You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: Bullish

The outcome of Japan’s snap election passed without making much noise in the financial markets last week as expected. The LDP sailed to an easy victory and secured the super-majority it needed to ensure the continuity of “Abenomics”, at least through the near to medium term.

With the last Bank of Japan policy meeting of the year also behind them, investors have been left with external forces as the foremost driver of Japanese Yen price action. Seasonal capital flows stand out as the most potent potential driver on this front and may drive the unit higher in the final weeks of 2014.

Swelling risk appetite – embodied by a relentless push upward by US share prices – was a defining feature of the macro landscape over the past year. This seemed to reflect a response to Fed monetary policy: the steady QE tapering process defined a clear window in which policymakers would not withdraw stimulus.

The landscape probably won’t look as rosy in 2015. While the precise timing of liftoff for the Fed policy rate is a matter of debate, the commencement of stimulus withdrawal at some point in the year ahead seems to be a given. The prospect of higher borrowing costs may fuel liquidation of exposure reliant on cheap QE-based funding as market participants lock in year-end performance ahead of tougher times ahead.

For currency markets, such a scenario may take the form of an exodus from carry trades, which are usually funded in terms of the perennially low-yielding Japanese unit. That would imply a wave of covering on short-Yen positions, pushing prices higher.

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: Bullish

The British Pound traded higher versus all G10 counterparts save the US Dollar and Japanese Yen. Why might it continue higher through the foreseeable future?

There’s relatively little in the way of foreseeable economic event risk out of the UK next week, and that may in fact play in the domestic currency’s favor. It was only two weeks ago when GBP/USD volatility prices traded to multi-year peaks, and a negative correlation between vols and the GBP helped explain why it fell sharply on clear uncertainty. Yet in a remarkable shift in sentiment, the Sterling now boasts the lowest volatility prices of any G10 currency. If correlations hold firm, this may be enough of a reason for continued appreciation.

A key exception comes from final revisions to Q2 Gross Domestic Product growth numbers due Tuesday, but surprises are relatively unlikely and only a big miss would force important GBP volatility. Beyond that, traders will keep an eye on the usual slew of early-month US economic event risk—especially the end-of-week US Nonfarm Payrolls report.

With the Scottish Independence Referendum now past, the UK currency can return to basics and trade off of traditional fundamental factors. Credit Suisse Overnight Index Swaps show that the Bank of England will raise benchmark interest rates by approximately 0.50 percentage points in the coming 12 months. This may not seem like much, but it is only second to the US Federal Reserve (and US Dollar) at +0.58%.

The clear divergence in growth and yield expectations between the UK and other major economies leaves the GBP in the position of strength. And though an obvious US Dollar uptrend makes us reluctant to buy into GBPUSD weakness, we believe the UK currency could trade higher through the coming week and perhaps month.

DAX forecast for the week of December 22, Technical Analysis

The DAX fell down to the €9200 level, but as you can see found enough support below in order to push the market higher. We ended up testing the €9900 level but pulled back slightly from there in order to form a hammer. We need to break above the €10,100 level to get a longer-term buy-and-hold type of signal, and we do think that it’s coming sooner or later. With that, we are bullish but we recognize that we need a little bit of work to be done first before putting any money into this marketplace.

Gold forecast for the week of December 22, 2014, Technical Analysis

The gold markets fell during the course of the week, breaking below the $1200 level. Because of this, it appears of the market is ready to go lower, perhaps heading to the 1150 or even 1140 below there. That being the case, we are still bearish of this market and we believe that the 1250 level above is in fact a massively resistive. Ultimately, the US dollar should continue to strengthen, and that should continue to put a bit of pressure on the gold markets on the whole as it works against buyers.

USD/JPY forecast for the week of December 22, 2014, Technical Analysis

With this being Christmas week, we don’t expect much out of this pair but we do recognize that the hammer that form for the previous week of course means that there is plenty of support. With that, we are not placing any long-term trades but we do recognize that pullback should represent value in the US dollar, giving us an opportunity to go long of a market that quite frankly should continue to go long. The meantime, we feel that selling is completely out of the question when it comes to the USD/JPY pair, and as a result we won’t.

USD/CAD forecast for the week of December 22, 2014, Technical Analysis

The USD/CAD pair tried to break higher during the course of the week, but as you can see struggled once we get above the 1.16 level. The resulting candle is a shooting star, and as a result we would not be surprise at all to see some type of pullback. With that being the case, we feel that that pullback should represent value in the US dollar, and have buyers stepping back into this marketplace given enough time. We think that a little bit of profit taking may happen in the short-term, but ultimately the long-term uptrend should continue

NZD/USD forecast for the week of December 22, 2014, Technical Analysis

The NZD/USD pair went back and forth during the course of the week, but ultimately finished fairly flat. With that being the case, we feel that the market will continue to bang around in this general vicinity and with this week being Christmas, we don’t really anticipate much in the way of large moves. However, we recognize that any rally in this market should be a selling opportunity and should continue to be so. We think that the market will ultimately go down to the 0.75 handle, which is the next large round number.

The GBP/USD pair fell during the bulk of the week, but bounce slightly in order to form something along the lines of a hammer. At the end of the day, and looks as if we are trying to find support near the 1.55 level. With that, we think that eventually this market bounces significantly, and then heads to the 1.60 handle. We have no interest in selling this market at least until we get below the 1.55 handle, which we do not anticipate to see happening this week.

The EUR/USD pair tried to break above the 1.25 level during the week, but then turned back around to break down towards the 1.22 handle. Because of this, we feel that the longer-term downtrend is going to continue and that rallies will continue to be selling opportunities. However, this is Christmas weeks ago expect a lot in the way of movement has more than likely the market will be fairly stagnant. With that being the case though, we have no interest in buying this market and think that eventually it should continue to fall.

EUR/USD Approaching Major Monthly Support (based on investing article)

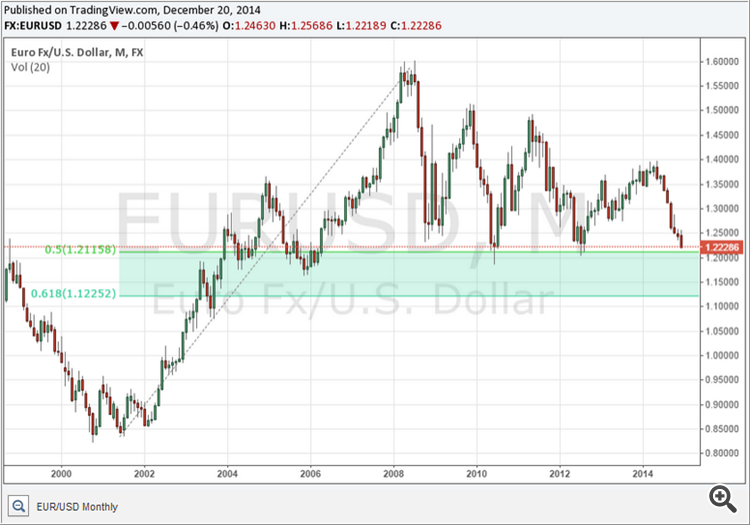

Below is a monthly chart of the EUR/USD. On it we can see that price is approaching, once again, the 50% retracement of the enormous leg up from the euro's inception around the turn of the millennium to its 2008 highs.

A break below the June 2010 low of 1.1875 could be another key sign of sustainable US dollar strength.

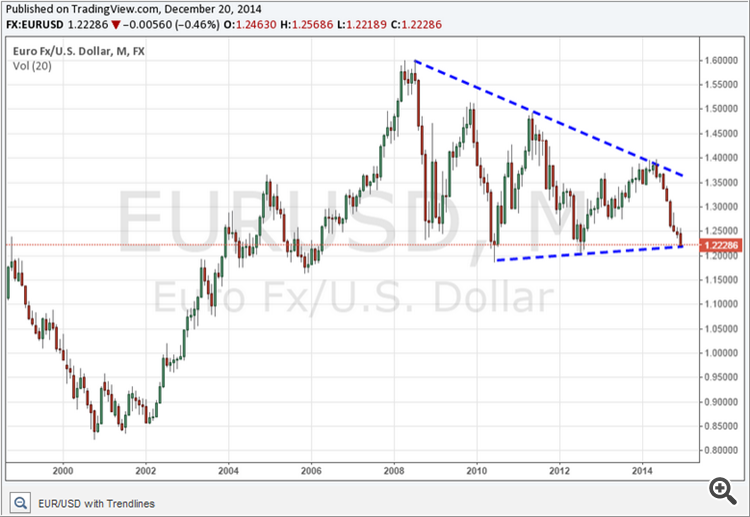

Below is the aforementioned monthly chart,but with some trendlines added. There may be some opportunities for traders to buy at the bottom trendline and sell at the top trendline. Breakouts of the trendlines could signal the direction of the trend for years to come.