You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

if actual > forecast = good for currency (for AUD in our case)

[AUD - Home Loans] = Change in the number of new loans granted for owner-occupied homes. It's a leading indicator of demand in the housing market - most homes are financed, so it provides an excellent gauge of how many qualified buyers are entering the market.

==========

Australia Home Loans Add 0.3% In JulyThe total number of home loans in Australia was up a seasonally adjusted 0.3 percent on month in July, the Australian Bureau of Statistics said on Tuesday - coming in at 52,251.

That missed forecasts for an increase of 1.0 percent, and down from the downwardly revised 0.1 percent gain in June (originally 0.2 percent).

The value of home loans for owner-occupied housing was flat on month at A$17.058 billion - down from the 1.7 percent increase in the previous month.

Investment lending climbed 6.8 percent on year to A$11.513 billion, after adding 0.1 percent a month earlier.

Forum on trading, automated trading systems and testing trading strategies

AminStar, 2014.09.09 22:09

US Dollar Strengthens Broadly as Expectations for Rate Hike Accumulate

The US dollar strengthened further overnight as market participants’ expectations for Fed interest rate raise timing becomes more imminent. The Treasury 10-year yields advance as BlackRock said that the improving labor and indications for inflation suggest that the Fed would increase borrowing costs. That is diverging from almost all other major central banks monetary policies. The greenback rose against the Japanese Yen to fresh 5-year high at 106.33 and fundamentals are expected to remain supportive for the US dollar. At the same time the Japanese Consumer Confidence was reported today lower than expected.

Next week the FOMC would release its projections and most likely would further cut monthly asset purchases program. In addition, the geopolitical risk has diminished significantly compared to August and that does not help the Japanese Yen, therefore continuation of these developments would further increase the USDJPY.

Elsewhere, the Euro against the US dollar also dropped to fresh 14-month low at 1.2864 as the greenback was strengthening while the demand for Euro remains weak. On the data front today we are expecting the Manufacturing and Industrial Production for UK while in the evening investors would anticipate the JOLTS Job Opening for further clues on US labor market performance.Trading Video: FX Volatility Surge Puts Dollar and S&P 500 on Alert

if actual > forecast (or actual data) = good for currency (for AUD in our case)

[AUD - Home Loans] = Change in the level of a diffusion index based on surveyed consumers. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

Bad time for Australia. Share market falls as consumer confidence drops

The Australian share market has suffered its worst fall in more than a month, with investors influenced by losses on Wall Street and an unexpected fall in consumer confidence.

All sectors fell but finance companies managed to post the slimmest losses.

The NAB and ANZ bank fell by 0.4 per cent and 0.25 per cent respectively, while the Commonwealth closed steady. Westpac gained 0.4 per cent.

The All Ordinaries index and the ASX200 both fell 34 points or 0.6 per cent to close at 5,574.

The mining sector was one of the hardest hit; BHP Billiton dropped 0.8 per cent and Rio Tinto 0.4 per cent, as the benchmark Chinese iron ore price softened a touch more overnight Tuesday.

Atlas Iron dropped 4.2 per cent and Fortescue Metals Group fell 2.7 per cent, but gold miner Newcrest gained 1.25 per cent.

The Westpac Melbourne Institute Consumer Confidence index fell sharply and unexpectedly in its latest reading, erasing the gains it had made over the previous three months.

The index is now 4.6 points lower at 94, with any reading below 100 indicating that pessimists outnumber optimists.

The Australian dollar was also hurt by the confidence index and continued its slide on speculation that US interest rates will begin increasing before those domestically.

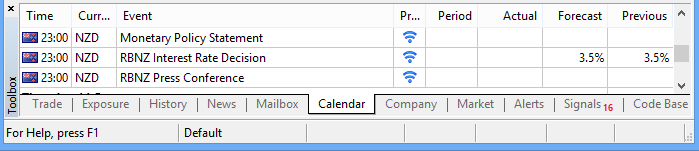

Trading the News: Reserve Bank of New Zealand (RBNZ) Rate Decision (based on dailyfx article)

According to a Bloomberg News survey, all of the 13 economist polled see the Reserve Bank of New Zealand (RBNZ) keeping the interest rate on hold at 3.50%, but the fresh batch of central bank rhetoric may produce increased volatility in the NZD/USD as market participants weigh the outlook for monetary policy.

What’s Expected:

Why Is This Event Important:

In light of the marked depreciation in the NZD/USD, the biggest risk for surprise will be a removal of the verbal intervention on the kiwi, and a further decline in the exchange rate may prompt Governor Graeme Wheeler to adopt a more hawkish tone for monetary policy as it fuels imported inflation.

Below-target inflation along with the slowdown in employment may encourage the RBNZ to retain a period of ‘interest rate stability’ in New Zealand, and the fresh batch of central bank rhetoric may spur a further decline in the NZD/USD should it drag on interest rate expectations.

Nevertheless, the RBNZ may no longer jawbone the kiwi as the lower exchange rate raises the risk for imported inflation, and the NZD/USD may face a more meaningful rebound ahead of the next Fed meeting on September 17 should Governor Wheeler unexpectedly adopt a more hawkish tone for monetary policy.

How To Trade This Event Risk

Bearish NZD Trade: RBNZ Continues Talk Down Interest Rate Expectations

- Need red, five-minute candle following the statement to consider a short New Zealand dollar trade

- If market reaction favors selling kiwi, short NZD/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish NZD Trade: Governor Wheeler Removes Verbal Intervention- Need green, five-minute candle to favor a long NZD/USD trade

- Implement same setup as the bullish New Zealand dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseNZDUSD Daily

- Will look for fresh highs should the NZD/USD carve a higher-low in July

- Interim Resistance: 0.8430 (23.6% retracement) to 0.8450 (23.6% expansion)

- Interim Support: 0.8160 (100% expansion) to 0.8180 (38.2% retracement)

Impact that the RBNZ rate decision has had on NZD during the last meeting(1 Hour post event )

(End of Day post event)

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2014.09.11

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 35 pips price movement by NZD - Official Cash Rate news event

AUDUSD Technical Analysis (based on dailyfx article)

The Australian Dollar appears poised to continue lower against the US Dollar after sliding to the weakest level in close to five months. A break below support at the bottom of a falling channel set from mid-June exposes the 38.2% Fibonacci expansion at 0.9085, with a further push beyond that targeting the 50% level at 0.8955. Alternatively, a reversal back above the channel floor – now recast as resistance at 0.9195, opens the door for a test of the 0.9245-64 area marked by a rising trend line set from April and the 23.6% expansion.

Technical Analysis: AUDUSD & NZDUSD trade similarly for different reasons

The NZDUSD made new lows on the back of comments from RBNZ’s Wheeler who said that the currency was overvalued and that rates would stay on hold until 1Q of 2015. Meanwhile in Australia, the AUDUSD made it’s new move lows despite much stronger employment statistics that had the market questioning the seasonals.

Inflation data in the UK and the US, German Economic Sentiment, US Federal Funds Rate and FOMC Press conference, GDP in New Zealand, US unemployment claims, Scottish Independence Vote are the major topics in Forex calendar. Check out these events on our weekly outlook.

Last week US jobless claims increased 11,000 last week, reaching 315K, exceeding the revised 304K posted in the week before. However, the 4 week moving average was little affected, rising 750 to 304K, 7% less than a year ago and still behind prerecession levels. Despite sluggish, hiring in August, the general trend is positive. The economy has generated an average of 215,000 jobs a month so far in 2014, up from 194,000 in 2013 and wage growth is expected to rise in the coming months alongside economic expansion. Will this trend continue?

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: NeutralEuro selling pressure appears to be waning at last after eight consecutive weeks of losses that brought the single currency to the lowest level in 14 months against the US Dollar. The operative question going forward is whether this precedes a period of consolidation before a reinvigorated push downward or a correction upward. The answer will be found in the markets’ response to a hefty dose of high-profile event risk on the domestic and the external fronts in the week ahead.

Looking inward, thespotlight is on the first ECB TLTRO operation due to be held on September 18. The effort represents one of many easing tools that Mario Draghi and company have deployed in recent months in an attempt to check the slide toward deflation and repair the seemingly broken monetary policy transmission mechanism that has made the central bank’s prior attempts at stimulus largely ineffective. The scheme envisions offering Eurozone banks cheap capital tied up with conditions pushing them re-lend it while passing on low borrowing costs to the real economy, stoking activity and boosting prices. The key variable in play will be the size of the liquidity provision that is ultimately taken up by banks tapping the facility. In a somewhat counter-intuitive turn of events, a large capital allocation seems likely to offer support to the Euro.

Externally, the first major item of note is the FOMC policy announcement. September’s outing will be accompanied by the release of an updated set of forecasts for key metrics of US economic activity as well as press conference from Chair Janet Yellen. The Fed has long warned about complacently buoyant risk appetite as the end of QE3 looms ahead next month. If policymakers opt to shake things loose with upbeat activity projections and/or a hawkish outing from Ms Yellen, this may put the Euro’s increasingly unattractive yield profile in stark relief and reinvigorate bearish momentum.

The second is the Scottish Independence referendum. Opinion polls ahead of the ballot essentially point to a 50/50 chance that Scotland will secede from the UK. This implies that – whatever the final result – a surge of volatility is likely to follow the results as those on the wrong side of the outcome are forced to readjust positions. A final vote in favor of independence is likely weigh on Sterling, sending capital fleeing to alternatives. The Euro looks like a natural beneficiary in such a scenario. Needless to say, a victory for the “no” campaign will probably yield the opposite result.

The U.S. dollar ended its ninth successive weekly gain against a basket of other major currencies on Friday as expectations for an early hike in U.S. interest rates continued to bolster investor demand.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, was last down 0.18% to 84.32, but ended the week with gains of 0.39%. It was the longest series of successive weekly gains in more than 17 years.

The dollar rallied to fresh six-year highs against the yen on Friday, with USD/JPY up 0.23% to 107.33 at the close. For the week, the pair added 2.05%.

Expectations that the Federal Reserve is growing closer to raising interest rates continued to boost the dollar against the yen and the euro, with the Japanese and European central banks likely to stick to a looser monetary policy stance.

A study by the San Francisco Fed published on Monday indicated that central bank officials see rates rising sooner than markets expect.

The Fed was expected to cut its asset purchase program by another $10 billion at its upcoming policy meeting next week which would keep it on track for winding up the program in October, and to start raising interest rates sometime in mid-2015.

Data on Friday showing that U.S. retail sales rose in August and another report showing that consumer sentiment rose to a 14-month high in September underlined the view that the economic recovery is deepening.

The yen remained under pressure after Bank of Japan Governor Haruhiko Kuroda said Thursday that the bank would be prepared to immediately loosen monetary policy or implement other measures if its 2% inflation target becomes difficult to meet.

EUR/USD was up 0.33% to 1.2964 late Friday, holding above the 14-month trough of 1.2858 reached on Tuesday.

The single currency has remained under pressure since the European Central Bank unexpectedly cut rates to record lows on September 4 and unveiled new easing measures in a bid to shore up inflation in the euro area.

The pound also pushed higher against the dollar on Friday, with GBP/USD up 0.18% to 1.6267 in late trade. The pair fell to 10-month lows on Wednesday as the prospects of Scottish independence rattled financial markets.

However, uncertainty over what currency an independent Scotland would use, as well as concerns over how much of the U.K. national debt it would take on looked likely to cap sterling’s gains ahead of the September 18 referendum.

In the week ahead, investors will be focusing on the outcome of Wednesday’s Fed policy meeting. Fed Chair Janet Yellen was to hold a press conference following the meeting.

Market participants will also be closely watching the outcome of Thursday’s independence referendum in Scotland.

Monday, September 15

- Markets in Japan are to remain closed for a national holiday.

- Switzerland is to produce data on producer price inflation.

- In the euro zone, Germany’s Bundesbank is to publish its monthly report.

- The U.S. is to release reports on manufacturing activity in the Empire State and industrial production.

Tuesday, September 16- The Reserve Bank of Australia is to publish the minutes

of its latest policy meeting, which contain valuable insights into

economic conditions from the bank’s perspective.

- The U.K. is to publish data on consumer price inflation, which comprises the majority of overall inflation.

- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- Canada is to release data on manufacturing sales.

- The U.S. is to produce data on producer price inflation.

Wednesday, September 17- New Zealand is to publish data on the current account.

- The

U.K. is to publish data on the change in the number of people employed

and the unemployment rate, as well as data on average earnings. In

addition, the Bank of England is to release the minutes of its latest

policy meeting.

- The euro zone is to release revised data on consumer price inflation.

- The

U.S. is to produce data on consumer prices. Later Wednesday, the

Federal Reserve is to announce its federal funds rate and publish its

rate statement. Fed Chair Janet Yellen is to hold a press conference

following announcement.

Thursday, September 18- New Zealand is to publish data on gross domestic

product, the broadest indicator of economic activity and the leading

measure of the economy’s health.

- Japan is to release data on the trade balance, the difference in value between imports and exports.

- Switzerland

is also to release a report on the trade balance. At the same time, the

Swiss National Bank is to announce its libor rate and publish its

monetary policy assessment.

- The U.K. is to release data

on retail sales, the government measure of consumer spending, which

accounts for the majority of overall economic activity. Meanwhile,

Scotland is to hold its independence referendum.

- The

U.S. is to produce a flurry of economic data, including reports on

initial jobless claims, building permits, housing starts and

manufacturing activity in the Philadelphia region.

Friday, September 19