All Blogs

CitiGroup Technicals believe that USDJPY will move higher soon for breaking 125.85 resistance level: "We are back above the inverted head and shoulder neckline/prior range top on USDJPY (124.49 and 124.58. respectively), which opens the way for towards the June high (125.85...

Last week overview Many analytics are talking that the probability for Fed rate hike is increased because of Employment report last Friday. Besides, there were some other news events which were affected on this probability: On Tuesday: hawkish talk from Atlanta Fed's Lockhart...

The euro dipped against the dollar on Tuesday after data showing that German economic sentiment unexpectedly deteriorated this month. EUR/USD was trading at 1.1025, from around 1.1037 ahead of the report. The closely watched ZEW index of German economic sentiment fell to 25.0 this month from 29...

JP Morgan estimated the false breakout by bouncing back starting to range between very strong support/resistance levels. Market refused to make necessary breaks to established good stable trend, says JP Morgan. "Market keeps on bouncing back and forth in a range between 1...

Oil price shows acrobatic jumps. After Monday's recovery, today it fluctuates sharply. Front-month WTI futures were at $44,64 (by 7.56 GMT), Brent at $50.72. This is a new decrease, compared to Monday: WTI fell 0.38%, Brent – 0.61...

Gold is still trading weaker with investors bracing for the hike as soon as September. However, ETF Securities' Mike McGlone talks about investor outflows in gold and other precious metals. Is it time for a short covering rally in gold...

Barclays evaluated the recent NFP data and made the conclusion that FOMC has already decided about what to tell during the next meeting. Barclays watched the job data and established the correlation between job market and FOMC decisions concerning the inyerest rate to be changed...

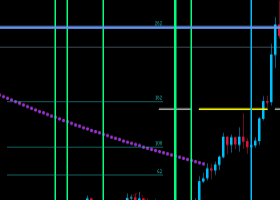

H4 price is on ranging market condition for breaking Ichimoku cloud two times from yesterday. Price is located inside Ichimoku cloud with ranging between 1.1040 resistance and 1.0847 support levels...

Bank of America Merrill Lynch is continuing with their fundamental forecasts concerning US Dollars related to the other currency, and continuing with criticizing the Federal Open Market Committee concerning their actions for example: "We argue that only a small part of the strong dollar rally sin...

China’s decision to devalue the yuan is good news for dollar bulls. China’s central bank cut the yuan’s daily fixing rate by a record 1.9 percent Tuesday after the International Monetary Fund last week delayed a decision to endorse it as a reserve currency...

US Dollar - "This week docket isn’t shabby for market movers – retail sales, UofM sentiment survey, upstream inflation reports, small business optimism and a July labor conditions aggregate – but none of the offerings carry the mark of a decisive view changer...

The strategy is to BUY low and SELL high. There was a price drop in eurusd which brought the prices close to the MAs in H4 and D1. Probably, it could go even a little bit lower, but entered a BUY order with a small lot size just to convey the idea of BUY from a LOW...

CRUDE OIL: With Crude Oil putting in a temporary bottom on Monday, it faces a move higher on correction. Resistance is located at the 45.50 level where a break will expose the 46.20 level. A break below here will aim at the 47.00 level and then the 48.00 level...

Barclays is suggesting to buy USD/CHF as the most tradable pair for this week: "We think poor Swiss fundamentals continue to support CHF depreciation from still-overvalued levels...

• Goldman in Ventureland: The inside story of how-and why-Goldman Sachs became a tech-investing powerhouse (Bloomberg) • Will Advances in Technology Create a Jobless Future...

This is busy week for euro with one high impacted news event - on Tuesday morning we will see ZEW German business confidence data which is expected to remain the same as last month’s figure: 63.9. And the figure which comes in below the expectations could prompt weakness...

This is the other interesting pair you can make money with, together with AUDCAD and NZDUSD. W1 price is on primary bullish with ranging between the levels: 2.1525 resistance level, and 1.9822 support level...

Refer to my old posts for more details on the forecast. As predicted in my previous posts, Gold and EURUSD are on their upward trend in D1. Please do remember that, i believe it as a retracement in MN and hence it could really go up in spikes...

Oil Predominantly Drills Into C$. As oil costs have taken a further fall, they've dragged the C$ in the interest of personal entertainment. No genuine astonishment there, after all the two are truly exceptionally associated...