Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 12288

- Derecelendirme:

- Yayınlandı:

- 2012.02.09 12:30

- Güncellendi:

- 2016.11.22 07:32

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

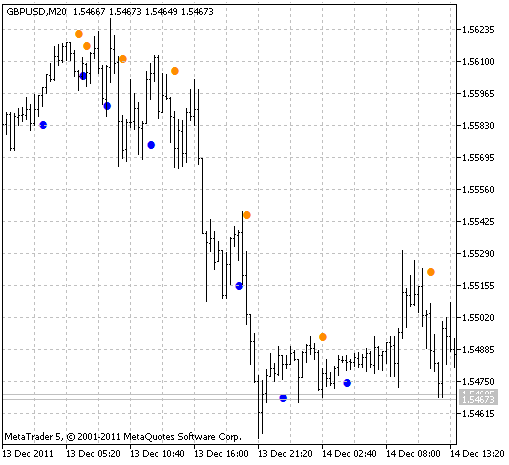

Signal indicator of the popular BrainTrend1 trading system with preliminary price timeseries smoothing.

Many traders experienced difficulties using standard BrainTrendSig1 (BTS1), as it gives many false signals. To solve this problem, it was necessary to use filters and load a chart with additional indicators. In this indicator the issue is solved with the help of JMA smoothing of the price timeseries used in the indicator calculation.

As a result, the indicator has become more stable. JMA-smoothing has greatly lessened the number of false signals. Such intervals are now perceived by the system as flat ones. The system sensitivity to the market volatility can now be managed by "Length_" parameter. Compared with conventional BTS1, the new indicator is a more reliable system. It can even be called a trend tracking system.

Place JMA.mq5 indicator compiled file to MQL5\Indicators.

MetaQuotes Ltd tarafından Rusçadan çevrilmiştir.

Orijinal kod: https://www.mql5.com/ru/code/756

LinearRegression

LinearRegression

When applied to financial markets this method is usually used to determine the moments of prices extreme deviation from a "standard" level.

J_TPO

J_TPO

Normalized oscillator displayed as a histogram.

3X_ParabolicRegression

3X_ParabolicRegression

Two rectilinear channels of standard deviations + curvelinear channel of the parabolic regression with interpolation of a price chart future values.

ATR channel

ATR channel

The channel based on ATR (Average True Range) technical indicator deviations from the moving average.