You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

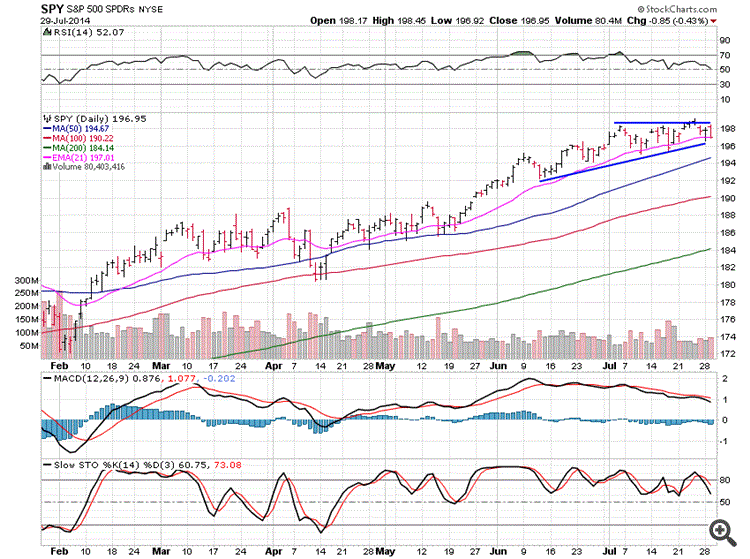

SPY Remains In A Chop

The S&P is still just hovering just below the important 2,000 level.

This consolidation could continue for another couple months and that would form a great bases that is needed to move above 2,000.

Looks like we won’t have too much to do still for a while but we can trade some good acting leading stocks using smaller position sizes.

Every-time I travel it’s nice to come back to the charts after a few days since it is like looking at them with fresh eyes so let’s take a look and see if there are any moves or patterns that are looking good.

SPDR S&P 500 (ARCA:SPY) remains in a chop and will until it can break above 200 with a large increase in volume.I’d look for a break lower out of this triangle, not a huge correction, just more sideways chop.

S&P Eyes Fresh Highs On News

The S&P 500 index currently following an upward sloping wedge as the price moves north in an ever tightening band. It looks to have just bounced off the trend line and will target fresh all-time highs in the weeks to come if the US economic data stays favourable.

The earnings season in the US is a big driver of the S&P 500 index and so far it has been positive. 46% of companies in the S&P 500 have delivered results and a solid 80% of those have announced positive. This optimism had pushed the S&P 500 to an all-time high during the week, however, it pulled back late in the week as traders took profits and one or two big companies announced losses (such as Visa and Amazon). The general consensus is that the earnings season will end positively and this should help the index respect the current bullish trend line.

The big test will come later this week when the US Non-farm Payroll data comes out. The last two reports have showed strong job creation (+217k and +288k respectively) which pushed the S&P 500 index to all-time highs on both occasions. This month has a higher estimate than both of the previous two, which could put more pressure on the report if it does not excel, however, this reflects the optimism in the US at the moment and provides a good omen for US bulls.

There is plenty of other data that could buoy the S&P this week. Advance GDP later today (30th Jul 12:30 GMT) will give a good snapshot of the state of the wider economy and couldn’t possibly be worse than last quarter’s -2.9% (annualised). This round the market is expecting +3.1%, which is a massive turnaround if it comes in as expected and will no doubt boost the markets.

The Federal Funds Rate and FOMC statement also today (18:00 GMT) will give the market an idea of the current thoughts of the US Federal Reserve. The interest rate has a large impact on equities as it creates demand based on the yield differential. Equities have been on a dream run partly because the interest rate means borrowing costs for investment are low and also because equities yield more than deposits. Interest rates are expected to stay at 0.25% and Quantitative Easing is expected to be scaled back by another US$10b. Any hawkish talk from the FED will negatively affect equities as there will be less cash to boost asset prices, however FED Chairwoman Janet Yellen is seen as dovish so do not expect any hard talk this time around.

The S&P 500 is likely to keep a very close eye on the economic calendar along with the remaining companies yet to report earnings. The consensus is for more positive data and if that is the case look for the bullish channel to hold firm and the all-time highs to be tested. Beware, as all of this news will increase volatility, which could knock out stop losses before the party begins.

Month-End S&P Knock Down

Funds typically mark up stocks on the last day of the month and through the first three days of the new month. Ahead of that, we often see strong liquidation as well as buying at the lows. That’s what we saw today, though the move was unusually strong with index arbitrage sell programs dominating the falloff after the morning rally.

The MiM showed a strong sell of over half a billion and the MOC turned out to be a full $1 billion. That points to a lot of liquidation of positions by big players, with the index arb following along to take advantage of the premium.

The S&P rallied from the pre-open and reached a high just shy of 1980. After that, it was major selling all the way down to a trendline which marked yesterday’s low as well.

In this kind of market, it’s important to pivot and not hold for too long. We were buyers at the open, then sellers for most of the day. The low will be a great place to look for a buying opportunity tomorrow.

HIGH: 1979.50 Mid-Morning

LOW: 1964.50 Just Now

LAST: 1965.90 DOWN 7 Handles

TOTAL VOLUME: 1.4mil minis; 4.2k bigs

MOC: SELL $1 BILLION

U.S. and Europe imposing new sanctions.

FOR TOMORROW:

Things start to warm up starting tomorrow

MBA Purchase Applications

ADP Employment Report

GDP

EIA Petroleum Stats Report

7yr. Note Auction

FOMC Announcements

They usually mark stocks up on the last and first 3 days of the month.

Early rally – saw the highs – didn't think they could sell off so hard – big time index arb sell programs.

Sold em today, buy em back tomorrow.

Will CME Group Miss Q2 Earnings On Lower Volumes?

Global futures exchange CME Group Inc. (NASDAQ:CME)) is scheduled to release second-quarter 2014 financial results before the opening bell on Jul 31.

In the last reported quarter, the company posted break-even results, although the four-quarter trailing average beat is pegged at 0.5%. Let us see how things are shaping up for this announcement.

Factors at Play

CME Group’s average daily volumes fell 12% year over year in the second quarter due to lower rate per contracts and sluggish volatility. Trading volumes account for a substantial portion of transaction fees revenues, a major revenue driver for the company.

Alongside, higher operating and interest expenses as well as capital expenditure are likely to adversely affect operating margins, which has been below the historical average of +60% over the last several quarters.

Moreover, risks from OTC markets and lack of any significant growth catalyst amid stiff competition and stringent regulations pose operational and financial risks. Alongside, a weak capital market and limited fund resources have compelled CME Group to delay its current share repurchase program, although dividend payouts continue to retain investors’ confidence.

Earnings Whispers

Our proven model shows that CME Group is unlikely to beat earnings as it lacks the required combination of two key components.

Zacks ESP: CME Group has a negative Zacks ESP. That is because the Earnings ESP, which represents the difference between the Most Accurate estimate of 79 cents per share and the Zacks Consensus Estimate of 80 cents, is -1.25%.

Zacks Rank: CME Group has a Zacks Rank #4 (Sell). We caution against stocks with Zacks Rank #4 and 5 (Sell-rated stocks) going into an earnings announcement.

Other Stocks to Consider

Here are some other financial companies you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Qiwi Plc (NASDAQ:QIWI) has Earnings ESP of +4.76% and a Zacks Rank #1 (Strong Buy).

United Insurance Holdings Corp. (NASDAQ:UIHC) has Earnings ESP of +2.33% and a Zacks Rank #1.

Lazard Ltd. (NYSE:LAZ)) has Earnings ESP of +1.59% and a Zacks Rank #2 (Buy).

Caterpillar’s Stock In Trouble?

Last week, Caterpillar (NYSE:CAT) reported earnings that sent the stock gapping below its 50-day moving average (DMA) with a 3.1% loss. The stock followed its lower-Bollinger Bands ® (BB) until today (July 29, 2014). The stock rallied earlier in relative out-performance to the market before fading to flatline.

All this might be rather unremarkable EXCEPT this is the fourth time this year CAT has closed below its rising 50DMA. The last two were in quick succession. This trading action suggests CAT’s primary uptrend at the 50DMA is in trouble. A retest of 200DMA support is likely on the near horizon at this rate. CAT broke out above tis 200DMA back in December, 2013 and has not looked back ever since, so a 200DMA retest will be a must-watch.

Caterpillar breaks down again – is the fourth time a charm?

After the post-earnings breakdown, I thought I lost a chance for a good entry point to get put options on CAT. So, I rushed to fade CAT as it approached its 50DMA today. I purchased the Sept 105/100 put spread figuring $100 is a good downside target for even a modest sell-off in the market. As a reminder, I find bearish bets on CAT to be a good hedge against the potential for a market sell-off. Since August and September tend to be the weakest months of the year, I think now is a great time to put on this hedge.

The good folks at StockTwits are evenly split on CAT, but sentiment is notably down from a month ago. That seems to me a large enough non-confirmation of CAT’s recent highs given how well StockTwits folks seem to crowdsource opinion on stocks (that’s an informal/anecdotal observation that I would LOVE to study with hard data – Howard Lindzon, are you listening?).

A 50/50 split in sentiment on StockTwits

Be careful out there!

Full disclosure: long CAT shares and put spread

Why It Is Often Better To Follow, Not Fight, Trends: Windstream Holdings

At the time of writing, Windstream Holdings, Inc. (NASDAQ:WIN) is surging 23.3% on news that the company received a favorable ruling from the IRS to convert to a REIT. From the press release:

WIN is a high-dividend paying stock that has been on a tear since early February and a nasty five-year low. This punctuated a downtrend in place since early January, 2011 and accelerated in May, 2012. The two trends are great examples of the benefits of following trends with the uptrend providing the best opportunity.

On the downtrend, WIN moved widely from lows to highs and shorts had to have stomachs of steel to hang on. As is often the case with shorting, fading at resistance worked best for this downtrend channel. The uptrend that finally developed was a distinct contrast with its orderly march higher and very neat and successful retests of important support at the 50 and 200-day moving averages (DMAs). I have the benefit of hindsight of course, but if I were short the stock, the extended trading range for most of 2013 would have encouraged me to bail at some point. Bolder shorts who were patient enough to hold on for the 2014 low could have bailed just based on the stock’s history of swinging wildly from lows to highs. Certainly, the breakout above the 50 and then 200DMA should have put shorts on notice with the first successful retest being the final warning. The last 50DMA breakout was different than the others in 2013 as it was accompanied by heavy buying volume – an early warning signal.

A persistent, yet highly volatile, downtrend until 2014′s low….

A high-volume breakout was an early signal of the high likelihood of the end of the downtrend(s)

Source: FreeStockCharts.com

The downtrend caught the attention of a growing number of shorts. In almost two years, shares short grew about 44%. Soon after the 2014 low, shorts finally began to back off; these early exiters perhaps saw the writing on the wall. Perhaps they bailed on the technical signal of 2013′s consolidation range breaking to the upside.

After a steady surge, aggressive shorts finally began to back-off WIN after the 2014 low

To make things interesting and more complicated, some ill-timed bear(s) or someone looking for major protection, sent the put/call ratio soaring in June. Open interest on the August $9 put soared from near nothing to over 10,000 on June 18th. This formed a distinct contrast to the 14,000 options of open interest in the January $10 call. These calls were in steady accumulation from early 2013 and well into this year.

An ill-timed move as the open interest put/call ratio surges in June

A rush to bet on a collapse or for protection…?

Slow and steady, traders/investors in long-term call options win the day

Source for options charts: Etrade.com

The trader(s) loading up on puts last month made a classic error in fighting the trend. However, I can imagine if I saw it happen in the moment, I might have jumped to the conclusion that someone “knows” something very bearish to WIN. Yet, the trader(s) steadily accumulating long-term calls were doing so despite the downtrend. In a way, the extended record of this buying could have outweighed the very short-term signal of the panic rush to grab puts expiring in a month. This represents a very mixed lesson and knowing who was the “smart” trader/investor is only clear with hindsight. Options trading is always difficult to interpret; doing so is much more an art than a science!

In my case, I had invested in WIN based on the dividend. At the time, I was on the lookout for high-yielding plays, especially in telco/communications, that offered discounts from sell-offs. WIN obliged back in May, 2012 and I was in. (I know, I know. The irony of a habitual contrarian giving a lecture on trend-following!) I felt brilliant at the time because the stock soon bottomed and rallied over the next month. My decision to hold since then was mostly based on using the high dividend as a buffer. I WISH I could say that I used the interesting technical and sentiment analysis above. It would have greatly informed my thinking on the stock! At least I held through the uptrend despite constant nagging in my head to sell. Instead, I decided to let the trend run its course…hoping that I would get a “good enough” signal whenever the trend came to an end.

Regardless, it was a no-brainer for me to sell into today’s surge and lock in profits; combined with the juicy dividend, this turned into a great longer-term trade/investment. No need to be a pig here. I still find WIN interesting and will definitely consider re-entering if the stock suffers another severe setback as its history suggests is bound to happen. However next time, I will conduct a more thorough (and more typical) battery of technical tests.

Be careful out there!

Full disclosure: no positions

Is The Luxury Goods Business In Deep Trouble?

Kanye West—the hip hop artist whose number-one hit “Gold Digger” epitomized the blingy excesses of the mid-2000s—made news earlier this month by going on an anti-luxury-good tirade:

“It’s like [luxury brands and retailers] want to steal you from you, and sell you back to you after they stole it… They want to make you feel like you less than who you really are.”

If Kanye West is really turning his back on conspicuous consumption, it is a sign of one (or all) of three things:

While the first two explanations are definitely plausible, I’m going to focus on the third. It’s been rough for luxury retailers of late. Coach (NYSE:COH) has seen its U.S. domestic sales virtually collapse as upstartMichael Kors (NYSE:KORS) has crowded its turf. But even Kors has hit something of a brick wall of late, and its share price has heading lower since late May on valuation concerns and lower margins.

Going higher upmarket, you see a slightly different dynamic. Luxury leather goods and drinks conglomerate LVMH Moet Hennessy Louis Vuitton(PARIS:LVMH), high-end watchmaker Swatch Group I (SIX:UHR) and Remy Cointreau (PARIS:RCOP) has also seen uneven growth over the past two years, though the primary driver here was a crackdown by the Chinese government on bribery and excessive gift giving.

Returning stateside, the simplest explanation for Big Luxury’s woes are simple supply and demand. There are more luxury brands than ever competing for a customer pool that has been forced to scale back its buying due to years of high unemployment and sluggish economic growth.

But might the winds of fashion be changing as well? And could demographic trends be at play?

Let’s break down America by its major demographic groups. Though U.S. stocks have long since blown past their pre-crisis highs, and home prices have recovered substantially in most markets, the 2008 meltdown and Great Recession that followed were devastating to the retirement plans of many Baby Boomers. The Boomers are more focused than at any point in their lives on securing their nest eggs for retirement. Bling spending is simply not a priority for all but the highest-income Boomers.

And my generation—Generation X? Gen Xers are now in the primes of their careers, earning more than they ever have. Unemployment among Gen Xers is the lowest of all major demographic groups. But Gen Xers also got hit the hardest during the housing bust, as they were the most likely to be recent buyers with large mortgages, and Gen Xers are at the stage of life in which most disposable income gets spent on their kids. And let’s not forget, the Gen Xers are a significantly smaller generation than the Boomers they followed.

That leaves the Millennials. Millennials are, as a general rule, known for being a little flashier and more brand conscious than Gen X, but this is also the generation that has most embraced the bearded hipster movement.

Hipsters are an odd lot. They eschew branded goods yet will pay a large premium for hybrid automobiles, organic groceries and even organic cotton clothes. (Seriously guys, last I checked you weren’t supposed toeat your t-shirts. Not sure I understand the appeal here.)

Somehow, hipsters have turned antibranding into a brand that they are willing to pay a premium to own. And their tastes are gradually going mainstream.

What is means is that “luxury goods” are not dying, but the notion of what constitutes a luxury good is. Americans are still willing to pay a premium for things that they value. It just happens that they are increasingly valuing different things.

Earlier this year, I wrote about the business of organic groceries, though I stopped short of recommending the stocks of Whole Foods (NASDAQ:WFM) due to valuation concerns and the reality that groceries are a rotten business. But I do believe that “upscale” fast food restaurants likeChipotle Mexican Grill (NYSE:CMG) are attractive stocks to buy on dips. Chipotle has seen mild margin compression due to rising food costs but remains wildly profitable and continues to add new locations.

Where does this leave the traditional luxury goods makers? Clearly, not all young Americans with higher-than-average incomes are bearded, brand-eschewing hipsters. I expect to see the industry return to more consistent growth as the economy continues to heal and as unemployment drops.

But China remains the real wildcard. As goes China, as goes the luxury industry. If China can avoid a true hard landing—and if the bling crackdown proves to be a short-term blip, like previous crackdowns—then the luxury goods makers should enjoy a solid finish to 2014 and a strong 2015. I don’t consider LVMUY, SWGAY or REMYF to be screaming buys at current prices, but I would consider all three to be good stocks to consider on any substantial pullbacks.

Disclosure: Charles Lewis Sizemore, CFA, is the editor of Macro Trend Investor and chief investment officer of the investment firm Sizemore Capital Management. Click here to receive his FREE weekly e-letter covering top market insights, trends, and the best stocks and ETFs to profit from today’s best global value plays.

Why Yelp Might Be Ripe For A Takeover After Earnings

Yelp Inc. (NYSE:YELP) is set to report FQ2 2014 earnings after the market closes on Wednesday, July 30th. Yelp is a restaurant and business reviews platform which offers outstanding search functionality and a great mobile experience. Formidable revenue growth from Google Inc (NASDAQ:GOOGL) and Facebook Inc (NASDAQ:FB) has demonstrated there is vigorous demand in the market for mobile advertisements. The question this week is, can any other social media companies keep up with the breakneck pace that Facebook has set?

This quarter 37 contributing analysts on Estimize.com have come to a consensus earnings expectation of -1c EPS and $87.04M in revenue compared to a consensus of -3c EPS and $86.43M from Wall Street. Over the previous 6 quarters the Estimize community has been more accurate than Wall Street in forecasting Yelp’s revenue every quarter and has been more accurate on earnings per share once.

Yelp has struggled with profitability since first revealing its financial information when it became a publicly traded company. Although Yelp has became the de-facto leader in restaurant ratings, reviews, and search, the company has not posted a single break-even quarter since its IPO. Through its checkered and brief history Yelp has missed the Estimize earnings consensus 4 times, and only topped it once. Consistent revenue growth and persistent takeover speculation have kept Yelp in focus as one of the most talked about stocks on the market.

On crowdsourced mergers and acquisitions platform, Mergerize.com, Yelp is the single most predicted takeover target with 22 predictions made. We have already seen plenty of merger and acquisition activity this year, especially in the biopharmaceuticals.

It’s believed that many of the food-tech platforms may be ripe for consolidation. There are tremendous economies of scale within the industry and the individual platforms tout millions of users each. As companies such as Yelp, GrubHub, and OpenTable onboard a critical infrastructure of restaurants and users, they become valuable strategic assets to other online advertisers. OpenTable was the first domino to fall back in June when the company was acquired by Priceline.com for a deal valued a $2.6 billion, a 46% premium to OpenTable’s stock price at the time.

The most common prediction about Yelp on Mergerize is that Yahoo may set its sights on the restaurant ratings and reviews website as soon as Alibaba (BABA) has its IPO sometime after Labor Day. The average price predicted for Yahoo to acquire Yelp on Mergerize is $8.67 billion, a 57% premium on Yelp’s current $4.93 billion market capitalization.

When Alibaba finally does go public, Yahoo! Inc (NASDAQ:YHOO) will be forced to sell a significant portion of its stake in the Chinese e-commerce behemoth. Yahoo CEO Marissa Mayer has promised to return half the proceeds of the Alibaba stake to shareholders, the other half will remain as a bankroll for Yahoo to go shopping.

Since joining Yahoo 2 years ago, Marissa Mayer has been pounding the table about her strategy of capturing daily user engagement on mobile devices. The shocking and terrific results from Facebook’s mobile advertising business suggest that she might have the right idea. Yelp would be a tailored fit to Yahoo’s portfolio of mobile brands and services that also aligns nicely with Mayer’s strategy of daily mobile engagement. Yahoo already has an established mobile advertising business, and Yelp could provide Yahoo with a much needed opportunity for revenue growth.

Estimize.com ranks and allows the sorting of analysts by accuracy. The analyst with the lowest error rate on Yelp is a consumer discretionary sector professional who goes by the username sana5000. Over 2 previously scored estimates on Yelp sana5000 has averaged an error rate of 10.6%. Estimize is completely open and free for anyone to contribute, and the base of contributing analysts on the platform includes hedge fund analysts, asset managers, independent research shops, non professional investors, and students.

The Estimize consensus was more accurate than the Wall Street consensus 65% of the time last quarter on the coverage of nearly 1000 stocks. A combination of algorithms ensures that the data is not only clean and free from people attempting to game the system, but also weighs past performance and many other factors to gauge future accuracy.

Contributing analysts on the Estimize.com platform are forecasting that on Wednesday Yelp will lose 2c per share fewer than Wall Street is predicting and beat the Street’s revenue consensus by a gap of less than $1 million. The Estimize community is expecting Yelp to post year over year revenue growth of 58% while the 1c loss per share remains unchanged compared to the same period of last year.

If Yelp’s earnings remain in a perpetual holding pattern and the stock price fails to push higher, the company may be looked at as a strategic acquisition sometime later this year.

UPS Slides Below 200-Day Moving Average

This morning, the leading package delivery company United Parcel Service, Inc. (NYSE:UPS)) is declining lower by $3.53 to $99.21 a share. Earlier today, the company reported earnings that were lower than the estimates, Q2 profit fell by 58.0 percent. United Parcel Service, Inc. lowered its full-year outlook for adjusted earnings to $4.90 to $5 a share from $5.05 a share. Traders and investors should now note that the current stock price is now trading below the important 50, and 200-day moving averages. These moving averages are watched closely by many institutional and retail stock traders. Often, when a stock declines below these moving averages it is viewed as a weak technical chart position for the stock. Traders and investors should now watch the $94.00 level as the next important near term support area. This support level on the chart was a prior pivot in February 2014. It should be noted that prior chart pivots will usually be defended by the institutional money when retested.

Daily Market Commentary: Bears Return

he day started well (for bulls) with some early follow through upside, but it wasn't long until bears were trying their hand again.

The S&P may have registered a channel breakdown. There was a close below channel support, although the day's low did not violate the low from yesterday. There was a marked rise in volume, confirming distribution.

There was also a distribution day for the NASDAQ Composite, but there was no support violation. The index continues to edge a relative advantage over the S&P, and maintains support of its 50-day MA. Bulls still have the edge here.

The Russell 2000 edged a higher close, but the retracement of early gains suggests the retest of the 1,131 swing low isn't done yet. However, it's near enough to the 200-day MA to suggest there is still support available, and buyers may still get a low risk bargain - although one solid sell off day would probably be enough to kill the long play.

The odd index out was the Nasdaq 100: minor losses on low volume, with room to nearest support at the 20-day MA. Nothing bearish here.

Bulls may still be able to hold their nose and buy here, but you wouldn't want to hold for long if sellers were to push markets down at least 1%, particularly for the S&P as it would confirm the channel breakdown.