You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Trading News Events: The Conference Board Consumer Confidence

2016-07-26 14:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

What’s Expected:From the article:

==========

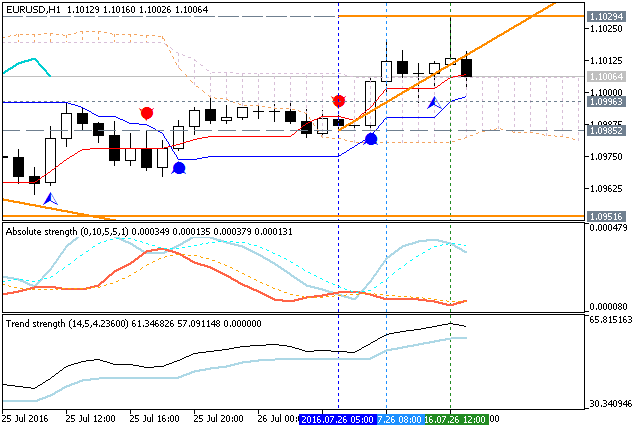

EUR/USD H1: bullish ranging near bearish reversal. The price is on ranging near and above Ichimoku cloud within the following key reversal support/resistance levels:

If the price breaks 1.0985 support level to below on close H1 bar so the bearish reversal will be started.If the price breaks 1.1029 resistance to above on close H1 bar so the bullish reversal will be continuing.

If not so the price will be continuing with the ranging within the levels.

=========

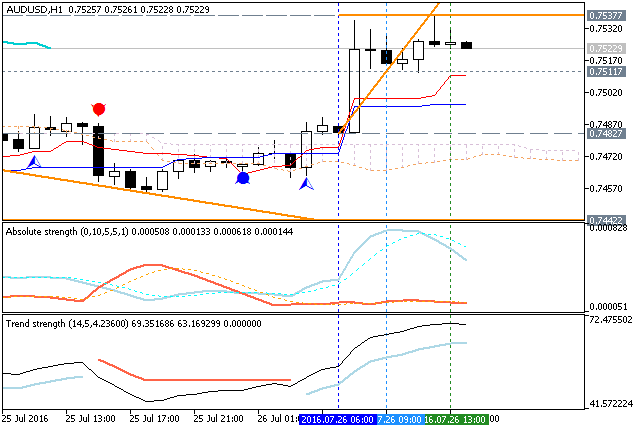

AUD/USD H1: ranging for the bullish continuation or for the bearish reversal. The price is located above Ichimoku cloud in the bullish area of the chart for the ranging within the following key reversal support/resistance levels:

If the price breaks 0.7582 support level to below on close H1 bar so the bearish reversal will be started.If the price breaks 0.7537 resistance to above on close H1 bar so the bullish reversal will be continuing.

If not so the price will be continuing with the ranging within the levels.

S&P 500 Daily Technicals: correction to be started or the bullish trend to be continuing (adapted from the article)

Sharply Unchanged, Consolidating or Topping?"There are no expectations of the Fed moving away from 0.50%, so the market’s attention will be on any language changes in the statement. It would seem likely this will be a low volatility meeting, however, we should always be on our toes just in case."

D1 price is located above Ichimoku cloud within very narrow support/resistance levels:

Ascending triangle pattern was formed by the price to be crossed to above for the bullish trend to be continuing. And Absolute Strength indicator is estimating the ranging correction to be started in the near future.

If D1 price breaks 2151.00 support level on close bar so the local downtrend as the secondary correction will be started.

If D1 price breaks 2169.75 resistance level on close bar so the bullish trend will be continuing.

If not so the price will be on ranging within the levels.

SUMMARY : bullish

TREND : possible daily correctionAUD/USD Intra-Day Fundamentals: Australian Consumer Price Index and 108 pips range price movement

2016-07-27 01:30 GMT | [AUD - CPI]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - CPI] = Change in the price of goods and services purchased by consumers.

==========

==========

AUD/USD M5: 108 pips range price movement by Australian Consumer Price Index news event

GBP/USD Intra-Day Fundamentals: U.K. Gross Domestic Product and 51 pips range price movement

2016-07-27 08:30 GMT | [GBP - GDP]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

"Change in gross domestic product (GDP) is the main indicator of economic growth. GDP was estimated to have increased by 0.6% in Quarter 2 (Apr to June) 2016 compared with growth of 0.4% in Quarter 1 (Jan to Mar) 2016."==========

GBP/USD M5: 51 pips range price movement by U.K. Gross Domestic Product news event

EUR/USD Intra-Day Fundamentals: U.S. Durable Goods Orders and 11 pips range price movement

2016-07-27 12:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From rttnews article:

==========

EUR/USD M5: 11 pips range price movement by U.S. Durable Goods Orders news event

Trading News Events: Federal Open Market Committee Interest Rate Decision (adapted from the article)

2016-07-27 18:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

What’s Expected:Why Is This Event Important:

"With Fed Funds Futures reflecting limited expectations for higher borrowing-costs in 2016, Chair Janet Yellen and Co. may largely endorse a wait-and-see approach for monetary policy as the central bank argues market-based measures of inflation compensation remains weak while ‘most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.’"

==========

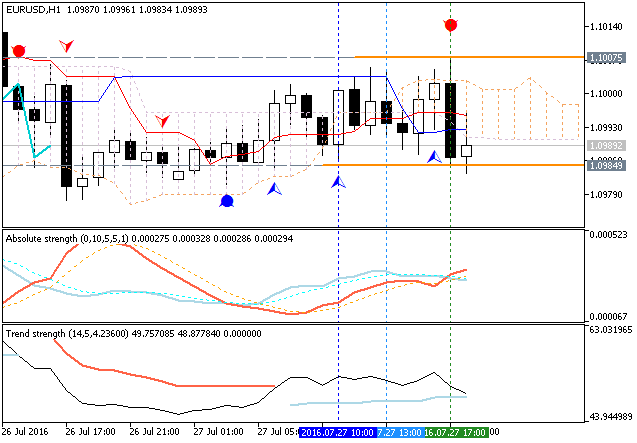

EUR/USD H1: bearish reversal. The price broke Ichimoku cloud to below for the possible bearish reversal with 1.0984 support level to be testing for the bearish trend to be started. The price is located now within the following support/resistance levels:

If the price breaks 1.0984 support level to below on close H1 bar so the primary bearish trend will be started.If the price breaks 1.1007 resistance to above on close H1 bar so we may see the reversal of the price movement to the bullish market condition.

If not so the price will be continuing with the ranging within the levels.

==========

EUR/USD M5: 39 pips range price movement by Federal Open Market Committee Interest Rate Decision news event

Fed keeps key interest rate steady but sees fewer risks (based on the article)

EUR/USD Intra-Day Fundamentals: U.S. Jobless Claims and 8 pips range price movement

2016-07-28 12:30 GMT | [USD - Unemployment Claims]

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From CNBC article:

==========

EUR/USD M5: 8 pips range price movement by U.S. Jobless Claims news event

Brent Crude Oil Technical Analysis - daily bearish with 42.54 key support (adapted from the article)

Daily price is on bearish market condition located below Ichimoku cloud: price is testing 42.54 support level to below for the bearish trend to be continuing. Alternative, if the price breaks 45.15 resistance level to above so the local uptrend as the bear market rally will be started, otherwise - ranging bearish.

Descending triangle pattern was formed by the price to be crossed to below for the bearish trend to be continuing.

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

H4 price is located below 100 SMA and near 200 SMA: the price is testing 1.1119 resistance level to above for the reversal of the price movement to the primary bullish market condition. For now - the ptrice is located within the following key reversal support/resistance levels:

Symmetric triangle pattern was formed by the price to be crossed for direction.

Daily price. United Overseas Bank is considering for EUR/USD for the ranging market condition with the high range to be expended up to 1.1150 level:

"We shifted to a neutral EUR stance yesterday and held the view that the current rebound in EUR could extend higher to 1.1150. We have seen a high of 1.1118 so far and the pullback from the top appears to be corrective in nature and from here, we continue to anticipate a move to 1.1150 (next resistance is at 1.1180/85). Support is at 1.1040 but the key level is 1.1000 (breach of this level would indicate that immediate upward pressure has eased)."