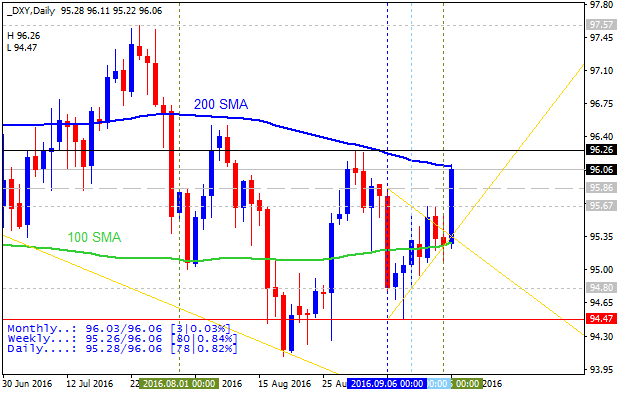

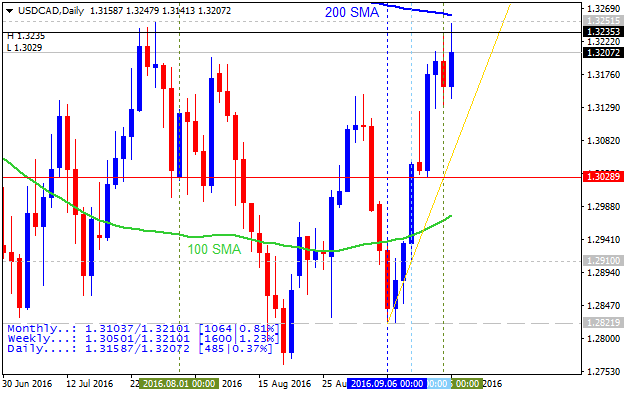

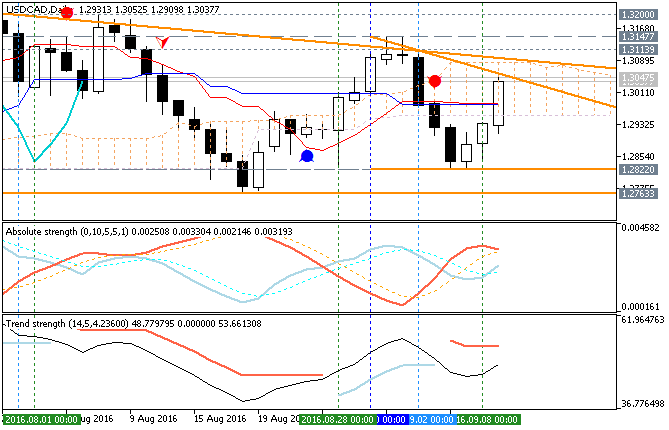

USDCAD Technical Analysis 2016, 11.09 - 18.09: possible bullish reversal on ranging way

Daily price is on secondary rally within the primary bullish

market condition: price broke one of Senkou Span line B of Ichimoku

indicator to above for the ranging rally to be located inside Ichimoku

cloud.

- The price is testing Senkou Span A line of Ichimoku indicator to above together with 1.3113 resistance level to be reversed to the bullish market condition.

- Chinkou Span line of Ichimoku indicator is breaking the price to above for the good possible breakout.

- Absolute Strength indicator is estimating the bullish reversal on ranging way in the near future.

If D1 price breaks 1.3113 resistance level on close bar from below to above so the reversal of the price movement from the ranging bearish to the primary bullish market condition will be started with 1.3200 level as a nearest daily target to re-enter.

If not so the price will be on bearish ranging within the levels.

- Recommendation for long: watch close D1 price to break 1.3113 for possible buy trade

- Recommendation

to go short: watch D1 price to break 1.2822 support level for possible sell trade

- Trading Summary: bear market rally

| Resistance | Support |

|---|---|

| 1.3113 | 1.2822 |

| 1.3200 | 1.2763 |

SUMMARY : bear market rally

TREND : bearish