All Blogs

Dollar Slides Versus Most Majors Ahead Of Consumer Sentiment Index The University of Michigan is scheduled to release its preliminary consumer sentiment index for March at 10 am ET Friday. Economists expect the index to rise to 92.2 from 91...

Canadian Dollar Extends Rally After Strong Retail Sales Data The Canadian dollar extended its early advance against the other major currencies in European deals on Friday, as Canadian retail sales accelerated at a faster pace in January...

Gold Recovers from 5-DMA Support Gold found support at 5-DMA level of $1247.87, but remains weak on the day around $1252.45 levels amid minor recovery in the USD index and moderate gains in the US stocks. Is Gold unimpressed by dovish Fed...

USD/JPY Extends Gains Ahead of Fed Speak The US dollar stays on a front foot against Japanese Yen, pushing USD/JPY higher to 11.60 levels ahead of speeches from Fed’s Rosengren and Dudley...

Analysts at Rabobank explained that Thursday was a busy day for central banks. As expected the Bank of England left policy on hold yesterday in an unanimous decision...

Three months since the U.S. lifted a 40-year ban on oil exports, American crude is flowing to virtually every corner of the market and reshaping the world’s energy map. Overseas sales, which started on Dec. 31 with a small cargo aboard the Theo T tanker, have been picking up speed...

EUR/USD Attempts a Tepid Bounce to 1.1300 The single currency is trimming earlier losses vs. the dollar, now pushing EUR/USD back to the area of 1.1290/1.1300 ahead of US data...

That was the week that was It has now been a week since the ECB delivered its latest package of measures and so far, the initial market reaction appears to have been positive...

GBP/USD Attempting Break Above 1.45 GBP/USD turned positive and is now attempting to break above 1.45 handle after BOE’s quarterly bulletin informed markets about UK economy’s resilience to China slowdown...

EUR/NZD Analysis for March 18th, 2016 Overview: Recently, EUR/NZD has been moving downwards. The price tested the level of 1.6590. In the H4 time frame, I found support level at the price of 1.6500, which is successfully held...

While reading into the cross-market impact on the dollar from equity and rate markets has been somewhat challenging lately, we believe most scenarios will leave the USD on the defensive...

The dovish outcome of the March Fed meeting dealt a blow to the FX divergence trade and it has sent the USD tumbling of late. We doubt that this is the end of the multi-year USD bull-run, however, and see the current levels as an opportunity to establish fresh USD-longs...

Gold Analysis for March 18, 2016 View : Since our last analysis, gold has been trading downwards. The price tested the level of $1,253.45. Strong resistance level is set at the price of $1,282.80...

According to FX Strategist at Scotiabank Eric Theoret, the pair’s outlook looks bearish in the short-term horizon. “GBP gains have run into considerable resistance at 1.45”. “Momentum signals are only modestly bullish and the trend has yet to be confirmed”. “A sustained break of 1...

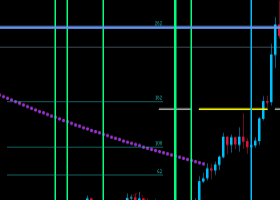

USD/CAD Intraday Technical Levels and Trading Recommendations for March 18, 2016 A bullish breakout above the previous consolidation zone between 1.2400 and 1.2800 was performed on July 15 (shown on the weekly chart). A significant bearish rejection was observed around 1.3450...

Intraday Technical Levels and Trading Recommendations for GBP/USD for March 18, 2016 On January 21, after the GBP/USD pair moved below 1.4220, evident signs of bullish recovery were expressed around 1.4075. Hence, previous weekly candlesticks closed above 1.4220 and 1.4360 again...

Intraday Technical Levels and Trading Recommendations for EUR/USD for March 18, 2016 In January 2015, the EUR/USD pair moved below the major demand levels near 1.2100 and 1.2000 where historical bottoms had been previously set in July 2012 and June 2010...

Technical Analysis of NZD/CHF for March 18, 2016 After finding the bottom near the 0.6500 psychological level and forming a bullish divergence on the RSI oscillator, NZD/CHF moved higher and broke the descending channel. At the same time, the pair broke above the very strong resistance (0...

Our long position in #GPBUSD opened on a breakthrough of a fractal up at 1.4438 is still relevant. Among additional signals we have only one bar of a «green zone». Find out more by checking out the Source Link. Please note that this post was originally published on Vistabrokers.com...

Technical Analysis of CHF/JPY for March 18, 2016 The CHF/JPY pair is expected to move lower after testing the 115.40 resistance (R1). Consider holding short positions with a stop loss just above R1, targeting either S1 (114.10) or S2 (113.60) as the final target for a potential upcoming wave down...