You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

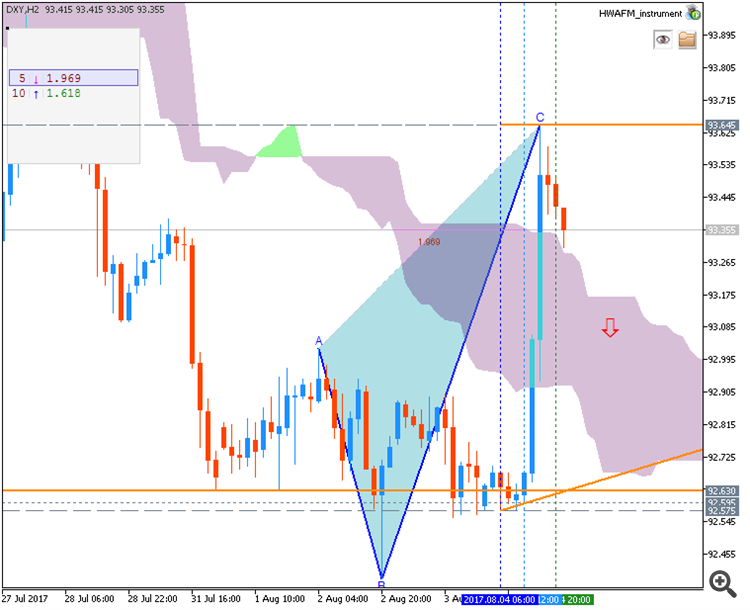

Harmonic Trading – Different Gartley Methods (based on the article)

"The beauty of the original Gartley pattern comes from the money management system involved. Money management with Gartley allows for hefty 1:3, 1:4 or even more as risk-reward ratios. If you want a Fibonacci and Gartley approach, look for no swing above 61.8% of the previous move lower. The series of lower highs overwhelms. Bulls look trapped. Gartley labeled this segment A-B. The longest in the pattern. And then, suddenly, bulls catch a bid. This is the B-C segment. How do we know this bounce matters? The answer comes from the A-B characteristics: the lower highs series gets broken by the B-C segment."

"Larry Pesavento took Gartley’s original work to a new level. Because of him, the Gartley 222 pattern became a well-known harmonic pattern today. The “Gartley 222” method as described by Pesavento derives its name from the page no. 222 from the original Harold’s Gartley’s book. The most simplistic representation of the Gartley 222 pattern looks like this" :

"Carney was a student of Pesavento. He didn’t like to leave to many possibilities for the retracement levels, so he worked on finding a better approach. Carney’s approach to harmonic trading was made public at the turn of the century. His approach uses specific Fibonacci ratios between the Pesavento’s Gartley 222 pattern."

"Traders need to know that harmonic patterns work best with a sound money management system. Before defining the target, one must deal with the potential loss."

AUD/USD Intra-Day Fundamentals: Australian Retail Sales and range price movement

2017-08-04 02:30 GMT | [AUD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Retail Sales news event

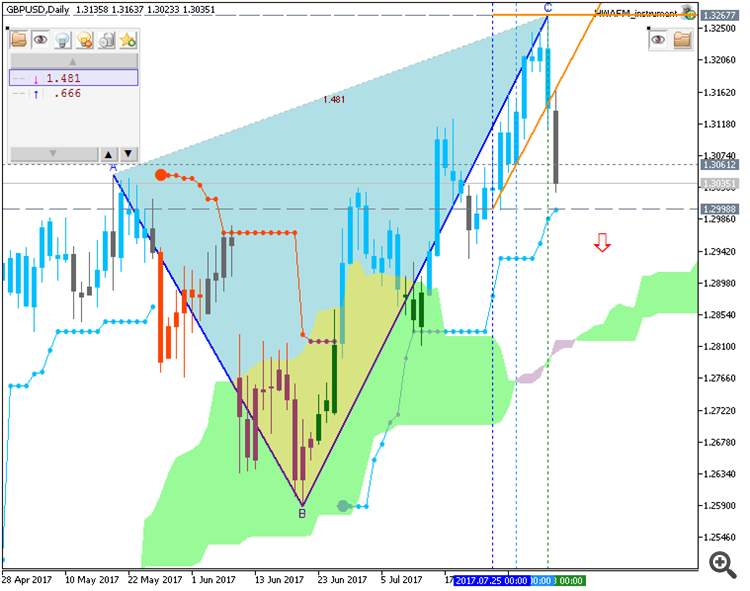

GBP/USD - daily ranging bullish; 1.3267 and 1.2817 are the keys (based on the article)

Daily price is located above Ichimoku cloud in the bullish area of the chart: the price was bounced from 1.3267 resistance level to below for the ranging to be started with 1.2817 Senkou Span line as the border between the primary bearish and the primary bullish trend on the chart.

Weekly Outlook: 2017, August 06 - August 13 (based on the article)

The US dollar remained on the back foot throughout most of the week, with the jobs report allowing for a comeback. Is this a temporary correction or the start of a dollar rally? The upcoming week features US inflation figures, the JOLTs data, a rate decision in New Zealand and more.

Weekly GBP/USD Outlook: 2017, August 06 - August 13 (based on the article)

GBP/USD made another move tot he upside but was forced to retreat on the BOE’s bearishness. Will it remain the loser? The upcoming week features a mix of figures from all sectors.

EUR/USD - intra-day correction to the bearish reversal; 1.1727 is the key (based on the article)

Intra-day H4 price was bounced from 1.1892 resistance level to below for the secondary correction inside the primary bullish trend to be started. The price is testing 1.1727 support level together with Ichimoku cloud to below to be reversed to the primary bearish market condition.

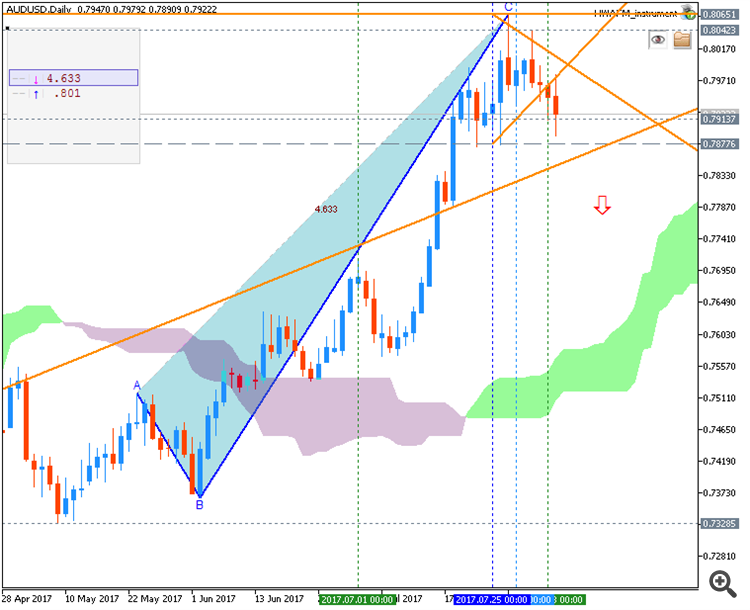

Weekly AUD/USD Outlook: 2017, August 06 - August 13 (based on the article)

The Australian dollar struggled with the highs but did not give up on these levels, despite RBA pressure. Where next? The upcoming week features speeches from central bankers as well as important surveys.

Weekly USD/CAD Outlook: 2017, August 06 - August 13 (based on the article)

Dollar/CAD moved up, correction previous losses as oil prices cooled down. The upcoming week features housing figures from Canada.

NZD/USD Intra-Day Fundamentals: New Zealand Inflation Expectations and range price movement

2017-08-07 04:00 GMT | [NZD - Inflation Expectations]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Inflation Expectations] = Percentage that business managers expect the price of goods and services to change annually during the next 2 years.

==========

From hotcopper article :

==========

NZD/USD M5: range price movement by New Zealand Inflation Expectations news event

USD/JPY Intra-Day Fundamentals: Japan Adjusted Current Account and range price movement

2017-08-08 00:50 GMT | [JPY - Current Account]

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - Current Account] = Percentage that business managers expect the price of goods and services to change annually during the next 2 years.

==========

From rttnews article :

==========

USD/JPY M5: range price movement by Japan Adjusted Current Account news event