You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Dow Jones Industrial Average - The Week Ahead (based on the article)

Daily price is above 55 SMA/200 SMA revcersal levels in the bullish area of the chart: the price is testing Fibo resistance level at 23,316 to above for the bullish trend to be continuing

==========

The chart was made on D1 timeframe with standard indicators of Metatrader 4 except the following indicator (free to download):

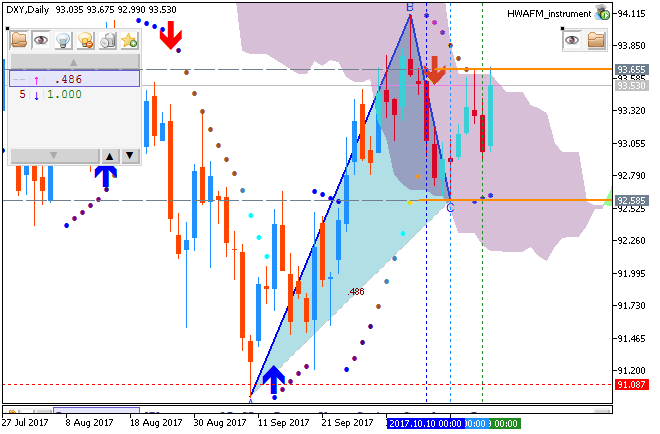

Weekly Outlook: 2017, October 22 - October 29 (based on the article)

The US dollar advanced against most currencies, but the moves were limited.The upcoming week is quite busy, featuring initial GDP reads from the US and the UK, rate decisions from the BOC and the ECB, and more.

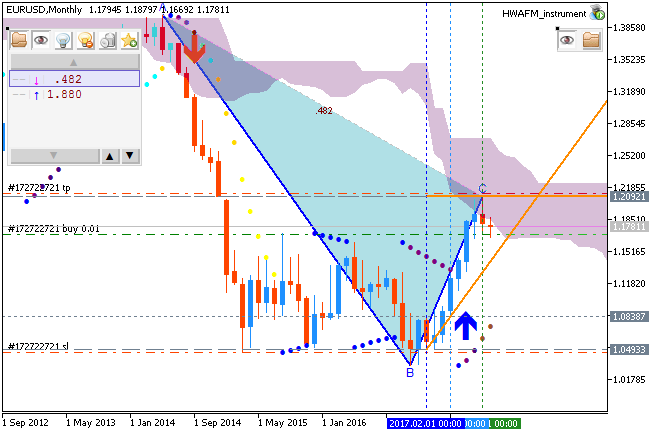

Weekly EUR/USD Outlook: 2017, October 22 - October 29 (based on the article)

EUR/USD was under some pressure on the ongoing crisis in Catalonia. The upcoming week is dominated by the all-important ECB decision. What will be the new size of the QE program? Here is an outlook for the highlights of this week.

Google - daily bullish ranging with narrow levels for direction; 997/978 are the keys (based on the article)

Daily share price is far above Ichimoku cloud in the bullish area of the chart. The price is on ranging within the narrow s/r level for the direction of the bullish trend to be resumed (997 resistance level) or for the secoindary correction to be started (978 support level).

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

EUR/USD - intra-day bearish below ranging reversal levels (based on the article)

H4 intra-day price is located below 200 SMA/55 SMA levels in the primary bearish area of the chart: the price is testing the last MA channel level at 1.1714 to below for the bearish trend to be continuing.

==========

The chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

NZD/USD - strong intra-day bearish; 0.6885 is the key (based on the article)

Intra-day price on H4 chart is far below 100 SMA/200 SMA in the primary bearish area: the price is testing 0.6885 support level to below for the bearish trend to be continuing.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

AUD/USD Intra-Day Fundamentals: Australian Consumer Price Index and range price movement

2017-10-25 01:30 GMT | [AUD - CPI]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian CPI news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Intra-Day Fundamentals - USD/JPY and GOLD (XAU/USD): U.S. Durable Goods Orders

2017-10-25 13:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From cnbc article :

==========

USD/JPY M5: range price movement by U.S. Durable Goods Orders news events

==========

XAU/USD M5: range price movement by U.S. Durable Goods Orders news events

==========

Chart #1 was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

==========

Chart #2 was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

USD/CAD Intra-Day Fundamentals: BOC Monetary Policy Report and range price movement

2017-10-25 15:00 GMT | [CAD - Overnight Rate]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves.

==========

From official report :

==========

USD/CAD M5: range price movement by BOC Monetary Policy Report news event

==========

Chart.

The chart was made on M15 timeframe with standard indicators of Metatrader 5 except the following indicator (free to download):

AUD/USD - daily bearish breakdown (based on the article)

Daily price is on bearish breakdown: price was bounced from Senkou Span line to below for the bearish trend toi be resumed and with 0.7690 support level to be broken for the breakdown to be continuing.

-----------

Chart.

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicator from CodeBase: