You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Technical Targets for NZD/USD by United Overseas Bank (based on the article)

H4 price was bounced from 0.7284 and 200 SMA to above to the bullish area of the chart with the traded within the following support/resistance levels:

- 0.7379 resistance level located far above 100 SMA/200 SMA in the bullish area of the chart, and

- 0.7284 support level located near 200 SMA in the beginning of the bearish trend to be started.

The descending triangle pattern was formed by the price to be broken to below for the possible bearish trend.Daily price. United Overseas Bank is expecting for this pair to be on ranging market condition within 0.7240/0.7380 levels:

"The breach of 0.7340 indicates that the recent bearish phase has ended. The outlook for NZD from here is unclear and we prefer to hold a neutral view and expect this pair to trade listlessly between 0.7240 and 0.7380. Looking further ahead, the downside appears to be more vulnerable but a sustained weakness is likely only if there is a break below the very strong 0.7220/40 support zone."

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: FOMC Statement and Federal Funds Rate

2016-09-21 18:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From ft article: Fed fund futures see 60% chance of 2016 rate hike"Fed fund futures, contracts that investors use to bet on interest rate movements, imply that there is a 60 per cent chance of a hike at the December meeting, up slightly from 59 per cent ahead of today’s decision, reports Robin Wigglesworth in New York."

==========

EUR/USD M5: 61 pips range price movement by Federal Funds Rate news events==========

AUD/USD M5: 67 pips range price movement by Federal Funds Rate news events==========

USD/CAD M5: 93 pips range price movement by Federal Funds Rate news eventsNZD/USD Intra-Day Fundamentals: RBNZ Official Cash Rate and 59 pips range price movement

2016-09-21 21:00 GMT | [NZD - Official Cash Rate]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Official Cash Rate] = Interest rate at which banks lend balances held at the RBNZ to other banks overnight.

=========="Global growth is below trend despite being supported by unprecedented levels of monetary stimulus. Significant surplus capacity remains across many economies and, along with low commodity prices, is suppressing global inflation. Volatility in global markets has increased in recent weeks, with government bond yields rising and equities coming off their highs. The prospects for global growth and commodity prices remain uncertain. Political uncertainty remains."

"Weak global conditions and low interest rates relative to New Zealand are placing upward pressure on the New Zealand dollar exchange rate. The trade-weighted exchange rate is higher than assumed in the August Statement. Although this may partly reflect improved export prices, the high exchange rate continues to place pressure on the export and import-competing sectors and, together with low global inflation, is causing negative inflation in the tradables sector. A decline in the exchange rate is needed."

==========

NZD/USD M5: 59 pips range price movement by RBNZ Official Cash Rate news event

AUD/USD Intra-Day Fundamentals: RBA Gov Lowe Speaks and 28 pips range price movement

2016-09-22 00:00 GMT | [AUD - RBA Gov Lowe Speaks]

[AUD - RBA Gov Lowe Speaks] = Opening Statement to the House of Representatives Standing Committee on Economics, in Canberra

==========

From SBS article: RBA governor Philip Lowe says a lower Australian dollar would be helpful to amplify the positive effects of its falls in recent years

A lower Australian dollar would be helpful in amplifying the economic benefits of its recent falls, Philip Lowe has said at his first appearance as Reserve Bank governor.

"Of course most central banks say the same thing - most people would like a slightly lower exchange rate and I think it reflects the deficiency in aggregate demand in the global economy," Mr Lowe told a hearing of the House of Representatives economic committee in Sydney.

"Many of my peers think the same, but of course we can't all have a lower exchange rate," he said.

==========

AUD/USD M5: 28 pips range price movement by RBA Gov Lowe Speaks news event

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: U.S. Jobless Claims

2016-09-22 12:30 GMT | [USD - Unemployment Claims]

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From MarketWatch article: Jobless claims fall to lowest level since July==========

EUR/USD M5: 7 pips range price movement by U.S. Jobless Claims news events

==========

AUD/USD M5: 8 pips price movement by U.S. Jobless Claims news events

==========

USD/CAD M5: 11 pips range price movement by U.S. Jobless Claims news events

Technical Targets for GBP/USD by United Overseas Bank (based on the article)

H4 price is located below 100 SMA/200 SMA levels in the bearish area of the chart and within the following support/resistance levels:

- 1.3120 resistance level located near 200 SMA in the beginning of the bullish reversal to be started, and

- 1.3027 support level located below 100 SMA/200 SMA in the bearish area of the chart.

The symmetric triangle pattern was formed by the price to be broken for the bullish reversal or for the bearish trend to be resumed.Daily price. United Overseas Bank is expecting for this pair to be on bearish market condition with the seconday ranging way:

"We highlighted the rapidly waning momentum yesterday and advocated shorts to book some profit at 1.3035. Subsequently, GBP rallied strongly and edged 1 pip above our stop-loss at 1.3120 (overnight high of 1.3121). From here, the risk of a short-term low would continue to increase and a clear break above 1.3120 would not be surprising (unless GBP can move and stay below 1.3035 within the next 1 to 2 days)."

Trading News Events: Canada Consumer Price Index (adapted from the article)

Bullish CAD Trade: Headline & Core CPI Beat Market Expectations

- "Need to see red, five-minute candle following the release to consider a short trade on USD/CAD."

- "If market reaction favors a bullish loonie trade, sell USD/CAD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit; set reasonable limit."

Bearish CAD Trade: Canada Inflation Report DisappointsDaily price is located within 200-day SMA (200 SMA) and 100-day SMA (100 SMA) in the ranging bearish area of the chart waiting for the direction of the trend: the price was bounced from 200 SMA level and 1.3253 resistance level to below for the 100 SMA with 1.2999 to be tested to below for the primary bearish trend to be resumed. RSI indicator is estimating the ranging condition to be continuing in the near future.

(all images/charts were made using Metatrader 5 software and free indicators from MQL5 CodeBase)

USD/CAD Intra-Day Fundamentals: Canada's Consumer Price Index and 123 pips range price movement

2016-09-23 12:30 GMT | [CAD - CPI]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - CPI] = Change in the price of goods and services purchased by consumers.

==========From official Statistics Canada source: The 12-month change in the Consumer Price Index (CPI) and the CPI excluding gasoline

==========

USD/CAD M5: 123 pips range price movement by Canada's Consumer Price Index news event

Fundamental Weekly Forecasts for Dollar Index, USD/JPY, GBP/USD, AUD/USD, USD/CNH and GOLD (based on the article)

Dollar Index - "Where rate speculation will offer the most proactive market influence, it is important to keep a weathered eye out for those influences that seem inert but can redefine the landscape should they stir. In the list of sidelined themes, risk trends remains a top consideration. The volatility and volume that revived capital markets on Friday the 9th is holding despite the familiar sense of lethargy trying to push back in. At present, any market-wide sentiment shifts immediately ahead would come without clear warning in scheduled events. However, if fear does start to shake loose investors, liquidity is likely to amplify the risk aversion and quickly rally the Dollar on inflows."

USD/JPY - "In theory the BoJ has committed itself to limitless bond purchases if it is to maintain a specific target on the 10-year JGB yield. In practice, however, the targeted bond was already trading just barely above the bank’s target. Nothing will change absent a material rally in JGB’s, and traders are effectively left with the status quo. Japanese Yen traders are likewise left with an effectively unchanged fundamental outlook, and this in itself favors a continued JPY rally (USD/JPY decline) versus the US Dollar. Only a material break above key range highs would shift our near-term trading bias on the USD/JPY."

GBP/USD - "GBP/USD stands at risk of breaking down from the triangle/wedge formation carried over from the previous month as the pair trades to fresh monthly lows going into the final week of September, and the Relative Strength Index (RSI) appears to be highlighting a similar dynamic as it fails to preserve the bullish formation carried over from the summer months. In turn, a break/close below the Fibonacci overlap around 1.2920 (100% expansion) to 1.2950 (23.6% expansion) may open up the next downside area of interest around 1.2630 (38.2% retracement), but the pound-dollar may continue to consolidate within a wedge/triangle formation should Fed officials fail to prop up interest-rate expectation."

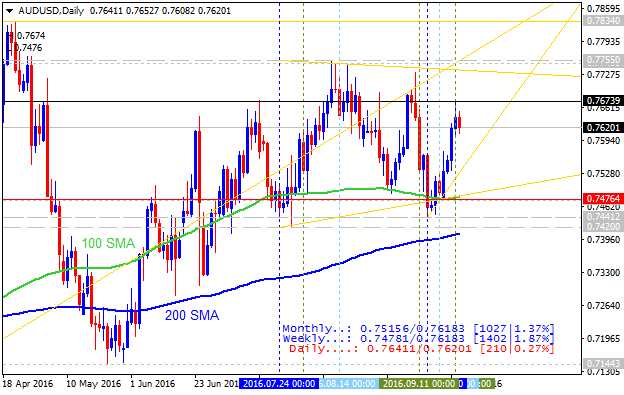

AUD/USD - "The voting pattern at last week’s FOMC meeting seems to nearly assure the former. As for the latter, Yellen’s assertion that things need only remain the same between now and the end of the year to warrant a hike keeps the bar relatively low. On balance, this hints the Aussie may find its way lower anew as the prospect of nearing stimulus withdrawal weighs on risk appetite and drives an adverse shift in yield spreads."

USD/CNH - "China will release official and Caixin Manufacturing PMI prints, key measures for the health of the economy and drivers for Yuan’s intraday moves. The August and September PMI reads sent out mixed signals: In August, the official PMI read showed contraction while Caixin PMI indicated expansion; in September, Caixin PMI read dropped while the official print rose. The September prints may give out more clues on what is really going on in the Chinese manufacturing sector. The major issue that Chinese manufacturing firms are facing is low demand and overcapacity. According to a survey conducted by Bloomberg, the consensus forecast for the official PMI is 50.5 and for the Caixin PMI is 50.1, both in expansion territory. If the PMI prints come out weaker-than-expected, the Yuan could weaken against the U.S. Dollar during the session, though it is very unlikely to break the key level of 6.70 with Yuan’s SDR inclusion on the horizon."GOLD (XAU/USD) - "Fed Governor Daniel Tarullo, Dallas Fed President Robert Kaplan, Vice-Chair Stanley Fischer, Chair Janet Yellen, Cleveland Fed President Loretta Mester, Kansas City Fed President Esther George and Fed Governor Jerome Powell slated for speeches. Also note we get the third and final revision of 2Q GDP with consensus estimates calling for an uptick in the annualized rate to 1.3% q/q from 1.1% q/q. Stronger US data could weigh on gold prices in the near-term but the technicals suggest that gold is primed for volatility in the days ahead."

Weekly Outlook: 2016, September 25 - October 02 (based on the article)

The Fed came and went and so did the BOJ, leaving a mixed picture after the high tension. Speeches from Yellen and Draghi among others, US Consumer Confidence, Durable Goods orders and GDP data from the US, UK, and Canada, stand out. These are the highlights on forex calendar.