Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD: NFPs beat expectations, gold and crude oil drop from ranges

US Dollar - "Looking at the docket over the coming week for cues and milestones, we have plenty of big ticket items. The problem is that they may not hit the correct pitch. On the consumer front, we have the aggregate Labor Market Conditions report for May (Monday), retail sales and first quarter household wealth (Wednesday), as well as the University of Michigan Consumer Confidence report to close us out (Friday). Inflation figures will also be represented between import (Thursday) and factory inflation indicators (Friday). The week end sentiment report will also offer up inflation expectations figures. This falls short of the top-tier measures likely necessary to redefine our trend. To continue lifting the Dollar back to 12-year highs set in April, there needs to be a certain degree of conviction. To carry the market beyond that threshold requires near certainty amongst the speculative ranks. We may have to wait until the Fed delivers its views before we find the market is prepared to commit itself to such a run…or further capitulate on its long-term advance."

GBPUSD - "The opening range for June will largely be in focus going into the key event risks line up for the week ahead, and a round of positive U.S. data prints may heighten the appeal of the greenback as the Fed is likely to retain an upbeat tone at the June 17 interest rate decision. On the other hand, a dismal consumption report may undermine the Fed’s expectation for a stronger recovery, and the pound-dollar may threaten the series of lower-highs carried over from the previous month should the data prints point to a further delay in Fed liftoff."

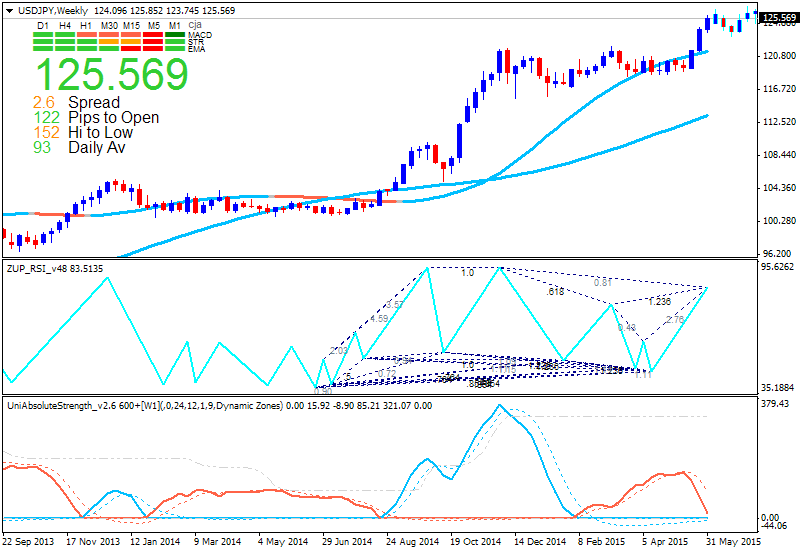

USDJPY - "The USDJPY moves in fits and starts—it is known to consolidate for months on end until ultimately breaking sharply in one direction. And indeed we recently argued that its recent break higher bears a clear resemblance to major rallies in the 2013 and 2014. On this alone we like trading it higher, but past performance is no guarantee of future results. It will be important to keep an eye on bond markets in the week ahead to judge the likelihood of continued yield-driven JPY declines."

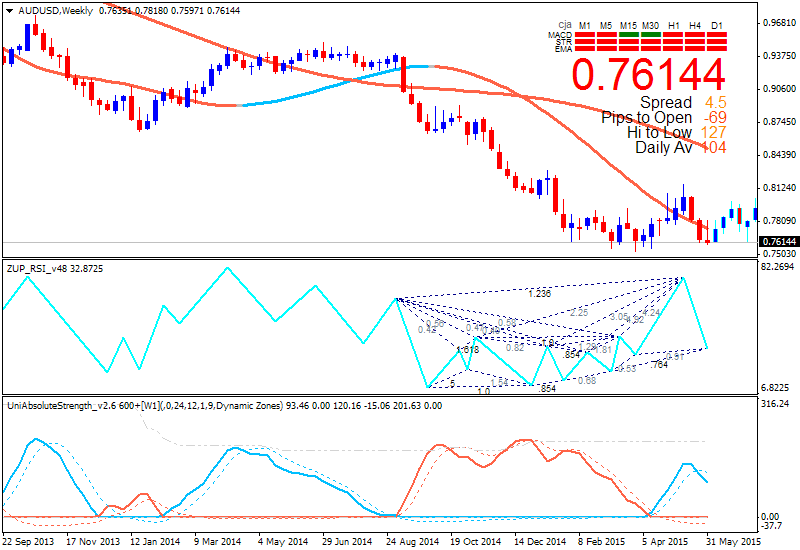

AUDUSD - "Aussie’s rebuilding correlation with the MSCI World Stock Index (0.65 on rolling 20-day studies) suggests it may find itself dragged alongside sharp swings in risk appetite. Volatility risk comes from on-going deadlock in the negotiations between Greece and its creditors as well as churning speculation about the timing of the first post-QE Fed interest rate hike ahead of the subsequent week’s FOMC sit-down."

GOLD - "From a technical standpoint, gold broke below trendline support dating back to the 2015 low on Wednesday with the break charging a decline into targets noted last week at 1176 & 1164 (stretch low was 1162). Prices have continued to hold within the confines of a well-defined descending pitchfork formation with Friday’s NFP decline taking the through the ML. We could get a near-term bounce early next week as RSI holds-40 into the close of the session but the broader focus remains weighted to the short-side while within this formation with a breach above 1179/80 invalidating our near-term bias. Such a scenario targets resistance objectives into the broader MLP off the yearly highs at ~1194/95. Key near-term support rests at 1163/64 where the 61.8% extension of the decline off the May highs converges on the 76.4% retracement off the advance off the March low. A break below this level targets key support into the November 2014 TL support / 1150/51."