Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

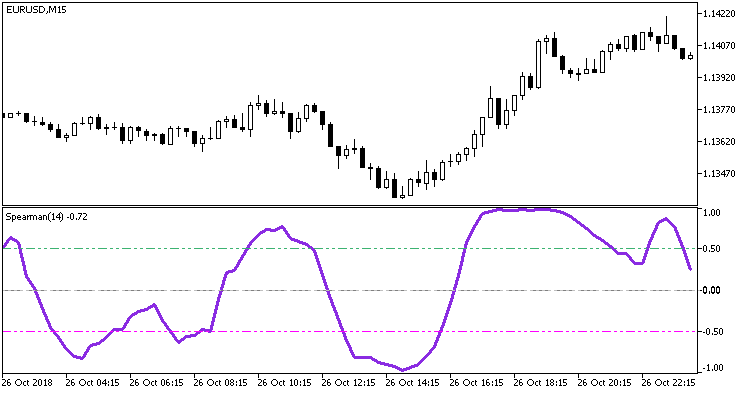

Spearman'ın Sıralama Korelasyon Katsayısı - Spearman'ın Sıralama Korelasyonu - MetaTrader 5 için gösterge

- Yayınlayan:

- Nikolay Kositsin

- Görüntülemeler:

- 129

- Derecelendirme:

- Yayınlandı:

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

Gerçek yazar:

Rosh

Bu gösterge osilatörlerin varyantlarından biridir, ancak stokastik ile karşılaştırıldığında, pivot noktalarında gecikme olmazken daha pürüzsüzdür.

Spearman'ın sıra korelasyon katsayısı, olgular arasındaki ilişkinin istatistiksel olarak incelenmesi amacıyla kullanılan parametrik olmayan bir yöntemdir. Bu durumda, iki sayı serisi arasındaki gerçek korelasyon derecesi belirlenir.

Spearman sıra korelasyon katsayısının pratik hesaplaması aşağıdaki adımları içerir:

- İşaretlerin her birini artan (veya azalan) sırada sıra numaralarıyla (rütbe) eşleştirin;

- Eşleşen her bir değer çiftinin sıra farklarını belirleyin;

- Her bir farkın karesini alın ve sonuçları özetleyin;

- Formülü kullanarak sıra korelasyon katsayısını hesaplayın:

![]()

eşleştirilmiş gözlemlerin sayısıdır.

eşleştirilmiş gözlemlerin sayısıdır.

Sıralama korelasyon katsayısını kullanırken, işaretler arasındaki ilişkinin yakınlığını koşullu olarak değerlendirin; katsayının 0,3 ve daha düşük değerlerini ilişkinin zayıf yakınlığının göstergeleri; 0,4'ten büyük ancak 0,7'den küçük değerleri ilişkinin orta derecede yakınlığının göstergeleri ve 0,7 ve daha büyük değerleri ilişkinin yüksek yakınlığının göstergeleri olarak kabul edin.

.

Spearman'ın sıra korelasyon katsayısının gücü, parametrik korelasyon katsayısınınkinden biraz daha düşüktür. Az sayıda gözlem olduğunda sıra korelasyon katsayısını kullanmak mantıklıdır.

Bu yöntem sadece nicel olarak ifade edilen veriler için değil, aynı zamanda kaydedilen değerlerin farklı yoğunluktaki tanımlayıcı özelliklerle tanımlandığı durumlarda da kullanılabilir. Açıklama burada alınmıştır.

Hesaplama algoritmasını etkileyen tek harici parametre rangeN'dir, bir model aradığımız çubuk sayısını belirtir. Eğer rangeN = 14 ise, o zaman Close[i], Close[i+1], ... dizisini alırız. Close[i+rangeN-1] dizisini alır ve bunlar için bir sıra dizisi oluştururuz, yani bu diziyi sıralarsak her kapanış fiyatının nerede olduğunu belirleriz. Bu durumda, gerçek bir grafiği monoton olarak artan bir grafikle karşılaştırdığımız ortaya çıkar.

Yön parametresi, azalan (true) veya artan (false) olarak sıralama anlamına gelir. True daha tanıdık bir resim verir, false ise ayna görüntüsü verir.

CalculatedBars parametresi, CPU kaynaklarından tasarruf etmek amacıyla hesaplamanın gerçekleştirildiği çubuk sayısını sınırlamak için tanıtılmıştır (ancak buna gerek yoktu). Sıfıra eşit bir değer, mevcut tüm geçmiş için hesaplama anlamına gelir. Maxrange = 30 parametresi maksimum hesaplama süresini ayarlar. Bu da kaynakları korumak için getirilmiştir. Belki birilerinin buna ihtiyacı olur.

Spearman'ın Sıralama Korelasyonu göstergesi

MetaQuotes Ltd tarafından Rusçadan çevrilmiştir.

Orijinal kod: https://www.mql5.com/ru/code/460

i-Sadukey_v1

i-Sadukey_v1

Dijital bir filtreye dayanan bu gösterge trend yönünü gösterir.

Salgın Tüccarı 1.0

Salgın Tüccarı 1.0

Breakout Trader 1.0, aralıktan kopmaların ticaretini yapar.

ColorMomentum_AMA

ColorMomentum_AMA

Momentum göstergelerine ve Kaufman uyarlamalı ortalamaya dayalı renk histogramı.

Tuyul Uncensored

Tuyul Uncensored

try to imitate trading system using expert advisor