Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Yayınlayan:

- Nikolay Kositsin

- Görüntülemeler:

- 14002

- Derecelendirme:

- Yayınlandı:

- 2011.09.14 12:46

- Güncellendi:

- 2016.11.22 07:32

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

Real author:

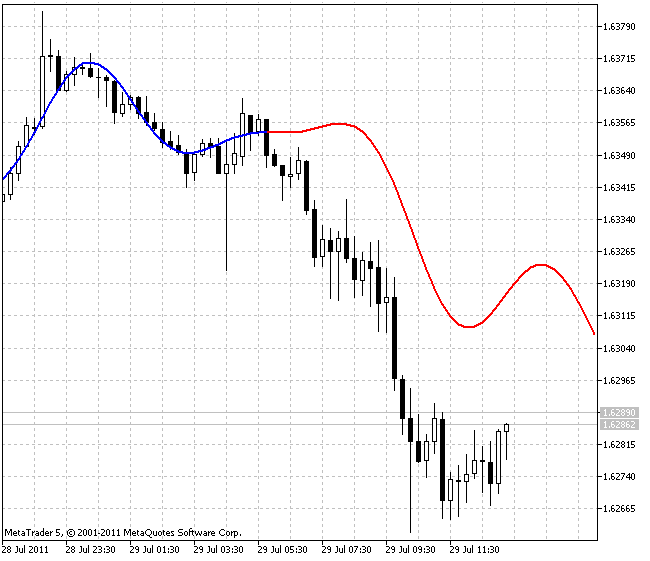

Extrapolator is a result of a long-term research in the field of Timeseries Forecasting. This indicator forecasts future price behavior. The indicator draws two lines: the blue one shows model prices on training bars, the red one shows predicted future prices.

The indicator is based on several methods that can be selected by the Method input variable:

- Fourier's series extrapolation; the frequencies are calculated using Quinn-Fernandes Algorithm;

- Autocorrelation Method;

- Weighted Burg Method;

- Burg Method with Helme-Nikias weighting function;

- Itakura-Saito (geometric) method;

- Modified covariance method.

Methods 2-6 are linear prediction methods. Linear prediction is based on finding of future values as linear functions of previous values. Assume that we have the x[0]..x[n-1] price range where the older index corresponds to more recent prices.

Forecasting of the x[n] future price is calculated as

x[n] = -Sum(a[i]*x[n-i], i=1..p)

where:

- a[i=1..p] - model ratios;

- p - model structure.

Named methods 2-6 find the a[] ratios by decreasing a mean-root-square error on the last training n-p bars. Of course, zero error forecast on training bars can be achieved by solving previously mentioned linear equation system directly at n=2*p using the Levinson-Durbin algorithm. Such a forecast method is called Prony Method. Its drawback is unstable forecasts of the future values of the range. Therefore, this method is not included.

Other input data are:

- LastBar - last bar index at previous data;

- PastBars - number of previous bars used to predict future values;

- LPOrder - linear module structure as a share from the number of previous bars (0..1);

- FutBars - number of future bars in a forecast;

- HarmNo - maximum number of frequencies for Method 1 (0 selects all frequencies);

- FreqTOL - measure of inaccuracy in frequencies calculation for Method 1 (>0.001 may not converge);

- BurgWin - weighing function index for Method 2 (0=Rectangular, 1=Hamming, 2=Parabolic);

This indicator was first implemented in MQL4 and published in Code Base at mql4.com 9.12.2008.

MetaQuotes Ltd tarafından Rusçadan çevrilmiştir.

Orijinal kod: https://www.mql5.com/ru/code/412

JJurX

JJurX

Slow adaptive trend line with ultralinear and JMA smoothings.

2pbIdealMA

2pbIdealMA

2pbIdeal1MA.mq5 and 2pbIdeal3MA.mq5 indicators are the moving averages with the smoothing algorithm developed by Neutron.

Go

Go

The simplest trend indicator.

JMA adaptive average

JMA adaptive average

Using JMA adaptive moving average is the best way to smooth price ranges with a minimum time lag.