You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

if actual > forecast (or actual data) = good for currency (for USD in our case)

[EUR - French Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

French manufacturing PMI 48.8 vs. 47.0 forecast

France’s manufacturing PMI rose more-than-expected last month, preliminary data showed on Tuesday.

In a report, Markit Economics said that French manufacturing PMI rose to a seasonally adjusted 48.8, from 46.9 in the prior month.

Analysts had expected French manufacturing PMI to rise to 47.0 last month.

Trading the News: New Zealand Trade Balance (adapted from dailyfx article)

A marked expansion in New Zealand’s trade deficit may spark fresh monthly lows in the NZD/USD as it dampens the outlook for growth and inflation.

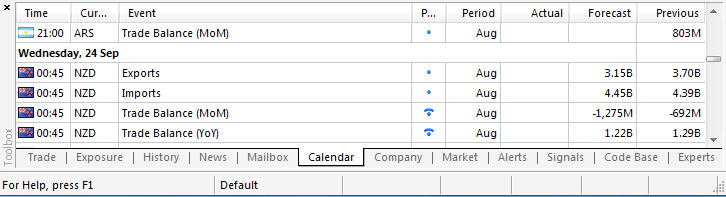

What’s Expected (MQ Metatrader 5 time as GMT+2):

Why Is This Event Important:

The weakening outlook for global trade may drag on interest rate expectations as the Reserve Bank of New Zealand (RBNZ) adopts a neutral tone for monetary policy, and Governor Graeme Wheeler may keep the cash rate on hold throughout the remainder of the year in an effort to combat the downside risk surrounding the real economy.

The trade report may highlight a weakening outlook for growth as business confidence deteriorates, and a marked expansion in the trade deficit may keep the RBNZ on the sidelines as the central bank continues to weigh the impact of the rate hikes from earlier this year.

However, the improved terms of trade along withexpectations for a faster recovery may generate a better-than-expected print, and we may see central bank Governor Wheeler show a greater willingness to further normalize monetary policy should the data dampen the downside risks surrounding the New Zealand economy.

How To Trade This Event Risk

Bearish NZD Trade: Deficit Widens to NZD1.125B or Greater

- Need red, five-minute candle following the release to consider a short NZD/USD trade

- If market reaction favors a long dollar trade, short NZD/USD with two separate position

- Place stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish NZD Trade: Trade Balance Tops Market Expectations- Need green, five-minute candle to favor a long NZD/USD trade

- Implement same setup as the bullish dollar trade, just in opposite direction

Potential Price Targets For The ReleaseNZD/USD Daily

- May see the bearish trend continue to take shape should RSI dip back into oversold territory

- Interim Resistance: 0.8370 (38.2% expansion) to 0.8390 (38.2% retracement)

- Interim Support: 0.7970 (50.0% retracement) to 0.8000 pivot

Impact that New Zealand Trade Balance has had on NZD/USD during the last release(1 Hour post event )

(End of Day post event)

New Zealand Has NZ$472 Million Trade Deficit

New Zealand posted a merchandise trade deficit of NZ$472 million in August, Statistics New Zealand said on Wednesday - representing 13 percent of exports.

That beat forecasts for a deficit of NZ$1.125 billion following the downwardly revised NZ$724 billion shortfall in July (originally NZ$692 million).

Exports were worth NZ$3.52 billion, topping expectations for NZ$3.20 billion and down from NZ$3.69 billion.

Live animals led the rise in exports, due to live cattle. Milk powder, butter, and cheese exports also contributed to the increase, led by higher quantities. The 16-percent rise in milk powder, butter, and cheese was led by milk fat and cheese.

"Cattle, milk fat, and cheese contributed to the rise in exports," international statistics manager Jason Attewell said. "It is the first time in three years that a rise in dairy was not led by milk powder."

Technical Analysis: EURUSD Breakout (based on dailyfx article)

As price with any breakout, there is always the potential for a price reversal. In the event of a false breakout, traders would first look for price to move back into range resistance located at the R3 pivot at a price of 1.2860. Once price has moved back into the trading range, reversal traders can look for price to potentially traverse the current 29 pip range back to support found at 1.2831. It should also be noted that price has the potential to break towards a lower low in the direction of the daily trend below the S4 pivot at 1.2818. In either scenario, this would indicate an end of bullish momentum drawing a conclusion to the present breakout environment.

Silver Breakdown Hints at USD Turning Point; EUR/USD, USD/CAD Not Done (based on dailyfx article)

During August and early-September, the rise of US Treasury yields neatly coincided with an already-bullish landscape for the US Dollar, proving to be further fuel to the fire. Yet over the past two weeks, the greenback has persisted as a top performer while long-end US yields have come back in after their brief jump. See the brief video above for what the technical breakdown in Silver means for the majors such as EURUSD and USDCAD over the coming days.

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

U.S. Durable Goods Orders Show Sharp Pullback In August

Reflecting volatility in commercial aircraft orders, the Commerce Department released a report on Thursday showing a sharp pullback in orders for manufactured durable goods in August following the substantial increase seen in July.

The report said durable goods orders tumbled by 18.2 percent in August after surging up by 22.5 percent in July. Economists had been expecting orders to plunge by about 18.0 percent.

Excluding orders for transportation equipment, durable goods orders actually rose by 0.7 percent in August compared to a 0.5 percent drop in July. The rebound matched economist estimates.

EUR/USD Drops Below 1.27 on Divergent Outlooks

The euro hit a 22-month low against the dollar on Thursday on the prospect of diverging monetary policy between the Federal Reserve and the European Central Bank as rate differentials swing decisively in the greenback’s favor.

The common currency fell to $1.2730 on trading platform EBS, its lowest since November 2012, and was down 0.3 percent on the day. The dollar index hit a new four-year high. The latest drop came as yield differentials between US 10-year Treasuries and their German counterparts traded near 15-year highs, driving more investors to buy the dollar.

A recent batch of economic data has also highlighted the diverging economic outlook for the euro zone and the United States. While German business sentiment fell again in September to its lowest level in nearly 1-1/2 years, sales of new U.S. single-family homes surged in August to their highest level in more than six years.

Canadian GDP, US Consumer confidence, ISM Manufacturing PMI, Rate decision in the Eurozone and important employment figures from the US including the all-important NFO report. These are the major events on Forex calendar. Here is an outlook on the main market-movers ahead.

Last week, the Scottish referendum threatening to quit the UK, resulted in a vote against independence pushing the pound higher after sharp drops. Likewise, the US dollar gained momentum as ECB Chairman Mario Draghi, RBA’s Stevens and Chinese policy makers considered using the Fed’s tactics to fight downturn economic trends. Finally the US GDP release showed the economy expanded at an annual rate of 4.6% in the second quarter, better than the 4.2% estimate made a month ago, providing momentum for strong growth the rest of the year. Will the US continue its growth trend?

Exports of automobiles, telecom equipment, industrial machines and semiconductors increased. Imports of oil products increased, but rising domestic production reduced the trade deficit in petroleum to its lowest in more than five years. The decline in trade deficit reinforces views that the US economy continues to strengthen. The U.S. trade deficit is expected to decline further to $41.0 billion in July.

The EUR/USD pair initially tried to rally during the week, but as you can see ended up falling and slicing through the 1.28 level like it wasn’t even there. Because of this, we believe that the euro continues to offer selling opportunities on rallies, but at this point in time we think that the market is probably aiming for the 1.25 handle. Be aware though, this is a market that is certainly oversold by any stretch of imagination and a snapback rally could happen at any point. Ultimately though, we have no plans on buying.

The dollar rose to fresh six year highs against the yen on Friday and hit 14-month peaks against the euro after data showed that the U.S. economy grew at its fastest pace in two-and-a-half years in in the second quarter.

USD/JPY hit highs of 109.52, the most since August 2008 and was last up 0.49% to 109.26.

EUR/USD was at lows of 1.2682 late Friday, the weakest since November 2012.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies ended Friday’s session up 0.51% to a four year high of 85.77, capping its eleventh consecutive weekly gain.

The dollar was boosted after the Commerce Department reported that U.S. gross domestic product was revised up to 4.6% in the three months to June from a previous estimate of 4.2%. It was the fastest rate of expansion since the fourth quarter of 2011.

The upbeat data added to the view that the strengthening economic recovery may prompt the Federal Reserve to raise interest rates sooner than markets are expecting.

In contrast, the Bank of Japan and the European Central Bank look likely to stick to a loose monetary policy stance amid concerns over faltering economic growth.

The pound fell to more than one week lows against the stronger dollar, with GBP/USD down 0.44% to 1.6243 late Friday. Elsewhere, sterling was close to two year highs against the single currency, with EUR/GBP at 0.7806 in late trade.

The commodity linked dollars fell to multi-month lows against the greenback. AUD/USD was down 0.29% to an almost six month trough of 0.8761 late Friday, while NZD/USD hit one year lows of 0.7860. USD/CAD was up 0.44% to 1.1156, the highest level since March.

Also Friday, the Russian rouble fell to a fresh record lower against the greenback, with USD/RUB up 1.69% to 39.14 in late trade. The rouble was pressured lower by falling oil prices. Crude oil is one of Russia’s largest exports.

In the week ahead, investors will be looking ahead to euro zone inflation data and the outcome of Thursday’s ECB meeting, while Friday’s U.S. nonfarm payrolls report will also be in focus after August’s report fell short of expectations. Wednesday’s Japanese manufacturing data will also be closely watched.

Monday, September 29

- In the euro zone, Germany and Spain are to release

preliminary data on consumer price inflation, which accounts for the

majority of overall inflation.

- The U.K. is to release a report on net lending.

- The U.S. is to produce data on personal income and expenditure, as well as a private sector report on pending home sales.

Tuesday, September 30- New Zealand is to release data on building permits, in addition to a private sector report on business confidence.

- Japan

is to publish reports on household spending, retail sales and average

earnings, as well as preliminary data on industrial production.

- Meanwhile, China is to publish the final reading of the HSBC manufacturing index.

- The

euro zone is to release preliminary data on consumer inflation and

unemployment, while Germany is to publish data on retail sales and

unemployment.

- The U.K. is to report on preliminary

business investment and the current account and IS TO release final data

on GDP growth. The country is also to produce private sector data on

house price inflation.

- Switzerland is to publish its KOF economic barometer.

- Later Tuesday, Canada is to release its monthly GDP report along with data on raw material inflation.

- The U.S. is to publish data on business activity in the Chicago region and a report on consumer confidence.

Wednesday, October 1- Japan is to publish the results of its Tankan manufacturing and services indices.

- Markets in China are to remain closed for a holiday, but the country is to release official data on manufacturing activity.

- Australia is to publish data on retail sales.

- The U.K. is to publish data on manufacturing activity.

- The

U.S. is to release the ADP report on private sector job creation, which

leads the government’s nonfarm payrolls report by two days. Late in the

day, the Institute of Supply Management is to release a report on

manufacturing activity.

Thursday, October 2- Markets in Hong Kong will be closed for a national holiday.

- Australia is to release data on building approvals and the trade balance.

- In the euro zone, Spain is to release a report on the change in the number of people unemployed.

- The U.K. is to publish data on construction activity.

- The

ECB is to announce its benchmark interest rate. The announcement is to

be followed by a press conference with President Mario Draghi.

- The U.S. is to publish the weekly report on initial jobless claims, as well as data on factory orders.

Friday, October 3