Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.27 07:17

Scalp Forex Breakouts with Pivot Points (based on dailyfx article)

- Pivots can help easily identify support & resistance levels

- Traders should monitor R4 and S4 values for breakouts

- As with any strategy, identify areas to exit your position

Scalping with Pivots

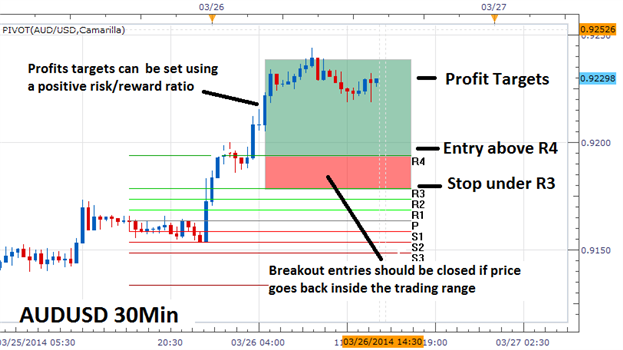

Pivot points can be great ways to identify key levels of support and resistance for the day trader. There are many types of pivots we can use and in today’s example, we will use camarilla pivots added to today’s AUDUSD graph seen below. Key levels of resistance are denoted with a green line (R1-4) while key levels of support (S1-4) are denoted by a red line.

In an uptrend, such as the AUDUSD chart below, traders will want to watch for a breakout above resistance. As R4 is the last line of resistance this line is an opportune place to look for potential market entries. Let’s look at a sample setup.

Breakout Entries

Once you have identified support and resistance, it is time to plan your entry. The most common methodology of trading breakouts is to set entries to buy a currency pair, in an uptrend, when resistance is broken. As well, traders can look to sell levels of support in a downtrend as price breaks to lower lows. This can be done using entry orders to enter the market as soon as price moves beyond one of these values.

Market orders can also be used to trade breakouts. This method is normally preferred by traders who have time to remain in front of their trading console and monitor their positions. Traders using market orders may often wait for one candle close to confirm a breakout prior to entering into their trade. Regardless of the entry method preferred, the objective is still the same.

Managing Risk

The last portion of any active trading strategy is to manage risk. When using pivot points, these pricing levels become fairly intuitive. When buying a breakout over R4, trades can be managed by placing stops under the R3 value. In the event that prices begin mobbing back through earlier levels of resistance, traders will want to exit the market at the first available convenience.

Once a stop has been placed, traders can then extrapolate their profit target. A simple methodology is to extrapolate a positive risk reward ratio of a traders choosing. This ensures in the event that the trade moves favorably profits are maximized, while cutting losing positions as quickly as possible.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

False Breakouts Counter:

The indicator displays the number of false breakthroughs for the specified period

Author: Serhii Ivanenko