Kestutis Balciunas / Profile

- Information

|

3 years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

I am a highly regarded trader, author & coach with over 16 years of experience trading financial markets. Today I am recognized by many as forex trading strategies and indicators developer. I also work with automated trading with top-accuracy Forex Robots and Expert Advisors. After starting blogging in 2014, I became one of the world's most widely followed forex trading coaches, with a monthly readership of more than 40,000 traders.

My Blogs:

Main blog: https://forexobroker.com/

Free Forex Trading Strategies: https://forextradingstrategies4us.com/

Free Forex MT4 Indicators: https://primeforexindicators.com/

Free Forex Trading Robots: https://forexearobots.com/

My Patreon: https://www.patreon.com/forexobroker

Myfxbook:

Follow me on socials:

Reddit: https://www.reddit.com/user/Dominic_Walsh_Trader/

Medium: https://medium.com/@Dominic_Walsh

Telegram: https://t.me/forextradingstrategies4us

Quora - https://www.quora.com/profile/Dominic-Walsh-46

Linkedin - https://www.linkedin.com/in/dominicwalshtrading/

Youtube - https://www.youtube.com/@DominicWalshLearnToTrade

Twitter - https://twitter.com/Forex_OBroker

Facebook - https://www.facebook.com/forexobrokertrading

Instagram - https://www.instagram.com/supremefxtraders/

My Blogs:

Main blog: https://forexobroker.com/

Free Forex Trading Strategies: https://forextradingstrategies4us.com/

Free Forex MT4 Indicators: https://primeforexindicators.com/

Free Forex Trading Robots: https://forexearobots.com/

My Patreon: https://www.patreon.com/forexobroker

Myfxbook:

Follow me on socials:

Reddit: https://www.reddit.com/user/Dominic_Walsh_Trader/

Medium: https://medium.com/@Dominic_Walsh

Telegram: https://t.me/forextradingstrategies4us

Quora - https://www.quora.com/profile/Dominic-Walsh-46

Linkedin - https://www.linkedin.com/in/dominicwalshtrading/

Youtube - https://www.youtube.com/@DominicWalshLearnToTrade

Twitter - https://twitter.com/Forex_OBroker

Facebook - https://www.facebook.com/forexobrokertrading

Instagram - https://www.instagram.com/supremefxtraders/

Kestutis Balciunas

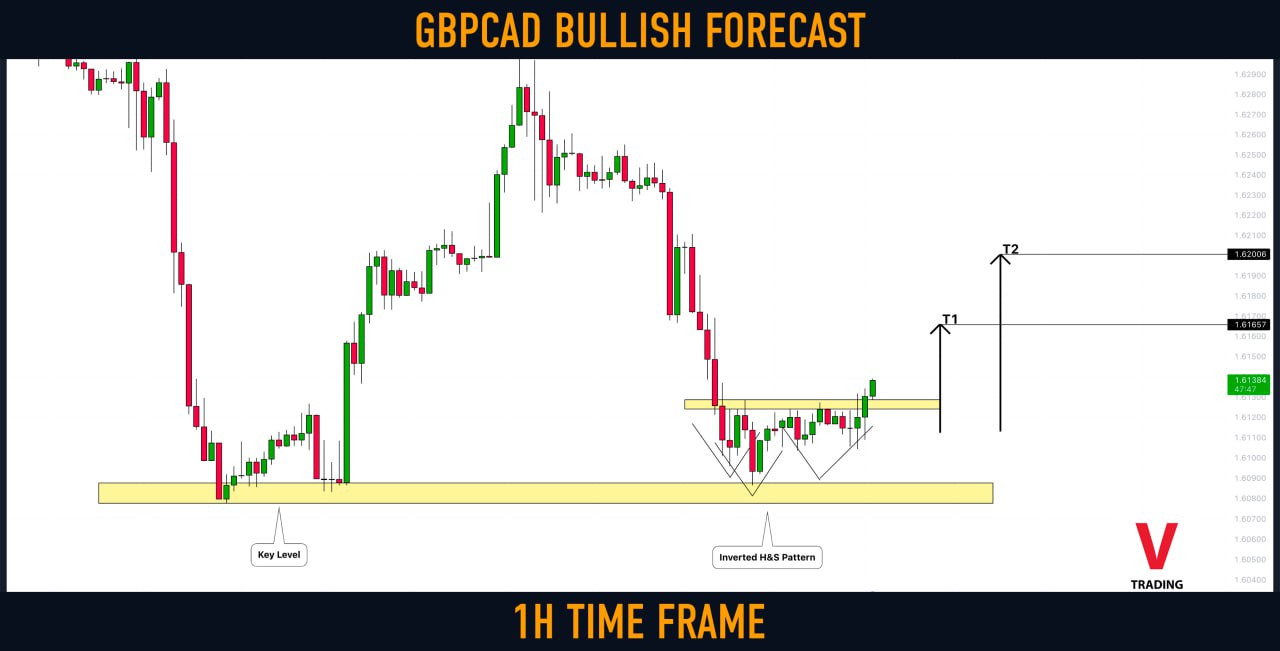

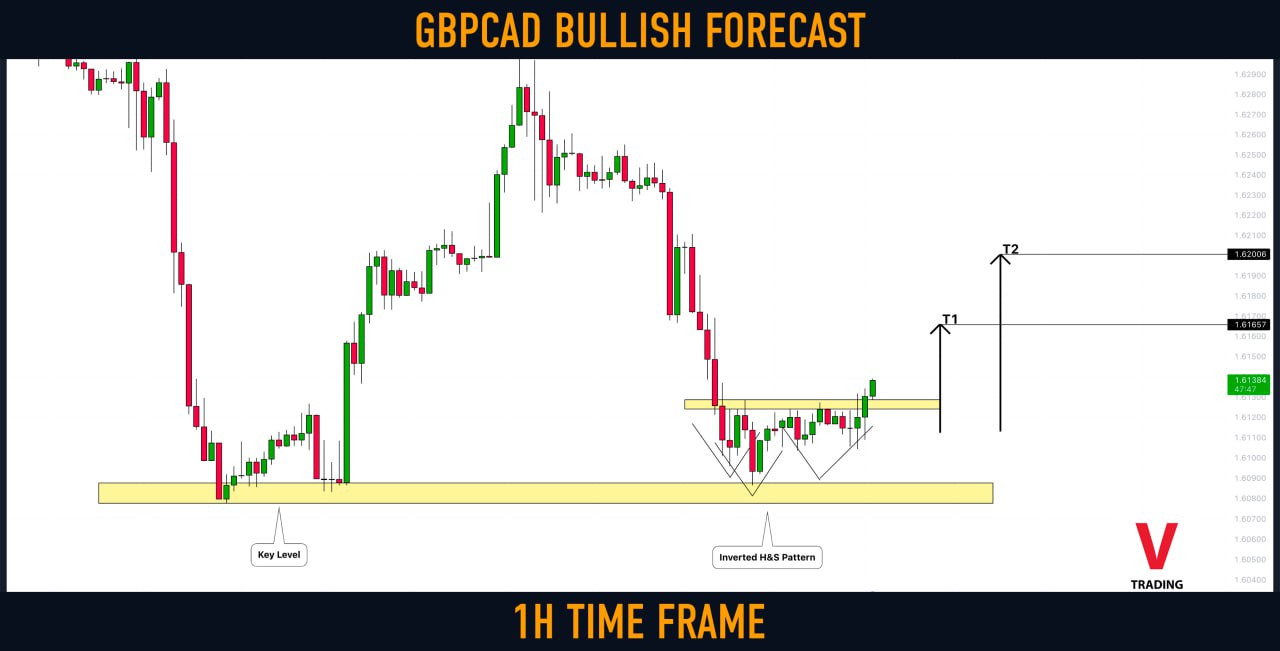

#GBPCAD: Classic Bullish Reversal

GBPCAD reached a key daily structure support.

The price formed a head & shoulders pattern on that

and broke its neckline, then.

I expect a pullback to 1.6165 / 1.62

GBPCAD reached a key daily structure support.

The price formed a head & shoulders pattern on that

and broke its neckline, then.

I expect a pullback to 1.6165 / 1.62

Kestutis Balciunas

[Consistent actions lead to consistent results]

I remembered my first trading system.

It was a Bollinger Band mean reversion strategy.

You buy when the price is at the lower band and sell when it’s at the upper band.

The first few trades I did were winners, then the losses came and I figured this trading strategy doesn’t work.

So, I moved on.

Next, I chanced upon harmonic patterns.

I spent half a year learning how to draw these patterns (guess I’m a slower learner).

At the start, I had some wins but slowly, the losses kicked in and eroded all my profits.

Again, I told myself…

“This trading strategy doesn’t work. Let’s try something else.”

This brought me to the world of price action trading, support and resistance, candlestick patterns, etc.

Again, the same pattern repeated itself.

I had some winners, some losers, and I gave up the strategy.

One day, I asked myself…

“Why does this always happen?”

“Why am I not getting any consistency in my trading?”

“It’s always a few winners and then the losses pile up and take everything away.”

Do you know what I realized?

The problem was me.

I was hopping from one trading strategy to the next.

My actions were inconsistent. And because my actions were inconsistent, I got inconsistent results (duh).

So, don’t make my mistakes.

If you want consistent results from trading, you must have consistent actions.

Stick to one trading strategy, master it—and then move on.

I remembered my first trading system.

It was a Bollinger Band mean reversion strategy.

You buy when the price is at the lower band and sell when it’s at the upper band.

The first few trades I did were winners, then the losses came and I figured this trading strategy doesn’t work.

So, I moved on.

Next, I chanced upon harmonic patterns.

I spent half a year learning how to draw these patterns (guess I’m a slower learner).

At the start, I had some wins but slowly, the losses kicked in and eroded all my profits.

Again, I told myself…

“This trading strategy doesn’t work. Let’s try something else.”

This brought me to the world of price action trading, support and resistance, candlestick patterns, etc.

Again, the same pattern repeated itself.

I had some winners, some losers, and I gave up the strategy.

One day, I asked myself…

“Why does this always happen?”

“Why am I not getting any consistency in my trading?”

“It’s always a few winners and then the losses pile up and take everything away.”

Do you know what I realized?

The problem was me.

I was hopping from one trading strategy to the next.

My actions were inconsistent. And because my actions were inconsistent, I got inconsistent results (duh).

So, don’t make my mistakes.

If you want consistent results from trading, you must have consistent actions.

Stick to one trading strategy, master it—and then move on.

Kestutis Balciunas

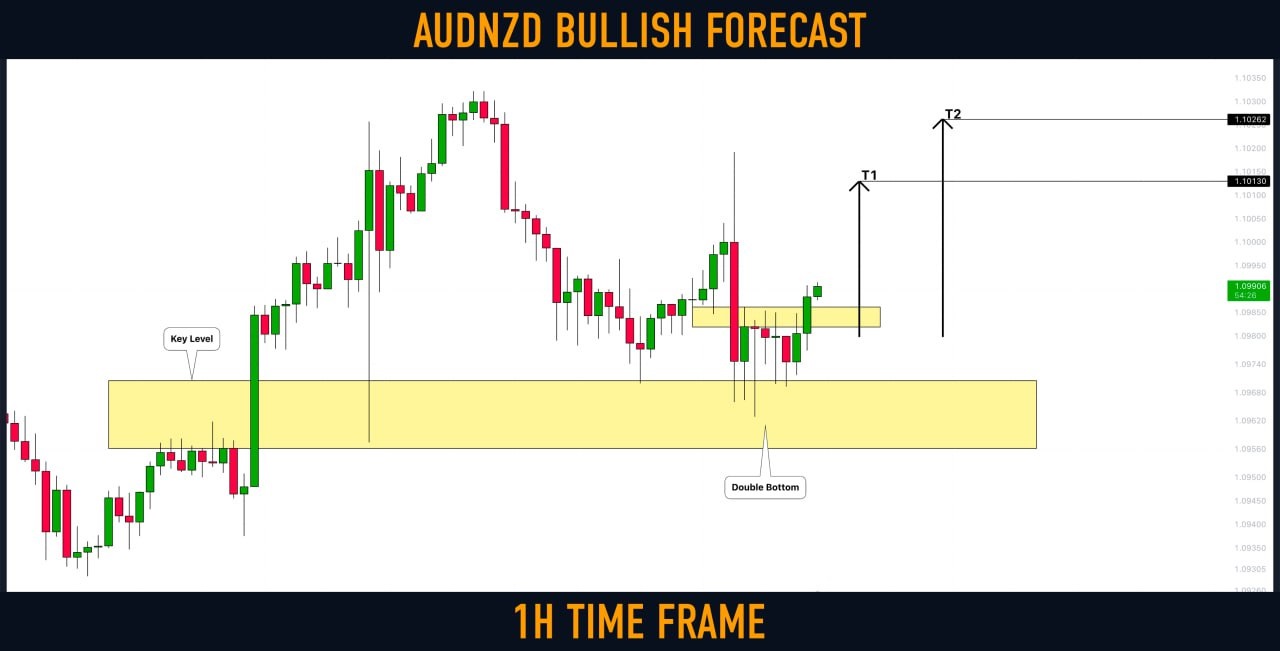

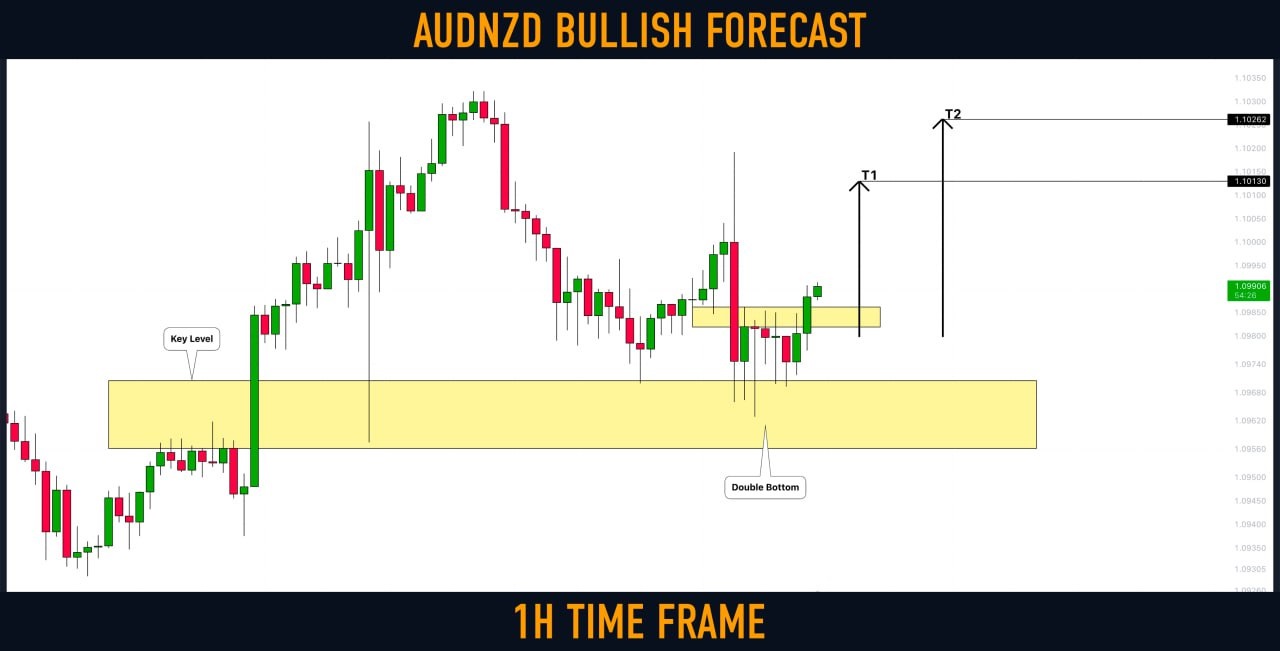

#AUDNZD: Classic Structure-Based Trade

AUDNZD reached a wide horizontal demand area.

The price formed a double top on that.

Its neckline has just been broken.

I expect a pullback to 1.101 / 1.102

AUDNZD reached a wide horizontal demand area.

The price formed a double top on that.

Its neckline has just been broken.

I expect a pullback to 1.101 / 1.102

Kestutis Balciunas

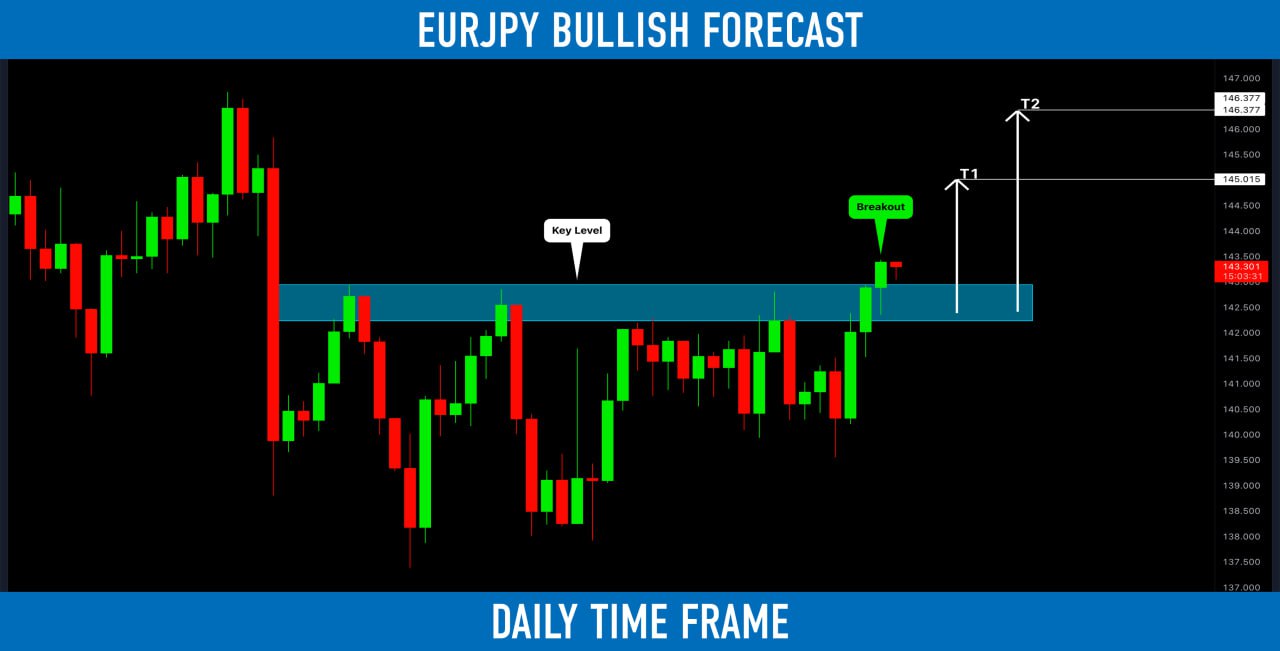

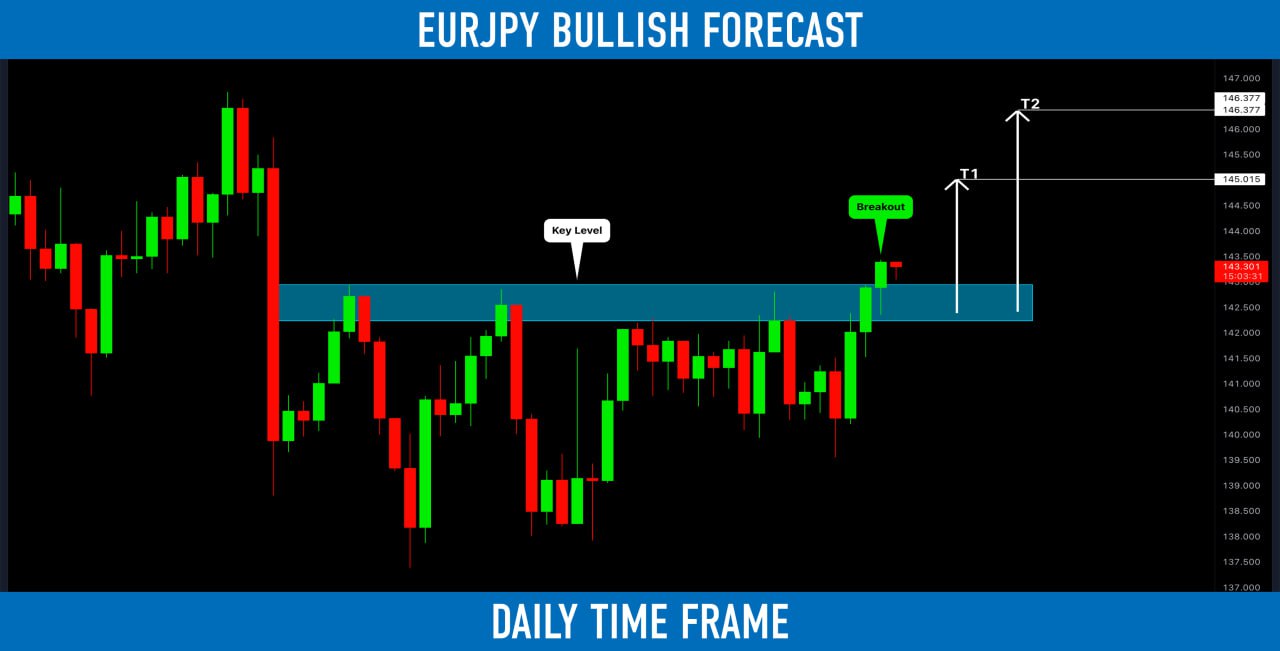

#EURJPY: Important Breakout

EURJPY finally broke and closed above a major horizontal resistance cluster on a daily.

The broken structure turned into a key support now.

I will expect a bullish continuation to 145.0 / 146.3 levels.

EURJPY finally broke and closed above a major horizontal resistance cluster on a daily.

The broken structure turned into a key support now.

I will expect a bullish continuation to 145.0 / 146.3 levels.

Kestutis Balciunas

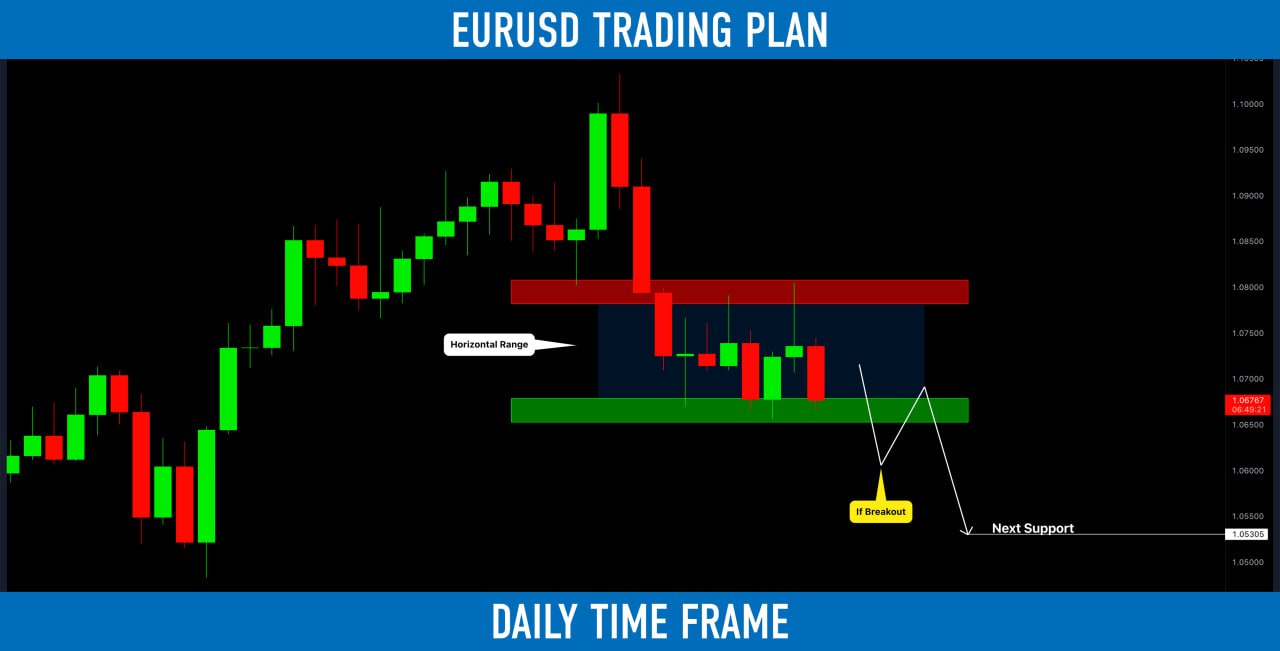

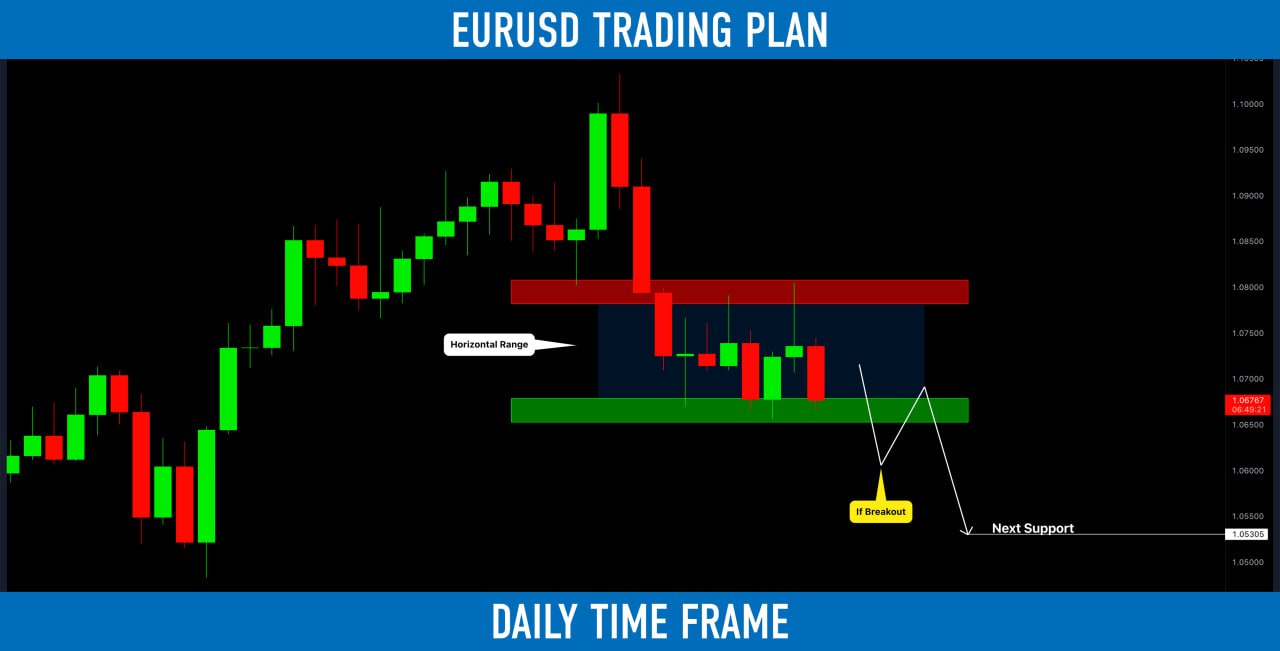

#EURUSD: Waiting For a Breakout

After a strong bearish movement, the pair is consolidating within a narrow horizontal trading range.

1.065 - 1.068 is its support.

I am waiting for its breakout (daily candle close below) to be short.

The pair will most likely drop then.

The goal will be 1.053

After a strong bearish movement, the pair is consolidating within a narrow horizontal trading range.

1.065 - 1.068 is its support.

I am waiting for its breakout (daily candle close below) to be short.

The pair will most likely drop then.

The goal will be 1.053

Kestutis Balciunas

MarketBreakdown | Dollar Index, GBPUSD, USDCAD, EURNZD

Here are the updates & outlook for multiple instruments in my watchlist.

1️⃣ Dollar Index (#DXY) daily time frame

The market is consolidating within a narrow horizontal trading range.

Taking into consideration that the index is very bullish from the beginning of February,

I believe that a bullish rally will continue.

Wait for a bullish breakout of the resistance of the range,

daily candle close above that will most likely trigger a bullish continuation.

2️⃣ #GBPUSD daily time frame

The pair was rejected heavily from a key daily structure resistance.

A rejection candle with a long wick was formed.

It indicates an intense bearish pressure.

I believe that the pair will most likely keep falling.

3️⃣ #USDCAD daily time frame

The market is trading within a wide horizontal trading range.

Its support was reached yesterday, and the market was rejected from that.

Probabilities are high that a resistance of the range will be reached soon.

4️⃣ #EURNZD daily time frame

The price is forming a substantial ascending triangle formation.

A bullish breakout of its resistance will initiate a solid bullish wave.

Wait for a daily candle close above the neckline as a confirmation.

Here are the updates & outlook for multiple instruments in my watchlist.

1️⃣ Dollar Index (#DXY) daily time frame

The market is consolidating within a narrow horizontal trading range.

Taking into consideration that the index is very bullish from the beginning of February,

I believe that a bullish rally will continue.

Wait for a bullish breakout of the resistance of the range,

daily candle close above that will most likely trigger a bullish continuation.

2️⃣ #GBPUSD daily time frame

The pair was rejected heavily from a key daily structure resistance.

A rejection candle with a long wick was formed.

It indicates an intense bearish pressure.

I believe that the pair will most likely keep falling.

3️⃣ #USDCAD daily time frame

The market is trading within a wide horizontal trading range.

Its support was reached yesterday, and the market was rejected from that.

Probabilities are high that a resistance of the range will be reached soon.

4️⃣ #EURNZD daily time frame

The price is forming a substantial ascending triangle formation.

A bullish breakout of its resistance will initiate a solid bullish wave.

Wait for a daily candle close above the neckline as a confirmation.

Kestutis Balciunas

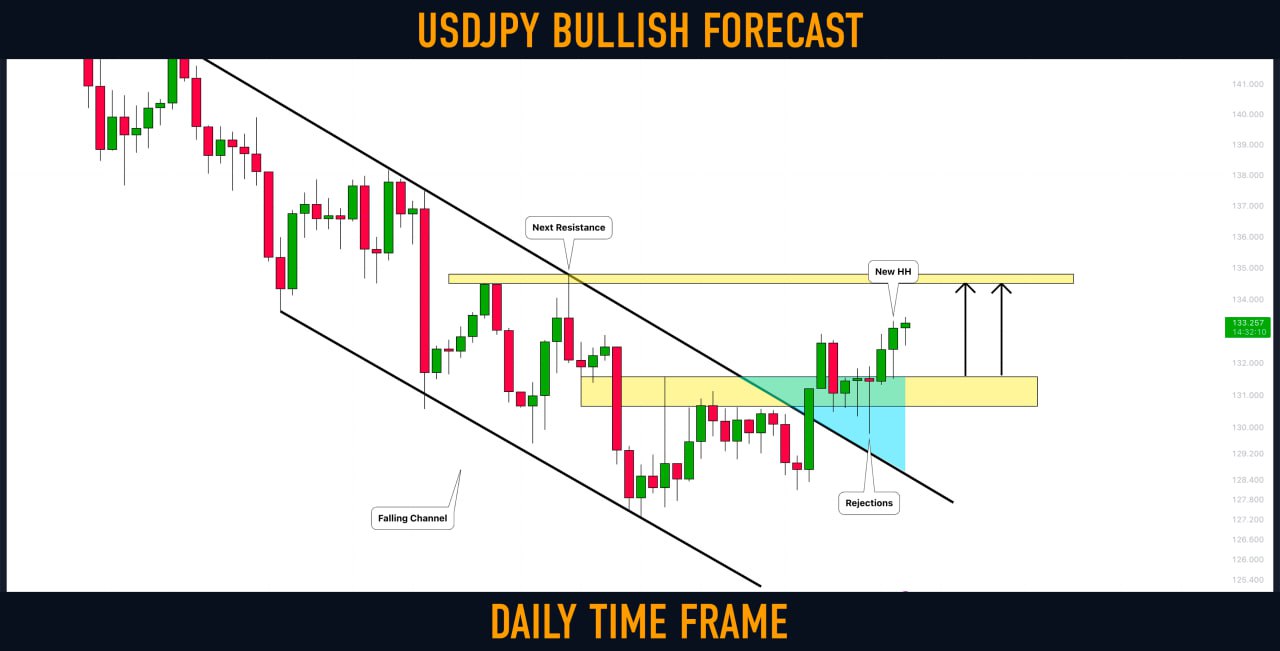

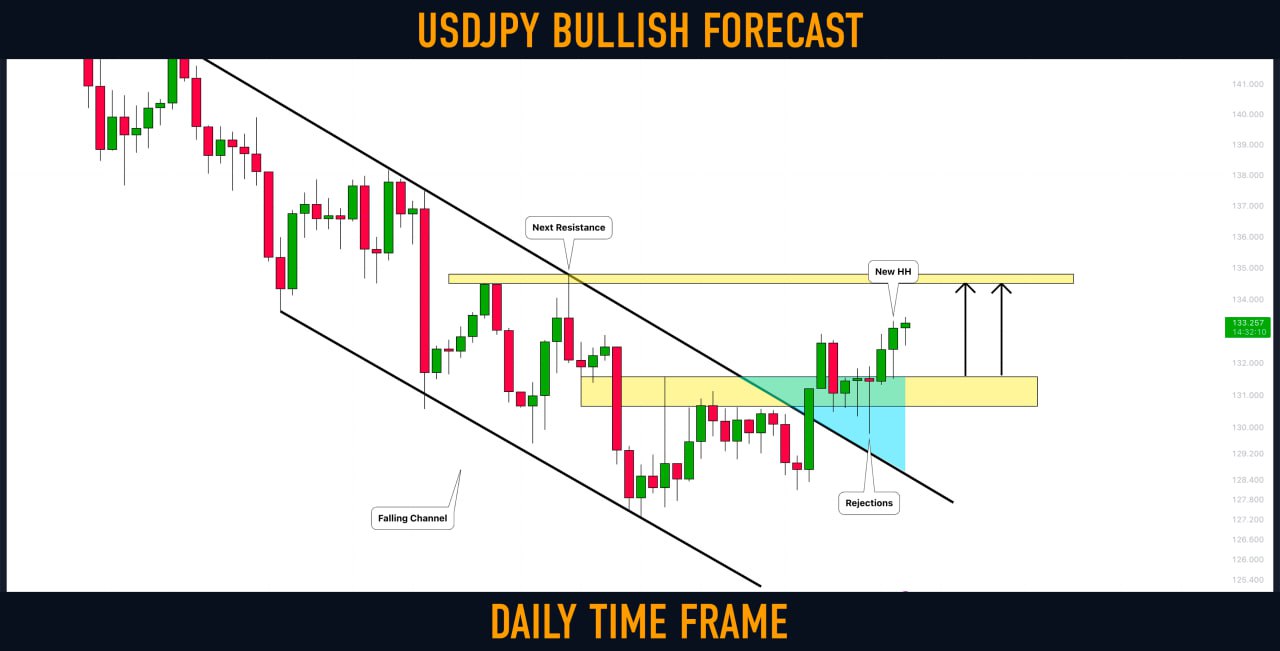

#USDJPY: Will We Go Higher?

Update for USDJPY.

Earlier, we spotted a confirmed breakout of a falling parallel channel on a daily.

The price has nicely respected the underlined blue zone we considered the buy zone.

The price bounced from that and set a new local higher-high higher close.

I will expect a further bullish continuation.

Next resistance - 134.5

Update for USDJPY.

Earlier, we spotted a confirmed breakout of a falling parallel channel on a daily.

The price has nicely respected the underlined blue zone we considered the buy zone.

The price bounced from that and set a new local higher-high higher close.

I will expect a further bullish continuation.

Next resistance - 134.5

Kestutis Balciunas

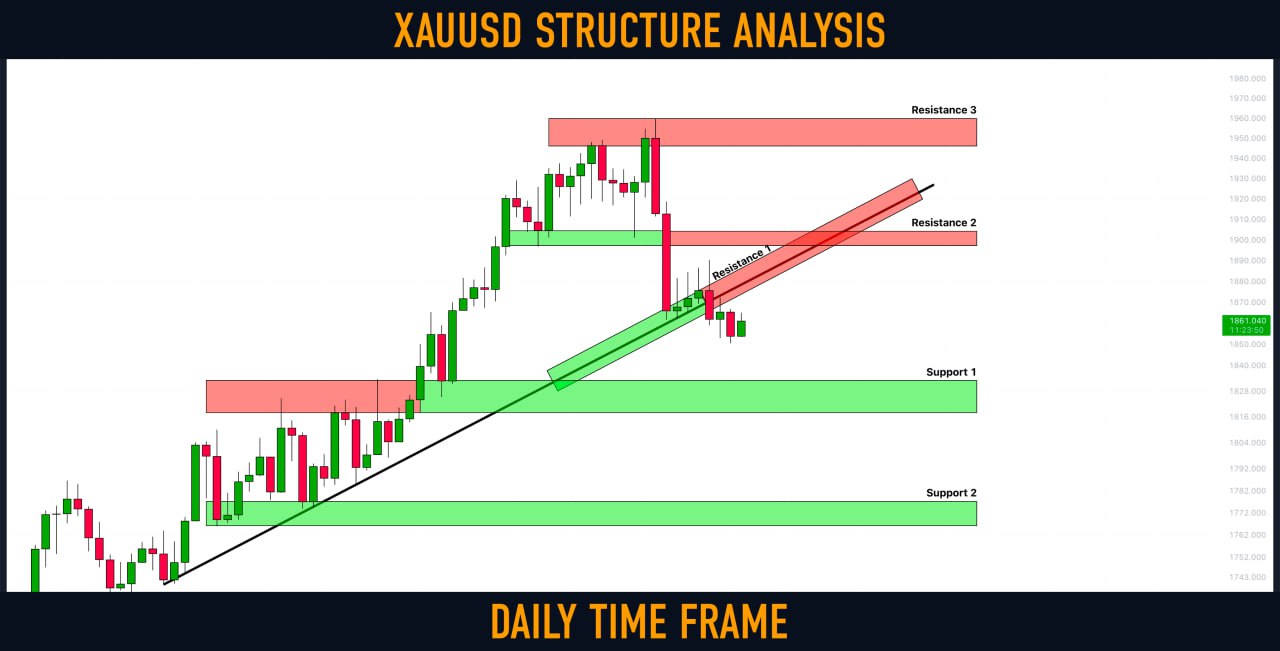

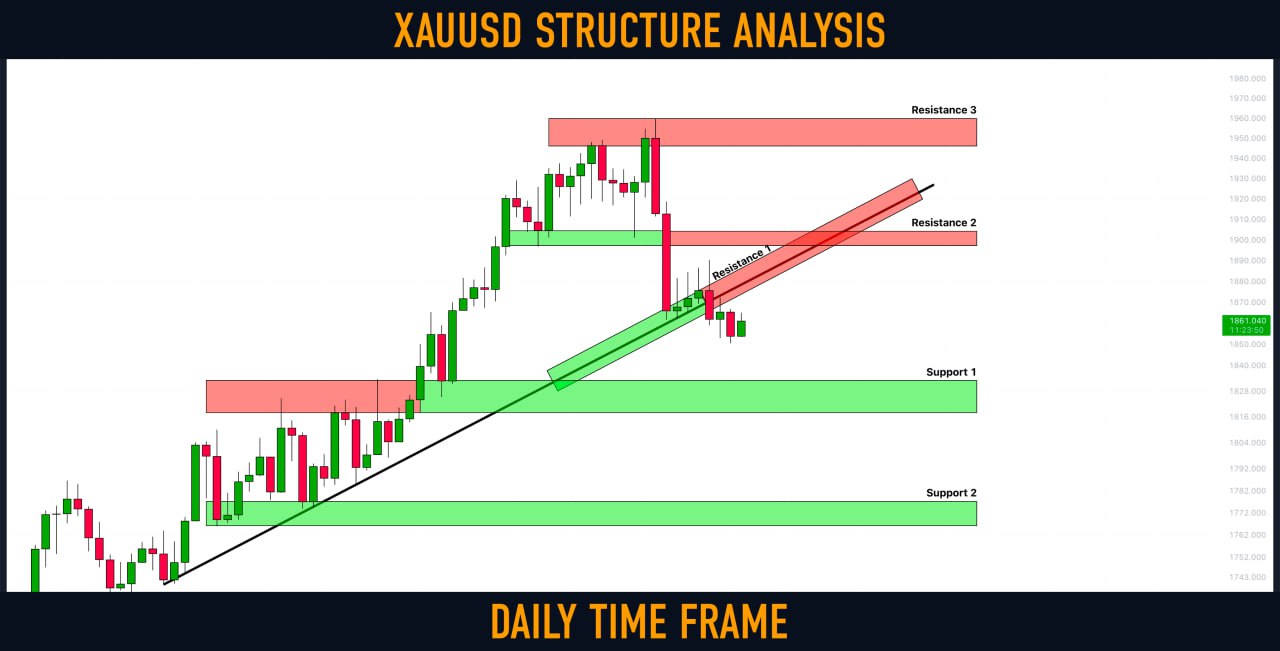

GOLD (#XAUUSD): Detailed Structure Analysis

Here are the important key levels to watch on Gold.

Resistance 1: Major broken trend line

Resistance 2: 1897 - 1904 area

Resistance 3: 1946 - 1959 area

Support 1: 1817 - 1832 area

Support 2: 1765 - 1777 area

The market remains relatively weak.

It looks like the market may retest the broken trend line.

Watch carefully!

Here are the important key levels to watch on Gold.

Resistance 1: Major broken trend line

Resistance 2: 1897 - 1904 area

Resistance 3: 1946 - 1959 area

Support 1: 1817 - 1832 area

Support 2: 1765 - 1777 area

The market remains relatively weak.

It looks like the market may retest the broken trend line.

Watch carefully!

Kestutis Balciunas

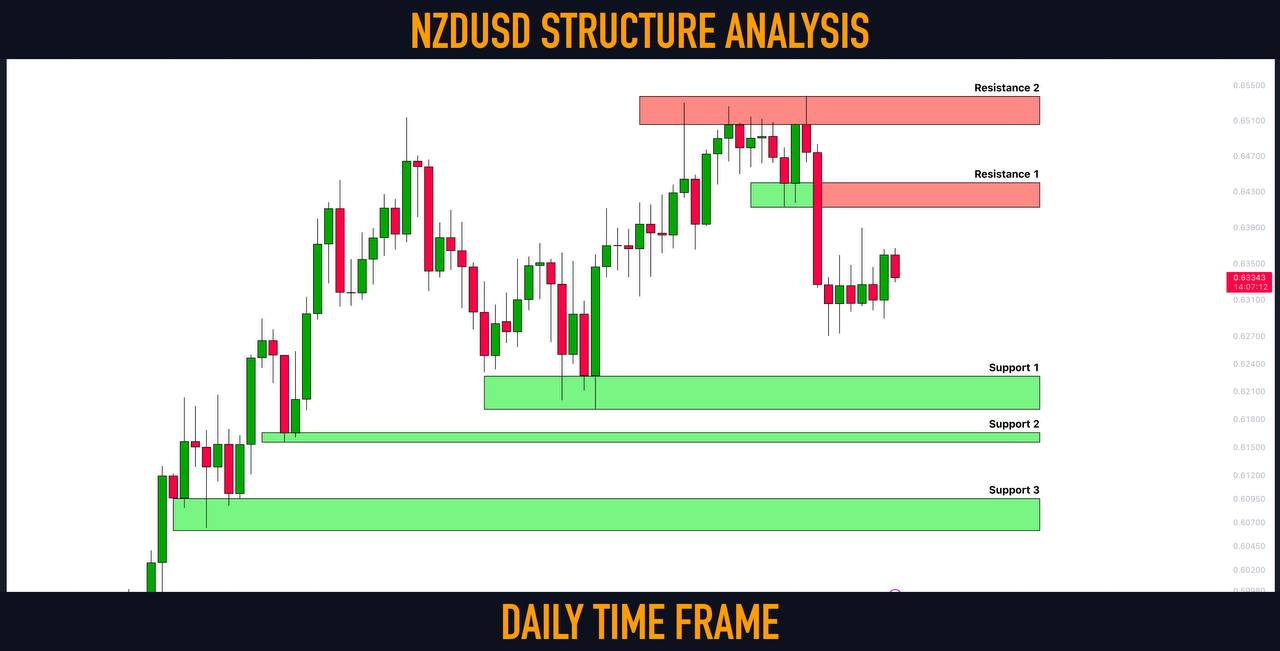

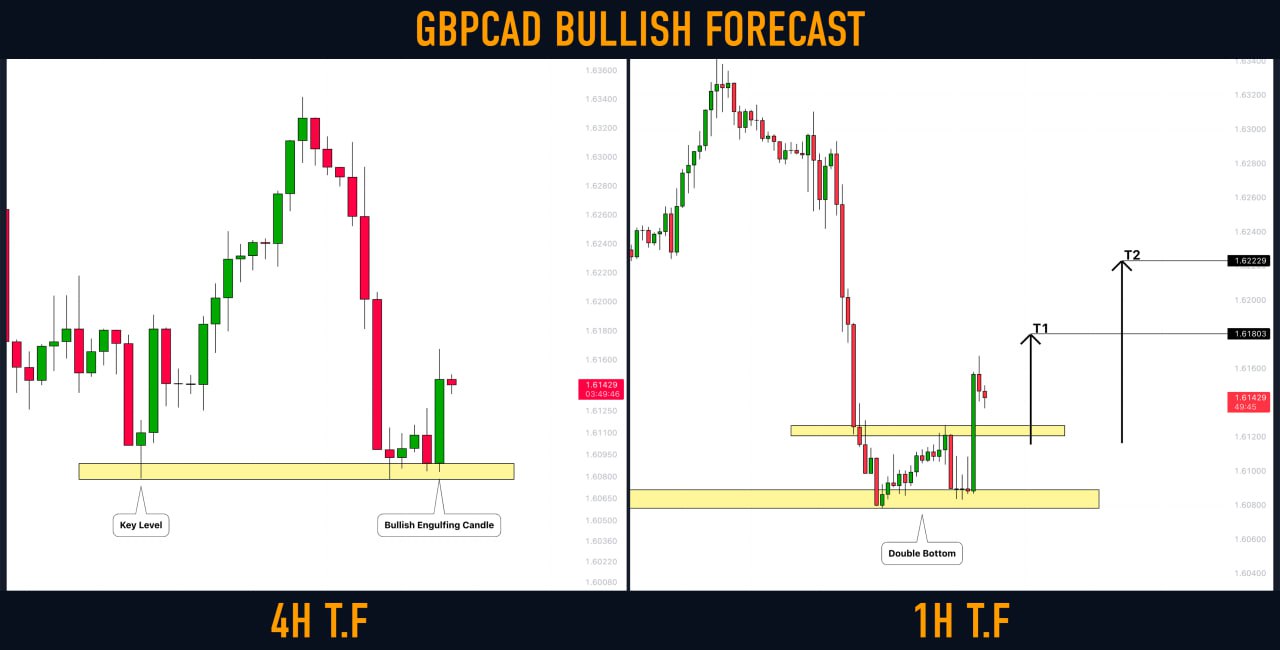

Here is my latest structure analysis for ⚠️NZDUSD.

Resistance 1: 0.6412 - 0.644 area

Resistance 2: 0.6505 - 0.6538 area

Support 1: 0.619 - 0.6226 area

Support 2: 0.6155 - 0.6165 area

Support 3: 0.606 - 0.6095 area

Consider these structures for pullback/breakout trading.

Resistance 1: 0.6412 - 0.644 area

Resistance 2: 0.6505 - 0.6538 area

Support 1: 0.619 - 0.6226 area

Support 2: 0.6155 - 0.6165 area

Support 3: 0.606 - 0.6095 area

Consider these structures for pullback/breakout trading.

Kestutis Balciunas

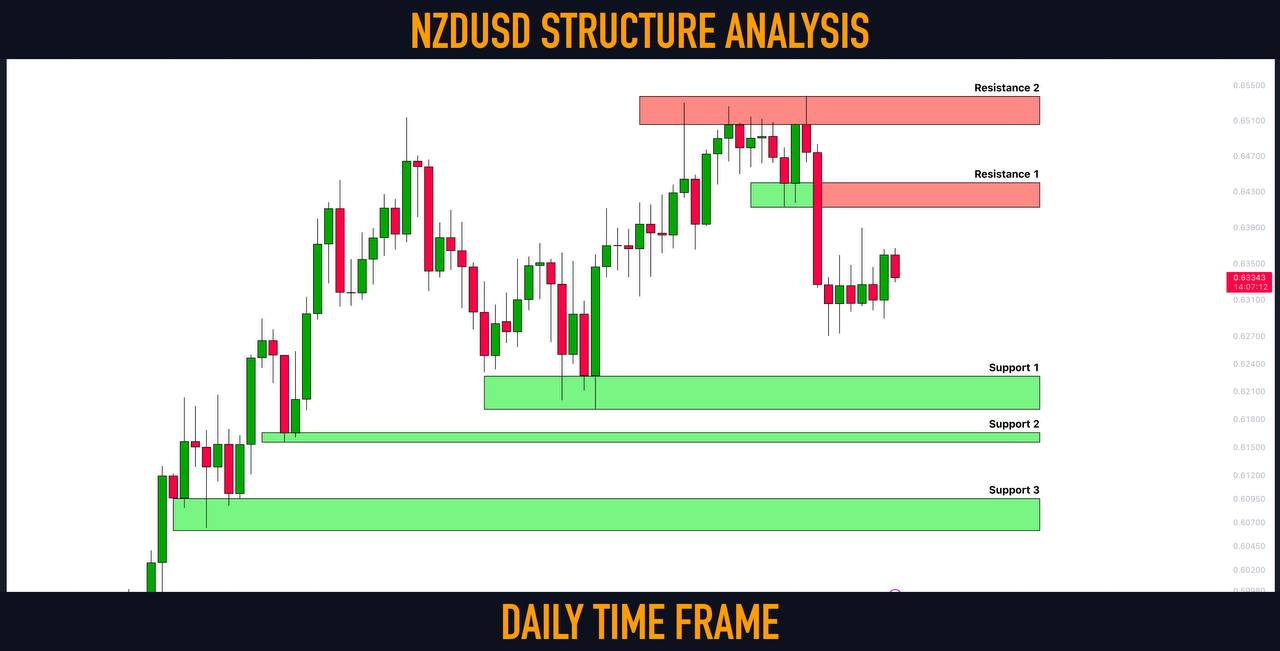

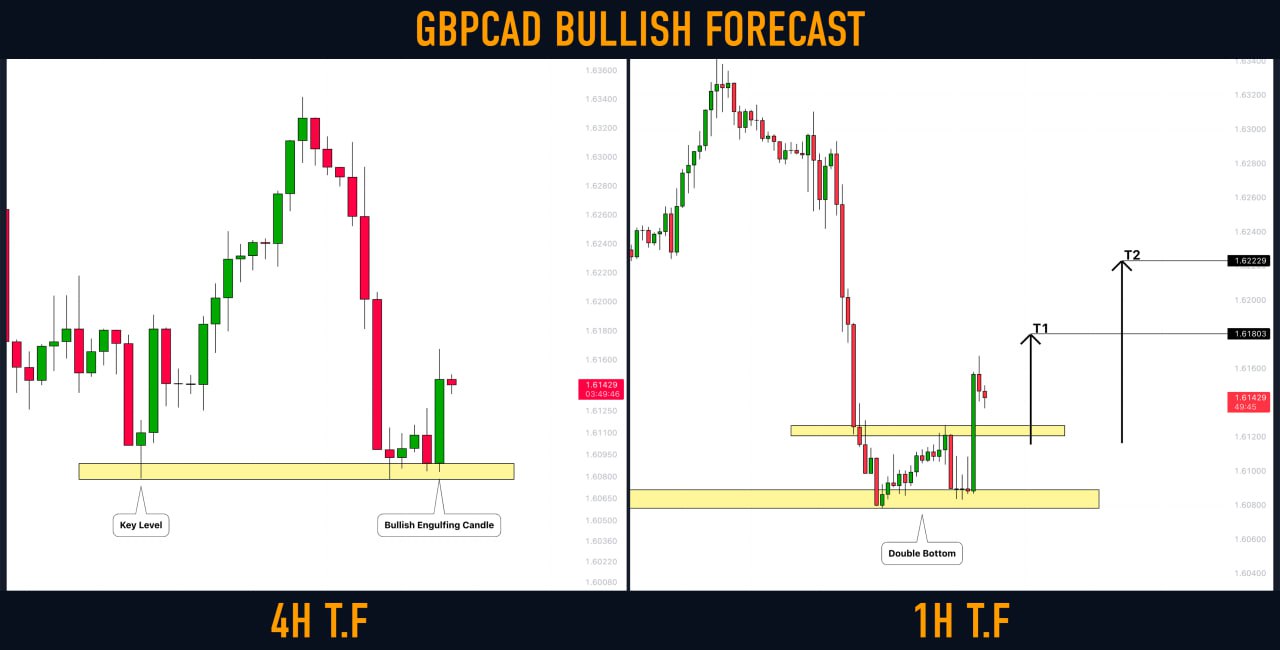

GBPCAD is taking off from a key horizontal support.

The price has formed a bullish engulfing candle on 4h, approaching that structure.

A double bottom on an hourly time frame was formed.

I expect a pullback to: 1.618 / 1.622

The price has formed a bullish engulfing candle on 4h, approaching that structure.

A double bottom on an hourly time frame was formed.

I expect a pullback to: 1.618 / 1.622

Kestutis Balciunas

USDCAD is trading within a wide horizontal trading range on a daily.

Approaching its resistance, the price formed a double-top pattern.

Its neckline was broken on Friday.

I expect a bearish move to 1.328 now

Approaching its resistance, the price formed a double-top pattern.

Its neckline was broken on Friday.

I expect a bearish move to 1.328 now

Kestutis Balciunas

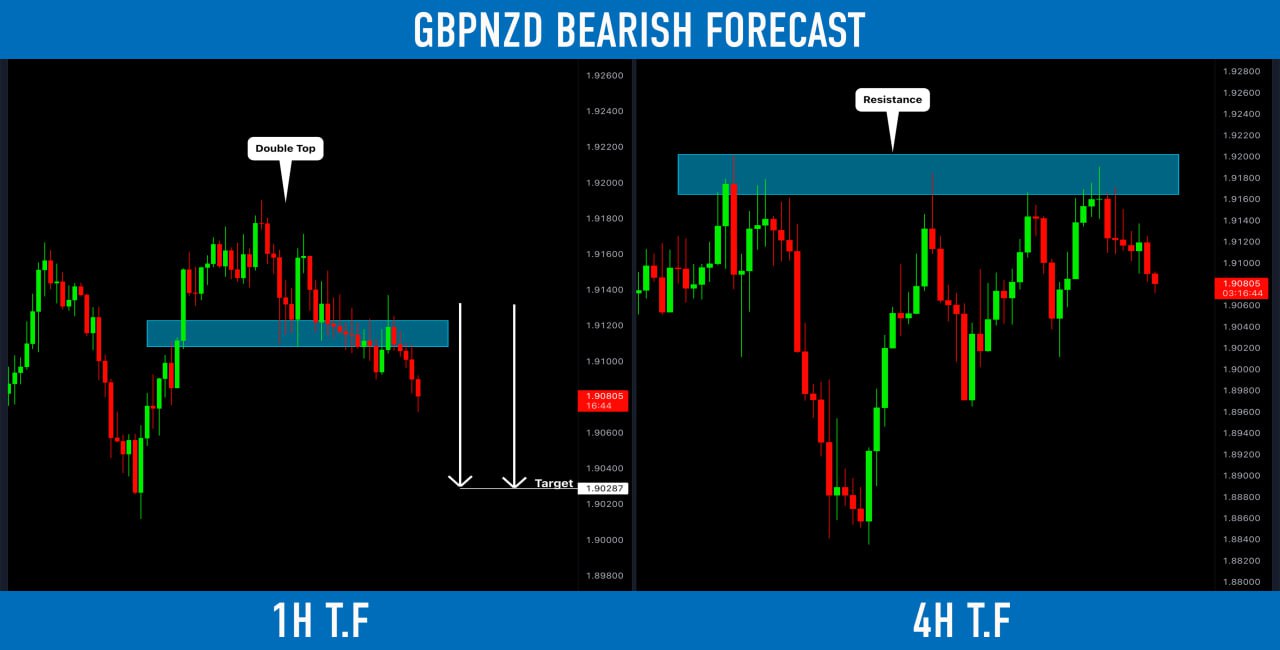

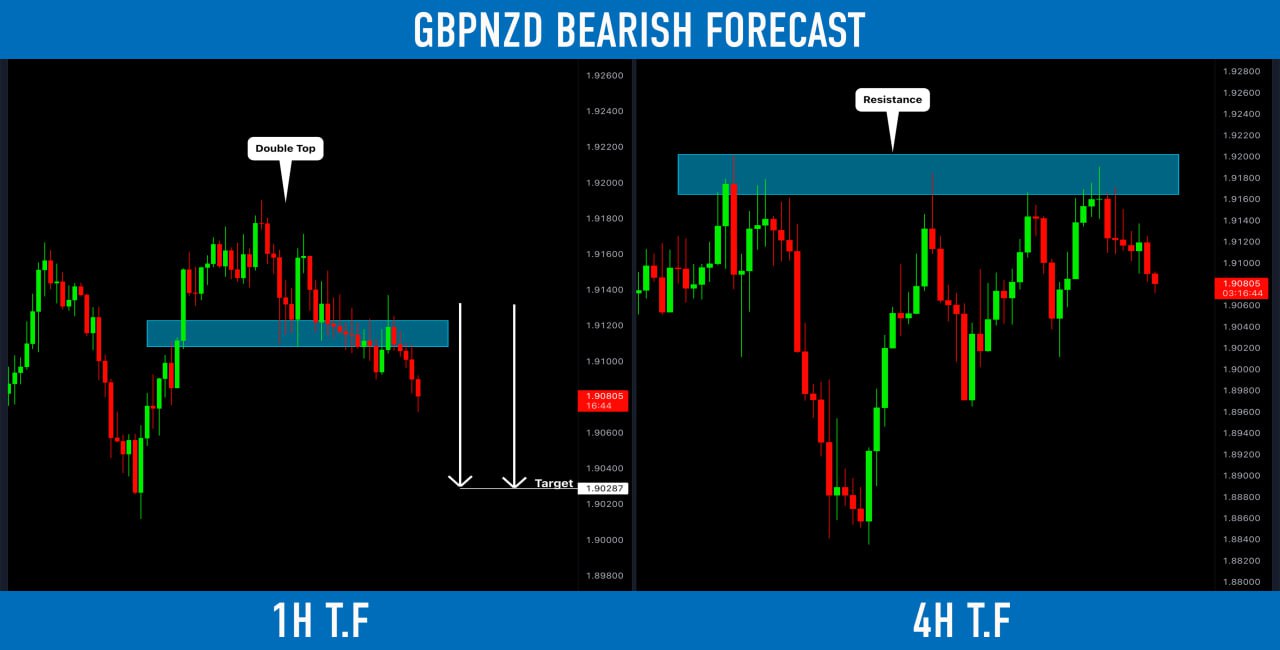

#GBPNZD: Bearish Move From Key Level

🔻GBPNZD reached an important supply cluster last week.

The price formed a double top pattern on an hourly time frame approaching that.

I expect a bearish continuation to 1.903

🔻GBPNZD reached an important supply cluster last week.

The price formed a double top pattern on an hourly time frame approaching that.

I expect a bearish continuation to 1.903

Kestutis Balciunas

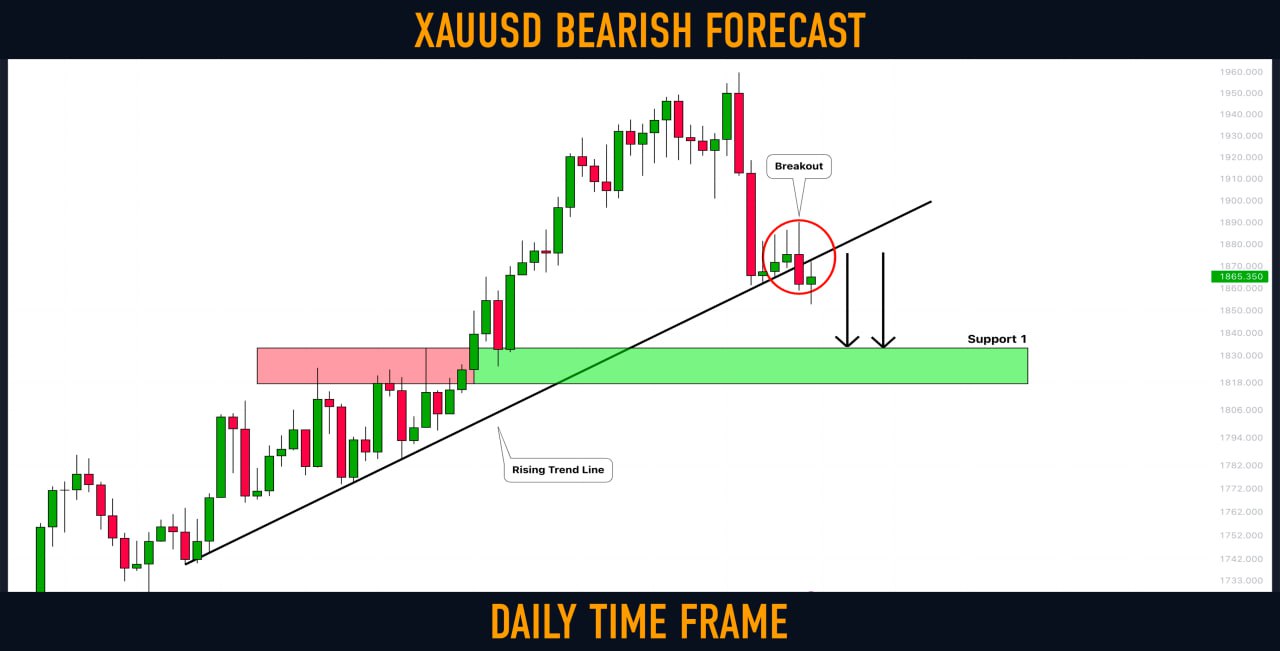

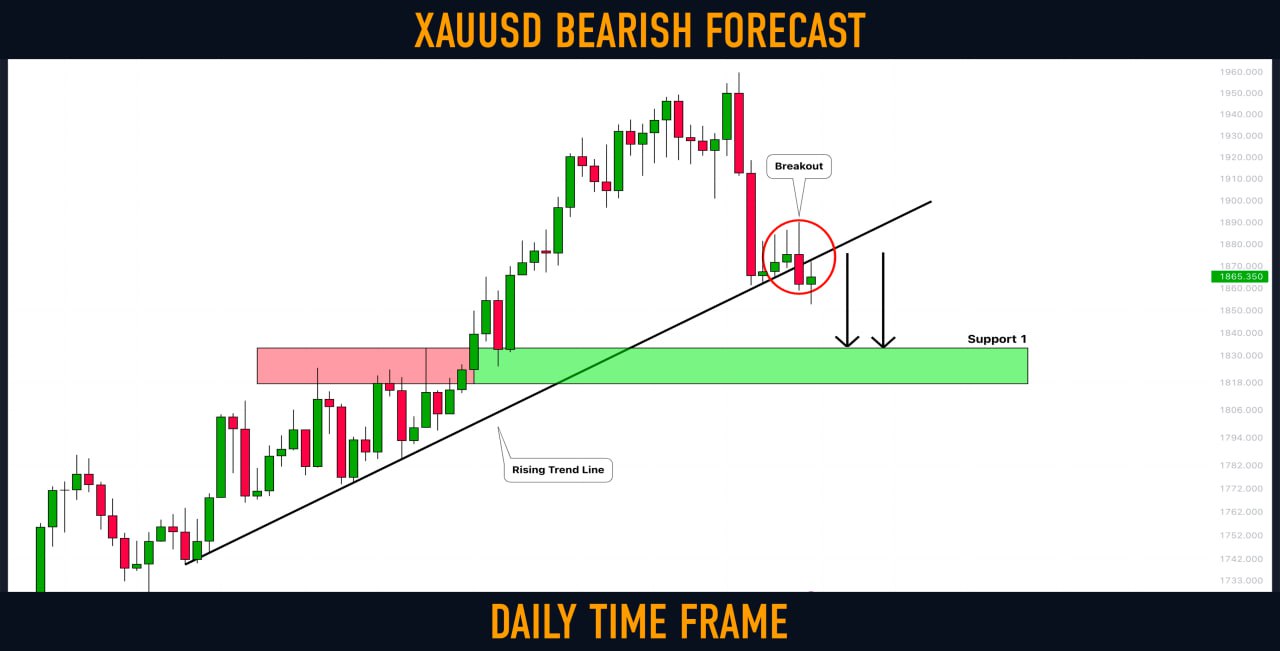

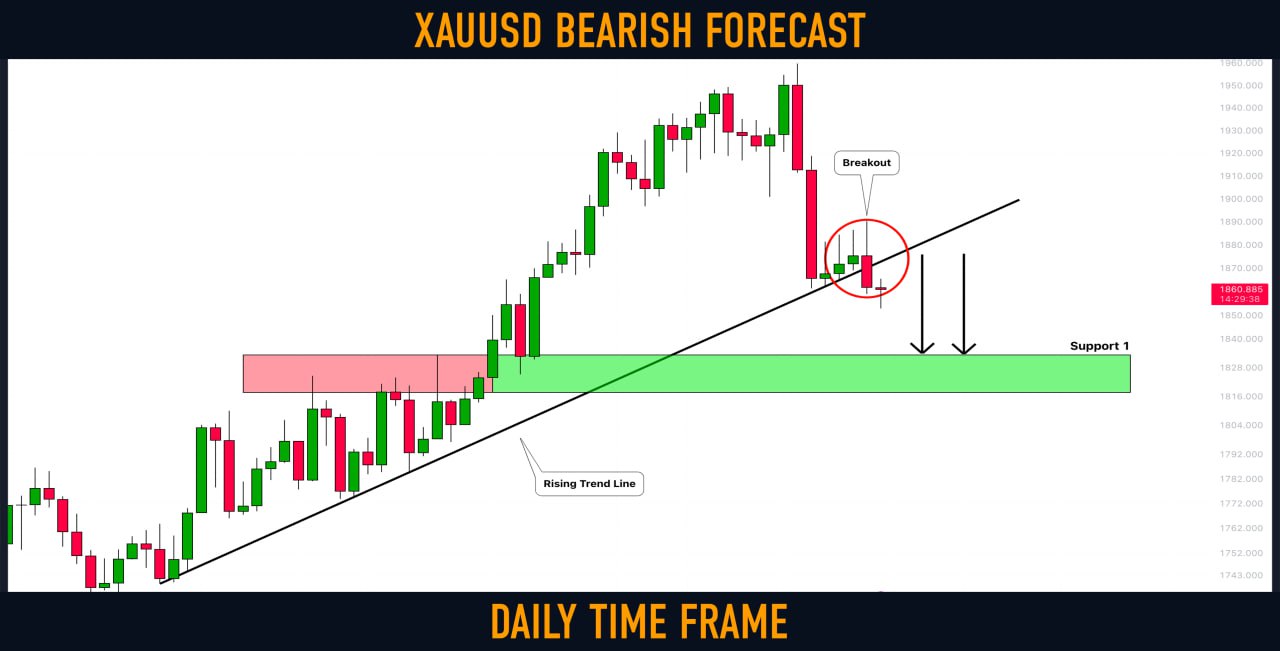

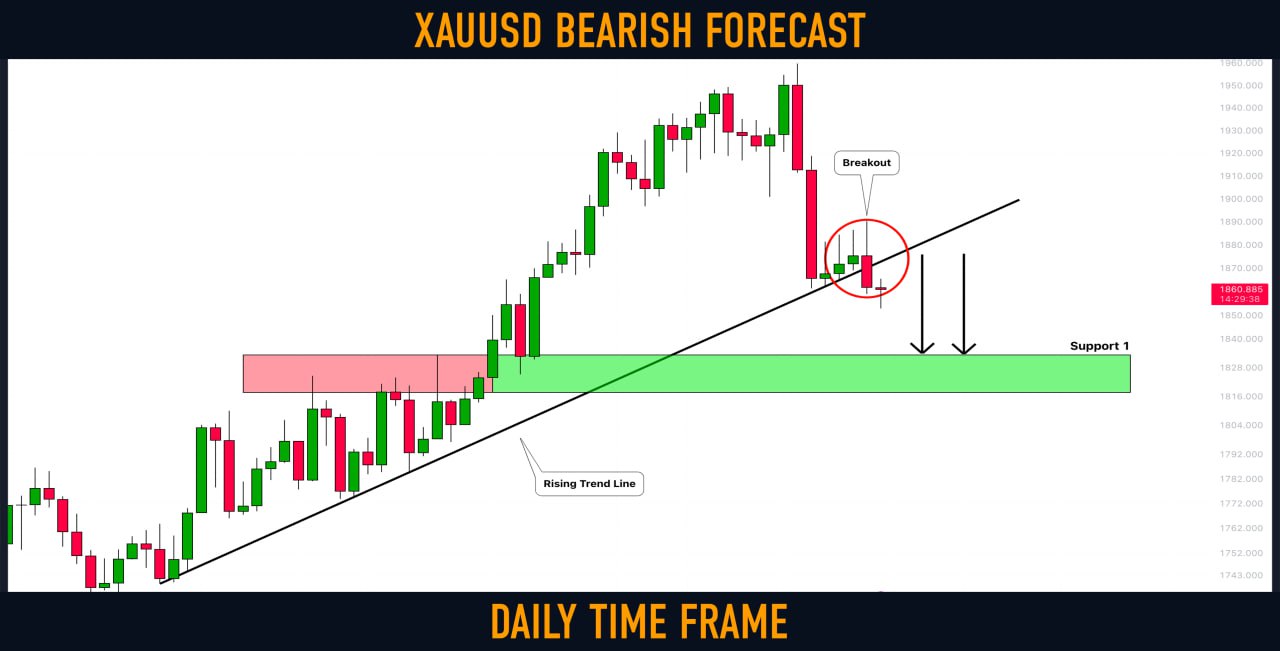

Gold (#XAUUSD): Bearish Outlook For This Week Explained

An important thing happened on 🔻Gold this week.

After a strong bearish movement, the price reached a major rising trend line.

The price was coiling on that since Monday.

On Thursday, it was broken, though.

The price closed below that, forming a bearish engulfing candle.

I believe that the market may keep falling next week.

Next support on focus is 1817 - 1833 area.

An important thing happened on 🔻Gold this week.

After a strong bearish movement, the price reached a major rising trend line.

The price was coiling on that since Monday.

On Thursday, it was broken, though.

The price closed below that, forming a bearish engulfing candle.

I believe that the market may keep falling next week.

Next support on focus is 1817 - 1833 area.

Kestutis Balciunas

EURUSD is moving into a correction phase. The price is resting against the conditional support at 1.065 and forming a bearish flag . This pattern shows us the potential to revive the fall further.

The price is testing the support zone of 1.07116 in a bearish flag format. Breakdown of the support of the local range may lead to the liquidation of the buying liquidity and activation of the momentum for a strong bearish impulse.

However I expect in the near term an exit of the price from the range downwards, breakdown of the support of 1.07116 and price movement towards 1.065, and then to 1.0430

The price is testing the support zone of 1.07116 in a bearish flag format. Breakdown of the support of the local range may lead to the liquidation of the buying liquidity and activation of the momentum for a strong bearish impulse.

However I expect in the near term an exit of the price from the range downwards, breakdown of the support of 1.07116 and price movement towards 1.065, and then to 1.0430

Kestutis Balciunas

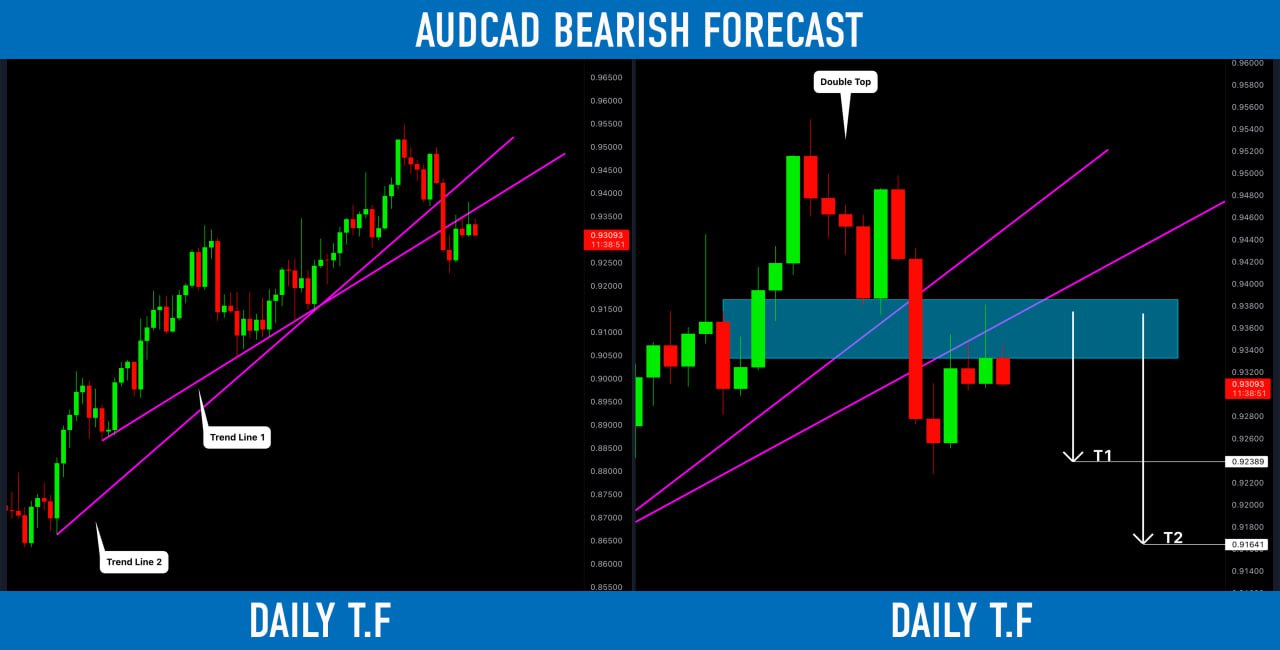

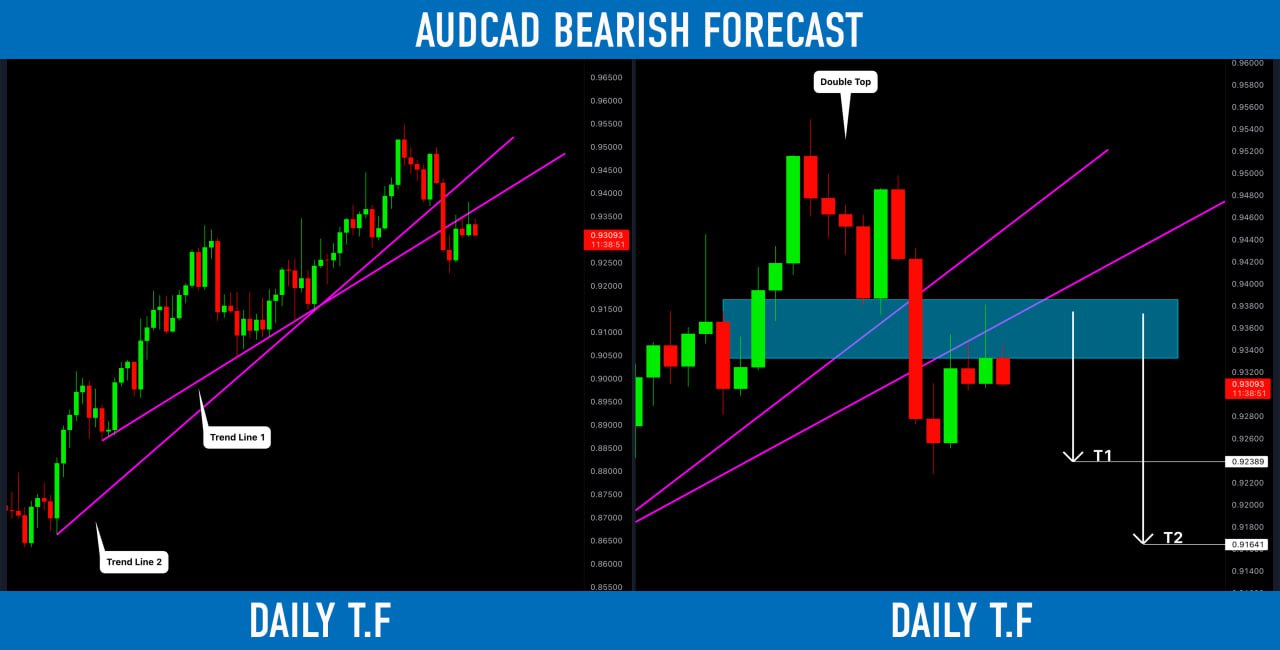

#AUDCAD: Bearish Outlook Explained

🔻AUDCAD looks very bearish:

the price has broken 2 rising trend lines on a daily,

formed a double top and broke its neckline as well.

The price is retesting the confluence zone based on the broken structures.

Probabilities are high that the pair will drop soon.

Goals: 0.924 / 0.916

🔻AUDCAD looks very bearish:

the price has broken 2 rising trend lines on a daily,

formed a double top and broke its neckline as well.

The price is retesting the confluence zone based on the broken structures.

Probabilities are high that the pair will drop soon.

Goals: 0.924 / 0.916

Kestutis Balciunas

Gold (#XAUUSD): That Was a Breakout 🟡

So it turned out that 🔻Gold broke a major rising trend line yesterday.

The market has successfully closed below that on a daily engulfing the last 3 bullish candles.

That violation may push the price lower.

Next support: 1833

So it turned out that 🔻Gold broke a major rising trend line yesterday.

The market has successfully closed below that on a daily engulfing the last 3 bullish candles.

That violation may push the price lower.

Next support: 1833

Kestutis Balciunas

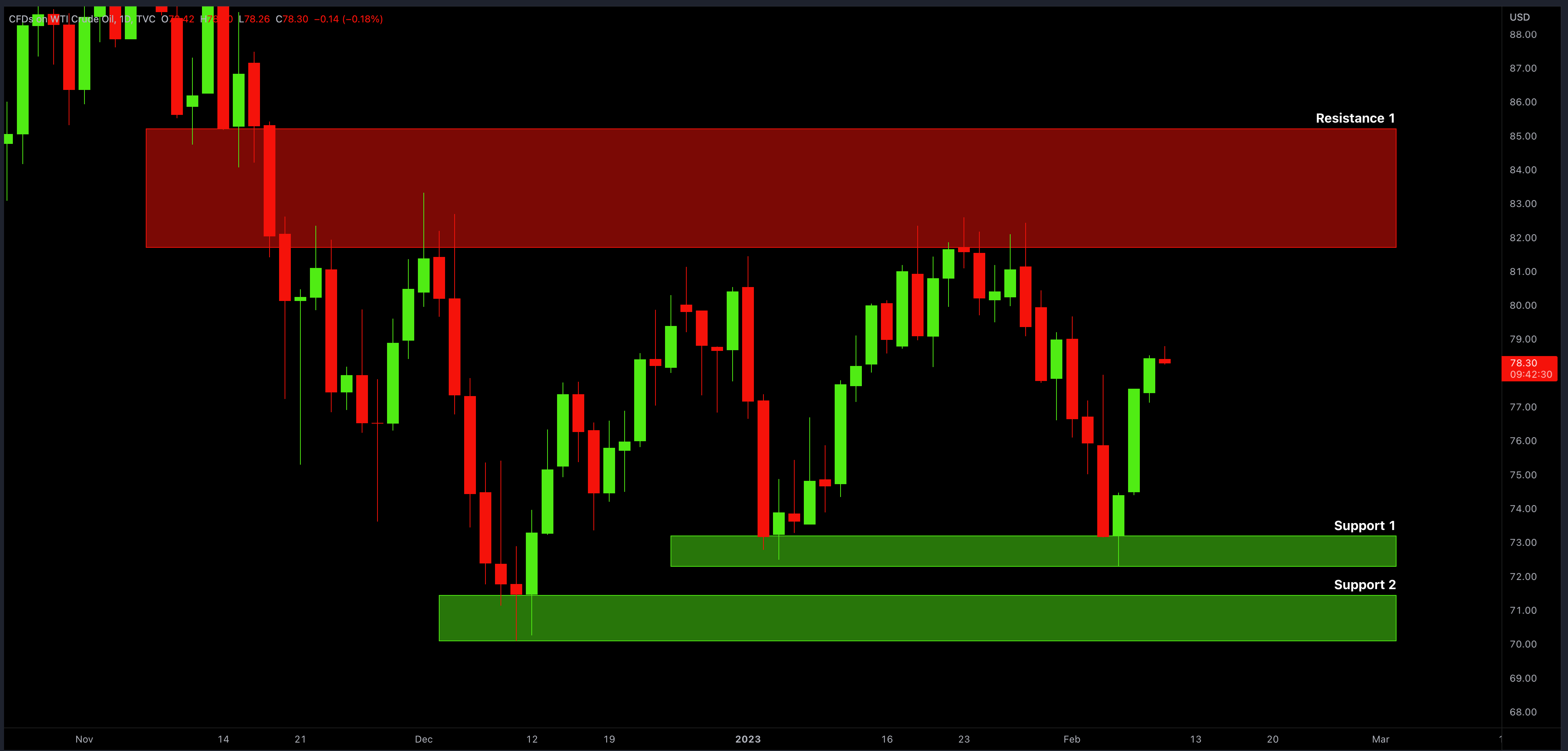

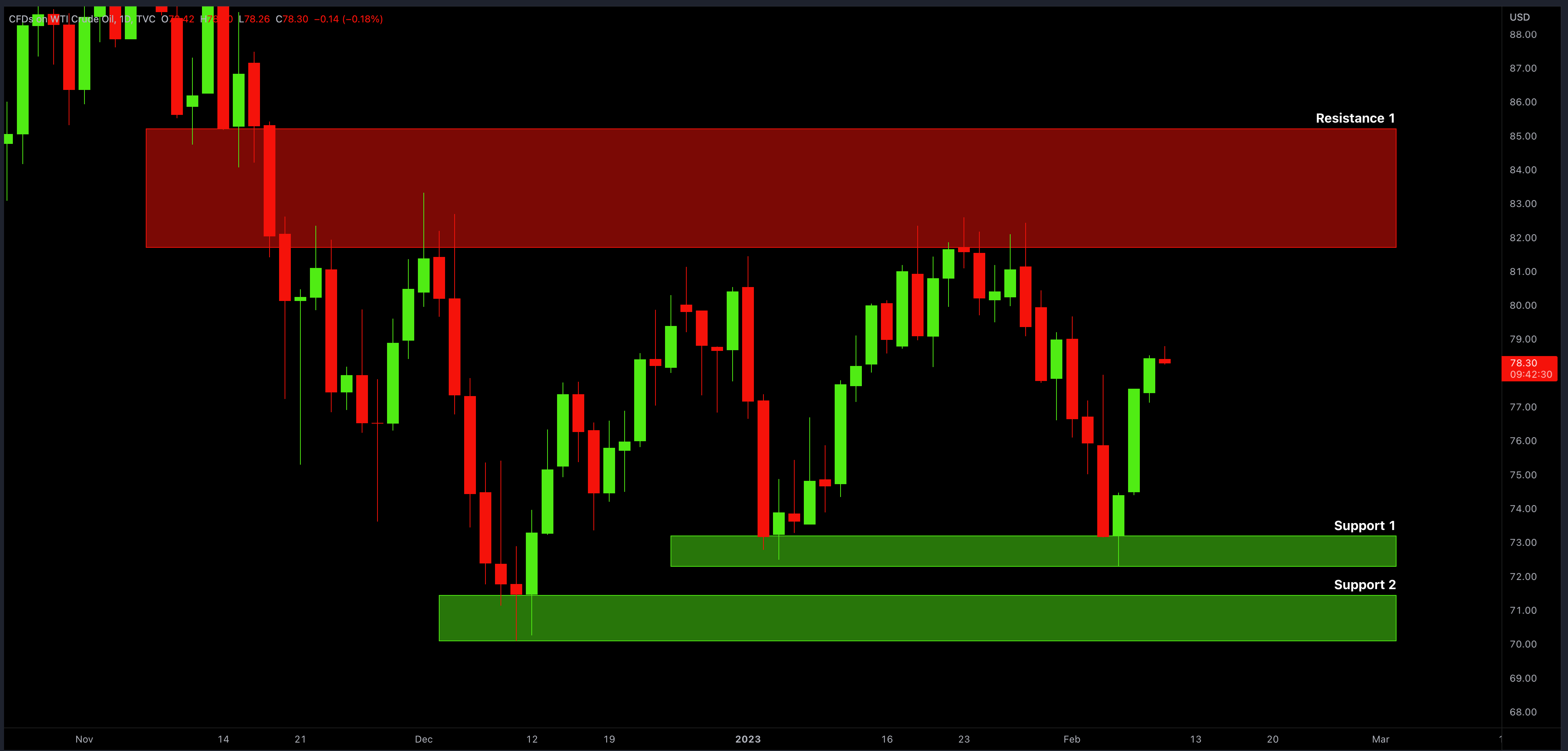

Here is my latest structure analysis for WTI Crude Oil.

Support 1: 72.3 - 73.2 area

Support 2: 70.0 - 71.4 area

Resistance 1: 81.7 - 85.2 wide supply area

Consider these structures for pullback/breakout trading.

Support 1: 72.3 - 73.2 area

Support 2: 70.0 - 71.4 area

Resistance 1: 81.7 - 85.2 wide supply area

Consider these structures for pullback/breakout trading.

Kestutis Balciunas

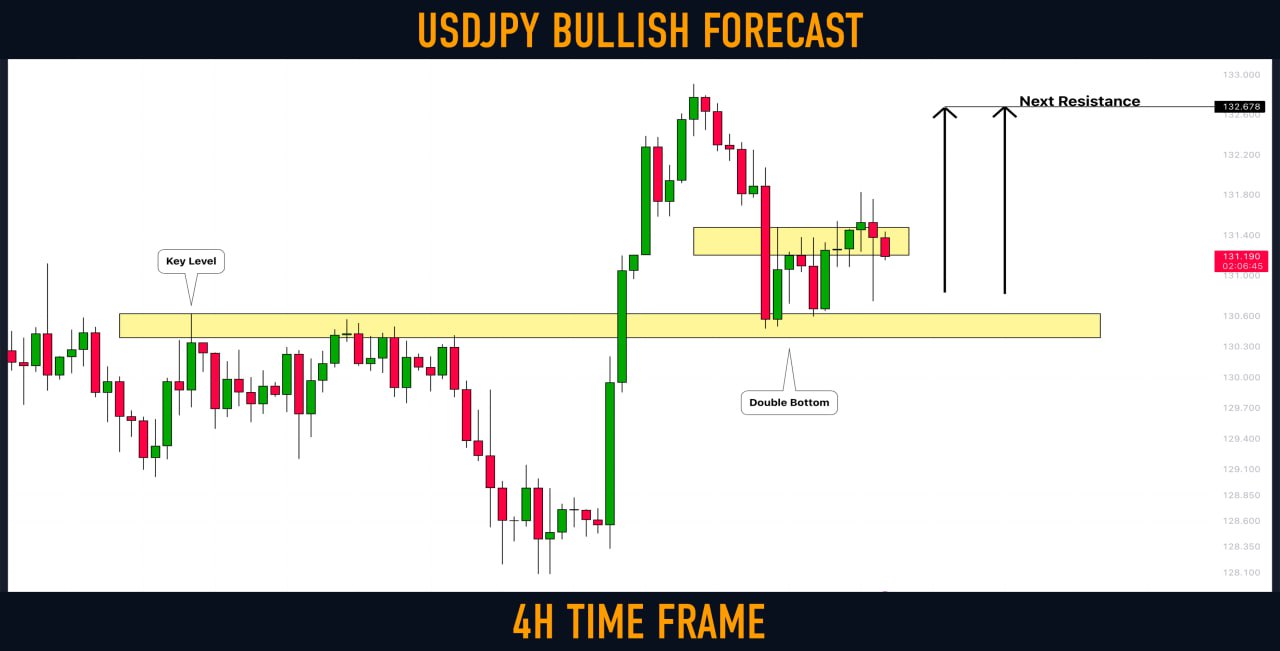

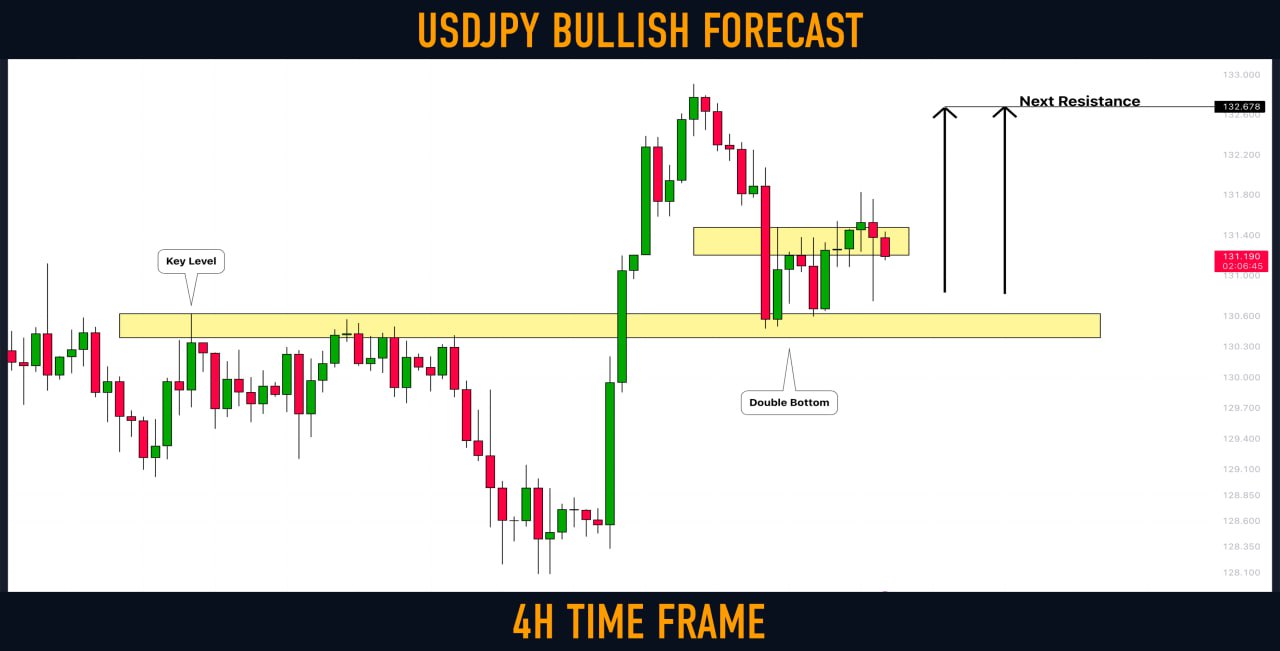

USDJPY is testing a key horizontal demand zone on 4H.

The price formed a double bottom pattern on that and broke its neckline then.

I expect a bullish movement to 132.7

The price formed a double bottom pattern on that and broke its neckline then.

I expect a bullish movement to 132.7

Kestutis Balciunas

EURJPY dropped nicely from a key daily structure resistance.

I think that the pair can go even lower.

I expect a bearish move to 140.14

I think that the pair can go even lower.

I expect a bearish move to 140.14

: