1.3650, The broader range appears to be $1.3500-$1.3700. This will keep implied volatility grinding lower, even though near 5%, it has already slipped to fresh multi-year lows. The fact that three-month implied volatility is above the historic (realized) volatility is also consistent with this outlook.

The third significant technical development was the breakdown of the US dollar against the Canadian dollar. It took a rise in Canadian retail sales twice what the consensus expected (1.1% vs. 0.6%) and a greater rise in inflation to two-year highs (2.3% on the headline and 1.7% on core) to push the US dollar below CAD1.08 for the first time since early this year. The US dollar closed below its 200-day moving average (~CAD1.0780) for the first time since Q1 13.

While the breakout is noteworthy, the technical readings caution against expecting strong follow through gains in the Canadian dollar immediately. The RSI and MACDs are not generating strong signals, and the US dollar finished below the lower Bollinger Band (~CAD1.0785). That said, the CAD1.0800-20 area should offer initial resistance now. On the downside, a break of CAD1.0740 signals a test on CAD1.07. The Bank of Canada meets on July 16, and after this string of data, it will likely be a bit less dovish in its neutrality.

2014-06-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

if actual > forecast = good for currency (for CNY in our case)

[CNY - HSBC Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

Acro Expand : The Hongkong and Shanghai Banking Corporation (HSBC), Purchasing Managers' Index (PMI).

==========

HSBC flash manufacturing PMI tops 50 for first time this year

CHINA’S factory sector appears to be doing well, with the HSBC flash manufacturing Purchasing Managers’ Index rising to a seven-month high of 50.8 in June, from May’s 49.4.

It’s the first time the index has topped 50 — the dividing line between expansion and contraction — so far this year (although a competing, official PMI has been stronger). That suggests a combination of government spending and improving exports may be arresting the downward slide the economy has seen so far this year — though a weak housing market remains a major concern.

The reading came in well above forecasts. A survey of analysts by Bloomberg tipped a slight rise in the survey to 49.7. The flash index is published ahead of final PMI data and is usually based on 85 per cent to 90 per cent of total survey responses each month.

HSBC’s chief China economist Hongbin Qu said the improvement in the PMI was broadbased, with both domestic orders and external demand subindices in expansionary territory.

“This month’s improvement is consistent with data suggesting that the authorities’ mini-stimulus are filtering through to the real economy,” he said.

“Over the next few months, infrastructure investments and related sectors will continue to support the recovery. We expect policy makers to continue their current path of accommodative policy stance until the recovery is sustained.”

Here’s what the major economists said:

- The June HSBC flash PMI came as a big upside surprise, jumping to 50.8 from 49.4 in May (versus a market forecast of 49.7). This rebound reflects the initial impact of Beijing’s mini-stimulus programs. As Beijing is determined to deliver stable growth with a slew of mini-stimulus measures, including central bank relending (QE in China) and targeted reserve requirement ratio cuts (a total of RMB200bn), we observed a bounce-back of confidence in the economy which will help bolster demand. -- Ting Lu and Xiaojia Zhi, Bank of America Merrill Lynch

- Today’s PMI reading is the latest sign that, in some sectors at least, downwards pressure on growth has largely eased. The continued recovery of both manufacturing PMIs in recent months, despite further weakness in the property sector, suggests that the government’s targeted approach to shoring up growth is working. The rebound in infrastructure investment since the end of Q1, along with more recent measures to boost lending to small firms, appears to have eased downwards pressure on manufacturing and industrial output. -- Julian Evans-Pritchard, Capital Economics

- Domestic demand is picking up, given the government’s supportive policies. On the monetary policy side, the central bank recently lowered the reserve requirement ratio for selected banks to support small and medium-sized enterprises and rural-related sectors. This will improve small business financial conditions in the coming months as banks will have more money available to pump into the economy ... But given the difficulties from the removal of excess capacity and the downturn in the property market, the pace of recovery will be mild. -- Fan Zhang, CIMB

- Over the last few months the Chinese government has rolled out quite a lot of easing plans, but the pick-up is still quite mild. It’s too early to say the economy has bottomed out. What the government can do now is buy time to allow the impact of reforms to kick in. We are still quite worried about the property sector, but there’s a chance we could see the economy improve based on more fiscal spending. -- Xie Dongming, OCBC

- It seems the selective easing is working, with the help of exports, although I wouldn’t say so soon that everything’s well. The housing downturn could continue to deepen, so the downside risk is still there. The drag from the housing sector will remain, so we’re unlikely to see a very strong rebound like we saw in the third quarter last year. Growth will probably flatline — that’s the best scenario in my view. -- Wei Yao, Société Générale

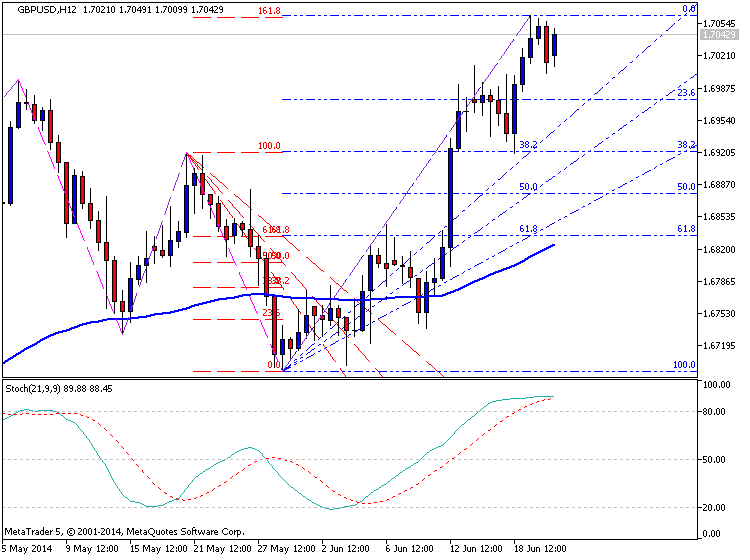

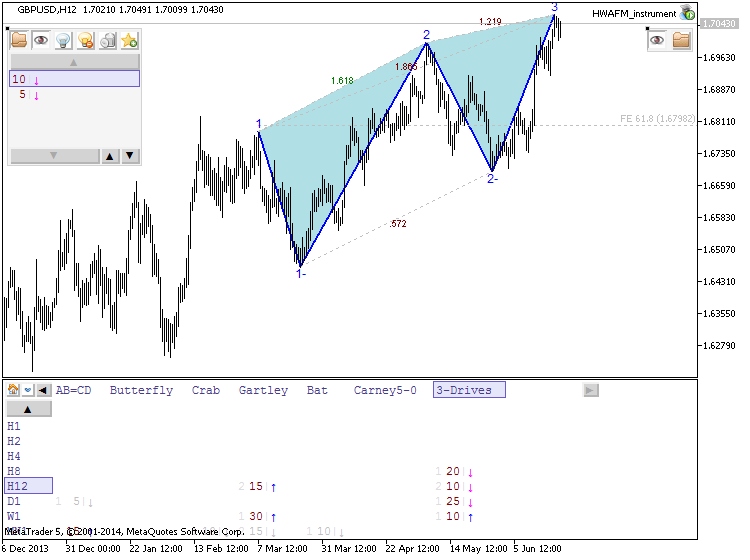

GBP/USD: Forex Trading – June 23, 2014

GBP/USD has recently made a strong convincing forex trading online break past its yearly highs at the 1.7000 major psychological level, indicating a continuation of the long-term rally. However, price has retreated back to the 1.7000 area after reaching highs past the 1.7060 levels.

Stochastic is also exhibiting a bearish divergence, which indicates forex trading online trend exhaustion. The technical indicator is currently pointing down from the overbought level, which means that bulls might not be ready to push the pair higher anytime soon. This could mean that a pullback near the broken resistance area is in play.

Going long at the 1.7000 level with a stop below the 61.8% Fibonacci retracement level at 1.6975 could yield a high return on risk if one aims for new highs. Moving the stop to entry once price tests the latest resistance at 1.7060 could be a good way to protect forex trading online profits.

Forex Trading Online Forecast

Recall that the BOE recently emphasized their hawkish bias, as the minutes of their latest monetary policy committee meeting revealed that policymakers are looking to hike interest rates this year. This is mostly because the U.K. economy showed signs of a pickup while rising home prices might warrant tighter monetary policy sooner or later.

BOE Governor Carney has already expressed this bias earlier in the month when he spoke of hiking rates sooner rather than later. He previously mentioned that the BOE was ready to tighten before the UK general elections take place next year.

As for the US, the FOMC statement turned out much less dovish than what many forex trading online analysts expected. For one, the Fed downgraded their growth forecasts for the year, although they upgraded employment and inflation estimates. Yellen decided against giving a timeline for interest rate hikes, saying that future monetary policy changes will continue to be dependent on a wide range of data.