With tomorrow's release of the US Consumer Price Index (CPI) looming, a cautious stance prevails overall.

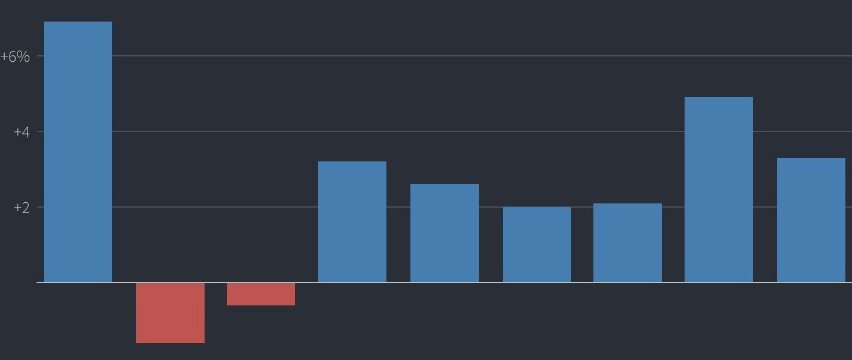

With tomorrow's release of the US Consumer Price Index (CPI) looming, a cautious stance prevails overall. The stock market appears relatively subdued in terms of vigilance, with many markets showing a steady pace. In Japan, Bank of Japan Governor Kuroda's maintenance of an accommodative stance seems to be well-received.

The USD/JPY pair is clinging near the 152 yen level. While the yield spread between Japan and the US provides support, concerns about intervention from the government or the Bank of Japan are capping the upside. However, with Prime Minister Kishida's visit to the US, there's a sentiment in some quarters not to disrupt the market.

Nevertheless, intervention did occur two years ago. With close coordination between Japanese and US financial authorities, the possibility of intervention happening again remains latent. The question lies in the level, speed, and timing. Crossing the 152 yen mark is seen as the closest possibility, with some suggesting it may not go beyond 155 yen. The speed will depend on the authorities' stance, although this may seem like hindsight speculation. Timing would likely be discretionary. The mention of Prime Minister Kishida's visit to the US is purely speculative.

If there's a swift and pronounced move towards yen weakness in response to tomorrow's US CPI data, caution is warranted. Be prepared for a sudden increase in market volatility.

In related events, the release of the ECB Bank Lending Survey and the implementation of the US 3-year Treasury auction ($58 billion) are scheduled. The speech by Schlegel, Vice President of the Swiss National Bank, on "Achieving Price Stability in Challenging Times" at an event is anticipated.

Selling pressure dominates the US dollar. After lingering around the 152.00 level, USD/JPY experienced a sudden drop of around 30 pips. The heightened caution is evident. However, if it surpasses 152.00, it's likely to extend its gains temporarily due to substantial stop-loss buying. Then, a sudden drop could occur following comments from the Bank of Japan or intervention. Entry opportunities may arise if there's a clear entry point.