All Blogs

The ECB President Mario #Draghi did not disappoint, providing the long-awaited “show” in the #EURUSD #market. After his speech the lower graphic border of the consolidation pattern "triangle" was broken. Find out more by checking out the Source Link...

YEN has been weak for the last couple of days, and thus AUDJPY has gone north, after making Double Bottom. In fact, this is one of the textbook reversal patterns – Double Bottom + Higher High. (Bullish divergence is a plus!) When we see this patter, we should look for Higher Low, and buy...

EUR/USD: Neutral: Daily closing below 1.0800 would indicate start of bearish phase. The break of 1.0800 suggests that the downward pressure is increasing rapidly. However, we prefer to see a daily closing below 1.0800 before expecting a sustained down-move in EUR/USD...

While the Federal Reserve is expected to perform "the loosest tightening on record," the normalization policy will nonetheless put "some upward pressure on bond yields," leading Christopher Case, Vice President and Director at TD Asset Management, to seek protection in U.S...

Pivot Points - Hourly Last Updated: Jan 22, 11:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.07856 1.0805 1.08176 1.08244 1.0837 1.08438 1.08632 USD/JPY 117.627 117.846 117.955 118.065 118.174 118.284 118.503 GBP/USD 1.41797 1.42043 1.42182 1.42289 1.42428 1.42535 1.42781 USD/CHF 1.00558 1...

After yesterday's #ECB meeting, it was a press conference of its head, Mario #Draghi. He said that the interest #rate will remain at the same level or lower for a long time. The #market understood it as a hint at the rate cut in March. Find out more by checking out the Source Link...

Pre European Open, Daily Technical Analysis Friday, January 22, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: under pressure. Pivot: 1.0895 Most Likely Scenario: short positions below 1...

I like to say, “Trading is a much more about observation”. When I last wrote about GBP/USD, it was testing a 30-year trendline into a turn window related to the 2014 – 2015 decline. The market ‘recovered’ from this time/price support for less than two days before turning down sharply again...

Pivot Points - Hourly Last Updated: Jan 22, 10:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.08042 1.08187 1.08249 1.08332 1.08394 1.08477 1.08622 USD/JPY 117.673 117.858 117.965 118.043 118.15 118.228 118.413 GBP/USD 1.41843 1.42071 1.42201 1.42299 1.42429 1.42527 1.42755 USD/CHF 1.00689 1...

In the first meeting of the European Central Bank for this year it proved Mario Draghi interest rates at 0.05%. Pair the euro against the US dollar lost about 150 points during Mario Draghi permit to test the 1.0776 area, no doubt today that the high volatility caused by the permit...

Pivot Points _ Daily Last Updated: Jan 22, 9:00 am +03:00 Symbol S3 S2...

Pivot Points - Hourly Last Updated: Jan 22, 9:00 am +03:00 Symbol S3 S2...

Hello Traders, Tuesday the 26th of January is Australia Day. This holiday will temporarily influence Australia 200 Index market hours. Currency and Commodity market hours will not be impacted by this holiday. Please see the table below for details...

GBPUSD: Having turned higher after taking back its intra day losses on Thursday, GBPUSD threatens more recovery pressure on correction. Support lies at the 1.4200 level where a break will turn attention to the 1.4150 level. Further down, support lies at the 1.4100 level...

USD/JPY bulls recovering eyeing 118 handle 22 Januari 2016 12:35 AM FXStreet (Guatemala) - USD/JPY has been better bid in a better risk environment instigated on the ECB and now massaged out of the markets while the Chinese crisis has started to stabilize...

AUD/USD: Bulls in a mission to keep 0.70 handle 22 Januari 2016 12:43 AM FXStreet (Bali) - AUD/USD has been climbing steadily since the start of business in the last US session, with Asian traders tracking the positive sentiment, as price reaches levels as high as 0...

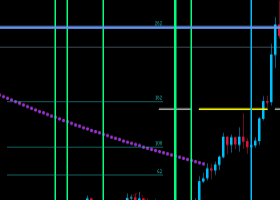

HI all fr my new strategy you can see 1750 pips in 1st month from 21/12 to 21/01 361$ from original deposit 750$ means +40% monthly profit wait our strategy to be on line thanks...

Billionaire financier George Soros has warned that the European Union is on the "verge of collapse" over the migrant crisis and is in "danger of kicking the ball further up the hill" in its management of the issue which has seen more than a million migrants and refugees arrive in the region in 20...