Series of US Economic Indicators Point to Dollar Strength, Attention Shifts to Views of US Financial Officials

The dollar continues to strengthen. A series of recent US economic indicators have all been supportive of dollar strength, including US employment statistics, US consumer price index, and yesterday's US retail sales figures. Alongside the rise in US bond yields, expectations for a rate cut by the US Federal Reserve later this year have been pushed back. After the major indicators have been released, the next focus for the market seems to be on the statements of US financial officials.

Today, events such as participation and speeches by Jefferson FRB Vice Chairman, Williams NY Fed President, Barkin Richmond Fed President, and Powell FRB Chairman are scheduled. Chairman Powell will participate in a discussion with Macklem, the Bank of Canada Governor, on the North American economy. The stance had been to maintain the baseline of three rate cuts by the end of the year, but will there be any changes in response to the series of strong US indicators? Other US financial officials are also expected to participate in events and speeches on financial policy and economic issues, providing some insight into the current views of the authorities.

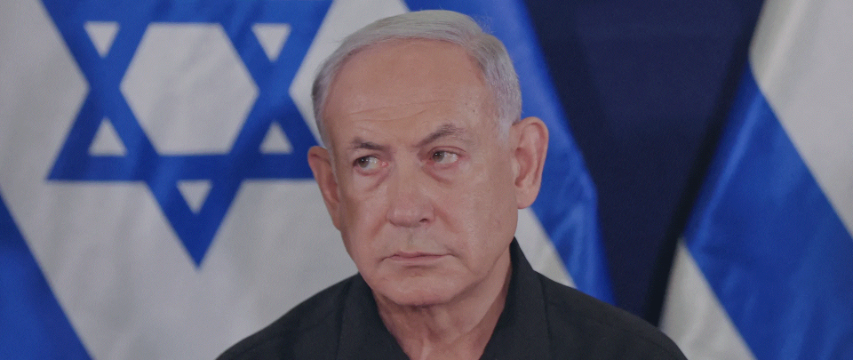

Concerning the Middle East situation, there is no end in sight to the confrontation between Israel and Iran. Moves such as inflation concerns due to rising commodity prices and evasive dollar buying due to risk aversion are also anticipated.

In the upcoming overseas market, economic indicators such as Canada's housing starts (March), Canada's consumer price index (CPI) (March), US housing starts (March), and US industrial production index (March) will be announced.

There are many other speaking events scheduled besides the aforementioned US financial officials. Events such as speeches by Bilouwa Dogaru, Governor of the Bank of France, and Bailey, Governor of the Bank of England, as well as announcements of earnings reports from US companies such as J&J, Morgan Stanley, and Bank of America will be watched closely.

While it was thought that the Middle East situation would settle, Israel has indicated a stance of retaliation, leading to increased tension in the region. This has caused a resurgence in crude oil prices. Cryptocurrencies have experienced another decline. However, it has been reported that Israel is seeking methods of retaliation that would avoid casualties. Depending on the specific content, the market may not be shocked by the next action, and it is expected that there will be even stronger rebound after Israel's response.