You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Market Adaptation with Gabe Velazquez

With most markets at historic levels, Gabe Velazquez shares his thought on why only the Russell 2000 has really good trading opportunities at current levels. This ties into market timing principles and the foundation of Supply & Demand theory. Gabe also answers several listener questions on subjects ranging from stocks to futures. The duo also take a look at the grain markets, which have been clobbered recently.

if actual > forecast = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

Trading the News: U.S. Non-Farm Payrolls (adapted from dailyfx)

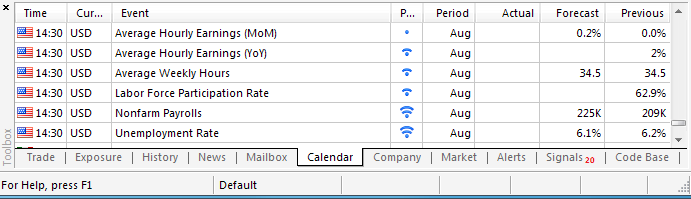

The EUR/USD may face a further decline over the next 24-hours of trade as the U.S. Non-Farm Payrolls (NFP) report is expected to show the world’s largest economy adding another 230K jobs in August while the jobless rate is expected to narrow to an annualized 6.1% from 6.2% the month prior.

What’s Expected:

Why Is This Event Important:

Signs of a more robust recovery may further boost interest rate expectations as the Federal Open Market Committee (FOMC) is expected to halt its asset-purchase program at the October 29 meeting, and the bullish sentiment surrounding the U.S dollar may gather pace throughout the remainder of the year as a growing number of central bank officials show a greater willing to normalize monetary policy sooner rather than later.

The pickup in economic activity paired with the highest ISM employment prints for 2014 may highlight a further expansion in job growth, and an above-forecast NFP figure may spur fresh monthly lows in the EUR/USD amid the deviation in the policy outlook.

On the other hand, the recent slowdown in private-sector consumption - one of the leading drivers of growth - may generate another weaker-than-expect print, and a soft employment reading may spur a more meaningful pullback in the greenback as it dampens the outlook for the world’s largest economy.

How To Trade This Event Risk

Bullish USD Trade: NFPs Climb 230K or Greater While Jobless Rate Slips to 6.1% or Lower

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Job Growth Falls Short of Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Downside targets remain favored as RSI pushes deeper into oversold territory.

- Interim Resistance: 1.3350 (61.8% expansion) to 1.3370 (50.0% retracement)

- Interim Support: 1.2870 (50.0% expansion) to 1.2900 (1.618% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

EURUSD M5 : 44 pips price movement by USD - Non-Farm Payrolls news event:

AUDUSD M5 : 46 pips price movement by USD - Non-Farm Payrolls news event:

The U.S. economy added 209K jobs in July, following a revised 298K increase the month prior. The print was below the average estimate of 230K. The jobless rate unexpectedly rose to 6.2% from 6.1% in June as discouraged workers returned to the labor force. Nevertheless, the greenback lost ground following the below-forecast print, with the EUR/USD rallying to a high of 1.3443 going into the European close.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.09.05

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 39 pips price movement by USD - Non-Farm Employment Change news event

Mark Carney and Haruhiko Kuroda speeches, New Zealand rate decision, Australian employment data, US Unemployment Claims, Retail sales and Consumer sentiment are the major events on our calendar for this week. Here is an outlook on the main market-movers coming our way.

Last week Non-Farm Payrolls declined below the 200,000 level with only a 142,000 job gain in August, considerably lower than the 230,000 gain expected by analysts. The unemployment rate fell by 0.1%, but was attributed to a 0.1 drop in the participation rate. Despite a rebound in economic growth during the second quarter, the recent employment data suggests the economy shifts to lower gear. Will this trend continue?

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: NeutralThe Australian Dollar is heading for another relatively flat finish to the week ahead of the Jackson Hole Symposium. The currency was afforded some support as RBA policy expectations shifted away from the more dovish end of the spectrum. This came on the back of a status-quo set of RBA Meeting Minutes and a relatively optimistic set of comments from Governor Stevens on the domestic economy. Additionally, a broader return to high-yielding instruments helped offset some of the negative cues provided by a deterioration in Chinese economic data.

Looking ahead, RBA policy bets as well as general market risk appetite remain the dominant themes to monitor for the Aussie. On the policy front; a void of local economic data is on the calendar heading into the end of the month. This is likely to leave the ‘period of stability’ baseline scenario for rates intact. Which in turn could keep the currency supported via its yield spread over its major counterparts.

Of course, the appeal of the currency’s interest rate advantage is intrinsically linked to broader risk sentiment. Implied volatility remains near multi-year lows despite a small recovery for the gauge over the past month. This suggests traders are pricing in a relatively small probability of major market swings in the near-term. Such an environment raises the attractiveness of carry trades and bodes well for the Aussie.

Further, the threat posed to investor optimism by ongoing geopolitical turmoil appears to have diminished in recent weeks. Storm clouds continue to loom over Eastern Europe and the Middle East. Yet traders seem to have become desensitized to the latest flare-ups. This suggests it would likely take a material escalation in the regional turmoil to threaten the resilience of the Australian Dollar.

NZDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for New Zealand Dollar: NeutralThe Reserve Bank of New Zealand (RBNZ) policy meeting on September 10 may heighten the bearish sentiment surrounding NZD/USD should the fresh batch of central bank rhetoric drag on interest rate expectations.

According to a Bloomberg News survey, all of the 12 economists polled forecast the RBNZ to keep the benchmark interest rate steady at 3.50% as Governor Graeme Wheeler adopts a neutral tone for monetary policy, and the New Zealand dollar may face a further decline in the days ahead if the central bank head sees a period of interest rate stability throughout the remainder of 2014. At the same time, Governor Wheeler may continue to highlight weaker commodity prices to favor a weakened outlook for the New Zealand dollar, but the recent slide in the higher-yielding currency may raise the outlook for price growth as it draws imported inflation.

With that said and given the near-term decline in NZD/USD, the biggest risk surrounding the RBNZ interest rate decision will be a removal of the verbal intervention on the kiwi as the central bank sees a more sustainable recovery in New Zealand. As a result, Credit Suisse Overnight Index Swaps continue to show expectations for at least one 25bp rate hike over the next 12-months, but dovish remarks from the RBNZ may push NZD/USD to give back the rally from the February low (0.8050) as market participants scale back bets for higher borrowing costs.

Nevertheless, the 0.8250-60 region remains the next key level of interest as NZD/USD retains the descending channel along with the downward trend in the Relative Strength Index (RSI), but a lack of jawboning from the RBNZ may foster a more meaningful recovery in the New Zealand dollar as the oscillator comes off of oversold territory.

Trading Video: Can the Dollar Sustain its Rally and the S&P 500 its Quiet? (based on dailyfx article)

Though it falls short of the S&P 500's maturity, the US Dollar's rally these past two months stands out as one of the financial market's top themes. An eight-week rally for the USDollar matches its longest run in 15 years, but the performance is all the more remarkable for the fundamental drivers backing its progress. Rather than find its footing through a 'flight to safety' or meaningful upgrade in policy forecasts, the greenback has drawn strength through its counterparts' difficulties. The culmination of unique issues for the Euro, Pound and Yen make for an effective lever; but it is also one that lacks for endurance. With equity markets pulsating 'extreme complacency' and the dollar stretched, we look at market conditions and potential setups for the week ahead in today's Trading Video.

NZDUSD Doji Ensemble Indicates Caution Near Critical Support (based on dailyfx article)

NZD/USD continues to skip across the critical 0.8260 barrier with a medley of short body candles suggesting caution from traders. A daily close below the nearby floor would be preferred for entering new short positions, given the context of a downtrend on the daily.

The Harami noted in the most recent candlesticks report delivered a short-lived bounce for NZD/USD. The emergence of a Gravestone Doji now hints at a pullback for the pair over the session ahead. Buying interest is likely be renewed near the 0.8267 lows.

NZDUSD Technical Analysis (based on dailyfx article)

- NZDUSD is Current Range Bound

- R3 Support Sits at .8295

- Market Breakouts Signaled Under .8274

NZDUSD 30min ChartThe NZDUSD starts the week supported going into the US session open. Currently price resides at range support, near the S3 camarilla pivot found at .8295. In the event price remains supported for the session, traders can look for a potential price bounce back towards range resistance. Currently resistance sits near the R3 pivot point at .8338, completing the days 43 pip trading range.

A breakout below the S4 pivot would signal a strong reversal back in the direction of the NZDUSD’s current daily trend. It should be noted that price has declined as much as 566 pip over the last two months of trading. Conversely a price break above R4 resistance at .8360, would indicate momentum shifting towards a higher high. In either of the above breakout scenarios, the range should be considered invalidated for the day with traders then positioning themselves with the markets new direction.