AI TradingVision GPX Introduction

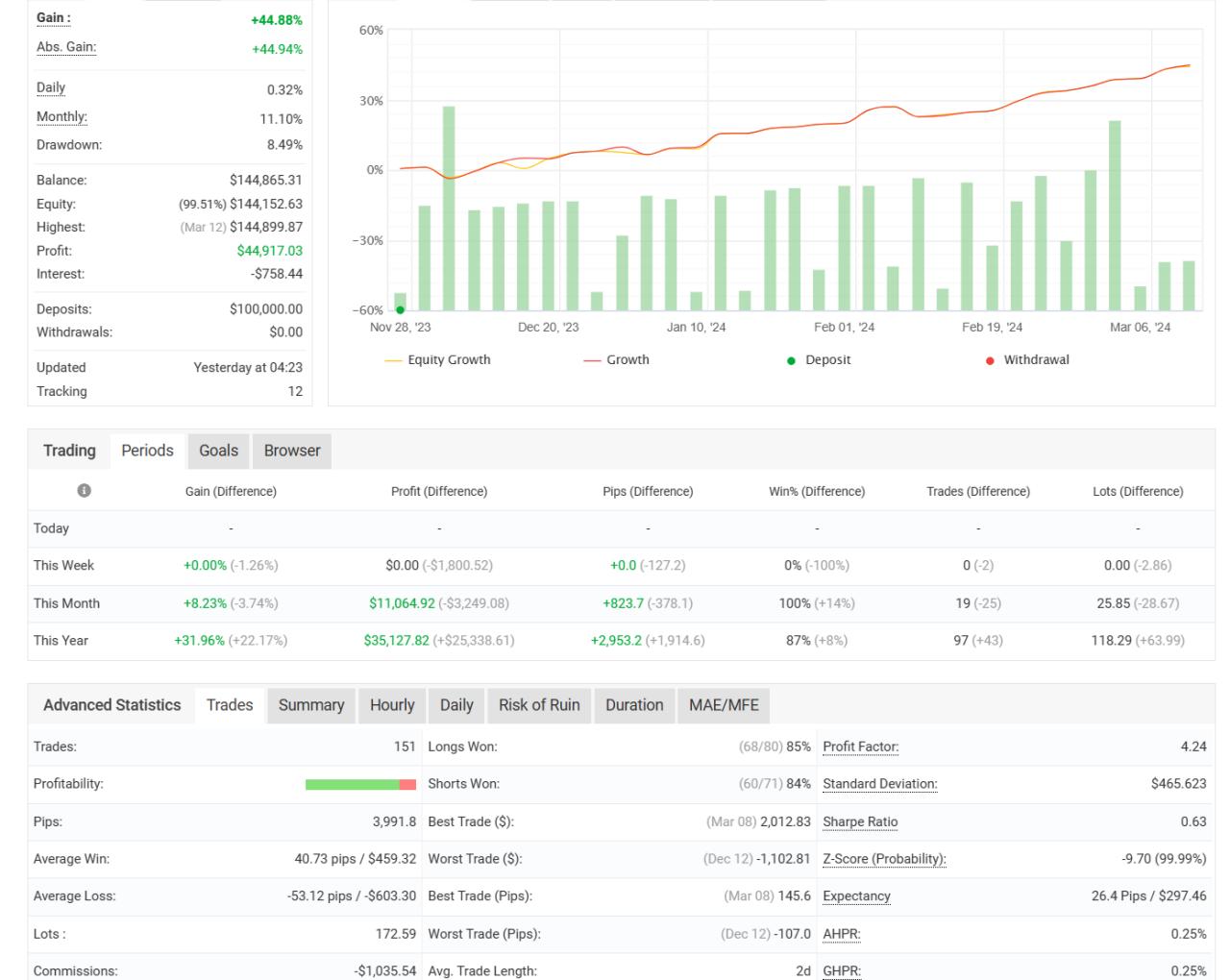

Live signal direct link1 : myfxbook.com/members/zayter/ai-tradingvision-gpx-demo/10561551

Live signal direct link2 : myfxbook.com/members/115863191/ai-tradingvision-gpx-gbpusd/10686462

Live signal direct link1 : myfxbook.com/members/zayter/ai-tradingvision-gpx-demo/10561551

Live signal direct link2 : myfxbook.com/members/115863191/ai-tradingvision-gpx-gbpusd/10686462

Introduction to AI Perspective Trading System

With the rapid development of AI technology, neural network technology has been quickly applied to various industries. However, we often cannot understand the decision-making and thinking methods of AI. Our EA (Expert Advisor) deconstructs and simulates the AI perspective to observe trading through visualization.

Our core team has over ten years of experience in the field of foreign exchange trading. Team members not only have rich industry experience, but they also have a deep academic background in their fields, allowing them to deeply understand and apply new technologies to deal with complex market dynamics.

GAN-Perceptron-XOR, also known as G.P.X, is an exceptional trading system that harnesses the power of Generative Adversarial Networks (GAN), Perceptron, and XOR operations. It is designed to create a robust trading tool capable of generating high-quality market data and trading signals, and making highly accurate predictions.

Firstly, it utilizes a Generative Adversarial Network (GAN) to simulate real-world financial markets. GANs generate new data that closely mirrors actual market data through 'adversarial' learning that occurs between a generative network and a discriminative network. This data is used to forecast possible future market trends.

The generated data is then fed into a Perceptron network. A Perceptron is the simplest form of a feedforward neural network, and its goal is to find the relationship between input data (the market data generated by the GAN) and the target result (e.g., the market rising or falling). Through training, the Perceptron can learn to recognize which market data patterns might lead to specific market behavior.

Finally, the system uses XOR operations to further process the Perceptron's output. In computer science, XOR is a binary operation that can be used to determine whether two bits are the same. In this system, XOR used to compare the Perceptron's predicted results with actual market behavior.

Some current suggestions and instructions for use:

- Once you've bought our product, please get in touch for the latest advice and updates: Click 'Send Message' to reach us.

- Currently recommended currency pairs:GBPUSD, AUDUSD, EURUSD

The configuration file is built-in, and you only need to use our recommended currency pairs with the default settings.Our strategy spans larger fluctuations, so high lot sizes are not needed.You can change the risk value based on your own risk tolerance, but it's advised to start with a risk value of 0.01 or min lot size mode or on a demo account to become familiar with how the EA operates first.

In live, EA needs to use its learned experience to predict, but it can be disrupted by news events. So we believe it should be somewhat conservative and leave some room for maneuver. Generally speaking, a maximum drawdown of less than 20% in backtests is considered safe, less than 10% is low risk, and over 30% is high risk. We suggest that keeping it around 10% can more easily cope with risks. Since the minimum value for the number of trades is 0.01 lots, when reducing the risk value cannot decrease the drawdown, increasing account funds is an option.

Explanation of lot size modes: These modes only affect the size of the order lot.

1. Risk mode: This mode calculates the order lot size before each trade based on the size of the funds and the risk value, allowing for compound growth.

2. Initial capital mode: This mode calculates the order lot size only once when the EA starts running, based on the size of the funds and the risk value. After that, changes in capital will not affect the lot size, so there is no compound growth.

3. Minimum lot mode: This mode uses the smallest lot of 0.01 for orders.

4. Custom mode: This mode uses a custom lot size value for orders.

5. Low-risk mode: Uses the first type of risk mode corresponding to a risk value of 0.005. It is effective with capital over $2,000. Below $2,000, it actually corresponds to a moderate risk of 0.01.

6. Medium-risk mode: Uses the first type of risk mode corresponding to a risk value of 0.01.

7. High-risk mode: Uses the first type of risk mode corresponding to a risk value of 0.02.

8. Highest-risk mode: Uses the first type of risk mode corresponding to the maximum risk value of 0.03.

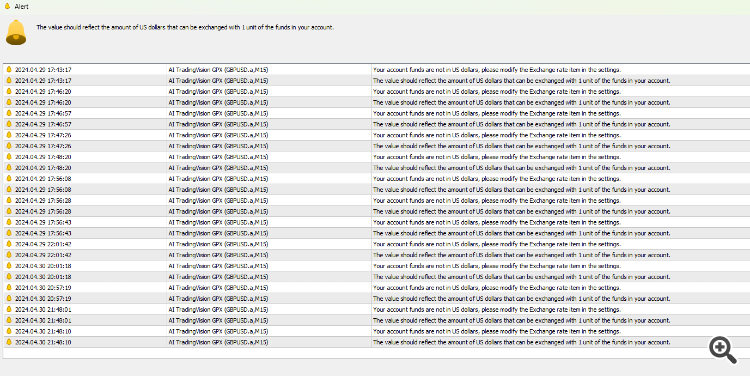

In backtesting mode, the EA cannot automatically obtain exchange rates. You need to change the account balance exchange rate to USD through the settings to standardize the risk value.

Our EA is not a high frequency trading EA, so it's normal to only have trading opportunities once every two or three days. Generally, as long as the hat icon in the top right corner of the main window turns blue, it proves the EA is running correctly.

In this market, people are used to scalping for fast profits, but scalping is difficult to maintain steadily. Also because the points gained per trade are too few, it requires very high position sizes, and is prone to blow up accounts when unusual market conditions occur. Our strategy can avoid these risks very well, and is also the common practice for large capital. Long term compounding is the low risk way to profit. Although such strategies are not popular among novice traders.

After starting, the EA will quickly look for opportunities to place orders. If there are existing positions in the backtest when the EA is set to order, this can result in different position entries between backtesting and live trading. However, synchronization is usually achieved after one or two trades, so there is no need for concern. If you wish to avoid this, you can start the EA when there are no open positions in the backtest; a last order comment of "stop of end" indicates that there are open positions. But, as backtesting data on the platform is typically half a day behind live market data, it may not be possible to accurately determine if there are orders at the current time. There's no need to deliberately sync.

We do use a real account for trading, and the results are consistent with backtesting. However, there needs to be a synchronization process. Synchronization is achieved when there are no open orders in both backtesting and live trading. This ensures that the entry and exit points will be consistent.

Please subscribe to the product channel for update, important notification services: Click to open the channel and subscribe at the top.

We use IC Markets RAW account data to train and test models. There are slight differences in data from different brokers. Using the same broker account avoids getting different results from our test account. https://icmarkets.com/?camp=74686Q&A

Q: What if We cannot respond immediately due to time zone differences?

A: If the time zone differences prevent immediate responses, we will reply within one business day after receiving a private message. Please be patient.

Q: How to handle synchronization issues when starting EA with positions from backtesting?

A: Upon starting EA, it will promptly seek trading opportunities. If there are existing positions from backtesting when placing live trades, this might lead to discrepancies in position points between backtesting and live trading. This typically synchronizes after one or two trades. To avoid this situation, activate EA when there are no open positions in backtesting; the "stop of end" comment indicates whether there are open positions. However, as backtesting data on the platform is usually half a day behind real-time market data, it may not be accurate to judge if there are current orders from backtesting.

Q: Why do some customers report poor live trading performance and inability to profit?

A: The main issue stems from slight inaccuracies in broker data due to internal order matching. We recommend using a broker and account type that aligns with our trained model to minimize differences. Our partner broker is a globally recognized major institution, ensuring the security of your funds. https://icmarkets.com/?camp=74686

Q: How should customers provide feedback if they encounter any issues?

A: If you encounter any issues, please contact our customer service team via private message to describe the situation first. Leaving a negative review directly is irresponsible, as it doesn't solve the problem and can harm both parties' interests. We expect responsible communication. contact our customer service team

Conclusion

- Modify Time: The time for modifying the price of the trailing stop. Zero means there is no limit to the modification interval.

- Buy and Sell Comments: The comments when the EA makes a buy or sell order.

- Max Drawdown (%): The maximum drawdown limit. If this limit is exceeded, it will close the orders with the same Magic number and the same currency pair under this EA.

- Recovery Time after Max Drawdown (hour): The recovery time required after triggering the maximum drawdown, measured in hours.

- Order Correction Interval Mode: The order correction uses the default settings or user-defined settings. We have obtained the optimal interval time based on big data and built-in corresponding parameters for each currency pair. If "Default" is selected, this option is effective. If "Customize" is selected, the value of the "Order Correction Interval" item will be used.

- Order Correction Interval: The interval points for each order after "Customize" is selected.

- Allowed Trading Direction: The direction in which EA is allowed to trade. Users can specify the direction of EA's orders based on their judgment of market trends.

- Order Lot Calculation Mode:

- In Risk Mode, each order calculates the lot size based on the available margin (Calculation formula: Lots = ACCOUNT_MARGIN_FREE / 1000 * Risk).

- The Initial Capital Risk Mode is similar, but it only calculates once each time the EA is loaded, and it won't calculate again regardless of profit or loss.

- Min Lot Mode will place orders using the minimum lot size, generally 0.01.

- In the Custom Lot Size Mode, the custom lot size below will take effect when this mode is selected, and orders will be placed according to this lot size.

- Risk Value Used for Backtesting: During backtesting, the EA will use this Risk value.

- Risk Value Used for Live Trading and Simulated Trading: During live trading and simulated trading, the EA will use this Risk value. This can prevent users from accidentally applying too large a risk value to live trading during testing (The maximum risk limit cannot exceed 0.03, and it is not recommended to use too high a risk value).

- Fix Lots: The number of lots to trade. Takes effect when using Custom Lot Size Mode.

- Maximum Lot Size Limit Allowed to be Breached: Each broker has a maximum limit for a single trade. When the maximum trading volume is reached, the EA uses repetitive orders to meet the order quantity.

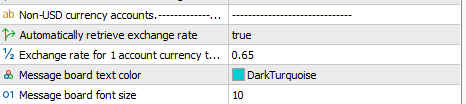

- Exchange Rate of 1 Account Currency into USD: When using a non-USD account, fill in how many USD can be exchanged for one unit of the account currency. For example, if one euro can be exchanged for 1.067 USD, you should fill in 1.067 here. This function can standardize the order lot size for accounts with different currencies.

NEW ADD:

Here are the instructions for AI tradingvision GPX:

The configuration file for our AI trading system, GPX, is built-in, so you only need to use our recommended currency pairs with the default settings. Our strategy covers broad fluctuations, so there's no need for high lot sizes. You can adjust the risk value to suit your personal risk tolerance. However, we advise starting with a risk value of 0.01 or the minimum lot size mode, or even on a demo account, to first familiarize yourself with the operation of the EA.

The default hand calculation method is not a percentage of funds. Our default calculation method is not affected by leverage and can control risk more accurately. The calculation formula is: Lots = Account available margin / 1000 × Risk.

In live trade, EA needs to use its learned experience to predict, but it can be disrupted by news events. So we believe it should be somewhat conservative and leave some room for maneuver. For risk considerations, you can refer to the maximum drawdown value from at least two years of backtesting.Generally speaking, a maximum drawdown of less than 20% in backtests is considered safe, less than 10% is low risk, and over 30% is high risk. We suggest that keeping it around 10% can more easily cope with risks. The default configuration 0.01 risk value can be considered medium risk. If you need to lower risk, you can reduce the risk value. For example, reduce 0.01 to 0.005.Since the minimum value for the number of trades is 0.01 lots, when reducing the risk value cannot decrease the drawdown,you could reduce the number of trades by using a custom interval mode and increasing the interval between orders,or increasing account funds is an option.

$1000 is recommended for a single currency pair. If using multiple pairs at the same time, it's suggested to add more funds and reduce the risk value for each pair.Remember to reduce the risk value.You can evenly distribute the 0.01 risk value to each currency pair.

You can set it flexibly based on your capital. If you only have $1000 in capital, We suggest you only use one currency pair. If you need to use multiple pairs simultaneously,We recommend:

Capital: Number of pairs needed x $1000, or even more.

Risk value: 0.01 / Number of pairs needed, or even less.

Our EA is not designed for high-frequency trading, so it's normal to only have trading opportunities every two or three days. Generally, as long as the hat icon in the top right corner of the main window turns blue, it indicates that the EA is running correctly.

Thank you for your support.