All Blogs

Article 50 of the European Treaty triggers fear among British policymakers. It seems that nobody wants to touch it with a barge pole. Will the Bregret turn into a Bremain instead of Brexit...

It was quite a surprise when the US Federal Open Market Committee released its statement following the 15 June monetary policy meeting: “…Information received since the Federal Open Market Committee met in April indicates that the pace of improvement in the labor market has slowed… …Although the...

The British decision to leave the EU continues sending shock-waves through financial markets with wide ranging implications. In currency markets, the biggest victim is obviously the pound, with the euro following suit...

Soothing words for markets from Osborne? That helped for a very short time and resumes its falls and is basically on its own. While there is a general “risk off” atmosphere which also weighs on the euro and commodity currencies, the fall in the value of GBP is at a higher order of magnitude...

Further comments from the Chancellor We should move towards arrangement that provides the closest possible economic ties with our neighbours Urgency is required to establish new arrangements with EU There has been no disorder in financial markets Does not expect the situation to deteriorate but h...

The US has another crack at picking a number for its Q1 GDP at 12.30 GMT Despite closing off Q2 this week, the US is still trying to get Q1 data right. The last showing of 0.8% GDP is expected to rise to 1.0% in the final reading. Consumer spending stayed at 1...

Details of the final Q1 2016 US GDP data report 28 June 2016 2nd est 0.8% Advance 0.5% Q4 2015 1.4% Personal consumption 1.5% vs 2.0% exp. Prior 1.9%. Q4 2015 2.4...

The Fed has repeatedly been upbeat on consumers The US GDP Q1 final revision was slightly higher than expected but it raises fresh questions about future growth. Consumer spending was revised down to +1.5% from +1.9%. Economists had expected a boost to 2.0...

Details of the April 2016 US Case Shiller house price index report 28 June 2016 Prior 0.9% 5.4% vs 5.4% exp y/y. Prior 5.4%. Revised to 5.5% NSA 1.1% vs 0.9% prior m/m. Prior revised to 1.0% US HPI 5.03% vs 5.15% prior y/y. Revised to 5.11...

USD/JPY nears Monday's high of 102.48 The pair is just a couple pips below Monday's high as stock markets open. It's bounce day but will it be of the dead cat variety? The strength of the bounce is often a good indicator of the strength of the trend...

S&P 500 up 22 points to 2024 It's bounce day. Will the bears sell the bounce? One clue will come from the technicals. The S&P 500 is testing the May low of 2025. Whether that breaks and whether we close above it are critical...

June consumer confidence from The Conference Board Prior was 92.6 (revised to 92.4) Best since October 2015 The index jumped from the worst since July 2015 to the best since August 2015. Details...

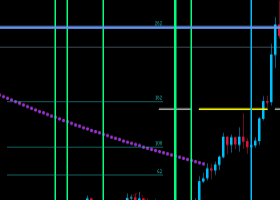

EUR/USD: We are bearish and look for resistance in the 1.1130 area to cap a move lower towards initial targets near Friday’s 1.0910 lows and then towards a swing target near 1.0840. Beyond there we are looking towards the 1.0710 area. Copy signals, Trade and Earn $ on Forex4you - https://www...

In Q4 2016, the new prime minister triggers Article 50 of the EU Treaty by notifying the EU that the UK intends to leave. That opens a two-year window for negotiating a withdrawal agreement...

Winners and losers of globalization at odds The dominant theme of the past three decades is globalization. It's meant open borders and open trade. The backlash is here. The Labour Left vs the Latte Left The wedge looks like it's immigration but it's really political correctness...

Dead cat or sustainable? I think there is far too much turmoil and uncertainty in the UK to sustain the bounce in European stock but it was party time today. UK FTSE +2.5% French CAC +2.5% German DAX +1.9...

Cable bounce fades All the gains since the start of London trading have evaporated and GBP/USD is now up just 60 pips on the day to 1.3284. The high was 1.3419. The level to watch is yesterday's US low of 1.3260. A break below would confirm that the minor uptrend since late yesterday is broken...

Firms uncertain about trade with Europe John Cridland, the Director-General of the Confederation of British Industry met with UK political leaders and his verdict was negative. He said he didn't come out of the meeting feeling great...

Draghi scoop from Bloomberg Bloomberg obtained Draghi comments from an EU Summit document. Sees GDP reduction for at least 3 years Concerned Brexit will lead to competitive devaluations It's time to address bank vulnerabilities...

Boris Johnson vs Theresa May A poll, which looks like an online survey, was released from UK website ConservativeHome today and showed a slight lead for Theresa May over Boris Johnson. It's not clear who will be in the race yet ahead of tomorrow's deadline...