You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Apple - Meeting In India On January 22 (based on the article)

USD/CAD Intra-Day Fundamentals: Canada's Consumer Price Index and 47 pips range price movement

2017-01-20 13:30 GMT | [CAD- CPI]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD- CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

The Consumer Price Index (CPI) rose 1.5% on a year-over-year basis in December, following a 1.2% gain in November.

==========

USD/CAD M5: 47 pips range price movement by Canada's Consumer Price Index news event

The major indices were each up about 0.2% as the day's ceremonies and inauguration speech were underway (based on the article)

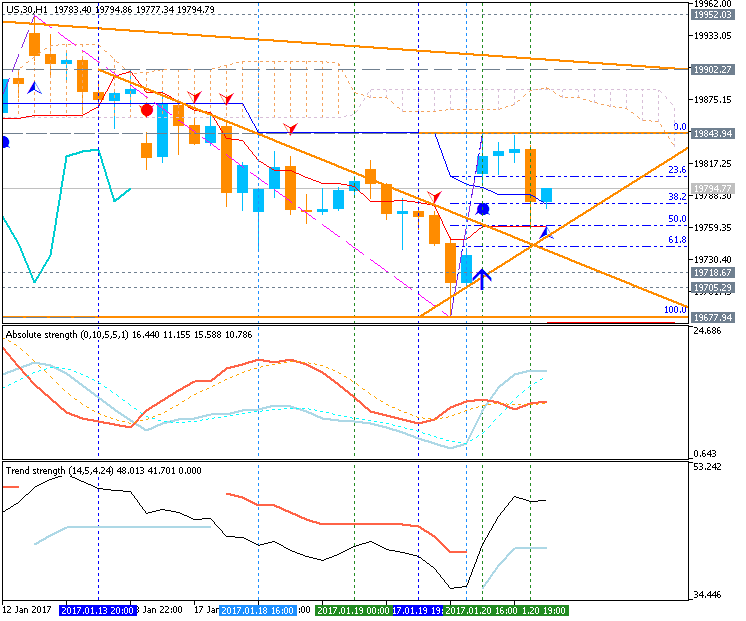

Dow Jones Industrial Average H1: the price high jumped from 19.677 support level to above to 19.843 resistance level to be tested for the rally to be continuing.----------------

S&P 500 rised from 2,258 support level to above for the resistance level at 2,277 to be testing for the bullish trend to be continuing. By the way, the secondary ranging condition to be started for the price to be waiting for the directionof the trend.

Weekly Outlook: 2017, January 22 - January 29 (based on the article)

The US dollar was mixed as Donald Trump entered the White House. Apart from Trump’s first week as President, we have some interesting publications: US and UK GDP, durable goods orders from the US and more These are the highlights of this week.

Weekly EUR/USD Outlook: 2017, January 22 - January 29 (based on the article)

EUR/USD enjoyed the dollar’s weakness but traded with relative caution after Draghi’s press conference. The upcoming week features a mix of PMIs, inflation, and GDP numbers. Here is an outlook for the highlights of this week.

Dollar Index - "Big-ticket fundamental news-flow does not enter the picture until Friday, when market participants will get their first look at fourth quarter US GDP figures. The annualized growth rate is expected to have slowed to 2.2 percent in the final three months of the year, down from 3.5 percent in the preceding period. Robust improvement in US data outcomes relative to consensus forecasts over the same period suggests analysts may be underestimating the economy’s vigor, opening the door for an upside surprise."

GBP/USD - "Looking at the economic docket for the week ahead, the 4Q Gross Domestic Product (GDP) reports coming out of the U.K. & U.S. may generate a buzz as both regions are projected to grow at a slower pace compared to the previous quarter, but the backward-looking data prints may do little to alter the range-bound conditions in the pound-dollar exchange rate amid the diverging paths for monetary policy. Fed Fund Futures are now pricing a greater than 70% probability for a June rate-hike as Chair Janet Yellen argues the Federal Open Market Committee (FOMC) is ‘closing in’ on its dual mandate, and the pickup in interest-rate expectations continues to foster a long-term bearish forecast for GBP/USD as the central bank remains on course for further normalize monetary policy in 2017."

GOLD (XAU/USD) - "Heading into next week, traders will be closely eyeing the release of US 4Q GDP figures on Friday. Consensus estimates are calling for an annualized print of 2.2% q/q, down from 3.5% q/q. Keep in mind that interest rate expectations remain firmly rooted for the second half of the year with Fed Fund Futures citing a 74% chance for a hike at the June meeting. However, with the inauguration of a new president and a more ‘business friendly’ administration expected to take the reins, markets may take more cues near-term by the first few days of the Trump presidency. From a trading standpoint, while the broader focus remains constructive, the advance remains vulnerable heading into the last full week of January trade."

Brent Crude Oil - "From a longer-term fundamental perspective, there is a traditional focus on commodities as an inflation hedge, which has become an important topic in recent months. We have seen a 97.5% rise in a key inflation benchmark, the US Treasury 10-year yield from Summer 2016 after the last panic purchase of Treasuries on Brexit-Fear played out. The recent move has acted in a similar fashion as the “taper tantrum” of 2012/13 that saw a rise of 163bps or 116.5% in the 10yr that aligned with Oil rising from the upper-$70 region to above $110 in late August 2013. Both yields and Oil peaked within a week of each other before a consolidation and an eventual breakdown. Therefore, for the Bullish Oil trade to work out, we would likely need a moderately weaker Dollar aided by higher inflation expectations, which can be viewed directly from the bond market."

Alibaba: daily ranging near bullish reversal level (adapted from the article)

Alibaba share daily price is located inside Ichimoku cloud with the testing Senkou Span line at 97.90 for the bullish reversal.

- "Alibaba is set to announce results for its December quarter early Tuesday morning before the market opens, followed by a conference call at 7:30 a.m. EST."

- "Alibaba should not have a problem beating estimates for the December quarter and guidance going forward should not be an issue either given the Chinese Lunar New Year Holiday (and shopping season) starting next Saturday."

- "As of December 30, 2016, there were 110.2 million shares (just under 5% of the float) of Alibaba held short compared to an average daily trading volume of 8.4 million shares. It would be safe to assume that amount is higher now that we are on the cusp of earnings for Alibaba."

If the price breaks 97.90 resistance level to above so the reversal of the dail price movement from the daily ranging bearish to the primary bullish market condition will be started.If the price breaks 86.01 support level to below so the primary bearish trend will be resumed.

If not so the price will be on ranging bearish within the levels.