Trading the News: U.K. Gross Domestic Product (GDP) - Preliminary U.K. 4Q GDP to Expand an Annualized 2.5% Amid Lowest Print Since 4Q 2013

An upward revision in the U.K. 1Q Gross Domestic Product (GDP) print may

heighten the appeal of the British Pound and spur a near-term rebound

in GBP/USD as signs of a stronger recovery raises the Bank of England’s

(BoE) scope to normalize monetary policy sooner rather than later.

Why Is This Event Important:

A marked uptick in the growth rate may spur a growing dissent within the

Monetary Policy Committee (MPC) as the central bank remains on course

to normalize monetary policy, and we may see a greater number of BoE

officials prepare U.K. households and business for higher

borrowing-costs as the economy gets on a firmer footing.

However, the widening trade deficit paired with the ongoing slack in

private-sector activity may drag on the growth rate, and a dismal GDP

figure may further delay the BoE’s normalization cycle especially on the

back of the uncertainties clouding the outlook for fiscal policy.

How To Trade This Event Risk

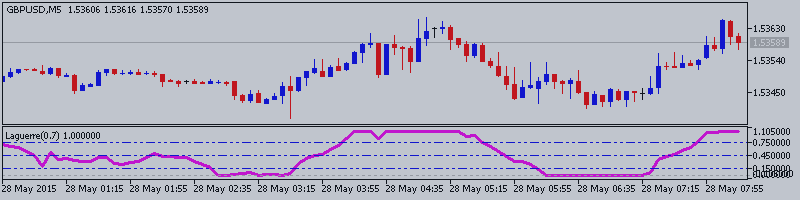

Bullish GBP Trade: U.K. 1Q GDP Expands Annualized 2.5% or Greater

- Need to see green, five-minute candle following the GDP report to consider a long trade on GBP/USD.

- If market reaction favors a long sterling trade, buy GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in the opposite direction.

GBP/USD Daily

- GBP/USD remains at risk for further weakness as price & the RSI fail to retain the bullish formation carried over from April;

- Interim Resistance: 1.5550 (61.8% expansion) 1.5570 (38.2% retracement)

- Interim Support: 1.5180 (23.6% retracement) to 1.5190 (50% retracement)