You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

DAX Index - daily bearish ranging with ascending triangle (based on the article)

Daily price is below Ichimoku cloud in the bearish area of the chart: the price is on ascending triangle pattern to be tested together with 12,294 resistance level to above for the secondary rally to be started, otherwise - bearish ranging within the levels.

U.S. Commercial Crude Oil Inventories news event: intra-day bullish breakout; daily bullish reversal; 52.28 daily level is the key

2017-08-23 15:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.3 million barrels from the previous week."

==========

Crude Oil M5: bullish breakout. The price is located far above 100-SMA/200-SMA reversal levels in the bullish area of the chart: price is testing ascending triangle pattern together with 52.28 resistance level to above for the bullish trend to be continuing..

If M5 price breaks 52.28 resistance level to above on close bar so the bullish trend will be continuing.

If the price breaks 51.65 support level to below on close M5 bar so the bearish reversal will be started.

If not so the price will be on ranging within the levels.

==========

Crude Oil Daily: bullish reversal. The price is ranging within and near 100-SMA/200-SMA ranging area with the resistance level at 52.28 to be tested for the possible bullish reversal.

Brent Crude Oil - daily bullish ranging within 53.50/50.07 levels (based on the article)

Price on the daily chart is above the Ichimoku cloud for the bullish trend area to be ranging within 53.50 resistance level forthe bullish trend to be resum,ed and 50.07 support level for the bearish reversal to be started.

GBP/USD Intra-Day Fundamentals: U.K. Gross Domestic Product and range price movement

2017-08-24 09:30 GMT | [GBP - GDP]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

GBP/USD M5: range price movement by U.K. Gross Domestic Product news event

Intra-Day Fundamentals - NZD/USD, Dollar Index and GOLD (XAU/USD): U.S. Jobless Claims

2017-08-24 13:30 GMT | [USD - Unemployment Claims]

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From rttnews article :

==========

NZD/USD M5: range price movement by U.S. Jobless Claims news events

==========

XAU/USD M5: range price movement by U.S. Jobless Claims news events

==========

Dollar Index M5: range price movement by U.S. Jobless Claims news events

USD/JPY - daily bearish ranging within 108.60/110.94 for bearish resumed or bullish reversal (based on the article)

Daily price broke Ichimoku cloud for the bearish area of the chart with the ranging within 108.60 support level for the bearish trend to be continuing and 110.94 resistance level for the bullish reversal to be started. Descending triangle pattern was formed by the price to be crossed to below for the beatrish as the most likely direction in this situation for example.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.04.24 19:29

Overbought vs. Oversold (baseed on dailyfx article)

- Overbought means an extended price move to the upside; oversold to the downside.

- When price reaches these extreme levels, a reversal is possible.

- The Relative Strength Index (RSI) can be used to confirm a reversal.

Like many professions, trading involves a lot of jargon that is difficult to follow by someone new to the industry. It’s our job as instructors to fill in as many knowledge gaps as possible to make the education process as simple as possible. Today, we will take a look at what it means for a currency pair to be overbought or oversold, and most importantly, what trading opportunities arise from these situations.Overbought vs. Oversold

These two terms actually describe themselves pretty well. Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback. This is clearly defined by a chart showing price movement from the “lower-left to upper-right” like the chart shown below.

Learn Forex: USDJPY Hourly Chart – Overbought

The term Oversold describes a period of time where there has been a significant and consistent downward move in price over a period of time without much pullback. Basically a move from the “upper-left to the lower-right.”

Because price cannot move in one direction forever, price will turn around at some point. Currency pairs that are overbought or oversold sometimes have a greater chance of reversing direction, but could remain overbought or oversold for a very long time. So we need to use an oscillator to help us determine when a reversal is actually occurring.

But, we must be patient before we enter our trades, because sometimes the RSI can stay overbought or oversold for quite awhile. The worst thing we can do is try to pick a top or a bottom of a strong move that continues to move into further overbought or oversold territory. So we must wait until the RSI crosses back under 70 or crosses back above 30.

When the RSI falls below 30, same rules apply. We want to wait until the RSI crosses back above 30 before we place a buy trade.

Putting RSI to Work

EUR/USD Intra-Day Fundamentals: German Ifo Business Climate and range price movement

2017-08-25 09:00 GMT | [EUR - German Ifo Business Climate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Ifo Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers.

==========

From official report :

==========

EUR/USD M5: range price movement by German Ifo Business Climate news event

Intra-Day Fundamentals - EUR/USD and Dollar Index: Fed Chair Yellen Speech

2017-08-25 15:00 GMT | [USD - Fed Chair Yellen Speech]

[USD - Fed Chair Yellen Speech] = Speech about financial stability at the Federal Reserve Bank of Kansas City Economic Symposium, in Jackson Hole.

==========

From marketwatch article :

==========

EUR/USD M5: range price movement by Fed Chair Yellen Speech news events

==========

Dollar Index M5: range price movement by Fed Chair Yellen Speech news events

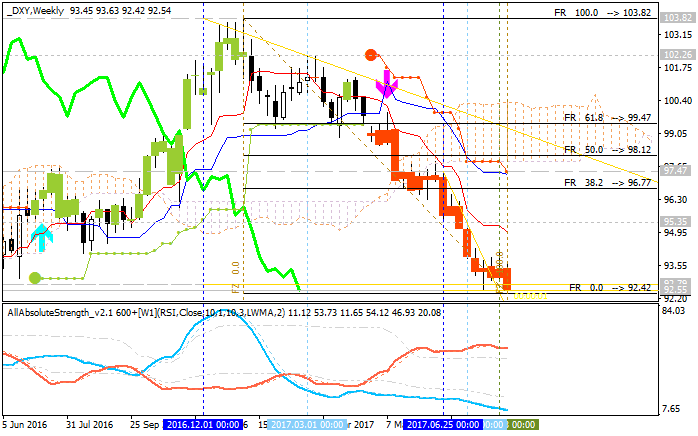

Weekly Outlook: 2017, August 27 - September 03 (based on the article)

The US dollar was on the back foot across the board in the last full week of August. An update on US GDP, consumer confidence, and the all-important Non-Farm Payrolls stand out.