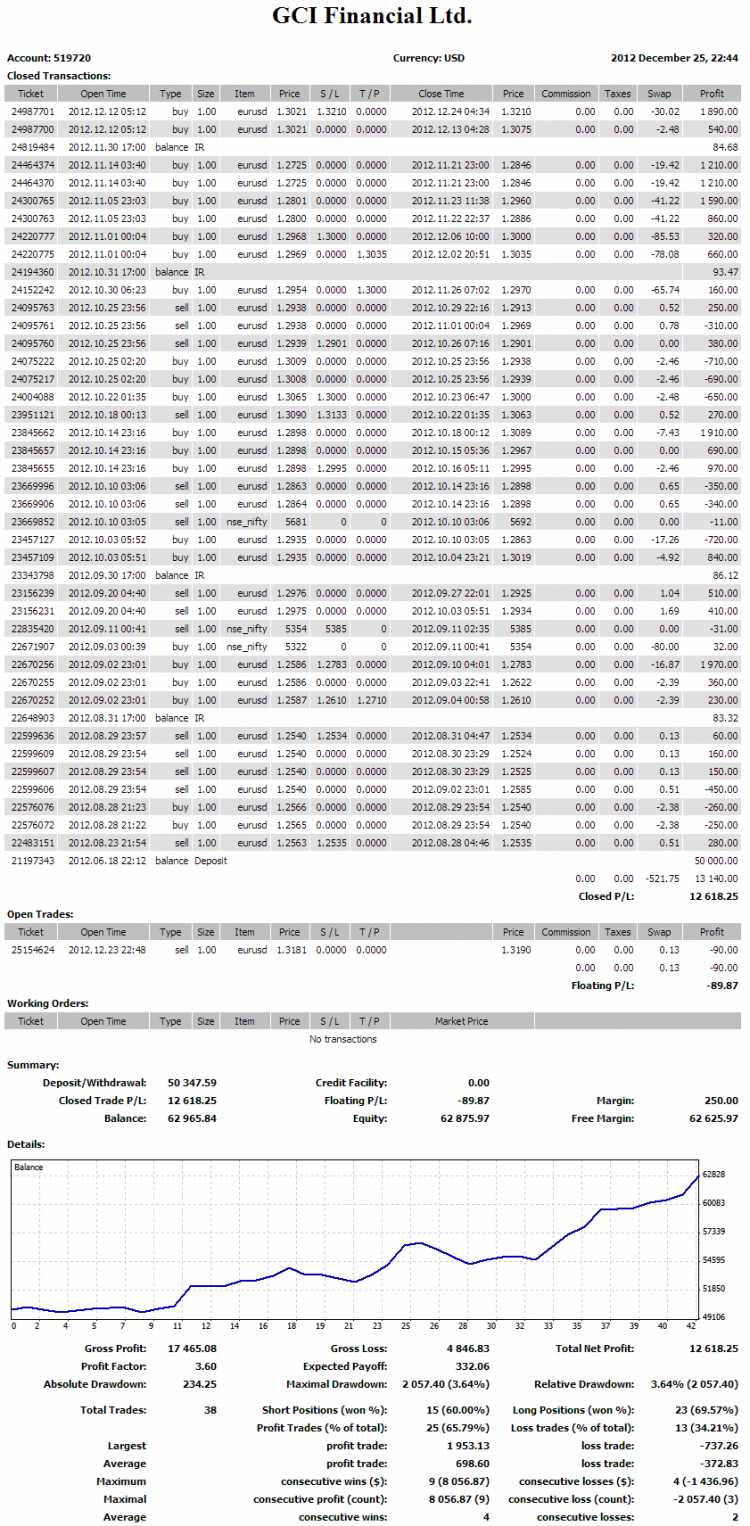

| Total Trades: | 21 |

@TerryTosan,

I am no senior, but I wish to share constructive feedback with you.

A back test does not show your strategy's logic. Without knowing the logic of your strategy, there is no way for me to determine if the strategy will sustain and gain profits for an account balance in the "long haul" of LIVE trading.

I have but one question for you to ask yourself.

"Is my EA prepared to handle all placed trades in any and all market conditions when run on a LIVE account balance?"

Thank you.

Congratulations! You are on the right track. I think you have a winning strategy. My only concern is that you have 3 losses in a row. This is going the create problems down the road. If you keep working at it, you will be able to find a winning strategy that won't fail you. Hope you to find a winning strategy that rarely loses, maybe 50:1.

I guess my strategy is working fine at this time below is the continuous progress/result of my strategy.

Looking for expert comments from Seniors please as I am doing this trades part time

I feel more comfortable on h4 timeframe as this timeframe makes me easy to handle my trades during my fulltime job as well

Your strategy may be very good, but I'd like to signal you that not always

setting a stop loss order you are exposed to very big risk. Set it where you suppose that stop will never be caught

if you prefer (i prefer tight stop losses) but not putting it ...mmmm

we can never exclude anything for the future.

kind regards

Giorgio

Your strategy may be very good, but I'd like to signal you that not always

setting a stop loss order you are exposed to very big risk. Set it where you suppose that stop will never be caught

if you prefer (i prefer tight stop losses) but not putting it ...mmmm

we can never exclude anything for the future.

kind regards

Giorgio

I can say that stop loss is not a part of my trading strategy as I am always in the trade whether buy or short.

BTW thanks for your suggestion I will keep SL if necessary.

What I wanted to know is the return. Is this returns are good as a part time trader?

...

What I wanted to know is the return. Is this returns are good as a part time trader?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Finally I have build my own trading strategy and below are the results which I got.

So expecting seniors to review it and expert comments on it whether this strategy is good or not?

Thanks in Advance

GCI Financial Ltd.