It seems like there's a continued strength in the dollar's upward momentum leading into the weekend. However, there's al

It seems like there's a continued strength in the dollar's upward momentum leading into the weekend. However, there's also a cautious anticipation regarding possible intervention.

In terms of economic data, upcoming releases include the US Import and Export Price Indexes for March, as well as the Preliminary University of Michigan Consumer Sentiment Index for April. The market focus might particularly be on the 1-year and 5-10 year inflation expectations accompanying the University of Michigan Index release. Consensus forecasts are similar to previous levels: +2.9% for the 1-year and +2.8% for the 5-10 year. Any deviations from these expectations could trigger a sensitive market reaction.

Regarding speeches and events, speeches and participation from various Federal Reserve Bank presidents are scheduled. The market will likely be attentive to any perspectives that could influence the speculation regarding the timing of a potential US rate cut.

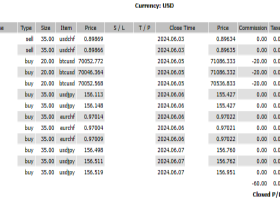

Additionally, USD/JPY is maintaining levels around the 153 yen mark, significantly surpassing the intervention alert level at 152 yen. While intervention from the Japanese government or the Bank of Japan remains possible, it's essential to remain cautious and consider political motivations. If intervention does occur, there's a plan to buy into USD/JPY after a drop following the intervention.

While intervention from the Bank of Japan could happen at any time, it's challenging to predict. If intervention occurs, the plan is to buy into USD/JPY after it drops following the intervention.