You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

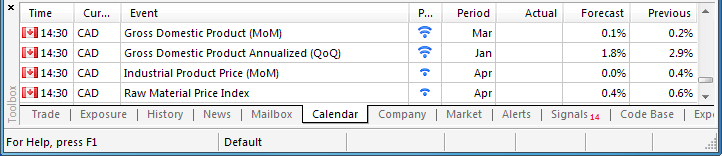

Trading the News: Canada Gross Domestic Product (GDP) (based on dailyfx article)

Canada’s 1Q GDP report may spur a meaningful rebound in the USD/CAD should we see a marked slowdown in the growth rate.

What’s Expected:

Why Is This Event Important:

A dismal GDP report may instill a bearish outlook for the Canadian dollar as Bank of Canada (BoC) Governor Stephen Poloz keeps the door open to further reduce the benchmark interest rate, and the central bank head may continue to endorse a dovish outlook for monetary policy amid the persistent slack in the real economy.

The slowdown in private sector consumption along with the ongoing weakness in the labor market may spur a lackluster GDP print, and a dismal development may spur a bullish breakout in the USD/CAD as it raises bets for a BoC rate cut.

Nevertheless, the ongoing expansion in the housing market paired with the rebound in building activity may produce another GDP reading above 2.0%, and a better-than-expected print may generate a further decline in the USD/CAD as the pair remains the bearish trend carried over from March.

How To Trade This Event Risk

Bearish CAD Trade: Growth Rate Slips Below 2.0%

- Need green, five-minute candle following the GDP report to consider a long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish CAD Trade: Canada 1Q GDP Exceeds Market Expectations- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in reverse

Potential Price Targets For The ReleaseUSD/CAD Daily

Impact that the Canada GDP report has had on CAD during the last quarter

(1 Hour post event )

(End of Day post event)

2013

4Q 2013 Canada GDP

USDCAD M5 : 46 pips price movement by CAD - GDP news event

The Canadian economy grew at a faster pace during the last three-months of 2013, with the growth rising another 2.9% following the 2.7% advance in the third-quarter, and the data print may encourage an improved outlook for the Canadian dollar as it raises the outlook for growth and inflation. The USD/CAD slipped back below the 1.1100 handle following the stronger-than-expected GDP print, with the pair ending the day at 1.1064

2014-05-30 12:30 GMT (or 14:00 MQ MT5 time) | [USD - Personal Consumption Expenditure]

if actual > forecast = good for currency (for USD in our case)

[USD - Personal Consumption Expenditure] = Change in the price of goods and services purchased by consumers, excluding food and energy

==========

U.S. Personal Spending Shows Unexpected Decrease In April

While the Commerce Department released a report on Friday showing that U.S. personal income rose in line with economist estimates in the month of April, the report also showed an unexpected drop in personal spending for the month.

The report showed that personal income rose by 0.3 percent in April following a 0.5 percent increase in March. The increase marked the fourth straight month of growth and matched expectations.

On the other hand, the Commerce Department said personal spending edged down by 0.1 percent in April after surging up by 1.0 percent in March. The modest decrease surprised economists, who had expected spending to rise by 0.2 percent.

2014-05-30 13:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

if actual > forecast = good for currency (for USD in our case)

[USD - Chicago PMI] = Level of a diffusion index based on surveyed purchasing managers in the Chicago area

==========

Chicago Business Barometer Shows Unexpected Increases In May

With demand strengthening as the economy continued to recover from the weather-related slowdown, MNI Indicators released a report on Friday showing that its reading on Chicago-area business activity unexpectedly rose to a seven-month high in May.

MNI Indicators said its Chicago business barometer climbed to 65.5 in May from 63.0 in April, with a reading above 50 indicating an increase in activity. The increase surprised economists, who had expected the barometer to dip to 61.0.

The Week Ahead: A Portfolio That Won't Ruin Your Summer

Investors came back from the long weekend ready to buy as the S&P 500 closed above the 1900 level in impressive fashion. Nevertheless, many analysts and TV pundits still point to the number of reasons why stocks should not be this high and can’t go higher.

The environment has also been difficult for individual investors as the choppy action in the S&P 500 and the wide swings in the Nasdaq 100 have made them difficult to trade. Clearly, the broad market has been in a non-trending mode, but it is still possible to find and buy stocks that are trending.

IMF Approves $4.6 Bln Aid For Greece

The International Monetary Fund approved $4.64 billion bailout payment to Greece after the completion of fifth review.

Deputy Managing Director of IMF, Naoyuki Shinohara said the Greek authorities have made significant progress in consolidating the fiscal position and rebalancing the economy.

The disbursements were delayed for a year amid questions over whether Greece continue its structural reforms. The lender approved the authorities' request for rephasing three disbursements evenly over the remaining reviews in 2014.

The primary budget posted surplus ahead of schedule. However, the lender observed that several challenges remain to be overcome before stabilization is deemed complete and Greece is back on a sustainable, balanced growth path.

Public debt is projected to remain high well into the next decade, despite a targeted high primary surplus.

Shinohara said additional fiscal adjustment is necessary to ensure debt sustainability, through durable, high-quality measures, while strengthening the social safety net.

He urged Greece to continue to improve tax collection, combat evasion and strengthen expenditure control. The authorities are taking remedial actions to clear domestic arrears and expedite privatization.

Further measures are needed to remove regulatory barriers and to reform investment licensing, Shinohara said.

Currency movements were mixed in the last week of May, and now a very busy week awaits traders: rate decision in Australia, Canada, the UK and the Eurozone are due alongside top-tier US events culminating in the all-important NFP report on Friday are the market movers on FX calendar. Here is an outlook on the highlights of this week.

The ECB kept the pressure on the euro with comments pointing to action. Also the data weighed on the common currency. In the US, the theory of a terrible first quarter and an improvement afterwards was reinforced by the news of contraction in Q1, while fresh jobless claims were encouraging. Apart from that, the pound was pounded and the Aussie recovered. And now, we have the top tier indicators in the first week of the month. Let’s start,

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: BearishThe Euro showed signs of life as it bounced off of fresh multi-month lows and ended a three-week losing streak. Yet traders await a critical European Central Bank interest rate decision to drive volatility in the week ahead.

Recent futures data showed large speculators headed into the week at their most short Euro since it bottomed in July of last year. Traders were likely increasing their bets on Euro weakness as the ECB is widely expected to cut interest rates in their coming meeting. Expectations often beget disappointments, however, and a rush towards Euro selling warns that the single currency may bounce on any ECB surprises.

All eyes turn to central bank President Mario Draghi as he said the ECB was “ready to act” at its next meeting. A Bloomberg News survey shows the majority of economists polled believe the bank will cut its Main Refinancing Rate to further record-lows and push its Deposit rate into negative territory. If the ECB fails to cut either rate it seems obvious that the Euro might rally. Beyond that, however, likely outcomes seem much less clear.

Derivatives traders have pushed forex volatility prices near record-lows across the majority of US Dollar and Japanese Yen pairs. And yet EURUSD 1-week prices have spiked near their highest levels of the year.

Any unexpected results from the European Central Bank would likely be the catalyst for important Euro moves, while end-of-week US Nonfarm Payrolls data could likewise spark significant EURUSD swings.

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: BullishThe GBP/USD looks poised to resume the bullish trend carried over from the previous year as the Bank of England (BoE) shows a greater willingness to normalize monetary policy sooner rather than later.

Indeed, the BoE policy meeting highlights the biggest event risk for the British Pound as there appears to be a growing rift within the Monetary Policy Committee (MPC), but the sterling remains vulnerable ahead of the June 5 interest rate decision as U.K. Mortgage Applications are expected to slow further in April.

Nevertheless, it seems as though BoE board member Martin Weale may make a greater push to raise the benchmark interest rate ‘sooner rather than later’ as he sees borrowing costs increasing by a full percentage-point over the next 12-months, while Mr. Charles Bean appears to be turning increasingly hawkish as the Deputy Governor anticipates real wage growth to ‘gradually’ increase in the second-half of the year.

With that said, the BoE Minutes due out on June 18 may reveal a growing dissent with the central bank as Governor Mark Carney remains in no rush to normalize monetary policy, but the rate decision may have a limited impact in driving near-term price action for the GBP/USD should the central bank once again refrain from releasing a policy statement.

As a result, a further shift in the BoE policy outlook should heighten the appeal of the British Pound, and the GBP/USD appears to be on course for a higher-high as the Federal Reserve remains reluctant to move away from its zero-interest rate policy (ZIRP).

"For The First Time In Forever," The Dow Will Hit The Magic 18,000 Zone

The basic factors that sustain a bull market is intact and will lke drive the Dow and S&P 500 to new all-time highs.

--------

How now Dow Jones? Once again, the tenacity and resolve of the bull market are being questioned by skeptics simply because it has been steadily driving up with little interruption. The bull is losing steam, they claim, as the slowed economy is pulling it back . And the bears continue to insist the bull is totally tired by now.

Well, here’s a loud hello! to the doomsayers who, predictably, are expected to belt a chorus of dire warnings that calamity will surely follow the double whammy that walloped the bears on Friday, May 30, 2014. Both the S&P 500-stock index and the Dow Jones industrial average surprised investors as they closed at new all-time highs (again) — despite disappointing first-quarter GDP numbers and lack of any glowing positive news.

The S&P 500 has been on a tear in recent months, rising 3.54 points, to 1,923.57 on Friday — its four-month consecutive advance this year. And the Dow industrials jumped 18.43 points, to a new record of 16,717.17 – its fifth highest close in history. No doubt this high road they traversing is rarefied territory for both the S&P 500 and the Dow which, indeed, may prove acrophobic to some investors who can’t take the market’s relentless rise.

So it’s understandable that the professional bears and the uninitiated among market players are seriously warning that the end of the bull market is in sight and should be losing strength at this point, and very much overdue for a 10% correction. And it wouldn’t be surprising if the market’s Nervous Nellies disengage from the market, if only temporarily, and count their profits so far.

But don’t fret, the 30-stock Dow may hesitate or stumble at this point but it should do what it has been doing all these years –come financial meltdown or the greatest recession ever. The markt continues to move higher on both fundamental and technical reasons. So don’t count on this bull market to give up the huge advance it has achieved the past many years.

But here’s the zinger: Some savvy bulls are confident the widely followed Dow Jones industrial average will rocket to the never-before touched 18,000 zone over the next 9 to 18 months, and the incredibly strong S&P 500 reaching the high 2,100 area. That’s a great distance from where the Dow and S&P 500 closed on Friday.

Sounds impossible? Far from it, really, as the record shows that this bull market has enough stamina and strength in reserve to keep on going. And part of its strength lies in the fact that most market players don’t believe it can go any higher since the Dow hit 16,000.

But for the doubters who would brand such a prediction hogwash or worse, let me review my past market predictions since 2011, at least. They all hit their mark. Apart from benefiting my 3o-year experiencing covering Wall Street and the market, my column and forecasts have been aided and abetted – and astutely guided – by the market strategies and thinking of outstanding market mavens, including Mario Gabelli, Carl Icahn, Warren Buffett, Lazlo Birinyi, Jeffrey Kleintop, and Sam Stovall.

On Feb. 20, 2012, this is how I headlined my column in this space: “Forget The Dow At 13,000: Buy The Dips As The Market Heads Toward New High At 15,000.” The Dow was then trading at 12,949.87. Here’s how I explained it: “The market in its infinite wisdom is signaling what is becoming more evident: The economy is showing signs of strength and fundamentally that is terrific positive news for a sustained upswing in the equity markets.”

And, of course, the Dow hit 13,000 – and then kept going, to 15,000 and later on to 16,000. At the time, many market technicians loudly warned of a huge correction of 10% of worse when the Dow was getting close to reaching 13,000.

But let me go back to several of my earlier market forecasts: On June 7, 2011, the Dow had tumbled to 12,151.26, causing plenty of investors to panic and ready to bail out. So I headlined my column: “How Now Dow Jones: With Almost Everyone Turning Negative On The Market, Is It Time To Buy?” Of course it was, and I definitely said so even when both technical and professional market watchers who focus on fundamentals – the GDP, jobless figures, and housing starts – have concluded that the market was in a horrible jam, caught in a downspin that indicated the bear market was back.

Again, the market accommodated the bulls, crossing the 13,000 level on Feb. 28, 2012, closing that day at 13,005. And then on Aug. 16, 2012, I advised investors “not to be late for the big party,” predicting another new high closing for the Dow and the S&P. My column’s headline blared: “Dow Industrial and S&P 500 Indices Seen Heading To New Record Highs.” Less than a year later, on Feb. 22, 2013, the Dow crossed 14,000 for the first time, closing that day at 14,000.17.

Several months later, on Nov. 19, 2013, with the Dow again blasting higher, my column’s headline read: “Investors Should Continue To Embrace Market’s Robust Advance For More Opportunities.” The Dow by then had crossed 15,000 and I predicted it was likely to spark higher and rise to 16,000 sooner than later. True enough, on Nov. 21, 2013, the Dow closed at 16,009.94.

By 2014, the market was really smoking hot, rising to yet another closing high, to 16,715.44 by May 13, 2014. And again on May 30, 2014, the Dow sprang again to a new all-time, to 16,717, 17. And that’s where another divergence of opinion will nag the market.

But one veteran market watcher who has been also very accurate and on-target in his forecasts, Lazlo Birinyi, president of Birinyi Associates, isn’t at all concerned about the market’s stamina to go even higher. He thinks every time investor gloom pervades the market, it is a time to look for opportunities to buy stocks. In an interview with the New York Times, Birinyi said the long market rally that started in 2009 isn’t likely to end until the market becomes dangerously wild. And so far, there is little evidence of that.

Birinyi believes, and rightly so, thast most of what passes for news about the market “is really noise.” His advice: “You need to stop and think and do the research. When you look deeper, you see a different picture,” says Birinyi.

The conditions that sustain a bull market is intact, according to Birinyi, and “we are in the last stage of a great bull market.” But this last stage of this bull market could well be taking another longt joyride towards another new all-time record high. The economy, if viewed objectively, has been doing well despite the meager GDP rise. Interest rates aren’t likely to flare up, contrary to what the bears predict, and inflation is still well under control. Of course, it isn’t hard to find sources of problems to justify a bearish stance towards the stock market.

But realistically, the market has been doing very well in predicting the outcome of things to come six to 12 months ahead of time. The fact that it is doing well against many odds is a good forward indicator of things to come in the economy and the health of the financial system.

So 18,000 for the Dow and 2,100 for the S&P over the next 9 to 18 months? Don’t be late for the big party. And be an opportunistic buyer.

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: BearishOn the domestic front, the spotlight is on a policy announcement from the Reserve Bank of Australia. The central bank is expected to keep the benchmark lending rate unchanged at 2.50 percent. That will put the focus on the statement released following the sit-down.

A dovish tone in minutes from May’s meeting undermined speculation about forthcoming interest rate hikes, sending the currency lower. Australian economic data has increasingly underperformed relative to market expectations since then, suggesting Glenn Stevens and company will be in no hurry to change their tune.

Meanwhile, GDP figures are set to show the pace of output growth accelerated in the first quarter and China’s PMI data is expected to reveal a pickup in the pace of factory-sector activity in May. That is likely to keep stimulus expansion bets at bay, helping to cement the status quo wait-and-see setting of monetary policy both in practice and in the minds of investors.

Sizing up the macro landscape, a critical mass of high-profile event risk informing the outlook on Federal Reserve policy looms ahead. As we’ve discussed previously, the fate of the FOMC’s effort to “taper” QE asset purchases with an eye to end the program this year – paving the way for interest rate hikes – has been a formative catalyst for the markets this year.

While last week’s US GDP data revealed more dismal first-quarter performance than was previously expected, Janet Yellen and her colleagues on the policy-setting FOMC committee have regularly dismissed the first three months of the year as a temporary soft patch. US economic data began to steadily improve relative to consensus forecasts in early April, seemingly supporting the central bank’s position.

Manufacturing- and service-sector ISM figures, the Fed’s Beige Book survey of regional economic conditions and the obsessively monitored Nonfarm Payrolls report are all due to cross the wires in the coming days. Continuation of the supportive trend in US news-flow may help scatter any lingering doubts about the approaching end of asset purchases and subsequent tightening. That may narrow the Aussie’s perceived yield advantage and drive broader risk aversion, all of which bodes ill for the currency.