You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

NZDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for the New Zealand Dollar: Neutral

The New Zealand Dollar snapped four consecutive weeks of gains, losing nearly 3 percent against its US counterpart. Selling pressure may continue to swell in the week ahead as a dovish RBNZ monetary policy announcement fuels rate cut speculation even as bets on near-term Fed tightening grow more confident.

The currencywas noticeably stung by January’s about-face in RBNZ rhetoric. The central bank backed away from the hawkish posture on display in December, saying it expected to keep borrowing costs on hold “for some time” and conspicuously noting that future adjustments can take rates “either up or down”.

That seemedto create an opening for the possibility of easing where one was not previously apparent. The Kiwi responded, punctuating two weeks of pre-positioning for a dovish shift with a drop to the lowest level in four years against the greenback. A cautious correction followed, seemingly fueled in equal parts by uncertainty on the US policy front amid disappointing data outcomes and a broader swell in risk appetite.

Sellers returned with a vengeance last week. The RBNZ signaled it is looking for ways to isolate problem areas in the housing market, suggesting it will opt for a surgical approach to cool activity over the blunt instrument of rate hikes. Meanwhile, a strong US payrolls reading fueled a palpable hawkish shift in traders’ Fed rate hike outlook. The report likewise fueled risk aversion, suggesting the prospect of stimulus withdrawal has emerged as a source of worry once again.

The markets don’t expect an outright policy change from the RBNZ. Indeed, priced-in expectations place the probability of a rate cut at a mere 4 percent. Economic news-flow has soured since January’s sit-down however, leaving room for Governor Wheeler to rhetorically build the foundation for a possible downward shift in borrowing costs at subsequent meetings. If that cements probabilities of a cut some time over the next 12 months in the minds of investors, the Kiwi is likely to suffer.

On the US data front, excitations point to a rebound in retail sales and a pickup in consumer confidence (as tracked by a University of Michigan survey). Such outcomes may further bolster Fed tightening bets, weighing on sentiment and amplifying perceptions of the policy divergence between the US and the rest of the G10. Needless to say, that bodes ill for the Kiwi in its own right. It would hurt more so if it came against the backdrop of softening yield prospects at home.

AUD/USD Threatens Bullish Momentum- NZD/USD Carves Top Ahead of RBNZ (based on dailyfx article)

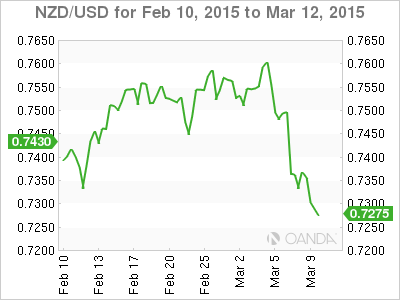

NZD/USD forecast for the week of March 9, 2015, technical analysis

The NZD/USD pair initially tried to break out to the upside during the week, but as you can see above the 0.75 level we have far too much in the way of resistance. On top of that, we believe that this market should continue to go lower based upon the fact that the US dollar continues to strengthen overall, and of course the jobs number out of America was stronger than anticipated. Every time this market rallies, we believe that will continue to selloff. We have no interest whatsoever in buying.

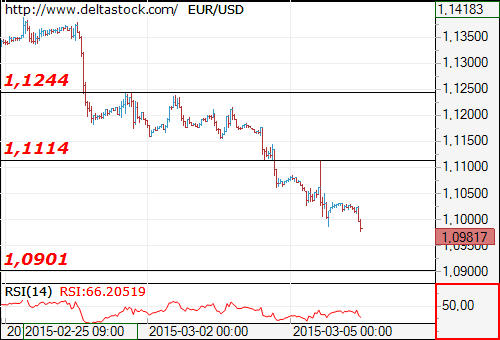

Major FX Pairs And Stock Indices: Key Resistance And Support Levels (based on investing.com article)

EURUSD

NZD/USD weekly outlook: March 9 - 13 (based on investing.com article)

The New Zealand dollar fell more than 1% against its U.S. counterpart on Friday, as stronger than forecast U.S. nonfarm payrolls data bolstered bets that the Federal Reserve will begin to raise rates sooner rather than later.

NZD/USD hit 0.7358 on Friday, the pair's lowest since February 12, before subsequently consolidating at 0.7362 by close of trade on Friday, down 1.62% for the day and 2.67% lower for the week.

The Labor Department reported that the U.S. economy added 295,000 jobs in February, far more than the 240,000 forecast by economists. The unemployment rate ticked down to 5.5% from 5.7% in January, the lowest since May 2008. Economists had forecast the unemployment rate would fall to 5.6%.

The robust jobs report fuelled expectations that the Federal Reserve will start raising interest rates as early as June, boosting the greenback.

The dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, jumped 1.39% to 97.74 late Friday, the highest since September 2003.

Elsewhere, the euro was weaker against the kiwi after European Central Bank President Mario Draghi confirmed that it will begin purchasing euro zone government bonds on Monday under its new quantitative easing program.

The combined monthly asset purchases will amount to €60 billion per month and are expected to run until September 2016.

In the week ahead, markets will be watching talks on Greece by euro zone finance ministers in Brussels on Monday, while Thursday’s U.S. retail sales report will also be closely watched for further indications on the strength of the recovery.

The outcome of a policy meeting of the Reserve Bank of New Zealand on Wednesday will also be in focus.

Chinese government data on consumer price inflation and industrial production will also be eyed.

On Sunday, China reported a trade surplus of $60.6 billion in the January-February period, compared to expectations for a surplus of $10.8 billion and up from a surplus of $60.0 in January.

Exports surged 48.3% from a year earlier last month, above expectations for a 14.2% increase, while imports tumbled 20.5%, much worse than forecasts for a decline of 10.0%.

The Asian nation is New Zealand's second largest trade partner.

Monday, March 9

Tuesday, March 10

Wednesday, March 11

Thursday, March 12

Friday, March 13

NZD/USD Technical Analysis: Kiwi Dollar Selloff Accelerates (based on dailyfx article)

The New Zealand Dollar accelerated downward against its US counterpart, sliding to the lowest level in a month. Near-term support is at 0.7340, the 38.2% Fibonacci expansion, with a break below that on a daily closing basis exposing the 50% level at 0.7256. Alternatively, a reversal above the 23.6% Fib at 0.7444 opens the door for a challenge of channel floor support-turned-resistance at 0.7551.

Prices are too close to support to justify entering short from a risk/reward perspective. On the other hand, the absence of a defined bullish reversal signal suggests that taking up the long side is premature. With that in mind, we will remain flat for now.

NZD/USD Down as Traders Await RBNZ Decision (based on marketpulse article)

The Reserve Bank of New Zealand (RBNZ) steps into the limelight this week with its monthly rate statement and subsequent press conference.

On January 28 the RBNZ kept benchmark interest rates on hold at 3.50%. The decision was not unexpected as it was already priced in by the market, but Governor Graeme Wheeler did change his stance regarding the previous statement of keeping the rate at current levels “for some time” into the possibility of a cut or hike if needed. Wheeler also took the opportunity to talk down the NZD as he still thinks it is overvalued.

Current USD strength has depreciated the NZD and put less pressure on the RBNZ to cut rates. A strong U.S. nonfarm payrolls (NFP) report has put pressure on the Federal Reserve to hike rates as soon as June, in turn boosting the USD across the board. NZD/USD was trading around 0.76 before the U.S. NFP and it’s now close to breaking 0.73 ahead of the Kiwi central bank announcement. Meantime, the Federal Open Market Committee’s (FOMC) two-day meeting is just around the corner. Chair Janet Yellen, although maintaining a neutral stance, has hinted that the “patient” language contained in the Fed’s statement could be dropped in the next couple of meetings. That, too, is helping the dollar appreciate.

if actual > forecast (or previous data) = good for currency (for CNY in our case)

[CNY - Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. Chinese data can have a broad impact on the currency markets due to China's influence on the global economy and investor sentiment. It's a leading indicator of economic health - production is the dominant driver of the economy and reacts quickly to ups and downs in the business cycle.

==========

China's Industrial Output, Retail Sales Growth Slows

China's industrial production and retail sales growth slowed more-than-expected at the start of the year, reflecting moderation in growth momentum, data revealed Wednesday.

Industrial production increased 6.8 percent year-on-year in the January to February period, the National Bureau of Statistics said. The annual growth was forecast to slow to 7.7 percent from 7.9 percent.

The NBS publishes combined data for January and February to avoid the distortions caused by the timing of the Chinese Lunar New Year.

During January to February, retail sales grew at a pace of 10.7 percent, slower than an 11.9 percent rise seen in December and an expected increase of 11.6 percent.

Likewise, fixed asset investment increased 13.9 percent, slower than an expected growth of 15 percent. Investment gained 15.7 percent during the twelve months to December.

The government early this month downgraded its growth target for 2015 to around 7 percent after achieving 7.4 percent expansion in 2014.

EURUSD Moves on Lower Lows (based on dailyfx article)

The EURUSD has opened Wednesdays trading with the creation of a new weekly lower low. This decline is significant as the pair has declined as much as 347 pips week to date. However, despite its weakness the EURUSD is attempting to trade back above todays S4 Camarilla pivot at 1.0607. While this does not negate the current downtrend, traders will watch to see if price moves back into today’s trading range starting at the S3 pivot near 1.0652. In the event price breaches this point, traders may begin looking for a move back up towards range resistance at 1.0741.

In the event that price begins to again gain momentum, trend traders may elect to look for a breakout again under the S4 pivot. This would signal a potential increase in USD strength and traders would look for further declines at this point. Conversely if price trades through todays range, towards the R4 pivot at 1.0786, it would suggest price beginning a larger counter trend move with the creation of a new higher high.

if actual > forecast (or previous data) = good for currency (for NZD in our case)

[NZD - Official Cash Rate] = Interest rate at which banks lend balances held at the RBNZ to other banks overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========New Zealand's Official Cash Rate Unchanged At 3.50%

The Reserve Bank of New Zealand's monetary policy board on Thursday announced that it was holding its Official Cash Rate steady at 3.50 percent - in line with expectations.

It was the fifth straight month with no change for the RBNZ, which had hiked the OCR by 25 basis points in each of previous four meetings prior to September.

Before that, there were 23 straight meetings with no change. The OCR had been at a record low 2.50 percent since March 10, 2011 as the country dealt with the global economic slowdown.

It wasn't until last March that the central bank felt confident enough in a recovery that it lifted the OCR - although no additional action is likely in the near term.

"Global financial conditions remain very accommodative, and are reflected in high equity prices and record low interest rates. However, volatility in financial markets has increased since late-2014 following the sharp drop in oil prices, continued uncertainty about the global outlook and U.S. monetary policy, and policy easings by a number of central banks," the bank said in a statement accompanying the decision.

"The New Zealand dollar remains unjustifiably high and unsustainable in terms of New Zealand's long-term economic fundamentals. A substantial downward correction in the real exchange rate is needed to put New Zealand's external accounts on a more sustainable footing," the bank said.

The RBNZ called it prudent to take more time and further observe the effects of its moves to date.

The bank pointed to several factors for taking its time in taking any further actions, including weak global inflation, falls in international oil prices and the high exchange rate.

"Our central projection is consistent with a period of stability in the OCR. However, future interest rate adjustments, either up or down, will depend on the emerging flow of economic data," the bank said.