You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

NZD/USD Intra-Day Fundamentals: New Zealand Overseas Merchandise Trade and 16 pips price movement

2016-09-25 21:45 GMT | [NZD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

====================

NZD/USD M5: 16 pips price movement by New Zealand Overseas Merchandise Trade news event

EUR/USD Intra-Day Fundamentals: German IFO Business Climate and 11 pips price movement

2016-09-26 08:00 GMT | [EUR - German IFO Business Climate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German IFO Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers.

====================

EUR/USD M5: 11 pips price movement by German IFO Business Climate news event

Intra-Day Fundamentals - EUR/USD and USD/CAD: U.S. New Home Sales

2016-09-26 14:00 GMT | [USD - New Home Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - New Home Sales] = Annualized number of new single-family homes that were sold during the previous month.

==========

From Market Watch article: New-home sales slip in August but top forecast

==========

EUR/USD M5: 10 pips range price movement by U.S. New Home Sales news events

==========

USD/CAD M5: 38 pips range price movement by U.S. New Home Sales news events

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

H4 price is on bullish ranging above 100 SMA/200 SMA area within the following support/resistance levels:

- 1.1283 resistance level located above 100 SMA/200 SMA in the bullish area of the chart, and

- 1.1220 support level located near 200 SMA in the beginning of the bearish trend to be started.

The ascending triangle pattern was formed by the price to be broken to above for the possible bullish trend to be resumed but the secondary correction within the primary bullish trend is already started with the price for 1.1234 support level to be tested to below.Daily price. United Overseas Bank is expecting for this pair to be on ranging within 1.1120/1.1290 levels:

"While the undertone for EUR has improved with the reasonably strong daily closing yesterday, it is premature to expect a sustained up-move. 1.1290 is still acting as strong resistance and even if there is a break above level, EUR is expected to face another solid resistance near 1.1325. That said, for the next few days, the positive undertone would stay intact unless there is a move back below 1.1180."

Intra-Day Fundamentals - EUR/USD and USD/CAD: The Conference Board Consumer Confidence

2016-09-27 14:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

==========

EUR/USD M5: 18 pips price movement by The Conference Board Consumer Confidence news events

==========

USD/CAD M5: 40 pips price movement by The Conference Board Consumer Confidence news events

AUD/USD Intra-Day Fundamentals: RBA Assist Gov Edey Speaks and 13 pips price movement

2016-09-28 00:20 GMT | [AUD - RBA Assist Gov Edey Speaks]

[AUD - RBA Assist Gov Edey Speaks] = The Speech at the Australian Financial Review Retail Summit, in Melbourne.

=========="This is a conference about the retail industry, not the payments industry. However, a retail business is not a business if the retailer cannot get paid. And a retailer won't be at their most competitive if their payment costs are higher than they should be. This is an issue staff at the Reserve Bank think about every day, and one that I hope retailers are taking a close interest in as well.

Today I'll talk about how the way we pay is changing, and what it means for retail businesses. I'll also talk about the Reserve Bank's role as a payments regulator and about some of the things that are just around the corner in payments."

==========

AUD/USD M5: 13 pips price movement by RBA Assist Gov Edey Speaks news event

Intra-Day Fundamentals - EUR/USD and AUD/USD: Durable Goods Orders

2016-09-28 12:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From Market Watch article: Durable-goods orders lose steam in August

"Orders for durable or long-lasting goods flattened out in August after a sizable gain in the prior month, pointing to ongoing difficulties for American manufacturers. Orders fell 22% for large commercial aircraft, a volatile category that’s exhibited large swings during the summer. Bookings for new autos rose 0.7%, however. Stripping out transportation, orders sagged 0.4%, the Commerce Department said Wednesday. Demand declined for heavy machinery, computers and electrical equipment. What’s more, shipments of core capital goods, a category used to help determine gross domestic product, fell 0.4% to mark the fourth straight decline."

==========

EUR/USD M5: 16 pips price movement by Durable Goods Orders news events

==========

AUD/USD M5: 15 pips range price movement by Durable Goods Orders news events

Intra-Day Fundamentals - EUR/USD and USD/CAD: U.S. Gross Domestic Product

2016-09-29 12:30 GMT | [USD - GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

EUR/USD M5: 24 pips price movement by U.S. Gross Domestic Product news events

==========

USD/CAD M5: 25 pips range price movement by U.S. Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Press review

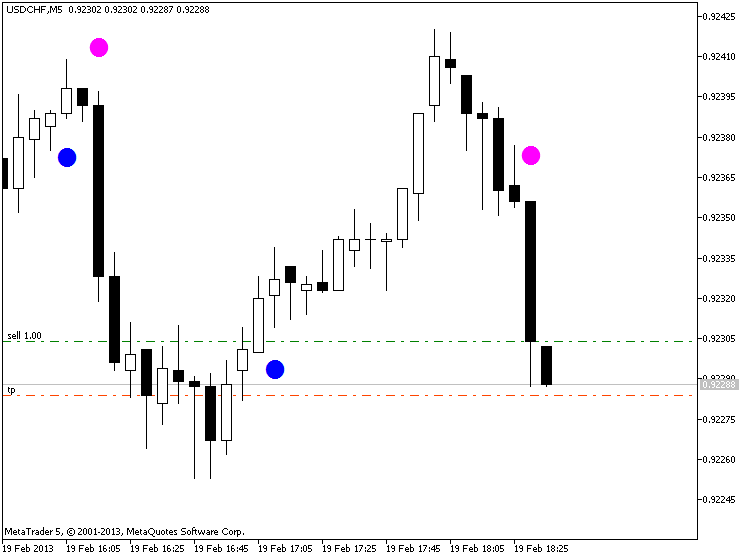

Sergey Golubev, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

USD/CNH Intra-Day Fundamentals: aixin Manufacturing PMI and 41 pips price movement

2016-09-30 01:45 GMT | [CNY - Caixin Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

=========="The seasonally adjusted Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – rose only slightly from the no-change mark of 50.0 in August to 50.1 in September. Although this signalled only a fractional improvement in the health of the sector, it was only the second time the headline index had posted in positive territory since February 2015."

==========

USD/CNH M5: 41 pips price movement by aixin Manufacturing PMI news event