You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Dax Index - daily bullish ranging waiting for the bullish to be resumed or to the ranging bearish reversal (based on the article)

Dax Index daily is located above Ichimoku cloud in the bullish area of the chart within the following support/resistance levels:

If the price breaks 11,892 resistance on close daily bar so the bullish trend will be resumed.

If the price breaks 11,403 support level to below so the reversal to the bearish condition will be started with the secondary ranging way - the price will be located inside Ichimoku cloud.

If not so the price will be on bullish ranging within the levels.

Gold (XAU/USD) Ahead of FOMC Rate Decision (based on the article)

Daily price is below 200-day SMA in the bearish area of the chart. The price is on ranging within 1,220/1,122 levels waiting for the direction of the strong trend to be started. If the price breaks 1,122 support level to below so the primary bearish trend will be resumed. Alternative, if the price breaks 1,220 resistance level so the secondary rally will be started with 1,264 nearest daily target as the bullish reversal level.

AUD/USD Intra-Day Fundamentals: Australian Trade Balance and 53 pips range price movement

2017-02-02 00:30 GMT | [AUD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

From official report:

==========

AUD/USD M5: 53 pips range price movement by Australian Trade Balance news event

M5 price is located above 200 SMA in the bullish area of the chart within the following support/resistance levels:

- 1.2701 resistance level located far above 200 SMA in the beginning of the bullish trend to be resumed, and

- 1.2659 support level located near 200 SMA in the beginning of the bearish trend to be started.

If the price breaks 1.2701 resistance to above on close M5 bar so the primary bullish trend will be resumed.If the price breaks 1.2659 support level on close M5 bar so the reversal of the intra-day price movement from the ranging bullish to the primary bearish market condition will be started.

If not so the price will be on bullish ranging within the levels.

"Fresh forecasts from BoE officials may highlight 'a slightly lower path for inflation than envisaged in the November Inflation Report’ as the central bank continues to assess sterling’s effect on U.K. price growth, and the Monetary Policy Committee (MPC) may stick to the highly accommodative policy stance throughout 2017 especially as the U.K. prepares to depart from the European Union (EU). Nevertheless, Governor Carney may stress ‘there are limits to the extent to which above-target inflation can be tolerated’ as the central bank anticipates a notable increase in price growth, and an unexpected upward revision in the quarterly inflation report (QIR) may fuel a larger recovery in GBP/USD as it boosts interest rate expectations."

"However, signs of stronger-than-expected growth paired with the pickup in U.K. wage growth may encourage the MPC to adopt a more hawkish outlook for monetary policy, and an unexpected upward revision to the quarterly inflation report may heighten the appeal of sterling as market participants scale back bets for additional monetary support."

Forum on trading, automated trading systems and testing trading strategies

CNY Manufacturing

Mauro Giuseppe Tondo, 2017.02.02 19:21

this night

02:45 Caixin Manufactoring Pmi

Cons 51.9 prev 51.9 Act?

Hong Kong PMI slips to contraction; Hang Seng China Enterprises Index with the daily correction to be started (based on the article)

"Business conditions in Hong Kong swung to stagnation in January, the latest survey from Nikkei revealed on Friday with a PMI score of 49.9. That's down from 50.3 in December, and it moves beneath the boom-or-bust line of 50 that separates expansion from contraction."

HSCE was bounced from 23,480 resistance level to belowfor 22,965 support level to be testing for the secondary correction to be started.

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and 112 pips range price movement

2017-02-03 01:45 GMT | [CNH - Caixin Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNH in our case)

[CNH - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

==========

USD/CNH M5: 112 pips range price movement by Caixin Manufacturing PMI news event

USD/CNH - weekly correction, daily bearish (adapted from the artile)

Weekly price is above Ichimoku cloud: the price was bounced from 6.9869 resistance level to below for support level at 6.7818 to be testing for the correction to be started.

Daily price in on bearish ranging located below Ichimoku cloud within the following s/r levels:

Chinkou Span line and Absolute Strength indicator are estimating the trend as the ranging bearish, and Trend Strength indicator is evaluating the future possible trend as the bullish.

Forum on trading, automated trading systems and testing trading strategies

Good news for Gold and Silver

Tomas Sekeres, 2017.02.03 16:35

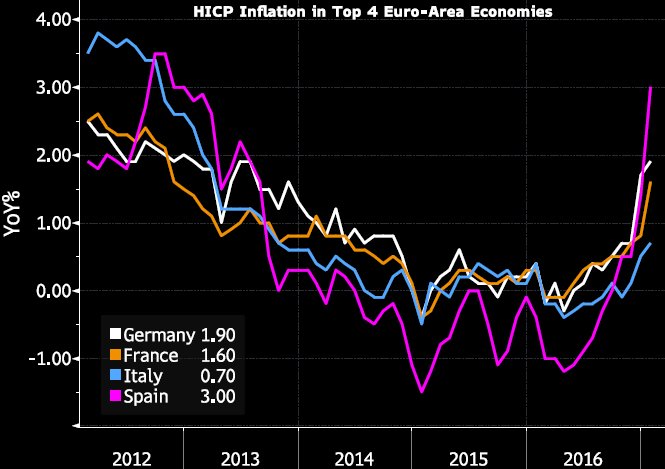

Inflation up in January in Top 4 Euro Economics. Good news for Gold and Silver.Intra-Day Fundamentals - EUR/USD, Dollar Index and S&P 500: Non-Farm Payrolls

2017-02-03 13:30 GMT | [USD -Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD -Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report:

==========

EUR/USD M5: 72 pips range price movement by Non-Farm Payrolls news events

==========

Dollar Index M5: range price movement by Non-Farm Payrolls news events

==========

S&P 500 M5: range price movement by Non-Farm Payrolls news events