You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Lahcene Ouled Moussa, 2016.02.25 09:37

( A ) 1.3675Last support turning point of Ascending Triangle.

The U.K.’s Gross Domestic Product (GDP) report may heighten the bearish sentiment surround British Pound and fuel the near-term decline in GBP/USD should the data encourage the Bank of England (BoE) to further delay its normalization cycle.

GBPUSD M5: 37 pips range price movement by UK GDP news event :

EUR/USD Intra-Day Fundamentals: Durable Goods Orders and 22 pips price movement

2016-02-25 13:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

EURUSD M5: 22 pips price movement by Durable Goods Orders news event :

Intra-Day Fundamentals: CNY Swift Global Payments CNY and 72 pips price movement for majors

2016-02-26 01:00 GMT | [CNY - Swift Global Payments]

==========

EURUSD M5: 19 pips price movement by Swift Global Payments CNY news event :

USDJPY M5: 33 pips price movement by Swift Global Payments CNY news event :

GBPUSD M5: 11 pips price movement by Swift Global Payments CNY news event :

USDCHF M5: 9 pips price movement by Swift Global Payments CNY news event :

Trading News Events: USD Gross Domestic Product (based on the article)

The preliminary U.S. 4Q Gross Domestic Product (GDP) report may produce headwinds for the greenback and spark a near-term a rebound in EUR/USD should the report highlight a slowing recovery in the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Even though the U.S. approaches ‘full-employment,’ a marked downward revision in the growth rate may undermine Fed expectations for a ‘consumer-led’ recovery, and the central bank may largely endorse a wait-and-see approach throughout 2016 in an effort to mitigate the downside risks surrounding the region.

Nevertheless, the pickup in private-sector consumption may generate a better-than-expected GDP print as it remains one of the leading drivers of growth, and signs of a more meaningful recovery may boost the appeal of the greenback as it puts increased pressure on the Fed to implement higher borrowing-costs over the coming months.

How To Trade This Event Risk

Bearish USD Trade: 4Q GDP Slows to Annualized 0.4% or Lower

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD.

- If market reaction favors a short dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: Growth, Inflation Top Market Expectations- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

nice..

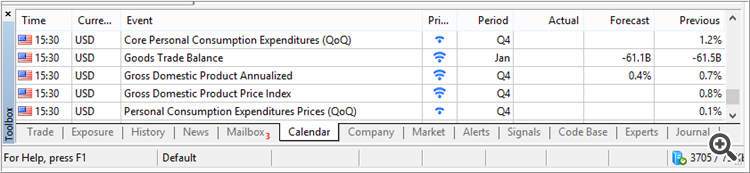

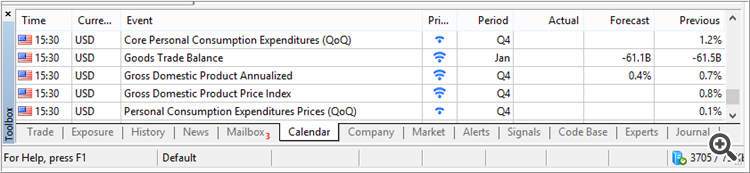

Sir what is your trading terminal? please tell me because in my terminal i have no calendar

nice..

Sir what is your trading terminal? please tell me because in my terminal i have no calendar

MT5 is good for technical analysis and news trading for example.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.26 10:58

Trading News Events: USD Gross Domestic Product (based on the article)

The preliminary U.S. 4Q Gross Domestic Product (GDP) report may produce headwinds for the greenback and spark a near-term a rebound in EUR/USD should the report highlight a slowing recovery in the world’s largest economy.

What’s Expected:

EURUSD M5: 39 pips range price movement by U.S. Gross Domestic Product news event :

Next Week's February NFP by BofA Merrill (based on the article)

EURUSD M5: 133 pips range price movement by Non-Farm Employment Change news event :

Forex Weekly Outlook Feb 29-Mar 4 (based on the article)

Rate decision in Australia, GDP data from Canada and Australia, Manufacturing PMI and Trade balance in the US as well as important employment data, including the monthly US jobs report. These are the highlights for this week.