Fundamental Weekly Forecasts for US Dollar, AUDUSD, GBPUSD. USDJPY and GOLD

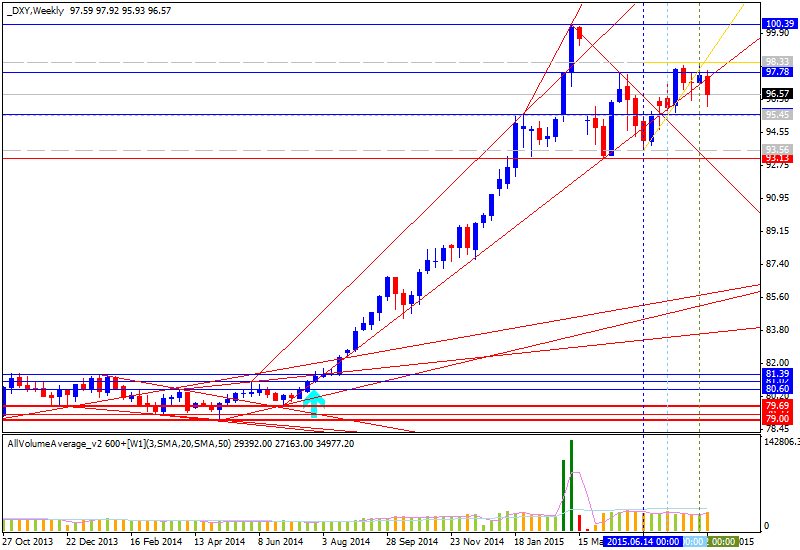

US Dollar - "Aside from data and the long weight for a return to active sentiment fluctuations, there is another motivator that Dollar traders should keep tabs on as it is unusual active: reserve interest. The US currency accounts for 64 percent of total world reserves, and that appeal produces a passive bid. Yet, that position is not rigid and nor is the USD. This past week we have seen the PBoC move to further open its exchange rate mechanism and Greece receive its bailout program. That will reinforce the Yuan and Euro – key Dollar counterparts."

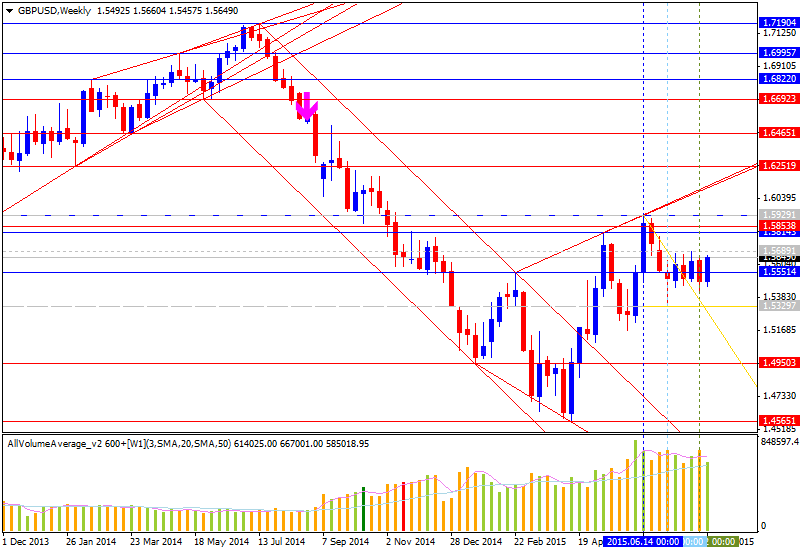

GBPUSD - "Recent CFTC Commitment of Traders data shows that large speculators remain marginally net-short the GBP/USD. Risks seem weighed to the downside absent major surprises out of upcoming UK economic data and Fed minutes."

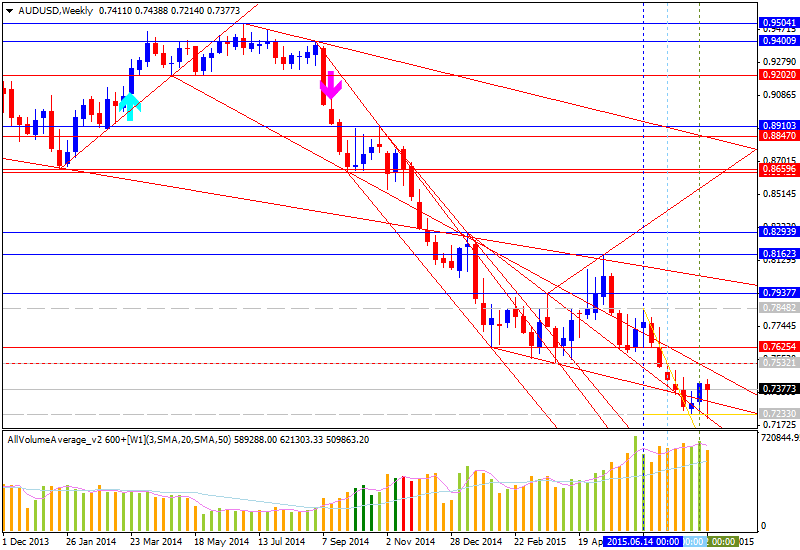

AUDUSD - "Domestically, the spotlight will be on minutes from Augusts’ RBA meeting. The document will probably reinforce the sense that central bank is firmly in wait-and-see mode. In fact, as much was firmly telegraphed by Assistant Governor Kent late last week. However, the degree to which the Aussie will be able to capitalize on the central bank’s shift away from a dovish posture this time around is unclear."

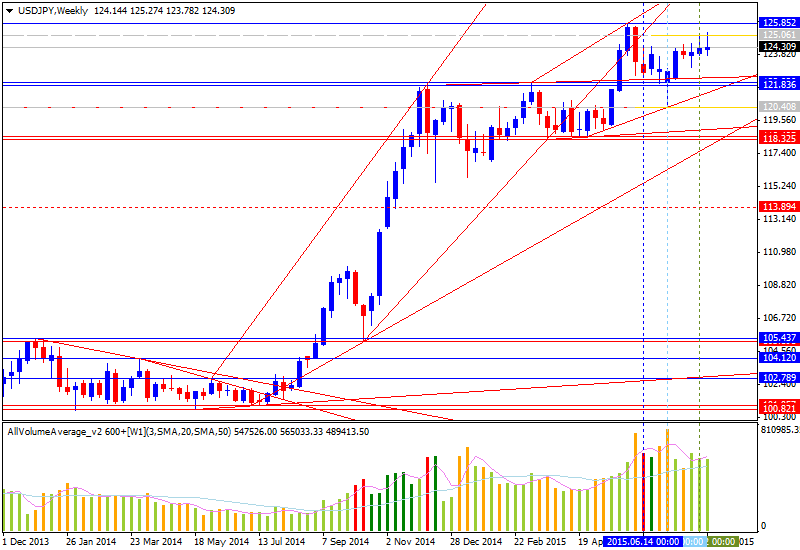

USDJPY - "Even though the long-term outlook for USD/JPY remains bullish amid the policy divergence, the fresh developments coming out in the days ahead is likely to produce increased volatility as market participants continue to gauge the timing of the Fed’s liftoff, while the BoJ keeps the door open to further embark on its easing cycle. With that said, we’ll continue to watch 123.80 (50% expansion) for near-term support, while resistance stands around 125.80 (61.8% expansion) to 125.84 (2015 high)."

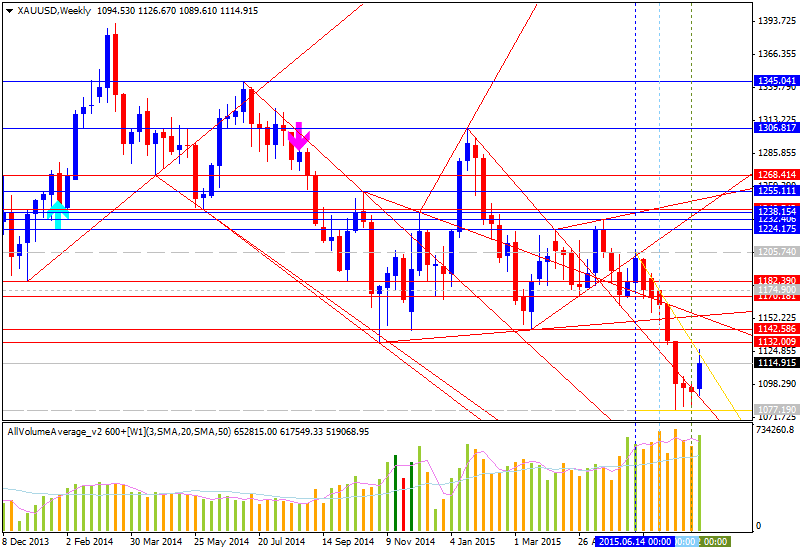

GOLD - "From a technical standpoint, gold turned from critical support we’ve noted over the past four weeks into 1067/70 where the median-line off the 2014 high converges on basic trendline support dating back to June 2006 and the 100% extension of the decline off the yearly high. Price has now broken out of a near-term descending median-line structure extending off the May high and although the broader bias remains weighted to the downside, near-term the risk for the rebound to press higher remains with key resistance & bearish invalidation eyed at 1145/50."