Indicators: TrendLine Touch Alert

newdigital, 2013.10.24 09:01

Simple Way to Trade Trendline Breakouts

Talking Points:

- Always wait for the current candle to close beyond the trendline to confirm the break.

- Enter into the trade when price retraces back within a few pips of the original trendline, trading in the direction of the original breakout.

- Set your Stop a few pips beyond the trendline and set your Limit at least twice as far as your Stop.

Step 1. - Locating the Trendline

As a review, a trendline is a line connecting two or more lows or two or more highs, with the lines projected out into the future. Traders than look at these projected lines and look for future prices to react around those levels.

Step 2. – Wait For a Confirmed Breakout

Next, we need to see how the price reacts to the projected trendline.

There are two potential outcomes when price comes into contact with a

trendline:

- The price will bounce off the trendline

- The price will break through the trendline

So we wait to see if the price does in fact break through the price. But we aren’t ready to place a trade just because the price breaks through the trendline. We need to wait and see if the current candle closes beyond the trendline. We require a candle to close beyond the trendline to confirm the breakout. This is a very important rule.

Check out the chart above depicting a trendline on a current USD/JPY

Hourly chart. There were two times in the past week where this trendline

was broken, but look what happened. They were false breakouts. Sellers

were not able to keep the price down below the trendline and both

potential breakout candles closed above the trendline. Had we sold at

either of those two opportunities, we would have been crushed two times

in a row. Something we definitely want to avoid.

So even though it is tempting to get immediately into a trade as price breaks a trendline in real-time, you would be susceptible to false breaks. Patience is a virtue.

Step 3. Set Up The Trade

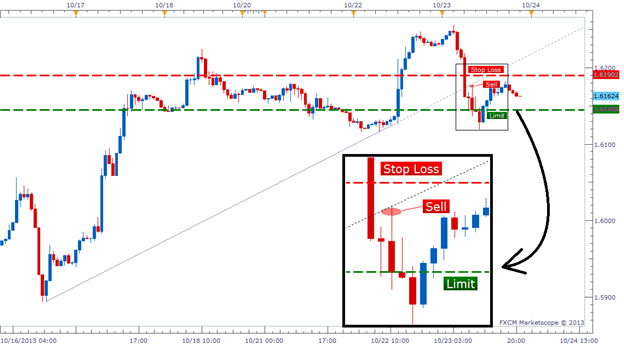

Remember the first image I showed you of the GBP/USD Hourly chart? Let’s

go back to that example because it actually ended up producing a near

perfect breakout setup. Soon after that snapshot was taken, the GBP/USD

fell and broke through our trendline with authority. A very short time

after that, the Hourly candle closed below the trendline and confirmed

the breakout as well. Once this happened, it was time to get to work to

setup this trade.

There are 3 things we needed to do to execute this breakout trade:

- Set an Entry order to Sell just below the original trendline.

- Attach a Stop order several pips above the trendline.

- Attach a Limit that is as least twice as large as our Stop (increase your trading profitability by learning the importance of the risk/reward ratio).

There is a saying that goes “What once was resistance, can later become support. And what once was support, can later become resistance.” This is the mantra we rely on when setting an Entry order near the original trendline. We are looking for price to retrace back to the point of support/resistance it just broke through, and then continue back into the direction of the original breakout. Take a look at how the trade was setup below.

Our Entry order to Sell was placed a couple pips below the trendline,

our Stop Loss was set several pips above the trendline (approx.. 15 pips

from our Entry) and our Limit was set twice as far as our stop (approx.

30 pips from our Entry). Within the next hour, the price retraced back

to the original trendline, and then move back in the direction of

original breakout, exactly what we wanted.

So to recap, we were able to enter into a trade on a confirmed breakout,

we were able to get in at a much more favorable price than entering the

break in real-time, and we were able to set an extremely tight stop

(read: lower our risk) beyond what should be a valid resistance level.

As it turned out, this particular trade was a success, but that

doesn’t mean every trade will be a winner. However, you should take

comfort in the fact that as long as you are using a 1:2 risk/reward

ratio, you only need to be correct 33% of the time to break even. If you

are right more than 33% of the time, you should be a profitable trader

in the long run with this strategy.

Breaking Bad

Trendline breaks can be tricky to trade, but hopefully this article gave

you a clear approach to mastering them. We've learned that you should

always wait for confirmation of a break by requiring the current candle

to close. We also learned placing our Entry order near the trendline

will give us a better entry price and reduce our risk by allowing a

tighter Stop. Setting our Limit as least twice as far as our Stop should

also help shift the odds in our favor. Good luck with your trading!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

channel_breakout_entry:

The market volatility indicator

Fig.1 The channel_breakout_entry indicator

Author: Nikolay Kositsin