You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

ECB Leaves Rates Unchanged After September Cut

The European Central Bank on Thursday left its key interest rates unchanged at a record low, in line with economists' expectations, after reducing them in a surprise move last month.

The Governing Council, led by President Mario Draghi, held the refinancing rate at a record low 0.05 percent, following its policy meeting in Naples, Italy.

The bank today kept the deposit rate at -0.20 percent and the marginal lending rate was maintained at 0.30 percent.

The three main interest rates were lowered by 10 basis points in September as euro area inflation is set to slow in the coming months.

EUR/USD Technical Analysis: Euro May Be Ready to Recover (based on dailyfx article)

The Euro may be preparing to launch a recovery against the US Dollar after prices put in a bullish Morning Star candlestick pattern. A daily close above the 1.2659-73 area marked by the November 2012 low and the 38.2% Fibonacci expansion exposes the 1.2754-60 zone bracketed by the July 2013 bottom and the 23.6% level. Alternatively, a reversal below the 50% Fib at 1.2602 clears the way for a challenge of the 61.8% expansion at 1.2532.

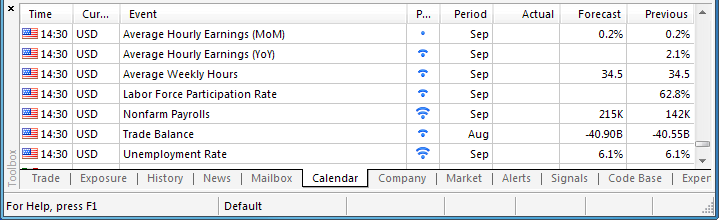

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

A pickup in U.S. Non-Farm Payrolls (NFP) may spur a further decline in the EUR/USD as the Federal Reserve is widely expected to halt its quantitative easing (QE) program at the October 29 policy meeting.

What’s Expected:

Why Is This Event Important:

The deviation in the policy outlook certainly casts a long-term bearish outlook for the EUR/USD, but a further slowdown in job growth may generate a larger pullback in the dollar as it would allow the Federal Open Market Committee (FOMC) to further delay the normalization cycle.

The ongoing decline in planned job-cuts along with the pickup in private sector activity may spur a meaningful uptick in job growth, and a positive print may spur another round of dollar strength as it boosts interest rate expectations.

However, the slowdown in building activity paired with the persistent weakness in the housing market may drag on hiring, and another disappointing employment report may trigger a near-term decline in the greenback as it dampens bets of seeing the Fed normalize policy sooner rather than later.

How To Trade This Event Risk

Bullish USD Trade: Job & Wage Growth Picks Up

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: NFPs Disappoint for Third Consecutive Month- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- As Relative Strength Index (RSI) comes off of oversold

territory, break of near-term bearish momentum should highlight a larger

topside correction.

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2500 pivot

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.10.03

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 68 pips price movement by USD - Non-Farm Employment Change news event

Rate decision in Japan and the UK, Employment data in Australia and Canada, US FOMC Meeting Minutes, US Unemployment Claims, Mario Draghi’s speech are the major market movers on FX calendar week. Here is an outlook on the top events coming our way.

Last week, US labor market top release showed a sharp gain of 248K new jobs in September, posting the lowest unemployment rate since 2008. These excellent figures reaffirm the strength in the US economy. The low job addition in August is regarded as a “blip” in the recovering labor market. The unemployment rate also surprised markets, falling to 5.9% from 6.1% in August and may prompt the Federal Reserve to raise rates sooner than estimated.

USDJPY Fundamentals (based on dailyfx article)

The Japanese Yen fell to fresh post-financial crisis lows versus the surging US Dollar, but a clear slowdown the USDJPY rally warns that it’s near an end. When might we buy?The difficulty in trading the USDJPY is clear: recent data shows that the trade is extremely crowded, and a sharp correction is possible if not likely. Yet the US Dollar continues to defy our expectations and is plowing higher across the board. We’ll need to wait for signs of concrete turnaround before getting short USDJPY.

An upcoming Bank of Japan Monetary Policy Meeting and Decision dominate event risk for the Japanese Yen in the week ahead, while clear USD outperformance keeps focus on a number of important US data releases. See the full video for our take on what to expect, but in sum: we are likely biding our time and keeping a very close eye on whether the USDJPY breaks above ¥110.

ssd

sdsd

USDJPY Fundamentals (based on dailyfx article)

The Japanese Yen fell to fresh post-financial crisis lows versus the surging US Dollar, but a clear slowdown the USDJPY rally warns that it’s near an end. When might we buy?

The difficulty in trading the USDJPY is clear: recent data shows that the trade is extremely crowded, and a sharp correction is possible if not likely. Yet the US Dollar continues to defy our expectations and is plowing higher across the board. We’ll need to wait for signs of concrete turnaround before getting short USDJPY.

An upcoming Bank of Japan Monetary Policy Meeting and Decision dominate event risk for the Japanese Yen in the week ahead, while clear USD outperformance keeps focus on a number of important US data releases. See the full video for our take on what to expect, but in sum: we are likely biding our time and keeping a very close eye on whether the USDJPY breaks above ¥110.

NZDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for NZDUSD: NeutralThe medium-term outlook for the NZD/USD remains bearish as the Reserve Bank of New Zealand (RBNZ) sticks to a neutral policy stance and retains the verbal intervention on the New Zealand dollar, but the pair may face a larger correction in the days ahead should the fresh back of central bank rhetoric coming out of the Federal Reserve drag on interest rate expectations.

The purchasing manager indices coming out of China during the first full week of October may have a greater impact on the kiwi amid the minor data prints in New Zealand, and a further slowdown in the world’s second-largest economy may dampen the appeal of the higher-yielding currency as it curbs the prospects for global growth. As a result, market participants may continue to look towards the safety of the U.S. dollar as the Federal Open Market Committee (FOMC) is widely expected to halt its quantitative easing (QE) program later this month, but it seems as though the central bank remains in no rush to move away from the zero-interest rate policy (ZIRP) as price growth continues to lag.

Despite the bullish U.S. dollar reaction to the upbeat Non-Farm Payrolls (NFP) report, we may see the group of Fed doves (Narayana Kocherlakota, William Dudley, Charles Evans and Daniel Tarullo) talk down interest rate expectations as weak wage growth continues to cast a subdued outlook for inflation. The prepared remarks may undermine the bullish sentiment surrounding the greenback should the central bank officials highlight the ongoing slack in the real economy, while comments from central bank hawks Richard Fisher and Charles Plosser may largely be ignored as it seems as though the two will continue to be the lone dissenters in 2014.

The EUR/USD pair fell hard during the course of the week, slamming into the 1.25 level. That level of course is a large, round, psychologically significant number and therefore we would not be surprise at all to see a little bit of a bounce from here. However, we believe that the 1.28 level above is massively resistive, and as a result we would be willing to sell on some type of pullback at this point in time. We have no interest in buying, as we believe that although this market is oversold, it is far too risky to go long of the Euro right now.

The U.S. dollar rallied to more than four year peaks against the other major currencies on Friday after the latest employment report showed that the economy added more jobs than expected last month, fuelling expectations for an early hike in U.S. interest rates.

The US Dollar Index, which tracks the performance of the greenback against a basket of six major currencies, was up 1.23% to 86.79 in late trade, a high last seen in June 2010, capping its twelfth consecutive weekly gain. The twelve-week rally is the longest since the index was created in 1971.

The U.S. economy added 248,000 jobs in September the Labor Department reported, well ahead of forecast for jobs growth of 215,000. The unemployment rate ticked down from 6.0% to 5.9%, the lowest level since July 2008.

The upbeat jobs report was tempered by slow growth in wages. Average hourly earnings rose by 2.0% year-over-year, slowing slightly from August.

The upbeat data added to the view that the strengthening economic recovery may prompt the Federal Reserve to raise interest rates sooner than markets are expecting.

In contrast, the Bank of Japan and the European Central Bank look likely to stick to a loose monetary policy stance amid concerns over faltering economic growth.

USD/JPY was up 1.22% to 109.77 in late trade, not far from Wednesday’s six year highs of 110.07.

The dollar also gained more than 1% against the euro, with EUR/USD dropping 1.22% to 1.2514, the weakest level since August 2012.

The European Central Bank refrained from implementing additional stimulus measures at its meeting on Thursday, despite euro area inflation slowing to a five year low last month, indicating that it will wait to see the effects of recent stimulus measures on the region’s economy.

Data on Friday showed that the bloc’s service sector slowed more sharply than initially estimated in September, fuelling fears that the economy is losing momentum.

The dollar hit a 15-month high against the Swiss franc, with USD/CHF adding 1.39% to settle at 0.9671. The pound slumped to 11-month lows, with GBP/USD down 1.08% to 1.5970.

Sterling came under pressure after Kristin Forbes, an external member of the Bank of England’s monetary policy committee, warned in a speech on Friday that the strong pound was acting as a drag on economic growth.

The Canadian dollar fell to six month lows, with USD/CAD up 0.82% to 1.1247 in late trade.

The Canadian dollar weakened after official data on Friday showed that the country unexpectedly posted a trade deficit in August as imports rose by the most in nearly two years, while exports slowed.

Elsewhere, the Russia rouble fell to record lows against the dollar on Friday. USD/RUB advanced 1.47% to 40.15 in late trade.

The rouble has been pressured lower by capital flight from Russia as a result of Western sanctions over the Ukraine crisis and by declining oil prices.

In the coming week, investors will be looking ahead to Wednesday’s Federal Reserve meeting minutes for further indications on the future possible direction of U.S. monetary policy.

Monetary policy decisions by the BoJ, Reserve Bank of Australia and the BoE will also be in focus.

Monday, October 6

- Markets in China are to remain closed for a national holiday.

- In the euro zone, Germany is to release data on factory orders.

- Later in the day, Canada is to publish its Ivey PMI.

Tuesday, October 7- New Zealand is to release private sector data on business confidence.

- Markets in China are to be closed for a national holiday.

- The BoJ is to publish its monetary policy statement and hold a press conference to discuss the monetary policy decision.

- Separately, the RBA is to announce its benchmark interest rate and publish its rate statement.

- The

Swiss National Bank is to publish data on its foreign currency

reserves. This data is closely scrutinized for indications of the size

of the bank’s operations in currency markets.

- Switzerland is also to release data on consumer prices and retail sales.

- The U.K. is to produce data on industrial and manufacturing production.

- Canada is to produce data on building permits.

Wednesday, October 8- Japan is to publish data on the current account.

- China is to report on its HSBC services PMI.

- Canada is to release data on housing starts.

- In the U.S., the Federal Reserve is to publish the minutes of its latest policy setting meeting.

Thursday, October 9- Japan is to release a report on core machinery orders.

- Australia is to release data on the change in the number of people unemployed and the unemployment rate.

- The BoE is to announce its benchmark interest rate.

- Canada is to report on new house price inflation.

- The U.S. is to publish its weekly government report on initial jobless claims.

- Later Thursday, ECB President Mario Draghi is to speak at an event in Washington; his comments will be closely watched.

Friday, October 10The euro fell to more than two-year lows against the dollar on Friday after an upbeat U.S. jobs report boosted expectations for an early interest rate hike, while weak euro zone data added to concerns over the economic outlook for the region.

EUR/USD was down 1.22% to 1.2514, the weakest level since August 2012 in late trade. For the week, the pair dropped 1.26%.

The Labor Department reported Friday that the U.S. economy added 248,000 jobs in September, well ahead of forecasts for jobs growth of 215,000. The unemployment rate ticked down to 5.9%, the lowest level since July 2008.

The upbeat jobs report was tempered by slow growth in wages. Average hourly earnings rose by 2.0% year-over-year, slowing slightly from August.

Despite this, the employment data added to the view that the strengthening economic recovery may prompt the Federal Reserve to raise interest rates sooner. The central bank is on track to end its asset purchase program later this month.

The US Dollar Index, which tracks the performance of the greenback against a basket of six major currencies, was up 1.23% to 86.79 in late trade, a high last seen in June 2010, capping its twelfth consecutive weekly gain. The twelve-week rally is the longest since the index was created in 1971.

Sentiment on the single currency was hit after data released earlier on Friday showed that the bloc’s service sector slowed more sharply than initially estimated in September, fuelling fears that the economy is losing momentum.

Research firm Markit revised its composite purchasing managers’ index, a measure of activity in the currency bloc’s manufacturing and services sectors, down to 52.0 from 52.5 in August, and below an initial estimate of 52.3.

A separate report did show that euro zone retail sales rose by 1.2% in August from a month earlier.

The European Central Bank refrained from implementing additional stimulus measures at its meeting on Thursday, despite euro area inflation slowing to a five year low last month, indicating that it will wait to see the effects of recent stimulus measures on the region’s economy.

ECB President Mario Draghi reiterated that the governing council remained “unanimous in its commitment” to taking more action should the inflation outlook deteriorate, leaving the way clear for quantitative easing.

Elsewhere, the euro was little changed against the yen on Friday, with EUR/JPY at 137.38, holding above Thursday’s almost one month lows of 136.85.

In the coming week, investors will be looking ahead to Wednesday’s Federal Reserve meeting minutes for further indications on the future possible direction of U.S. monetary policy.

A speech by Mario Draghi in Washington on Thursday will also be in focus.

Monday, October 6

- In the euro zone, Germany is to release data on factory orders.

Wednesday, October 8- In the U.S., the Federal Reserve is to publish the minutes of its latest policy setting meeting.

Thursday, October 9- The U.S. is to publish its weekly government report on initial jobless claims.

- Later Thursday, ECB President Mario Draghi is to speak at an event in Washington; his comments will be closely watched.

Friday, October 10