You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The euro pushed higher against the dollar on Friday, but remained within striking distance of 14-month lows as the prospects of an early hike in U.S. interest rates continued to underpin investor demand for the greenback.

EUR/USD was up 0.33% to 1.2964 late Friday, holding above the 14-month trough of 1.2858 reached on Tuesday.

The pair was likely to find support at the 1.29 level and resistance at around 1.3015.

Expectations that the Federal Reserve is growing closer to raising interest rates continued to support the dollar, with the European Central Bank likely to stick to its looser monetary policy stance.

A study by the San Francisco Fed published on Monday indicated that central bank officials see rates rising sooner than markets expect.

The Fed was expected to cut its asset purchase program by another $10 billion at its upcoming policy meeting next week which would keep it on track for winding up the program in October, and to start raising interest rates sometime in mid-2015.

Data on Friday showing that U.S. retail sales rose in August and another report showing that consumer sentiment rose to a 14-month high in September underlined the view that the economic recovery is deepening.

The single currency has remained under pressure since the ECB unexpectedly cut rates to record lows on September 4 and unveiled new easing measures in a bid to shore up inflation in the euro area.

The euro rose to two month highs against the weaker yen on Friday, with EUR/JPY up 0.56% in late trade. For the week the pair gained 2.17%.

The yen fell to more than six year lows against the dollar on Friday amid expectations for more stimulus from the Bank of Japan.

BoJ Governor Haruhiko Kuroda said Thursday that the bank would be prepared to immediately loosen monetary policy or implement other measures if its 2% inflation target becomes difficult to meet.

In the week ahead, investors will be focusing on the outcome of Wednesday’s Fed policy meeting. Fed Chair Janet Yellen was to hold a press conference following the meeting. Tuesday’s report on the ZEW German business sentiment index will also be closely watched.

Monday, September 15

- In the euro zone, Germany’s Bundesbank is to publish its monthly report.

- The U.S. is to release reports on manufacturing activity in the Empire State and industrial production.

Tuesday, September 16- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- The U.S. is to produce data on producer price inflation.

Wednesday, September 17- The euro zone is to release revised data on consumer price inflation.

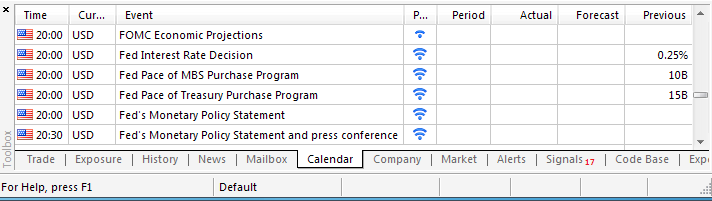

- The

U.S. is to produce data on consumer prices. Later Wednesday, the

Federal Reserve is to announce its federal funds rate and publish its

rate statement. Fed Chair Janet Yellen is to hold a press conference

following announcement.

Thursday, September 18if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. It's a leading indicator of economic health - production reacts quickly to ups and downs in the business cycle and is correlated with consumer conditions such as employment levels and earnings.

==========

U.S. Industrial Production Unexpectedly Edges Down 0.1% In August

With manufacturing output falling for the first time since January, the Federal Reserve released a report on Monday showing that U.S. industrial production unexpectedly decreased in the month of August.

The report said industrial production edged down by 0.1 percent in August after inching up by a downwardly revised 0.2 percent in July.

The modest drop came as a surprise to economists, who had expected production to climb by 0.3 percent compared to the 0.4 percent increase originally reported for the previous month.

The unexpected drop in industrial production came as manufacturing output fell by 0.4 percent in August after rising by 0.7 percent in July.

The Fed noted that the production of motor vehicles and parts tumbled by 7.6 percent in August after jumping by more than 9 percent in July.

Meanwhile, the report also said mining output rose by 0.5 percent in August after dipping by 0.3 percent in the previous month.

Utilities output also surged up by 1.0 percent in August after plunging by 2.7 percent and 2.0 percent in July and June, respectively.

if actual > forecast (or actual data) = good for currency (for EUR in our case)

[EUR - German ZEW Economic Sentiment] = Level of a diffusion index based on surveyed German institutional investors and analysts. It's a leading indicator of economic health - investors and analysts are highly informed by virtue of their job, and changes in their sentiment can be an early signal of future economic activity

==========

German ZEW Investor Confidence Eases Less Than Expected

Germany's investor confidence weakened less-than-expected in September, reports said Tuesday citing data from the Centre for European Economic Research/ZEW.

The ZEW economic sentiment index fell to 6.9, which was above economists' forecast for a score of 5. In August, the index reading was 8.6.

The current conditions index of the survey, meanwhile, tumbled to 25.4, which was well below the consensus expectation of 40. In August, the reading was 44.3.

The Eurozone economic sentiment index of the survey eased to 14.2 in September. In August, the reading was 23.7.

EURUSD Technical Analysis: Short at 1.3644 (based on dailyfx article)

A daily close above the 14.6% Fibonacci retracementat 1.2981 exposes the 23.6% level at 1.3057. Alternatively, a turn below the 50% Fib expansion at 1.2864 opens the door for a test of the 61.8% threshold at 1.2794.

Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision (based on dailyfx article)

The Federal Open Market Committee (FOMC) interest rate decision may spur a bearish reaction in the dollar (bullish EUR/USD) if the central bank remains reluctant to move away from the zero-interest rate policy (ZIRP).

What’s Expected:

Why Is This Event Important:

Even though the Fed is widely expected to conclude its asset-purchase program at the October 29 meeting, we would need a more hawkish twist to the forward-guidance for monetary policy to favor further USD strength.

The dollar may come under pressure should we get more of the same from the Fed, and the greenback may face a larger correction over the remainder of the month should Chair Janet Yellen see greater scope to retain the highly accommodative policy stance for an extended period of time.

Nevertheless, sticky inflation paired with the uptick in wage growth may spur a greater dissent within the committee and push the FOMC to lay out a more detailed exit strategy as the central bank looks to move away from its easing cycle.

How To Trade This Event Risk

Bearish USD Trade: FOMC Remains Reluctant to Normalize Monetary Policy

- Need green, five-minute candle following the policy statement to consider a long EUR/USD position

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish USD Trade: Policy Statement Shows Larger Dissent & Shift Away from ZIRP- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same strategy as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Risks Larger Topside Correction as the Relative Strength Index (RSI) Threatens Bearish Momentum

- Interim Resistance: 1.2990 (23.6% retracement) to 1.3025 (23.6% expansion)

- Interim Support: 1.2858 (Monthly low) to 1.2870 (50.% expansion)

Impact that the FOMC rate decision has had on EUR/USD during the last meeting(1 Hour post event )

(End of Day post event)

EURUSD M5 : 32 pips price movement by USD - Federal Funds Rate news event:

The Federal Open Market Committee (FOMC) voted to reduce its asset-purchase pace to $25B from $35B in July amid the sharp economic rebound in the second quarter. However, the Fed also highlighted the significant underutilization of labor resources and reiterated that it is appropriate to maintain the current fed fund rate for a considerable period of time even after the quantitative easing program ends. The Fed’s dovish tone dragged on the greenback, with EUR/USD climbing above 1.3400, but we saw limited follow-through behind the initial reaction as the pair ended the day at 1.3395.

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========U.S. Consumer Prices Unexpectedly Show Modest Drop In August

With a substantial decrease in energy prices more than offsetting higher prices for food and shelter, the Labor Department released a report on Wednesday showing an unexpected drop in U.S. consumer prices in the month of August.

The Labor Department said its consumer price index dipped by 0.2 percent in August after inching up by 0.1 percent in July. The modest drop came as a surprise to economists, who had expected consumer prices to come in unchanged.

AUDIO - Currencies with David Warner

A former Broker at FXCM, David Warner is now teaching Forex classes for Online Trading Academy. Coming from a traditional investment background, David shares some of the major things he has learned over the years with Power Trading Radio listeners. Later Merlin and David take a look at a couple currency pairs for potential trading opportunities and suggestions on how to trade economic data releases.

EUR/USD Vulnerable to Hawkish Fed- Outlook May Hinge on T-LTRO (based on dailyfx yotube channel)

The EUR/USD may look beyond the FOMC policy meeting to break out of the rate as the ECB implements the targeted long-term refinancing operation (T-LTRO).

=============

2014-09-18 09:15 GMT (or 11:15 MQ MT5 time) | [EUR - Targeted LTRO]

[EUR - Targeted LTRO] = Total value of money the ECB will create and use to loan to Eurozone banks. It provides liquidity to banks which usually leads to lower long-term interest rates and stimulates growth.

LTRO = Long Term Refinancing Option

==========MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.09.18

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD Technical Analysis (based on dailyfx article)

The Euro may correct higher against the US Dollar after forming a bullish Piercing Line candle pattern coupled with positive RSI divergence. A daily close above trend line resistance at 1.2951 exposes the September 16 high at 1.2994. Alternatively, reversal below above the 1.2858-71 area marked by the September 9 low and the 14.6% Fibonacci expansion opens the door for a test of the 23.6% level at 1.2796.

G20 Meetings, Mario Draghi’s speech, German Ifo Business Climate, US New Home Sales, US Durable Goods Orders, US Unemployment Claims are the main highlights this week. Here is an outlook on the major events coming our way.

Last week Scotland voted NO on independence from the UK in the historic referendum. The NO campaign’s victory was more decisive than the opinion polls had suggested, leaving the 307-year union in place. UK’s Prime Minister David Cameron acknowledged the Scots’ demand to have more power in the UK legislation and form a new constitutional settlement for the entire UK. Markets reacted with relief, bank shares climbed sharply after the market opened. Sterling initially gained in reaction to the result, rising 0.3 % higher to $1.6442, but later fell back against the dollar. Will the UK economy speed up growth in the coming months?