You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Please note that it is external content/article which is not fully related to MQ or mql5 website. I mean - there are international economic and forex portals which are continuedly promoting all MT5/mql5 services making their independent opinions for example.

=============

MQL5 Automated Trading Robots and Expert Advisors Code Base For MetaTrader 5

MQL5 code base is the official coding community for trading robots commonly known as EAs for the new MetaTrader 5 forex trading platform. EAs or Automated forex trading is a popular forex topic among forex traders. However, the challenge for traders is how to find a good quality forex trading robot. This is where MQL5 Market comes in; MQL5 Market is hosted by MetaQuotes Software Corp. , The Makers of MetaTrader Software. To get a good quality forex trading robots a Trader Should Join the MQL5 Community of Automated Forex Traders.

For a new forex trader or any other trader wanting to learn how to start automated forex trading, the best place to start at is at the official MQL5 codebase community that is hosted by MetaQuotes Software Corp. the maker of MetaTrader 5. The MQL5 codebase is hosted by the programmers of MetaTrader 5, the programming language of MetaTrader 5 is known as MQL5.

MQL5 Market – Automated Forex Trading

As a new trader you can go to the MQL5 website (www.mql5.com) and learn what is automated trading and how to write an Expert Advisor to trade with. But because most forex traders may not want to learn a programming language and may want to use their time for trading, A trader who doesn’t want to learn programming can directly access trading robots on the MQL5 Market, The MQL5 Market is a community where Expert Forex traders using automated trading robots that are profitable sell their automated forex trading systems, Traders can Buy a forex Robot from the expert traders or order one to be coded for them using the MQL5 Market.

The MQL5 is also a good place for experienced forex currency traders, the MQL5 Market allows experienced traders who can demonstrate that they have a profitable trading robot to get additional earnings by placing their robots on the MQL5 Market. These Trading Robots are also made available directly From the MetaTrader 5, where traders using the MetaTrader 5 can access these trading robots. The screenshot below shows how a trader can access the Market from the MetaTrader 5 Software.

Forex Trader can access the MQL5 Market directly from the MetaTrader 5 platform. The trader can then automatically install the trading robot onto their forex trading platform and start trading with the automated trading robot. The MQL5 Market contains free trading robots and free Expert Advisors as well the paid forex trading robots. The trader can also try out any forex trading robot by downloading the demo version of a forex trading robot after registering in the MQL5 Community.

The Trading robots with the most credits are the most profitable forex trading EAs, These are also the top rated, and a trader may want to start with the top rated trading robots on the MQL5 Market. However, the top rated trading robots are not free and the owners of these systems will sometimes require a trader to make a payment so as to get access to them.Cyprus Industrial Production Plunges In May :

Cyprus's industrial production declined sharply in May, data released by the Republic of Cyprus showed on Tuesday.

Industrial production declined at a faster annual rate of 16.8 percent in May, following a decline of 5.9 percent in April.

Production in mining & quarrying declined 48.7 percent, while manufacturing output fell 19.3 percent. Electricity supply shrunk 3.4 percent, while output in the water supply and materials sector decreased 9.4 percent.

During the January-May period, industrial production recorded a fall of 13.0 percent from last year.

A.M. Kitco Metals Roundup: Gold Weaker On Position Evening As Key Data Points Awaited :

Comex gold futures prices are modestly lower in early U.S. trading Tuesday, pressured by some position evening and technical chart consolidation ahead of some big economic data due out in the next few days that will most certainly be markets-moving. December gold was last down $5.50 at $1,324.10 an ounce. Spot gold was last quoted down $3.70 at $1,324.00. September Comex silver last traded down $0.214 at $19.65 an ounce.

Asian and European stock markets were firmer overnight in subdued trading, as key worldwide economic data points are approaching fast. The highlights this week are the U.S. Federal Reserve’s FOMC meeting that begins Tuesday and the U.S. employment report Friday. Most expect the Fed will leave its monetary policy unchanged and continue to lean well to the dovish side at this week’s meeting. Many Fed watchers are actually looking ahead to the next FOMC meeting, in September, at which time the central bank could begin its much-anticipated “tapering” of its monthly bond-buying program, also called quantitative easing.

For the U.S. jobs report, the key non-farm payrolls figure is forecast to rise by around 175,000 workers in July. The overall unemployment rate is expected to have declined by 0.1%, to 7.5%.

The U.S. gross domestic product reading for the second quarter will also be released Wednesday.

European traders are awaiting the European Central Bank and Bank of England monthly meetings that occur on Thursday. Asian traders and investors are awaiting manufacturing data from China, due out Thursday.

The European Union did see its overall consumer confidence rise to the highest level in over a year, it was reported Tuesday. At present, the EU sovereign debt problems are pushed to the back burner of the market place, but have not just disappeared.

The U.S. dollar index is near steady Tuesday morning and hovering near Monday’s five-week low. The greenback bears have the overall near-term chart advantage. Meantime, Nymex crude oil futures prices are lower Tuesday morning and hit a three-week low overnight. While the crude oil bulls still have the overall near-term technical advantage, they are fading.

U.S. economic data due for release Tuesday includes the weekly Goldman Sachs and Johnson Redbook retail sales reports, the S&P/Case-Shiller home price index, and the consumer confidence index.

The London A.M. gold fix is $1,322.25 versus the previous London P.M. fixing of $1,331.00.

Technically, December gold futures see a four-week-old price uptrend in place on the daily chart. The gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at $1,350.00. Bears’ next near-term downside breakout price objective is closing prices below solid technical support at $1,300.00. First resistance is seen at Monday’s high of $1,338.50 and then at $1,350.00. First support is seen at the overnight low of $1,318.10 and then at $1,308.90.

September silver futures are in a gentle four-week-old uptrend on the daily chart, but now just barely so, and bulls need to show more power very soon to keep it in place. Bulls’ next upside price breakout objective is closing prices above solid technical resistance at the July high of $20.595 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at $19.215. First resistance is seen at the overnight high of $19.875 and then at $20.00. Next support is seen at the overnight low of $19.50 and then at $19.215.

2013-07-30 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence (CCI)]

If actual > forecast = good for currency (for USD in our case)

==========

U.S. Consumer Confidence Pulls Back Off Five-Year High In July :

With consumer expectations regarding the short-term outlook weakening in July, the Conference Board released a report on Tuesday showing that U.S. consumer confidence for the month fell by more than economists had anticipated.

The Conference Board said its consumer confidence index dropped to 80.3 in July from a revised 82.1 in June. Economists had been expecting the index to dip to 81.0 from the 81.4 originally reported for the previous month.

The bigger than expected decrease by the consumer confidence index came after it reached a more than five year in June.

"Consumer Confidence fell slightly in July, precipitated by a weakening in consumers' economic and job expectations," said Lynn Franco, Director of Economic Indicators at The Conference Board. "However, confidence remains well above the levels of a year ago."

Reflecting the weakening in consumer expectations, the expectations index fell to 84.7 in July from 91.1 in June.

The Conference Board said the percentage of consumers expecting business conditions to improve over the next six months fell to 19.1 in July from 21.4 in June, while consumers expecting conditions to worsen remained virtually unchanged at 11.2 percent.

Consumers' outlook for the labor market was also less upbeat, with those expecting more jobs in the months ahead falling to 16.5 percent from 19.7 percent, while those expecting fewer jobs rose to 18.1 percent from 16.1 percent.

Meanwhile, the report said the present situation index climbed to 73.6 in July from 68.7 in June, as consumers' appraisal of current conditions continued to improve.

Consumers saying business conditions are "good" rose to 20.9 percent from 19.4 percent, while those saying conditions are "bad" fell to 24.5 percent from 24.9 percent.

The Conference Board noted that the assessment of the job market was also more positive, as those saying jobs are "plentiful" climbed to 12.2 percent from 11.3 percent, while those saying jobs are "hard to get" dipped to 35.5 percent from 37.1 percent.

"Consumers' assessment of current conditions continues to gain ground and expectations remain in expansionary territory despite the July retreat," Franco said.

She added, "Overall, indications are that the economy is strengthening and may even gain some momentum in the months ahead."

Last Friday, Thomson Reuters and the University of Michigan released a separate report showing that consumer sentiment improved to its best level in six years in July

The report showed that the consumer sentiment index for July was upwardly revised to 85.1 from the preliminary reading of 83.9. Economists had expected the index to be upwardly revised to 84.0.

With the upward revision, the index was above the final June reading of 84.1 and at its highest level since July of 2007.

2013-07-31 01:00 GMT (or 03:00 MQ MT5 time) | [NZD - ANZ Business Confidence]

If actual > forecast = good for currency (for NZD in our case)

==========

New Zealand Business Confidence Jumps To 14-Year High

Confidence among New Zealand businesses climbed to its highest level in fourteen years in July, the latest business outlook survey by ANZ showed Wednesday.

A net 53 percent of survey respondents expect better times ahead, up by 3 points from June. This was the highest level of headline confidence since April 1999.

Firms' assessment of their own business situation remained high, with the corresponding indicator easing just one point from last month's three-year high to a net 44 percent in July.

Companies' profit expectations increased to a 14-year high of 29 percent. Investment intentions weakened from June's 10-year high, but remained at a healthy level of 20, which was the second highest in eight years.

Employment indicator was down one point to 16, but was at its second highest level in three years. Export intentions continued to recover, the survey found.

Confidence among construction firms was at four-year high, despite a slight easing from June. Sentiment improved in manufacturing, which was the least optimistic sector in July.

As we are going to see FOMC Statement at 18:00 today (GMT time, or at 20:00 MQ MT5 time) so this is the latest news from intl'l economic portal about how to trade this news events (thanks to dailyfx as it is really great economic portal).

================

EUR/USD- Trading the Fed Open Market Committee (FOMC) Meeting

Trading the News: Federal Open Market Committee Meeting

What’s Expected:

Time of release: 07/31/2013 18:00 GMT, 14:00 EDT

Primary Pair Impact: EURUSD

Expected: 0.25%

Previous: 0.25%

DailyFX Forecast: 0.25%

Why Is This Event Important:

Beyond the Federal Open Market Committee’s (FOMC) interest rate announcement, further details surrounding the exit strategy may heighten the appeal of the U.S. dollar amid the growing discussion at the central bank to taper the asset-purchase program. As the Fed anticipates a stronger recovery in the second-half of the year, the policy statement accompanying the rate decision may sound less dovish this time around, and the central bank may show a greater willingness to move away from its easing cycle as the economy gets on a more sustainable path.

The FOMC may turn increasingly upbeat towards the economy amid the pick up in job growth paired with the resilience in private sector consumption, and we may see a growing number of central bank officials adopt a more hawkish tone for monetary policy as the outlook for growth and inflation improves. However, the FOMC may continue to strike a cautious outlook for the region amid the persistent slack in the real economy, and the central bank may adjust the policy outlook in favor of its highly accommodative stance in order to encourage a stronger recovery.

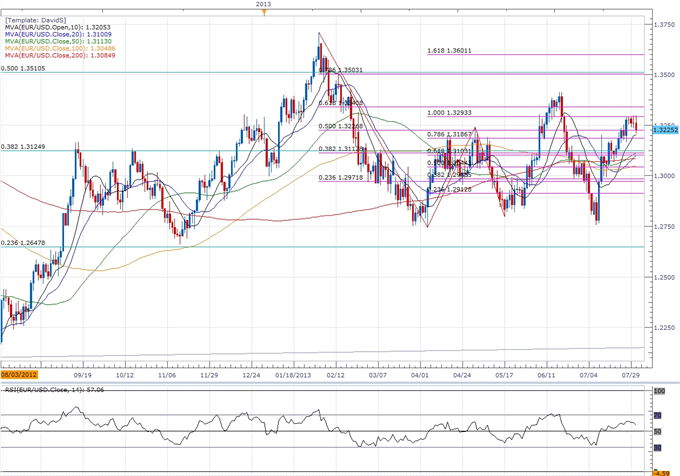

Potential Price Targets For The Rate Decision

As the EURUSD remains largely capped by the 1.3300 handle, a more upbeat FOMC may spark a more meaningful reversal in the exchange rate, and we will be watching the downside targets ahead of the highly anticipated Non-Farm Payrolls report due out on Friday as the pair appears to have carved out a near-term top ahead of August. However, we may see a topside break in the EURUSD should the Fed shift its forward-guidance in favor of its highly accommodative policy stance, and the pair may coil up for another run at 1.3400 should the central bank sound more dovish this time around.How To Trade This Event Risk

Trading the given event risk may not be as clear cut as some of our previous trades as the FOMC is widely expected to maintain its current policy, but further details surrounding the exit strategy may spark a bullish reaction in the U.S. dollar as the central bank appears to be slowly moving away from its easing cycle. Therefore, if the FOMC sounds more upbeat this time around and shows a greater willingness to taper the asset-purchase program, we will need to see a red, five-minute candle following the policy statement to generate a sell entry on two-lots of EURUSD. Once these conditions are fulfilled, we will place the initial stop at the nearby swing high or a reasonable distance from the entry, and this risk will establish our first target. The second objective will be based on discretion, and we will move the stop on the second lot to breakeven once the first trade hits its mark in an effort to preserve our profits.

On the other hand, the Fed may lay out a greater argument to retain its highly accommodative policy amid the ongoing slack in the real economy, and the central bank may keep the door open to shift its asset-purchase program in either direction in an effort to encourage a stronger recovery. As a result, if the FOMC shows a greater willingness to further embark on its easing cycle, we will implement the same strategy for a long euro-dollar trade as the short position laid out above, just in the opposite direction.

The FOMC showed a greater willingness to scale back its asset-purchase program even as the central bank stuck to its current policy in June, and we should see the Fed slowly move away from its easing cycle as they anticipate a stronger recovery in the second-half of the year. Indeed, the more upbeat tone from the FOMC propped up the greenback, with the EURUSD slipping below the 1.3300 handle, and the reserve currency held firm throughout the day as the pair closed at 1.3293.

The Basics of Forex Leveraging :

Leverage in trading simply refers to the ability to increase the size of your trade or investment by using credit from a broker. When trading using leverage, you are effectively borrowing from your broker, while the funds in your account act as collateral. This collateral is referred to as margin.

The amount of leverage available is based on the margin requirement of the broker. Margin requirement is usually shown as a percentage, while leverage is expressed as a ratio. For example, a broker might require a minimum margin level of 2%. This means that the customer must have at least 2% of the total value of an intended trade available in cash before opening the position. A 2% margin requirement is equivalent to a 50:1 leverage ratio. In practical terms, using 50:1 leverage, having $1,000 in your account would allow you to trade up to $50,000 worth of a given financial instrument. At a 50:1 leverage, a 2% loss in the instrument traded completely wipes out a fully leveraged account. Conversely, a 2% gain doubles the account.

Leverage by Market and Instrument

Leverage available differs substantially depending on what market you are trading and from which country you are based. For example, the degree of leverage available for trading stocks is relatively low. In the United States, investors typically have access to 2:1 leverage for trading equities, a margin level of 50%.

The futures market offers much higher degrees of leverage, such as 25:1 or 30:1, depending on the contract traded.

The leverage available in the forex market is higher still at 50:1 in the U.S. and as high as 400:1 offered by brokers internationally.

Leverage in Forex Trading

High leverage availability, coupled with a relatively low minimum balance to open an account, has added to the allure of the forex market to retail traders. However, excessive use of leverage is often and correctly cited as the primary reason for traders blowing out their accounts.

The danger that extreme leverage poses to investors has been recognized and acted on by the U.S. regulatory bodies, which have created restrictions on the amount of leverage available in forex trading. In August 2010, the Commodity Futures Trading Commission (CFTC) released final rules for retail foreign exchange transactions, limiting leverage available to retail forex traders to 50:1 on major currency pairs and 20:1 for all others.

As of 2013, brokers outside the U.S. continue to offer leverage of 400:1 and higher.

Examples of Leveraged Trades in the Forex Market

In our first example, we'll assume the use of 100:1 leverage

In this case, to trade a standard $100K lot you would need to have margin of $1K in your account. If, for example, you make a trade to buy 1 standard lot of USD/CAD at 1.0310 and price moves up 1% (103 pips) to 1.0413, you would see a 100% increase in your account. Conversely, a 1% drop with a standard 100K lot would cause a 100% loss in your account.

Next, let's assume you are trading with 50:1 leverage and 1 standard $100K lot. This would require you to have margin of $2K (2% of 100K).

In this case, if you buy 1 standard lot of USD/CAD at 1.0310 and price moves up 1% to 1.0413, you would see a 50% increase in your account, while a 1% drop with a standard 100K lot would equal a 50% loss in your account.

Consider here that 1% moves are not uncommon and can even happen in a matter of minutes, especially after major economic releases. It could only take one or two losing trades using the leverage described in the examples above to wipe out an account. While it's exciting to entertain the possibility of a 50% or 100% increase in your account in a single trade, the odds of success over time using this degree of leverage are extremely slim. Successful professional traders often suffer a string of multiple losing trades but are able to continue trading because they are properly capitalized and not overleveraged.

Let's now assume a lower leverage of 5:1. To trade a standard $100K lot at this leverage would require margin of $20K. An adverse 1% move in the market in this case would cause a far more manageable 5% loss.

Fortunately, micro lots enable traders to use lower leverage levels such as 5:1 with smaller accounts. A micro lot is equivalent to a contract for 1,000 units of the base currency. Micro lots allow flexibility and create a good opportunity for beginning traders, or traders starting with smaller account balances, to trade with lower leverage.

Margin Calls

When you enter a trade, your broker will keep track of your account's Net Asset Value (NAV). If the market moves against you and your account value falls below the minimum maintenance margin, you may receive a margin call. In such an event, you could receive a request to add funds to your account, or your positions could simply be flattened automatically by the broker to prevent further losses.

The Use of Leverage and Money Management

The use of extreme leverage is fundamentally antithetical to the conventional wisdom on money management in trading.

Among the widely accepted tenets on money management are to keep leverage levels low, to use stops and to never risk more than 1-2% of your account on any one trade

The Bottom Line

Data disclosed by the largest foreign-exchange brokerages as part of the Dodd-Frank financial reform legislation has shown that a majority of retail customers lose money trading. A substantial if not leading cause is the misuse of leverage.

However, leverage has key benefits, providing the trader with greater flexibility and capital efficiency. The absence of commissions, tight spreads and available leverage are certainly beneficial to active forex traders, creating trading opportunities not available in other markets.

We are going to have the following news event soon :

2013-08-01 11:45 GMT | [EUR - ECB Interest Rate]

so this is the article from dailyfx about how to trade this news event.

================

Trading the News: European Central Bank Interest Rate Decision

What’s Expected:

Time of release: 08/01/2013 11:45 GMT, 7:45 EDT

Primary Pair Impact: EURUSD

Expected: 0.50%

Previous: 0.50%

DailyFX Forecast: 0.50%

Why Is This Event Important:

The European Central Bank (ECB) interest rate decision may weigh on the single currency as the Governing Council adopts forward-guidance for monetary policy, but the fresh batch of central bank rhetoric may drag on the single currency should President Mario Draghi show a greater willingness to further embark on the easing cycle. As the euro-area remains mired in recession, the ECB may allude to additional rate cuts down the road, and Mr. Draghi may sounds more dovish this time around as the outlook for growth and inflation remains weak.

Recent Economic Developments

The Upside/Bullish ScenarioThe ECB may continue to call for a recovery later this year as confidence in the euro-area picks up, and a more neutral policy statement may set the tone for a short-term rally in the EURUSD as market participants scale back bets for more central bank support.

The Downside/Bearish Scenario

Release

Expected

Actual

Euro-Zone Unemployment Rate (JUN)

12.2%

12.1%

Euro-Zone Consumer Price Index Core (YoY) (JUL A)

1.2%

1.1%

Euro-Zone Trade Balance s.a. (MAY)

16.2B

14.6

As the ECB looks for an export-led recovery, the ECB may look to limit the upside in the single currency, and we may see the Euro struggle to hold its ground should the Governing Council may show a greater willingness to implement more non-standard measures.

Potential Price Targets For The Rate Decision

As the EURUSD struggles to clear the 61.8% Fibonacci retracement from the February decline (1.3340), the pair looks poised to consolidate ahead of the ECB interest rate decision, but we may see a run at the June high (1.3415) should President Draghi strike a more upbeat tone for the monetary union. However, should the central bank show a greater willingness to embark on its easing cycle, the EURUSD may struggle to maintain the rebound from July (1.2754), and the single currency may work its way back towards the 23.6% retracement (1.2640-50) over the near to medium-term as market participants increase bets for additional monetary support.

How To Trade This Event Risk

Trading the given event risk may not be as clear cut as some of our previous trades as the Governing Council is widely expected to retain its current policy, but the fresh batch of central bank rhetoric may set the stage for a long Euro trade should the ECB sound more upbeat this time around. Therefore, if President Draghi strikes an improved outlook and adopts a more neutral tone for monetary policy, we will need a green, five-minute candle following the statement to generate a long entry on two-lots of EURUSD. Once these conditions are met, we will set the initial stop at the nearby swing low or a reasonable distance from the entry, and this risk will establish our first target. The second objective will be based on discretion, and we will move the stop on the second lot to cost once the first trade hits its mark in an effort to protect our profits.

On the other hand, the Governing Council may turn increasingly cautious towards the economy as the region struggles to return to growth, and the ECB may show a greater willingness to ease policy further in order to pull the region out of recession. As a result, if Mr. Draghi surprises with a rate cut or talks up bets for additional monetary support, we will implement the same strategy for a short euro-dollar trade as the long position laid out above, but in the opposite direction.

Impact that the European Central Bank Interest Rate Decision has had on EUR during the last meeting

Period

Data Released

Estimate

Actual

Pips Change

(1 Hour post event )

Pips Change

(End of Day post event)

JUL 2013

07/04/2013 11:45 GMT

0.50%

0.50%

-88

-77

July 2013 European Central Bank Interest Rate Decision

Although the European Central Bank stuck to its current policy in July, the Governor Council pledged to keep interest rates low for an ‘extended period’ of time as the monetary union remains mired in recession. Indeed, the ECB’s forward-guidance for monetary policy dragged on the Euro, with the EURUSD dipping below the 1.2900 handle, but we saw the pair consolidate during the holiday trade as it ended the day at 1.2912.

2013-08-01 11:00 GMT (or 13:00 MQ MT5 time) | [GBP - BoE Interest Rate Decision]

If actual > forecast = good for currency (for GBP in our case)

==========

BoE Keeps QE Unchanged, Rate At 0.50%

The Bank of England retained its quantitative easing at GBP 375 billion and its record low interest rate on Thursday.

The Monetary Policy Committee headed by Governor Mark Carney decided to retain the asset purchase programme at GBP 375 billion. The previous change in asset purchases was in July 2012, when it was raised by GBP 50 billion.

The panel also decided to keep the key interest rate unchanged at 0.50 percent. The current rate is the lowest since the central bank was established in 1694.

The minutes of the meeting, to be published on August 14, will reveal today's voting pattern.

As previously announced, the MPC will also respond to the Chancellor's request for its assessment of the use of thresholds and forward guidance at that time.

==========

Strategies for EURUSD and GBPUSD Ahead of ECB and BoE

Currency Analyst Christopher Vecchio discusses trade setups ahead of the Bank of England, and what specifically to look for that could prompt moves in either direction. Also covered is strategy ahead of the European Central Bank policy meeting.

2013-08-01 12:30 GMT (or 14:30 MQ MT5 time) | [EUR - ECB Press Conference]

==========

Reaction to ECB press conference :

Mario Draghi offered nothing new during his press conference this afternoon. Aside from pointing out the improved sentiment in the euro area - following the rise in the PMIs over the last few months to close or above 50, the level that separates growth from contraction - the statement was essentially a carbon copy of the statement from last month.

Despite efforts to avoid providing clarity on the ECBs forward guidance, Draghi did finally concede that rates will remain low until at least July next year. However, he did caveat this with comments that suggested this date is not set in stone and can be changed. It was essentially a commitment to forward guidance that came with small print that we’re not meant to pay attention to. In other words, the forward guidance offered by the ECB remains pointless, as confirmed by the complete lack of reaction in the markets to these comments.

Draghi also claimed that the ECB did not discuss adding thresholds to the forward guidance, which is hard to believe. It seems ridiculous that one of the most powerful central banks would offer forward guidance, without even discussing potential thresholds, even if the decision to stick with the previous guidance was “unanimous”. If these aren’t even being discussed then the ECB is missing a simple opportunity to put the markets at ease over whether we can expect rate hikes in the medium term.

On the subject of what the ECB isn’t doing, Draghi confirmed that rate cuts weren’t even discussed at the meeting, as they instead focused on forward guidance (which in effect barely exists). Again, it seems very strange that rates weren’t even discussed, despite the fact that they were discussed so much at previous meetings, including the prospect of negative deposit rates. It would appear, future rate cuts are now off the table.

One interesting point that arose was the potential to release minutes of the meetings in the future, similar to what we have in the US and the UK. Draghi claimed the discussions are at an early stage and that the minutes must not risk the members independence, which appears to be very odd at a time when everyone is seeking more transparency. If the ECB has nothing to hide in its meetings, what’s the risk?