You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EURUSD: Is it Oversold?

The ECB (European Central Bank) introduced a huge package of measures to inspire economic growth. EURUSD stays under pressure in the medium term, but could rebound to 1.37 short-term.

ECB: Timing the economy

After months of expectation, the European Central Bank has presented a huge package of measures aimed at boosting the anemic economic growth of the Eurozone and increasing inflation. The ECB cut interest rates to its lowest level ever to 0.15% and introduced a negative deposit rate of -0.10%. In addition, it will end the so called “sterilization tender,” which should increase money market liquidity by more than 150 billion euros. The ECB will also provide banks with any liquidity needed against collateral until the end of 2016. Finally, it might soon announce the purchase of ABS (asset-backed securities). It appears clear that Mr. Draghi considers the current time to be crucial. He does not, however, disregard the introduction of quantitative easing in the future—particularly if inflation were to decline during the summer. The news eased sovereign debt yields in Italy and Spain with the Italian hitting an historical low of 2.75%. EURUSD could stay under pressure over the medium term; however, in the short term, it might rebound to 1.37. The market is oversold. Funds are extremely short for EURUSD, and seasonal conditions support a rebound in the second half of the year.

US: The economy is still trending

Last week, the ISM Index confirmed the US economy is still performing well. The Production Index showed the widest movement reaching 61 (+5.3) and attesting that the winter weakness was only temporary. In fact, new orders rose to almost 57, and deliveries face challenges meeting the strong demand. The employment component, on the other hand, fell to 52.8. However, this increased in the manufacturing survey. Overall, US employment has performed nicely, but job creations fell to 217,000 in May. On an annual basis, the number is 281,000 versus 264,000 in 2013. The unemployment rate remained stable at 6.3%, but there is still a large number of part-time workers wanting to work fulltime. This represents 46% of the labor force as compared to 20% in the first half of 2000 for those not able to find work. The Job Openings and Labor Turnover Survey data for April offered a brighter picture and showed there were more than 4 million job openings, which is not too far from the peak of 4.6 million registered before the housing slump. Nonetheless, hiring improved only mildly, increasing by 2,000 people from the previous month. On the contrary, layoffs are at their lowest level since the index was created in 2000. The study of cycles still anticipates unemployment numbers to bottom out sometime in 2014/15 and then increase again for the last wave.

2014-06-16 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Foreign Securities Purchases]

if actual > forecast = good for currency (for CAD in our case)

[CAD - Foreign Securities Purchases] = total value of domestic stocks, bonds, and money-market assets purchased by foreigners during the reported month. Demand for domestic securities and currency demand are directly linked because foreigners must buy the domestic currency to purchase the nation's securities

==========

Canadian foreign securities purchases increase more-than-expected

Foreign investors’ acquisitions of Canadian securities increased more-than-expected in April, official data showed on Monday.

In a report, Statistics Canada said that foreign investment increased by a seasonally adjusted C$10.13 billion in April, above expectations for purchases of C$4.27 billion.

Foreign investors sold C$1.41 billion worth of Canadian securities in March.

At the same time, Canadian investment in foreign securities slowed to C$2.5 billion.

Following the release of the data, the Canadian dollar was lower against its U.S. counterpart, with USD/CAD rising 0.15% to trade at 1.0873.

Can the 2014 World Cup Affect the Forex Market?

Could the 2014 FIFA World Cup opening in Brazil this week affect the global Forex market? It might seem a crazy idea on a par with traders using moon cycles to try to forecast market movements, but don’t dismiss the idea out of hand.

A recent study by Goldman Sachs has concluded that the stock index of the winning country has on average outperformed global equity indices by 3.5% during the first month after the final, before underperforming the same measure by 4% over the following year! These are statistically significant numbers that should not be ignored. The concept is logical: a short-lived phase of football-related euphoria followed by a comedown. If such an effect has been observed in equity markets, there should also be an impact for Forex trading in the Forex market.

If you “get” football (as an Englishman, I would rather die than call it soccer), you probably won’t find this unreasonable. If you don’t, consider the well-known weekend effect that has been observed to warp stock market prices between Friday and Monday. Even today, these human factors can still affect market prices, at least over the short-term. I do not need any persuading, as I lived through two occasions where the English team failed narrowly to reach the finals of major football tournaments, once in the World Cup of 1990 and then again in the European Championship of 1996, going out to arch-rivals Germany on penalties both times.

The sense of building euphoria as the team progressed further was palpable and had a visible effect in offices as well as in bars: people were happy, agreeable, and less skeptical than usual. Conversely, when the knockout blows came, a mood of depression and lethargy prevailed for several days. Of course, as the sport is more popular among men, the effect was more pronounced among the male half of the population: consider that despite the advances toward gender equality made over recent years, the financial services industry is still very male-dominated almost everywhere.

The Effect of the 2014 World Cup on Forex Trading

So, how might you profit in Forex trading from the results of the 2014 World Cup? My experiences as a trader and as a football fan lead me to suggest the following plan of action.

Before the Round of 16 games, pay attention only to results of individual matches where there is a major upset which significantly changes the prospect of at least one team’s likely progression to the next round. Then during the knockout stages, pay more and more attention to each game with each progressive round.

Teams that get a boost are places where you can look for longs when their national market opens after the match, shorting teams which are being eliminated. Each round will become more and more significant, giving better and better trading prospects. Of course, the best potential trade is likely to be long the winner of the final and short the loser.

To be sure, there are a couple of flies in the ointment when it comes to Forex and the 2014 World Cup. Firstly, the fact that nine of the teams, among them many of the best teams, all have the same currency (the Euro) might mean there is no practical trade you can take as a reaction to the performances by these teams. Either a match will be played between two Euro teams, or if a Euro team wins or loses against a non-Euro team, you cannot really assume the Euro will be impacted: it is bigger than one member nation, even a large one. The second problem is that your broker may not offer a trade in the exotic currencies of some of the non-European teams that are likely to do well, such as the Brazilian Real or the Argentinian Peso.

The best outcome to hope for in Forex terms would be an unexpected and dramatic victory by any of Australia, England, Japan, Korea and Mexico. They each have their own individual currencies, all of which (except for the Korean Won) are readily available at most Forex brokers, although the Mexican Peso carries a relatively high spread. The remaining currencies all have quite low spreads. The best bet of all would be a dramatic victory by England, which not only dominates the volatile GBP but is a truly football-crazy country. The GBP tends to start moving at around 7am London time so if England produce a shock, be ready to buy the GBP the next morning. But as an Englishman, conveniently, I’ll be hoping for that anyway!

AUDIO - The New Depression with Richard Duncan

Economist and author of several books, Richard Duncan joins John O’Donnell and Merlin Rothfeld for a look at what he feels is the New Depression. A cycle of debt expansion that is leading to a nearly inevitable collapse, that not even a gold standard can safe. The trio discuss this and several other topics while Mr. Duncan offers a radical solution to it all. A solution that would put America back on top, and get us out from all this debt.

Hungary Court Says Banks Should Be More Transparent With Forex Loans

Hungary's top court ruled Monday that exposing retail customers to foreign-exchange risk wasn't unfair, boosting the stock exchange and reducing risks for the country's banking sector that in the precrisis years sold hundreds of thousands of loans to clients who are now demanding a revision of their contracts.

The court ruled that while the exchange-rate risk itself wasn't unfair to clients, banks should have offered sufficient information about the risk when selling foreign-currency loans.

Foreign-currency mortgages and consumer loans were popular in Hungary before the 2008 financial crisis because they were cheaper than local-currency loans. The Hungarian forint's depreciation against the Swiss franc, the currency to which most of the loans are tied, has made the loans expensive, leading to lawsuits against banks.

At the end of March, foreign-exchange mortgage and home-equity loans combined amounted to 3.423 trillion forints ($15.09 billion), or 53% of all retail lending, according to Wall Street Journal calculations based on Hungarian central bank data.

The court also said it was unfair of banks to use a different exchange rate for loan disbursements and repayments, ruling instead that loan contracts should be redrafted to use the central bank's midrate.

In addition, the court said it was unfair of banks to raise interest rates unilaterally under the contracts without informing customers beforehand.

With the rulings, the supreme court has kicked the ball back to the government's court to find a way to rid households of their expensive foreign-exchange loans, which have been holding back domestic consumption and boosting Hungary's external debt.

Eliminating foreign-currency loans was one of the election promises of the governing Fidesz party, which won a two-thirds majority in parliament in general elections in April.

"Hurdles are now gone for the lawmakers to take action. Now it is up to them to tackle the issue," said Gyorgy Wellmann, head of the court's decision-making body, at a news conference.

He said the decision isn't retroactive but instead serves as guideline for courts in lawsuits currently pending.

The ruling has opened the way for Fidesz to use its legislative power to ensure banks repay unfair gains they made on foreign-currency retail lending, a top party official said.

"The ruling unquestionably states that banks took people's money in an unfair way, and empowers the government to serve justice," said Antal Rogan, head of Fidesz's group of parliamentary representatives.

Fidesz will consult all parties involved in forex loans and submit a draft bill on the issue to parliament in the autumn, Mr. Rogan said. The bill will apply to both foreign-exchange mortgages and home-equity loans, he added.

The costs of phasing out such mortgages could amount to several hundreds of billions of forints, Mr. Rogan said. He declined to comment on whether the costs would be shared among banks, borrowers and the government, or borne solely by banks.

Banks are ready for talks and are bracing for a solution that will be "socially fair and equitable for the banks," said Levente Kovacs, head of the Hungarian Banking Association.

The latest ruling will put additional burdens on the already heavily taxed banking sector, said ING Bank. ING economist Andras Balatoni estimated the one-time drop in banks' profitability at 350 billion forints in total.

The market welcomed the ruling, which initially pushed shares in Hungary's OTP Bank almost 1.8% higher during the day. The bank closed 0.8% higher.

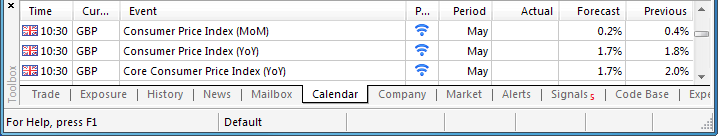

Trading the News: U.K. Consumer Price Index (based on dailyfx article)

A marked slowdown in the U.K.’s Consumer Price Index (CPI) may generate a larger pullback in the GBP/USD as it limits Bank of England (BoE) scope to normalize monetary policy sooner rather than later.

What’s Expected:

Why Is This Event Important:

Nevertheless, the BoE Minutes due out later this week may reveal a growing dissent within the Monetary Policy Committee (MPC) as U.K. officials see a stronger recovery in 2014, and the market reaction to the U.K. CPI print could be short-lived should we see a growing number of central bank officials adopt a more hawkish tone for monetary policy.

U.K. firms may offer discounted prices amid weak wage growth paired with the slowdown in private sector credit, and a weak inflation print may undermine the near-term outlook for the GBP/USD as it drags on interest rate expectations.

Nevertheless, the resilience in private sector consumption along with the ongoing improvement in the labor market may limit the downside risk for price growth, and a stronger-than-expected CPI print may heighten the bullish sentiment surrounding the sterling as it fuels bets for a rate hike.

How To Trade This Event Risk

Bearish GBP Trade: U.K. CPI Slips to 1.7% or Lower

- Need red, five-minute candle following the release to consider a short British Pound trade

- If market reaction favors selling sterling, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Headline Reading for Inflation Exceeds Market Forecast- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily

- Carves Series of Higher-Lows in June; Higher-High in Place?

- Interim Resistance: 1.7000 Pivot to 1.7030 (100.0% expansion)

- Interim Support: 1.6720 (61.8% expansion) to 1.6730 (50.0% retracement)

Impact that the U.K. CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

April 2014 U.K. Consumer Price Index

GBPUSD M5 : 34 pips price movement by GBPUSD - CPI news event:

U.K. consumer prices increased an annualized 1.8% in April after expanding 1.6% the month prior, while the core rate of inflation climbed 2.0% to mark the fastest pace of growth since September. Despite the stronger-than-expected CPI print, the GBP/USD slipped below the 1.6825 region following the release, but the British Pound pared the decline during the North American trade to close at 1.6836.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.06.17

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 38 pips price movement by GBP - CPI news event

Gold (XAU/USD) Retreats to Challenge June’s Trendline Support

In June so far, gold (xau/usd) has found support at 1240.50. After putting in a price bottom, traders bought gold up to 1285 today before price retreated.

XAU/USD 4H chart 6/16

Trendline, bearish continuation: As gold rallied this month, it approached the apex of a previously broken triangle, which would be in the 1290-1300 area. At 1285, traders also saw a trendline resistance extending from a previous triangle. The decline looks just as strong as the bullish price action it is going against, but overall price action is still bullish as gold trades above June’s rising trendline. A clean break below 1270 could clear this trendline, and signal bearish continuation at least toward 1250, 1240.

Trading implications:

If price is supported above 1270, there could still be some upside risk toward the 1290-1300 area, but for short-term traders this would be very little potential reward unless they believe gold has turned bullish. I think a break above 1300 could give the bullish outlook some weight, but for now, the short to medium term mode is still bearish. Therefore, with a bearish outlook, a trader can wait for a price closer to 1300 to fade, or if price breaks below 1270, the trader can either trade into the bearish breakout, or wait for a pullback and short at a price below the 1285 high.

Sideways Market:

When you look at the daily chart, you do not see any clear direction. While 2014 was bullish going roughly from*1183*to 1388, the 2013 gold market was bearish, with price falling from 1700 to below 1200.

XAU/USD daily chart 6/16

Price is now right in the middle of the 2014 range, and one has to question whether 2014 price action is a new primary move or just a secondary move to the prevailing primary bearish move. I would side on the bearish outlook until the market shows ability to push above 1300. In the bearish outlook, the 1182.35 low on the year would be in sight, but let’s limit it first to 1200.

2014-06-17 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - RBA Meeting Minutes]

[AUD - RBA Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

RBA Minutes: Policy Stance Continues To Be Appropriate

Members of the monetary policy board of the Reserve Bank of Australia felt that the current level of stimulus in the Australian economy continues to be appropriate, minutes from the central bank's June 3 meeting revealed on Tuesday.

The board members also said that economic growth is expected to remain slightly below trend, while inflation figures to remain within the target range of 2 to 3 percent.

"Global and domestic economic conditions overall were little changed from the previous meeting. Growth of Australia's major trading partners remained consistent with the earlier outlook, with growth early in 2014 around its long-run average," the minutes said.

At the meeting, the board kept the nation's benchmark interest rate unchanged at 2.50 percent, in line with expectations; the rate has been unchanged since last August.

The RBA has reduced the cash rate by a cumulative 225 basis points since November 2011 to help the economy sustain the economic growth in view of fading support from the mining boom.

"The expectation of substantial falls in mining investment, below-average growth of public demand and non-mining investment remaining subdued for a time implied that the pace of growth was likely to be a little below trend over the rest of this year and into the next, before gradually increasing," the minutes said.

The government estimates real GDP to continue growing below trend at 2.5 percent in 2014-15, before accelerating to near-trend growth of 3 percent in 2015-16.

The board said continued accommodative monetary policy should provide support to demand, and help growth to strengthen over time.

In the board's judgment, monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target.

On the currency, the bank said the exchange rate remains high by historical standards, particularly given the further decline in commodity prices.

"Given this outlook for the economy and the significant degree of monetary stimulus already in place to support economic activity, the Board judged that the current accommodative stance of policy was likely to be appropriate for some time yet," the minutes said.

Also on Tuesday, the Australian Bureau of Statistics said that the total number of new motor vehicle sales in Australia was up a seasonally adjusted 0.3 percent on month in May, standing at 92,410. That follows the flat reading in April.

By category, sales of other vehicles climbed 3.4 percent on month and sales of sports utility vehicles jumped 1.8 percent, while sales of passenger vehicles fell 2.0 percent.

By region, Victoria saw the largest increase (3.5 percent) followed by South Australia (1.3 percent) and the Australian Capital Territory (0.8 percent). The Northern Territory had the largest decline in sales (19.2 percent) followed by Queensland and Tasmania with 2.1 percent each.

On a yearly basis, sales declined 2.0 percent after falling 1.9 percent in the previous month.

Trading Video: Are Breakouts, Reversals Possible Ahead of the Fed?

EURUSD looks ripe for a break from a tight range and GBPUSD is standing at the threshold of major 1.7000-resistance. Yet, with the Fed ahead, strategy is imparative. Tentative breakouts or reversals from stimulus-sensitive capital markets or dollar-based majors are not unlikely in these trading conditions. But follow through and conviction with such a prominent uncertainty directly ahead is very unlikely. We look at the genuine appeal of different setups in today's Trading Video.

Experts Cut Swiss 2014, 2015 Growth Forecasts: SECO

The Swiss government's expert panel lowered the growth forecasts for the economy for this year and next, citing sluggish recovery in exports, the State Secretariat for Economic Affairs SECO said Tuesday.

The growth outlook for this year was cut to 2 percent from 2.2 percent and the projection for next year was reduced to 2.6 percent from 2.7 percent. In 2013, the Swiss economy expanded 2 percent. In the first quarter of this year, the alpine economy grew 0.5 percent sequentially.

The economic upturn in Switzerland is likely to further strengthen in 2015, but the pace of improvement may be slower than expected given the sluggish recovery in exports, the experts' panel said.

Experts also expect the recovery in the labor market to progress gradually and lead to a modest decline in unemployment. The unemployment rate forecasts for this year and next were left unchanged at 3.1 percent and 2.8 percent, respectively.

The inflation projections for 2014 and 2015 were also maintained at 0.1 percent and 0.4 percent, respectively.