You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD key levels for the bulls from JP Morgan (based on forexlive article)

JP Morgan publish the next technical analysis for EURUSD, and for now - about the key levels for the bullish trend to be continuing in intra-day and day trading:

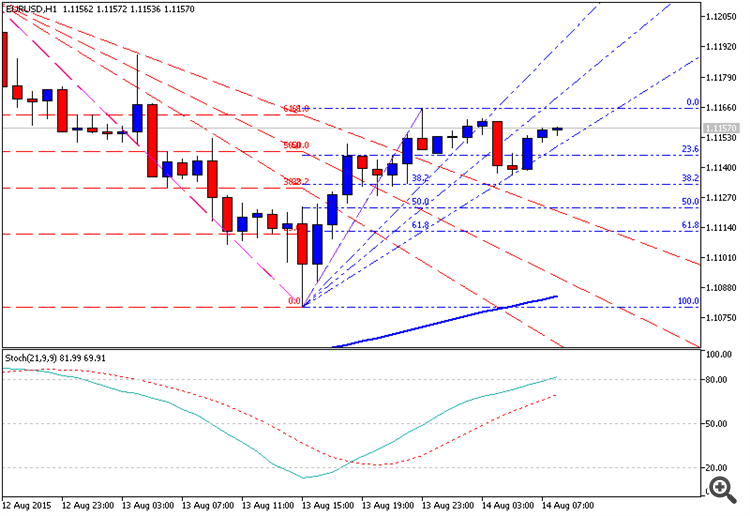

As we see from intra-day H1 chart - the EUR/USD is traded between Fibo resistance at 1.1160 and 23.6% Fibo support at 1.1145 for possible breakout of the price movement of the key resistance levels. Thus, forecast made by JP Morgan may be the rrue in this case.EUR/USD, USD/JPY, EUR/GBP, AUD/USD - Intraday by SEB (based on efxnews article)

Skandinaviska Enskilda Banken (SEB) made some intra-day analysis for few pairs whch may be used for the next week for example. Those pairs are the following: EUR/USD, USD/JPY, EUR/GBP and AUD/USD. This is very short technical analysis for good s/r levels and for the direction to be followed:

EUR/USD: "The failed move below 1.1126 (and the created downside spike) keeps the short term wave pattern unclear. As long as 1.1190 remains unbroken there’s still a possibility that an upward correction ended the other day but if making way above the resistance new highs should be penciled in."

USD/JPY: "With the pair still below the mid body resistance downside risks are increasing. If also today manages to stay below 124.68 then downside risks will be even further enhanced going into next week. A move below 124.07 will likely lead to a loss of the 123.79 key support."

EUR/GBP: "The ongoing correction has still room to move a bit further north. The primary target for the move is 0.7176 with a possible extension towards the trend line at 0.7200. Once there look for offers to be returning."

AUD/USD: "After the latest rejection from the 2001 trend line the pair fell down but only to a marginally new low. Price action with no follow through selling together with a bullish divergence hints of an overly oversold market and therefore also an increasing reaction risk. Shorts should be very cautious should we break above 0.7440 (if such a move takes place today it will also create a bullish key week reversal)."

Forex Weekly Outlook August 17-21 (based on forexcrunch article)

Japan GDP data, Inflation in the UK, the US and Canada, FOMC Meeting Minutes, US Unemployment Claims and Philly Fed Manufacturing Index. These are our market movers for this week. Join us as we explore the highlights on Forex calendar.

U.S. data released last week raises hopes for a Fed rate hike by the end of the third quarter. Retail sales rebounded in July amid a rise in purchases of automobiles and other goods, suggesting growth rate is positive in the second and third quarters. Retail sales edged up 0.6%, in line with market forecast, while core sales, excluding automobiles gained 0.4%. The robust release added to a strong employment data, suggesting the US economy is on solid footing. Will this trend continue?

Weekly Outlook for USD, EUR, JPY, GBP, AUD by Morgan Stanley (based on efxnews article)

Morgan Stanley is continuing to make a weekly forecast for the currency pairs making on technical analsysi, fundamental analysis and for some Morgan Stanley's expectation about what they want for us to do for example sorry.

As we see - the expectation for EUR is bearish and for AUD is bearish too (USD is for bullish condition).

USD: "We believe USD strength will be focused against EM and commodity currencies going forwards, with AxJ particularly underperforming. This is largely a result of the CNY move, but also reflects growth differentials and structurally lower commodity prices. However, we would expect the path against other G10 currencies to be driven more by data into September, as the market watches the Fed closely."

EUR: "We believe EUR could benefit from the latest developments in China. CNY moves could spill over into general asset market volatility. This would support currencies with current account surpluses that have been used to fund risky holdings, as investors unwind their risky positions. EUR is such a currency. In addition, many investors have hedged their European equity holdings, and as these positions are unwound, this will lead to buying back of hedges, supporting EUR."

JPY: "We believe JPY is likely to face conflicting forces following the developments in China. On the one hand, this increases deflationary risks for Japan, as a weaker CNY could lead to disinflationary pressure in Japan. It also challenges Japanese competitiveness, given the impact on the REER. On the other hand, uncertainty on CNY is likely to de-stabilize risk appetite, leading to repatriation and supporting JPY. Overall, we expect the latter effect to win out in impact, but recognize the risks."

GBP: "The dovish inflation report and risk appetite getting hit has provided some headwinds for GBP. However with China developments still playing on markets’ minds and the Fed coming back into play, we believe GBPUSD is going to be driven more by the USD side of the pair. The BoE is still one of the central banks heading towards a hike next year so GBP should gain some relative strength. Here we like to buy against the more vulnerable commodity currencies (CAD, NOK and AUD)."

AUD: "We believe AUD is likely to be an underperformer following the developments in China this week, though stabilization in the near term could provide some relief for the currency. However, given China’s close trade relations with China, any CNY weakness will lead to de facto AUD REER appreciation, which may be countered by AUDUSD weakness in order to maintain competitiveness."

Goldman Sachs - Elliot Wave technical analysis on the daily EUR/USD (based on forexlive article)

Goldman Sachs made Elliot Wave technical analysis on the daily EUR/USD and those are the following comments (below their chart):

If we look at the other patterns so we can see just two situations around: short-term (forming bearish patterns) and long-term (forming bullish patterns).

Short-term scenario

This is forming bearish gartley for H12 timeframe:

This is the forming bearish retracement pattern for H8 timeframe:

Long-tern situation with bullish

Forming bullish butterfly pattern and forming bullish 3-Drives pattern for MN1:

Thus, we can confirm for EURUSD to be in bearish market condition in short-term situation up to 2015 year-end for example, and in bullish condition in long-term in 2016.BNP Paribas for USD - 'We expect to be a choppy second half of August' (based on efxnews article)

BNP Paribas are forecasting the strong USD but with the secondary ranging market condition - just because of China news on Fed expectations:

As we see from the chart - Dollar Index Future (DXY) is located above 100-SMA/200-SMA for bullish condition and, seems, this bullish condition will be continuing in August as well. But the choppy market was started in the end of April this year and there is no any indication that this choppy condition will be finished by the beginning of September. Thus, we can confirm the forecast made by BNP Paribas.

5 reasons to believe gold prices could recover to $1,200 at year-end - HSBC (based on cnbc article)

The bank made a forecast for the price of gold at year-end and estimated that it will be increase as much as 10 percent higher than current levels. The bank set out five reasons in a report on Friday for the experts to believe gold prices could recover to $1,200 per ounce at the year-end.

1. Fed tightening is already priced into gold

"With a shift in the Federal Reserve's policy having been anticipated in the financial markets since as early as 2013, some of the declines based on a rate rise have already occurred." Thus, the reaction of the gold may not be negative one in any case.

2. Actual Fed hikes could see gold prices rise

"This pattern has important ramifications for gold. History shows that gold prices…generally rise, though sometimes with a lag, after the first rate hike."

3. There's scope for a short-covering rally

Short positions on the Comex touched the peak on July 7 while long positions are at their highest since December 2009.

4. Low prices will, ultimately, spur demand

"In important gold consuming nations, such as China, India, Indonesia, and Vietnam, as well as other EMs, consumers may have fewer tools at their disposal with which to protect savings and household wealth against rising prices or low or negative real interest rates."

5. Central bank buying will remain supportive

"The PBoC is an important central bank with significant influence. The mere fact that they have accumulated gold may lead other EM central banks to examine purchasing bullion. Also many central banks hold quite low levels of gold reserves in relation to their forex holdings, leaving room for further accumulation."

Friday held the MA. Today more below. (based on forexlive article)

"The EURUSD closed last week by keeping the 100 hour MA (blue line in the chart below) as a support level. Today in the Asia-Pacific session, the price dipped below that moving average level, and has stayed below (at least on a closing basis) since that time. The weaker than expected Empire manufacturing has push the price back above the moving average, but last hours closing price could still not close above it. So there is some reluctance to have a momentum shift to the upside. The current 100 hour moving average comes in at 1.11147."

Weekend Edition with John O'Donnel (based on fxstreet article)

John and Merlin break down the week’s biggest news headlines from the currency devaluation from China, to the sale of coal mines by Goldman Sachs. They also take a look at the decision by the EU to bail out Greece once again. How long will it last? Finally, commodities continue to be crushed providing potential buying opportunities for those ok with more Risk!

FOMC Meeting Minutes expectations by Barclays and September Fed hike (based on efxnews article)

Barclays made a forecast for high impacted fundamental news events which will be on Wednesday at 19:00 GMT. The bank is telling that Federal Open Market Committee is already made a decision concerning a September Fed hike. Besides, Barclays is expecting the USD dollar to gain strength because "fears around China and weak commodity prices should keep pushing investors out of risky assets":

-

"We do not expect a material change and we anticipate that the document

will echo the latest comments from different FOMC members. We think

they will want to keep options open and will probably signal the data

dependency of their decisions ahead. We believe that the FOMC

has already made up their mind about their next move, absent any market

disruptive events in the months ahead. Our base case remains a September

Fed hike."

-

"Furthermore, we argued that the actual path of the normalization process will be more important for FX markets. The pace at which the Fed could tighten monetary conditions should depend heavily on price measures."

-

"We expect the USD to be supported in the next weeks mainly due to external factors.

Fears around China and weak commodity prices should keep pushing

investors out of risky assets, benefiting the USD under different

scenarios."

The next FOMC Meeting Minutes will be in Oct 8, 2015 so we should really expect something important one for this release on on Wednesday at 19:00 GMT concerning September Fed hike.