You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Japan Eco Watchers' Current Index Rises More Than Expected In December (based on rttnews article)

A measure of people's assessment of the Japanese economy improved in December after worsening in the previous two months, survey figures from the Cabinet Office showed Tuesday.

The current index of the economy watchers survey rose by 3.7 points to 45.2 in December from 41.5 in November. Economists had forecast the index to rise to 44.0.

A reading above 50 suggests optimism and a score below 50 indicates pessimism. The latest increase was the first in three months.

Meanwhile, the outlook index climbed to 46.7 in December from 44.0 in the prior month. It was the highest score since September, when it was at 48.7.

Marcel Thieliant, a Japan economist at Capital Economics noted that the strong rebound in the Economy Watchers Survey in December stands in stark contrast with other business surveys which mostly weakened last month.

The economist said he would place more weight on small business confidence and the PMIs, which on balance worsened at the end of last year and remain consistent with falling industrial output.

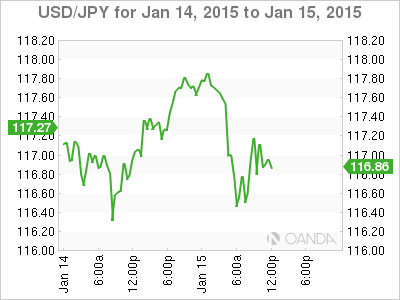

USD/JPY Lower (based on benzinga article)

The U.S. Dollar is trading lower against Japan's Yen in afternoon trading. Some market chatter is looking ahead to the Bank of Japan next week and is expecting the BOJ to cut Japan's core CPI forecast to 1.5 percent from 1.7 percent.

The USD/JPY is trading weak and for the most part is reacting to moves in the U.S stock market. The USD/JPY pair is trading at 117.96, down 0.37.

USD/JPY Technical Analysis: Support Below 118.00 Pressured (based on dailyfx article)

The US Dollar is testing the bottom of now-familiar range support below the 118.00 figure against the Japanese Yen once again. Near-term support is at 117.91, the 23.6% Fibonacci retracement, with a break below that on a daily closing basis exposing falling channel support at 116.87. Alternatively, a reversal above channel top resistance at 119.16 opens the door for a test of the December 23 high at 120.82.

Prices are too close to support to justify entering short from a risk/reward perspective. On the other hand, the absence of a defined bullish reversal signal suggests that taking up the long side is premature. With that in mind, we will remain flat for now.

if actual > forecast (or actual data) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity

==========

Australia Jobless Rate Slips To 6.1% In December

The unemployment rate in Australia came in at a seasonally adjusted 6.1 percent in December, the Australian Bureau of Statistics said on Thursday.

That beat expectations for 6.3 percent, and it was down from the revised 6.2 percent in November.

The Australian economy added 37,400 jobs to 11,679,400 in December - well above forecasts for 5,000 following the gain of 42,700 jobs in the previous month.

The increase in employment was driven by increased full-time employment for both females (up 23,300) and males (up 18,200). The increase in full-time employment was marginally offset by a fall in part-time employment, down 4,100.

The participation rate was 64.8 percent, topping expectations for 64.7 percent - which would have been unchanged.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2015

newdigital, 2015.01.15 11:48

Markets Gone Wild And Turmoil in Europe But Silver Demand Strong

The dollar rallied from .85 to .92 as the 10 year bond yield went from 2.62% in September to 1.83%. Gold is recovering from its early November lows at $1,140 as it almost touched $1,250 this week.

Looking at Europe, it seems Greece is back in the news and it will probably remain in the news for some time. The Syriza Party is probably going to win the election and throw out the current regime of “technocrats.” Syriza has said they will not pay and have told the people of Greece they will simply default on the loans and leave the Euro. This is going to create disorder for the short term, but will allow Greece to regain it’s sovereignty and begin rebuilding it’s nations wealth.

The silver institute is claiming there will be a 27% increase in the use of industrial silver by 2018–mining operations are either slowing down or shutting down, where in the world are we going to find 27% more silver over the next 3 years? According to Andrew Hoffman, that is not entirely correct. The number of ounces required for industrial use are going to be further squeezed by the investment demand which, as Steve St. Angelo has pointed out on numerous occasions, is on the rise and will continue to rise at a much greater clip than industrial demand. 2013 and 2014 were back-to-back record years for both the American Silver Eagle and the Canadian Silver Maple Leaf. Not an easy task when you are talking about 44 million and 25 million, respectively, for the top two silver coins in the world. That is a massive amount of silver in just those two products alone. It is unlikely that the new demand will be satisfied, according to Hoffman.

The US Mint reported for their 2014 sales a gold-silver ratio of 83.9. Currently, real world ratio is 74.5 ounces of silver to ounces of gold. According to mother nature there is approximately 9.5 ounces of silver coming out of the ground for every 1 ounce of gold. There is a divergence between demand and price.

AUDIO - Commodities & Futures with Don Dawson (based on fxstreet article)

Commodities have had a rough time of late! Oil is getting crushed, copper falling like a rock, and others languishing with a strong dollar and potential global recession. Master trader, Don Dawson joins Merlin Rothfeld for a look at the driving forces behind these commodities and offers insights into where they may be headed next. The duo also answer several listener questions which are also in line with the Futures theme.

USD/JPY Technical Analysis: Yen Touches 1-Month High (based on dailyfx article)

The US Dollar edged lower for a fourth consecutive day against the Japanese Yen, dipping to the lowest level in a month. A daily close below falling channel floor support at 116.64 exposes the 38.2% Fibonacci retracement at 115.48. Alternatively, a reversal above the 23.6% Fib retracement at 117.91 opens the door for a test of channel top resistance at 118.96.

Risk/reward considerations argue against entering short with prices in close proximity to support. On the other hand, the absence of a defined bullish reversal signal suggests taking up the long side is premature. We will remain flat for now, waiting for a more actionable opportunity to present itself.

USD/JPY - Yen Posts Gains As U.S. Unemployment Claims Jumps (based on seekingalpha article)

The Japanese yen continues to move higher, as the pair trades in the high-116 range on Thursday. On the release front, Japanese Core Machinery Orders improved to 1.3%, but this was well below expectations. Later today, Japan will release Tertiary Industry Activity. The markets are expecting a gain of 0.3%. In the US, Unemployment Claims was unexpectedly weak, jumping to 316 thousand. PPI posted a decline of 0.3%, matching the forecast. The Empire State Manufacturing Index rose to 10.3 points and we’ll get a look at the Philly Fed Manufacturing Index later in the day.

US employment numbers slipped on Thursday, as Unemployment Claims surprised with a reading of 316 thousand. This was well above the estimate of 299 thousand and was the highest reading since June 2014. However, the first full week of the year often shows a spike in claims, since holiday workers are dismissed, resulting in a higher number of claims. Earlier in the week, JOLTS Jobs Openings climbed to 4.97 million, easily beating the forecast of 4.86 million. This is the indicator’s highest level since January 2001. The strong employment numbers are a welcome result of the robust economy, as the deepening recovery fuels demand for more workers. The health of the labor market is an important component of any decision to raise interest rates, so upcoming employment releases will be under the market microscope as the Fed mulls when to raise interest rates.

Earlier in the week, US retail sales caught the markets off guard with sharp declines in the December readings. Core Retail Sales came in at -1.0%, while Retail Sales followed suit with a loss of 0.9%. Both key indicators recorded their worst showings since May 2010. However, retail sales were solid in the past two months, so the numbers for Q4 will be in positive territory.

Trading the News: U.S. Consumer Price Index (CPI) (based on dailyfx article)

A marked slowdown in the U.S. Consumer Price Index (CPI) may trigger a short-term squeeze in EUR/USD should the development dampen the Federal Open Market Committee’s (FOMC) scope to normalize monetary policy sooner rather than later.

What’s Expected:

Despite expectations for a rate hike in mid-2015, the Fed may sound increasingly cautious and preserve its highly accommodative policy stance beyond schedule as the central bank struggles to achieve its mandate for price stability.

Nevertheless, improved business confidence paired with the pickup in economic activity may limit the downside risk for price growth, and the stickiness in core inflation may heighten the appeal of the greenback as a growing number of central bank officials show a greater willingness to normalize monetary in 2015.

How To Trade This Event Risk

Bearish USD Trade: U.S. CPI Slips to Annualized 0.7% or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: Inflation Report Exceeds Market Forecast- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- EUR/USD remains at risk for a further decline as long as the RSI pushes deeper into oversold territory.

- Interim Resistance: 1.1840-50 (50% expansion)

- Interim Support: 1.1500 pivot to 1.1565 (weekly low)

Impact that the U.S. CPI report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

AUDUSD M5: 12 pips price movement by USD - CPI news event:

EURUSD M5: 13 pips price movement by USD - CPI news event:

The U.S. Consumer Price Index (CPI) slowed to an annualized rate of 1.3% from 1.7% in October on the back of falling energy prices, with the core rate of inflation narrowing to 1.7% from 1.8% during the same period. Indeed, subdued price pressures raise the risk of seeing the Fed further delay its first rate hike, but it seems as though the central bank will normalize monetary policy in 2015 as the committee anticipate the drop in oil prices to have an positive impact on the real economy. Despite the initial tick higher in EUR/USD, the dollar remained resilient against its European counterpart as the pair slipped below the 1.2400 handle during the North American trade to end the day at 1.2343.

MetaTrader Trading Platform Screenshots

USDJPY, M5, 2015.01.16

MetaQuotes Software Corp., MetaTrader 5

USDJPY M5: 44 pips price movement by USD - CPI news event

Forex Weekly Outlook January 19-23 (based on forexcrunch article)

German ZEW Economic Sentiment, Inflation data in New Zealand, Rate decision in Japan, the Eurozone and Canada, Employment data from the UK and the US and housing data from the US. These are the main market movers on Forex calendar. Join us as we explore the highlights of this week.

Last week, US data failed to raise optimism with a surprise 0.9% drop in retail sales registering their largest decline in 11 months and a 1.0% decline in core sales. In the manufacturing sector the Philly Fed index fell to 6.3 points, while expected to reach 20.3 points. Jobless claims increased unexpectedly to 316,000 from 297,000 crossing to 300,000 line. However, the Empire State index surged to 10 points from 5.3 in the prior month. Will we see better figures this week?