USD, EUR, JPY, GBP, AUD: Outlooks For The Coming Week - Morgan Stanley

USD: Bullish Despite the Fed. Bullish.

The more dovish Fed meeting does not change our bullish USD view. To us, the story for USD strength has always been much more about growth differentials than rate differentials. The Fed’s concern about global growth only highlights the extent to which this divergence continues. In the near term, there may be some short-lived retracement as markets reprice the first Fed hike, but we would use dips as a buying opportunity against EM and commodity currencies.

EUR: Still Supported from Risk. Neutral.

We remain bearish on EUR over the medium term but see reason for some support in the near term. EURUSD has been supported in the immediate aftermath of the Fed’s decision to keep rates on hold, benefiting from its inverse relationship with risk appetite. Eventually, we believe the effects of ECB policy and other bearish factors will push EUR lower, but we are not maintaining any shorts currently in our portfolio.

JPY: Expect Strength on Crosses. Neutral.

We see upside to USDJPY as limited and believe there is scope for JPY to strengthen on the crosses. The S&P downgrade is likely to have limited impact on the currency, with most debt held domestically and Japanese pension fund reallocation largely completed. Market expectations for further BoJ easing are still high, but our economists are not expecting such a development. Rather, they see focus on building domestic inflationary pressures, rather than importing it via weaker FX.

GBP: Risk-Appetite Driven. Bearish.

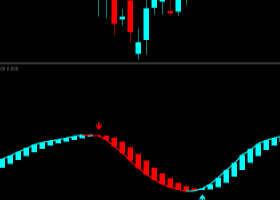

We maintain our long bearish GBP view and like to sell against USD and JPY. We note that GBP is highly sensitive to risk appetite as can be seen by its high correlation with our global risk demand index (GRDIIDX). For this reason we continue to monitor the equity market reaction in this Fed-dependent environment. With inflation remaining low and the BoE not changing its tone in the recent minutes, we remain watchers of rate expectations too.

AUD: A Relative Outperformer. Bearish.

We see scope for AUD to outperform in the near term, but prefer to play this via long AUDNZD or long AUDCAD positions, given our generally bearish view on commodity and EM currencies. Scope for fiscal stimulus from China should offer some support to the currency as well. On top of this, with a new prime minister, political uncertainty should be reduced somewhat, offering further support.