Demystifying Trade Signals:

How to Harness Their Power

Trade signals are ubiquitous in the financial world, offered by services, social media channels, and even fellow traders. But how do you, the discerning trader, separate the golden nuggets from the fool’s gold? This article will equip you with the knowledge to assess and leverage trade signals for your benefit.

Understanding the Signal Symphony:

Presentation Styles:

Trade signals come in a multitude of formats, each with its own strengths and weaknesses:

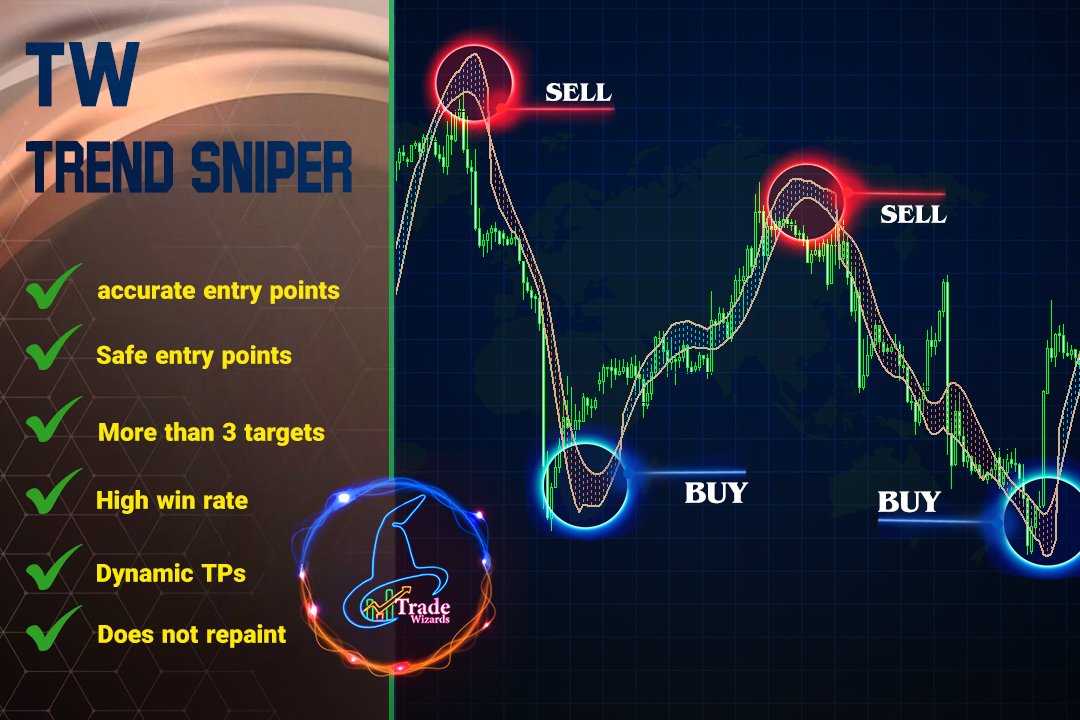

- Technical Analysis-Based: These signals rely on technical indicators and chart patterns to identify entry and exit points. They may come with a simple chart highlighting the relevant indicators or a more detailed breakdown of the trade rationale.

- Fundamental Analysis-Based: These signals focus on company news, economic data releases, and broader market trends. They might include a brief write-up explaining the underlying logic for the trade.

- Pure Price Action: These signals identify entry and exit points based solely on price movements, often using price channels or breakout levels.

- Sentiment-Based Signals: Gauging market mood through social media or surveys, these can be helpful for short-term scalping but susceptible to herd mentality.

- Paid Signal Services: These offer curated signals from experienced traders, often with entry/exit prices and stop-loss levels. However, their effectiveness hinges on the provider’s track record, which can be challenging to verify.

The Two Sides of the Signal Coin

Positive Points:

- Time-Saving: Signals can expedite your research process, especially if you’re strapped for time.

- Expertise Shortcut: They offer insights from potentially experienced traders, allowing you to tap into their knowledge base.

- Emotional Detachment: Signals can help remove emotion from your trading decisions, leading to a more disciplined approach.

Negative Points:

- Accuracy Concerns: Past performance isn’t always indicative of future results. Be wary of services promising guaranteed returns.

- Blind Following: Reliance on signals can hinder your own trading education and risk assessment skills.

- Misaligned Strategies: A signal provider’s trading style might not mesh with your own risk tolerance or investment horizon.

The Art of the Informed Trade

So, how can you truly benefit from trade signals? Here’s a practical approach:

- Educate Yourself: Master the basics of technical and fundamental analysis. This empowers you to understand the rationale behind signals and avoid blindly following them.

- Treat Signals as Prompts: Use them to identify potential trading opportunities, but always conduct your own analysis before committing capital.

- Risk Management is Key: Never rely solely on a signal to make risk management decisions. Always set stop-loss orders and adhere to your pre-defined risk parameters.

the end:

Sharpen Your Skills: View signals as a springboard for your own trading development. Use them to learn new technical indicators or identify fundamental patterns that resonate with your trading style.

By adopting a critical and inquisitive approach, trade signals can become a valuable tool in your trading arsenal. Remember, successful trading is a marathon, not a sprint. Use signals to enhance your knowledge and decision-making, not as a shortcut to riches.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Happy trading

may the pips be ever in your favor!