All Blogs

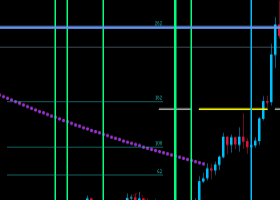

EURUSD risk remains lower on further decline in the new week as it closed lower the past week. Support stands at the 1.1300 where a break will aim at the 1.1250 level. A break below here will target the 1.1200 level. Further down, support lies at the 1.1150. On the upside, resistance resides at 1...

PASR is a total method. It revolves around PRICE ACTION at SUPPORT and RESISTANCE. It is not just PRICE bouncing off SUPPORT and going to RESISTANCE or vice versa. It is about WATCHING what PRICE does at these important PRICE levels. Read this awesome topic on ForexFactory to learn more...

From the day that you decide make the move from a demo account to a live account, things change in ways that you could never really be fully prepared for. What is trading psychology...

UBS, which is a leading banking company hailing from Switzerland has decided that it is time to face the coming Brexit fallout ahead of time and completely withdraw from the island nation. The banking giant has been given the approval to take out more than EUR 32 billion out of the UK...

First, a review of last week’s events: - EUR/USD. One of the development scenarios, supported, however, by only 30% of experts, suggested a decline of the pair to the lower border of the medium-term side channel 1.1300-1.1500...

Version for MT4 GS target: https://www.mql5.com/en/market/product/33127 Version for MT5 GS target5: https://www.mql5...

The Reserve Bank of India (RBI) seems to have made a major turn back, adopting a full dovish rhetoric after having favored a hawkish stance in the past, a move that surprised the market, which was expecting a neutral posture given Fed’s recent monetary policy meeting...

The Bank of England (BoE) joined a growing list of central banks shifting gears towards a dovish stance. Following high profile adjustments at the Fed and ECB, the BoE indicated that Britain is now confronted its weakest economic growth in 10 years...

General information NewsBreaker EA is trying to trade strong short-term trends during the announcement of important economic news. The EA is supported by an integrated news filter. The economic news calendar of investing.com is used. To open suitable trades the Expert Advisor uses several filters...

Three months ahead of general elections, the new Reserve Bank of India (RBI) Governor Das surprised the marketplace with a rate cut of 0.25%, putting the Current Rate at 6.25%. No change had been expected...

When central banks loosen money, it’s time to get bullish and fill your boots with shares. Loose money has been the primary inflator of asset prices in the last 10 years or longer. Should 2019 see slower economic growth – but easy money – equity prices will rise...

Pivot (invalidation): 52.75 Our preference Short positions below 52.75 with targets at 51.80 & 51.35 in extension. Alternative scenario Above 52.75 look for further upside with 53.10 & 53.75 as targets...

Pivot (invalidation): 15.6200 Our preference Long positions above 15.6200 with targets at 15.7500 & 15.8600 in extension. Alternative scenario Below 15.6200 look for further downside with 15.5400 & 15.4300 as targets...

Pivot (invalidation): 1306.00 Our preference Long positions above 1306.00 with targets at 1313.00 & 1317.00 in extension. Alternative scenario Below 1306.00 look for further downside with 1303.00 & 1299.50 as targets...

Pivot (invalidation): 2725.00 Our preference Short positions below 2725.00 with targets at 2687.00 & 2671.75 in extension. Alternative scenario Above 2725.00 look for further upside with 2740.00 & 2774.25 as targets...

Pivot (invalidation): 11120.00 Our preference Short positions below 11120.00 with targets at 10919.00 & 10825.00 in extension. Alternative scenario Above 11120.00 look for further upside with 11175.00 & 11237.00 as targets...

Pivot (invalidation): 5.2380 Our preference Long positions above 5.2380 with targets at 5.2780 & 5.2960 in extension. Alternative scenario Below 5.2380 look for further downside with 5.2220 & 5.2060 as targets...

Pivot (invalidation): 0.7105 Our preference Short positions below 0.7105 with targets at 0.7055 & 0.7030 in extension. Alternative scenario Above 0.7105 look for further upside with 0.7120 & 0.7140 as targets...

Pivot (invalidation): 1.3290 Our preference Long positions above 1.3290 with targets at 1.3355 & 1.3375 in extension. Alternative scenario Below 1.3290 look for further downside with 1.3260 & 1.3230 as targets...