The Future of Currency Trading.

The outside trade business without bounds is prone to be greater, all the more firmly directed and more different—as far as monetary standards exchanged, the scope of business members, and the innovation and procedures connected.

Bigger volumes will reflect proceeding with financial development and more prominent interconnectedness, as well as forex's expanding significance as an advantage class. The huge banks and multifaceted investments will turn out to be less predominant, as new contestants with diverse points and exchanging techniques enter the business sector.

Without a doubt, there are numerous motivations to trust

that the time of the huge, high-hazard position merchant will end. One is the

steady ascent of algorithmic, or robotized, exchanging: in 2004, these

represented only 2% of all exchanges; this year, surprisingly, they surpassed

half.

At that point there are the new sorts of merchant. "The

globalization of speculation, with protection and benefits subsidizes now

significant financial specialists in worldwide capital markets, has prompted

the broadening of substances that consistently swing to the forex

business," says Professor Mark Taylor, senior member of Warwick Business

School in the U.K

"The business sector is turning out to be more divided

with new players coming in, in some cases from startling segments," says

Michael Kitson, a financial expert at the University of Cambridge Judge

Business School in the U.K. These incorporate forex-centered mutuals and trade

exchanged trusts, which may be the vanguard of a large group of option

mass-market venture items. There is additionally a developing armed force of

autonomous retail financial specialists, particularly in Asia and the Far East.

Mr. Kitson trusts that more prominent rivalry and business discontinuity will

help make a more level playing field.

On the other hand, the best effect on forex markets may be new enactment, for example, Dodd-Frank, EMIR and Basel III. Dodd-Frank's purported Volker Clause, for instance, intends to partitioned high-chance exercises, for example, subordinates exchanging, from retail and business keeping money, successfully confining exclusive exchanging by banks (i.e. banks exchanging with their own cash). "A principal purpose behind the instability is the reduced part of the banks as 'market producers' because of the restriction on exclusive exchanging," remarks Patrick Teng, author and boss merchant of Six Capital. He takes note of that "banks have begun to assume agent and the part of restrictive exchanging is presently being assumed control by autonomous entrepreneurial firms, (for example, Six Capital), banks turning off free units or even by flexible investments."

"Unmistakably, merchants are eliminating restrictive exchanging," says Chiara Banti, teacher in money at the University of Essex in the U.K., in spite of the fact that this may likewise be on account of Basel III intensifies banks' financing imperatives. Keeping in mind critical expectations of problematic new regulations have not yet appeared, the in all probability effect of more prominent straightforwardness will be smaller spreads. "Limitations on exclusive exchanging more likely than not diminished liquidity, so the banks are offloading their requests somewhere else in the business sector," Prof. Taylor says.

More tightly regulation to anticipate rate fixing—for which

more than $9 billion of fines have so far been forced—will make it less

demanding to squeeze charges against individual dealers and their directors. On

the other hand, a few controllers are moving speedier than others. "The

plenty of new money related regulations are not being globally

facilitated," says Mr. Kitson.

Another significant impact of new regulation is that banks will execute customer requests at the every day settle electronically, taking out the human component and fortifying the pattern towards algorithmic or robotized exchanging.

Dr. Banti takes note of that "regulation makes exchanging more costly, while low offer ask spreads renders business sector making less beneficial. Subsequently, there is less exclusive exchanging and a decrease in the liquidity gave by merchants."

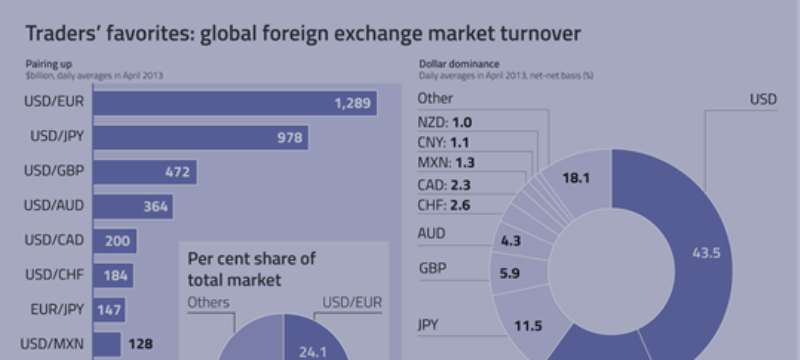

In the matter of what will be exchanged, Mr. Kitson expects, "a more different pool of monetary forms, including the yuan and the rupee, to inevitably join the primary coin sets exchanged, as these economies are substantial and becoming speedier than the U.S. then again Europe."

The very structure of the business sector is evolving. Prof. Taylor predicts a movement from the present "oligopoly" of banks, whose business sector creators and exchanging stages are broadly utilized by different players, towards a multilateral forex market. "The rise of new players will depend all that much on improvements in innovation and exchanging stages," he says.

"Thinking little and searching for approaches to total

achievement reliably is the best approach to make significant benefits and

recover liquidity," Mr. Teng. https://www.mql5.com/en/signals/120434#!tab=history