You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

if actual > forecast (or previous data) = good for currency (for CHF in our case)

[CHF - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level, excluding automobiles and gas stations. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

==========Swiss Retail Sales Fall In January

Swiss retail sales declined in January after recovering in the prior month, provisional results from the Federal Statistical Office showed Monday.

Excluding fuel, retail sales dropped 0.3 percent from last year, reversing a 1.9 percent rise in December.

Sales of food, drinks and tobacco registered an annual increase of 1.4 percent, while non-food sector sales declined 1.4 percent.

Retail sales fell by real 2.1 percent month-on-month in January, reversing the 1 percent rise in the prior month. This was the first fall in four months.

EUR/USD rallies slightly on Monday, ahead of critical Fed meeting (based on nasdaq article)

The euro edged slightly higher on Monday, slamming the brakes on its rapid depreciation against the U.S. dollar ahead of a highly-anticipated Federal Reserve meeting later this week.

EUR/USD gained 0.70% or 0.0073 to 1.0569 in U.S. afternoon trading. The pair fell below 1.05 at last week's close, as the start of the European Central Bank's €60 billion a month quantitative easing program coincided with expectations of an interest rate hike from the Fed. Since the start of the year, the pair is down roughly 10%.

Last week analysts from Deutsche Bank (XETRA:DBKGn) and Goldman Sachs (NYSE:GS) both revised their timetables on when the euro could reach parity against the dollar, moving up the dates from previous forecasts. Deutsche Bank even predicted that the euro could fall to 0.85 against the dollar by 2017. On Monday, Alan Ruskin head of foreign exchange strategy for Deutsche Bank, went one step further.

Speaking with CNBC's Power Lunch, Ruskin said he thinks it is possible the euro could reach a historic low against the dollar of 0.82. The euro hasn't reached a level that low since 2002.

"If you think of what's driving the euro, a lot of this has been hedging from foreigners who've held euro bonds and euro equities," Ruskin told CNBC. "I think that it will slow somewhere near parity."

The Fed could remove its reference to "remaining patient," from its minutes when the Federal Open Market Committee stages a two-day meeting this week, beginning on Wednesday. The reference typically indicates that it will start raising interest rates at either of its next two meetings. It has been six years since the U.S. central bank has increased rates, which have remained near zero since the Financial Crisis.

Elsewhere, Greece and its euro zone creditors appeared to be far apart in negotiations concerning the reform measures Athens must employ to extend a critical bailout package. Greece prime minister Alexis Tsipras appears unwilling to agree to some of the austerity measures required by the euro zone in order to strike a deal.

"Whatever obstacles we may encounter in our negotiating effort, we will not return to the policies of austerity," Tsipras told Greece newspaper Ethnos.

[AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

RBA considered cutting interest rates, decided to wait for more data

The Reserve Bank of Australia’s minutes from its policy meeting earlier this month showed us that members considered loosening monetary further this month, but it was decided that more data was needed and it would take some time for the economy to respond to an earlier cut in the OCR. It’s also clear that the RBA is nervously watching the housing market; it is acutely aware that softer monetary policy is helping to fuel the red-hot residential housing market in Sydney and, to a lesser extent, Melbourne.

The key lines from the minutes are:

On interest rates

On the housing market

EURUSD Uptrend Continues As Dollar Retreats

The EURUSD advanced for a second consecutive day on Tuesday, as core Eurozone inflation was confirmed higher in February, while German investor confidence soared to a 13-month high in March.

The EURUSD climbed 0.45 percent to 1.0617, easing off an intraday high of 1.0651. The pair is testing the initial resistance at 1.0636. A clean break above this level would lead to 1.0704. On the downside, near-term support is at 1.0484.

In economic data, Eurozone consumer prices declined in February, the European Commission confirmed on Tuesday. Annual CPI in the 19-member currency zone fell 0.3 percent, compared to 0.6 percent in January.

Energy prices increased 1.6 percent in February but were down 7.9 percent compared to year-ago levels. Global crude prices are forecast to remain under pressure in the short-run as the supply glut intensifies.

So-called core inflation, which strips away volatile goods such as food and energy, rose at an annual rate of 0.7 percent in February, compared to 0.6 percent the previous month.

The European Commission also said Eurozone employment rose 0.1 percent in the fourth quarter and 0.9 percent year-on-year, adding further evidence the currency region was slowly gaining momentum.

In a separate report on Tuesday the Centre for European Economic Research (ZEW) said investor sentiment in Germany reached a 13-month high in March, a sign Europe’s largest economy had turned a corner.

The closely monitored investor confidence index rose 1.8 points to 54.8 in March. That was the fifth consecutive monthly gain and the highest level since February 2014. The euro-wide investor sentiment index surged nearly ten points to 62.4.

“Economic sentiment in Germany remains at a high level. In particular, the continuing positive development of the domestic economy confirms the expectations of the experts,” said ZEW president Clemens Fuest in a statement.

He added, “At the same time, limited progress is being made with regard to solving the Ukraine conflict and the sovereign debt crisis in Greece. This has a dampening effect on sentiment.”

“It’s now, first of all, about what the Greek government will implement in the necessary reform steps that it has promised,” said Michael Grosse-Brömer, who serves as the parliamentary whip of Chancellor Angela Merkel. “They must now finally deliver and not make a new proposal every other week.”

AUDIO - Talking Stocks with Gabe Velazquez

Master trader and coach, Gabe Velazques joins Merlin in studio to talk about his current Pro Trader class at Online Trading Academy. The duo talk about how the markets have evolved and created the need for understanding multiple asset classes to help trading performance. They also stress the importance of a trading plan and journaling. Stocks covered in this show: QQQ, SPY, DIA, IWM, NFLX, USO

EUR/USD Technical Analysis: Short Entry Sought on Bounce (based on dailyfx article)

A Euro recovery against the US Dollar may be brewing against the US Dollar after prices formed a bullish Piercing Line candlestick pattern. Positive RSI divergence bolsters the case for an upside scenario. Near-term resistance is at 1.0623, the 61.8% Fibonacci expansion, with a break above that on a daily closing basis exposing the 50% level at 1.0796. Alternatively, a drop below the 76.4% Fib at 1.0408 opens the door for a challenge of the 100% expansion at 1.0060.

Our long-term outlook envisions Euro weakness. With that in mind, we will treat any on-coming upswing as corrective and look to enter short once signs of a renewed turn lower emerge. In the meantime, we will remain on the sidelines.

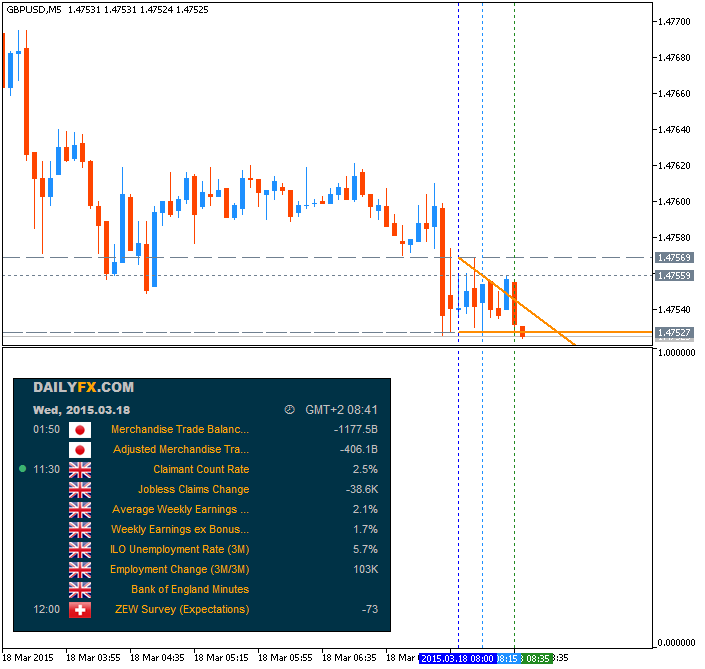

Trading the News: GBP Jobless Claims Change (based on dailyfx article)

Another 30.0K decline in U.K. Jobless Claims paired with a hawkish Bank of England (BoE) Minutes may spark a near-term rebound in GBP/USD should the fundamental developments boost interest rate expectations.

What’s Expected:

Why Is This Event Important:

At the same time, Average Weekly Earnings are projected to increase an annualized 2.2% after climbing 2.1% in January, and a marked expansion in household earnings may encourage BoE Governor Mark Carney to normalize monetary policy sooner rather than later as the central bank anticipates a more sustainable recovery in the U.K economy.

However, the slowdown in building activity along with the pullback in business outputs may drag on hiring, and a dismal labor report may push Governor Carney to further delay the normalization cycle in an effort to encourage a stronger recovery.

How To Trade This Event Risk

Bullish GBP Trade: Claims Slip 30.0K or More Accompanied by Stronger Wages

- Need green, five-minute candle following the print to consider a long GBP/USD trade

- If market reaction favors buying sterling, long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Labor Report Fails to Meet Market Expectations- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in opposite direction

Potential Price Targets For The ReleaseGBPUSD Daily Chart

- The near-term rebound in the RSI may pave the way for a

larger rebound in GBP/USD as the oscillator comes off of oversold

territory.

- Interim Resistance: 1.5000 pivot to 1.5020 (50% expansion)

- Interim Support: 1.4700 pivot to 1.4710 (78.6% expansion)

Impact that the U.K. Jobless Claims Change has had on GBP during the last release(1 Hour post event )

(End of Day post event)

2015

U.K. Jobless Claims decline another 38.6K in January following the revised 35.8K contraction the month prior. The unemployment rate subsequently fell to 5.7% in three-months through November, reaching the lowest level since September 2008. In addition, private wages grew more-than-expected over the last quarter at an annualized rate of 2.1% amid forecasts for a 1.7% print. The ongoing improvement in the U.K. labor market may encourage the Bank of England (BoE) to retain a hawkish tone for monetary policy as the central bank anticipates stronger wage growth in 2015. The sterling gained ground following slew of positive prints, with GBP/USD breaking above the 1.5400 handle to end the day at 1.5444.

EURUSD Pre-FOMC Pivot Values - Breakouts Occur Above R4, and Below S4 Pivots (based on dailyfx article)

The EURUSD has opened Wednesdays trading range bound, trading between pivot support and resistance. Current range bound conditions are not surprising as many traders are waiting on today’s FOMC even prior to taking positions on markets. Currently price has traded off pivot resistance at 1.0624, but has yet to test range support found at 1.0569. These values complete the current range valued at 55 pips.

During the FOMC event, any surprises may cause the EURUSD to breakout. Traders should watch the S4 pivot at 1.0541. This would signal a potential return to USD strength and a resumption of the pair’s current long term trend. Conversely if price breaks above the R4 pivot at 1.0651, it would suggest price is beginning a larger counter trend move, creating a new higher high.

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future

==========Press Release

“Information received since the Federal Open Market Committee met in January suggests that economic growth has moderated somewhat. Labor market conditions have improved further, with strong job gains and a lower unemployment rate. A range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately; declines in energy prices have boosted household purchasing power. Business fixed investment is advancing, while the recovery in the housing sector remains slow and export growth has weakened. Inflation has declined further below the Committee’s longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of energy price declines and other factors dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. Consistent with its previous statement, the Committee judges that an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. This change in the forward guidance does not indicate that the Committee has decided on the timing of the initial increase in the target range.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

by Chris Vermeulen

The most important thing to realize is that when a full blown bear market starts virtually all stocks and commodities drop including gold, silver and oil. Knowing that, investors must be aware that when the stock market starts its bear market the fear will rise and investors will inevitably sell their holdings and this means we could see gold and oil continue to fall much further from these levels before a true bottom is in place.

Is this time different than the 2008/09 bear market? Yes, this time we have possible wars starting, oil pipelines overseas being cut off, counties and currencies failing and even negative bond yields in some parts of the world – it’s a mess to say the least. There are a lot of things unfolding, most seem to be negative for the economy.

The currency problems and possible war breakout will be bullish for gold and oil. So if a bear market starts in equities, and a war or currency fails gold and oil should rally while stocks fall.

But if we don’t have those sever crisis’ then if gold and oil break below their critical support level which is the red line on the charts and a bear market in stocks start you do not want to be long stocks or commodities.