You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Deutsche Bank analysis – EUR/USD targets (based on forexlive article)

Near-term, Deutsche Bank thinks that the recent pause in EUR/USD drop could extend into year-end with market positioning very extended, real yield fair value still in the high 1.20s, and ECB expectations running ahead of what was delivered at its December meeting last Thursday.

Going out to next year, DB sees more downside to the currency with the risks being skewed to greater, rather than lesser weakness. DB outlines 3 reasons behind this view:

In line with this view, DB targets EUR/USD in 2015 at 1.22 for Q1, 1.20 for Q2, 1.18 for Q3, and 1.15 for Q4.

Forum on trading, automated trading systems and testing trading strategies

ramasubburam, 2014.12.10 13:45

what will be happen by ECB draghi QE approach ..........

We can start all movements behind to solve and escape from ECB draghi QE approach in EURO pair ,bcz QE make more changes at QE1 Time ..........so good comments welcome now here

NZDUSD Technical Analysis (based on dailyfx article)

We will tactically opt against entering long. The markets appear enveloped by seasonal profit-taking on risk-geared positions, as expected. That may bode ill for the sentiment-sensitive Kiwi, meaning the up move might swiftly fizzle. As such, we will remain flat and look for the bounce to yield a selling opportunity in line with the larger trend.

Trading News Events: U.S. Advance Retail Sales (based on dailyfx article)

Trading the News: U.S. Advance Retail Sales

A pickup in Advance U.S. Retail Sales may generate short-term decline in EUR/USD as stronger consumption raises the growth and inflation outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Indeed, an expansion in household spending is likely to heighten the appeal of the greenback and boost interest rate expectations as a growing number of Fed officials show a greater willingness to normalize monetary policy in mid-2015.

However, sticky inflation along with the slowdown in private sector credit may drag on household spending, and a dismal development may foster a more meaningful rebound in EUR/USD as it raises the FOMC’s scope to zero-interest rate policy (ZIRP) for an extended period of time.

How To Trade This Event Risk

Bullish USD Trade: U.S. Retail Sales Climbs 0.4% or More

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Private-Sector Consumption Falls Short of Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Despite the string of lower-highs, a bullish break in the Relative Strength Index (RSI) may highlight a larger for EUR/USD.

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

Impact that the U.S. Retail Sales report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

2014

U.S. Retail Sales increased 0.3% from the month prior, with 10 of the 13 components showing an expansion in October. Despite stagnant wage growth, the resilience in private sector consumption may put increased pressure on the Fed to normalize monetary policy as it remains one of the leading drivers of growth. The initial reaction to the better-than-expected print was short-lived as EUR/USD climbed above the 1.2500 region during the North American trade to end the day at 1.2521.

MetaTrader Trading Platform Screenshots

XAGUSD, M5, 2014.12.11

MetaQuotes Software Corp., MetaTrader 5

XAGUSD ( silver/dollar )

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video December 2014

newdigital, 2014.12.12 05:39

Forex: Bearish EUR/USD Formation Remains in Focus- AUD Hit by RBA Rhetoric

EUR/USD retains the bearish formation amid growing bets for ECB QE, while the aussie struggles to hold its ground as the RBA toughens the verbal intervention.

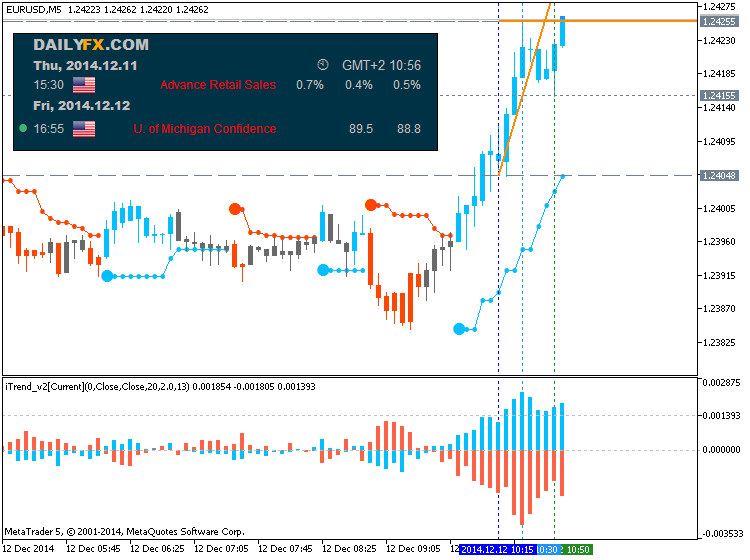

Trading News Events: U. of Michigan Confidence (based on dailyfx article)

Trading the News: U. of Michigan Confidence

Another uptick in the U. of Michigan Confidence survey may spur a further decline in the EUR/USD amid growing speculation for a Fed rate hike in mid-2015.

What’s Expected:

Why Is This Event Important:

Positive data prints coming out of the U.S economy should continue to fuel interest rate expectations and heighten the bullish sentiment surrounding the greenback as a growing number of Fed officials scale back their dovish tone for monetary policy.

However, we the survey may disappoint as U.S. households face sticky price pressures paired with the ongoing slack in the real economy, and a dismal print may spur a larger correction in the greenback as it drags on expectations for higher borrowing-costs.

How To Trade This Event Risk

Bullish USD Trade: U. of Michigan Survey Climbs to 89.5 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Consumer Confidence Falls Short of Market Forecast- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Failed attempts to close above 1.2450-70 may highlight

near-term topping process for EUR/USD especially as the RSI largely

retains a bearish momentum.

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

Impact that the U. of Michigan Confidence has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

The U. of Michigan Confidence survey unexpectedly surged to 89.4 in November from 86.9 the month prior to mark the fourth consecutive advance. Despite the uptick in sentiment, 12-month inflation expectations weakened further during the same period, with the figure slowing to an annualized 2.6% from 2.9% in October. Nevertheless, the ongoing improvement may highlight a stronger recovery for the U.S. economy as private-sector consumption remains one of the leading drivers of growth. The initial bullish dollar reaction was very short-lived as EUR/USD pushed back above the 1.2450 region following the data print, with the pair ending the day at 1.2521.

AUDIO - Global Commodities with Frank Holmes (based on dailyfx article)

CEO and Chief Investment Officer of U.S Global Investors, Frank Holmes joins Merlin Rothfeld and John O’Donnell for a look at the macro issues facing global markets. Demographics play a big part in Mr. Holmes’s optimistic view about markets going forward. The trio also look at the prospects for Oil moving forward and a potential bottom around $50.

The US dollar retraced some of the previous gains but managed to retrace the retracement as well. Japan’s Lower House Elections, UK inflation and employment data and the most important event: the last Fed decision for the year are the main highlights for this week. Follow along as we explore the Forex market movers.

The US consumer is certainly upbeat: US retail sales release showed Americans spent 0.7% more in November compared to the previous month and core sales followed suit. Also confidence is high, the highest since January 2007 according to UoM. This is partially attributed to the collapse in oil prices, which is hurting the Canadian dollar. In the euro-zone, the highly anticipated TLTRO fell short of predictions, strengthening the notion that QE is coming to the old continent. The antipodean currencies took different directions: the Aussie got a target of 0.75 from the central bank, while the New Zealand’s central bank seemed upbeat. Volatility continues being high despite the upcoming holidays. And now, we have the most important central bank speaking out:

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: NeutralThe British Pound finished the week modestly higher but continued to trade in a tight range versus the US Dollar. A busy week ahead threatens to force a decisive break in the GBPUSD and other pairs.

The simultaneous release of UK Jobless Claims and Earnings data with Bank of England Minutes will likely prove the highlight in the days ahead, and GBPUSD traders should likewise keep a close eye on a highly-anticipated US Federal Reserve interest rate decision that same day. Earlier-week UK Consumer Price Index inflation figures as well as late-week UK Retail Sales results could also elicit reactions from GBP pairs.

Whether or not the Sterling mounts a sustained recovery versus the US Dollar will likely depend on the direction of interest rate expectations for both the Bank of England and the US Federal Reserve. A sharp compression in the spread between UK and US government bond yields helps explain why the British Pound fell to fresh 14-month lows versus the Greenback through November. Yet a great deal of uncertainty surrounds both the Fed and BoE; any surprises out of the coming week’s economic data and central bank rhetoric could easily force a repricing of yields and the GBPUSD exchange rate.

The US Dollar in particular looks vulnerable on any disappointments from the Federal Reserve, and indeed the previously-unstoppable USD finally showed concrete signs of slowing through the past week of trade. And though the Sterling could itself see fairly significant volatility on UK event risk, we expect that the overall US Dollar trend will ultimately dictate whether the GBPUSD makes a sustained recovery.

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: NeutralThe near-term outlook for USD/JPY remains mired by Japan’s December 14 snap election, but the ongoing deviation in the policy outlook should continue to produce a further advance in the exchange rate as a growing number of Fed officials show a greater willingness to normalize monetary policy in 2015.

Despite the risk for a material shift in fiscal policy, recent headlines suggests ‘Abenomics’ will continue to influence the Japanese Yen in the year ahead as the Liberal Democratic Party (LDP) is widely expected to retain majority in the lower-house of the National Diet. As a result, the Bank of Japan (BoJ) may continue to highlight a dovish outlook for monetary policy at the December 19 meeting, and Governor Haruhiko Kuroda may keep the door open to further expand the asset-purchase program as the technical recession undermines the central bank’s scope to achieve the 2% target for inflation.

In contrast, there’s growing speculation the Federal Open Market Committee (FOMC) will remove the ‘considerable time’ phrase and implement a more hawkish twist to the forward-guidance as lower energy costs boost disposable incomes for U.S. households. The improved outlook for personal consumption – one of the leading drivers of growth – may encourage the Fed to boost its economic and interest rate projections as the central bank anticipates a stronger recovery in 2015. With that said, the bullish sentiment surrounding the greenback may gather pace over the remainder of the year should the fresh developments coming out of the FOMC heighten interest rate expectations.

In turn, the fundamental outlook continues to cast a long-term bullish outlook for USD/JPY, and we will retain the approach to buy-dips in the exchange rate unless there’s a meaningful change in fiscal/monetary policy. Dollar-yen appears to be coiling for a move higher as it holds above the 117.00 handle, with the next key topside objective for USD/JPY comes in around 122.30-40, the 78.6% Fibonacci retracement from the 2002 decline.