Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 12598

- Derecelendirme:

- Yayınlandı:

- 2018.07.19 16:26

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

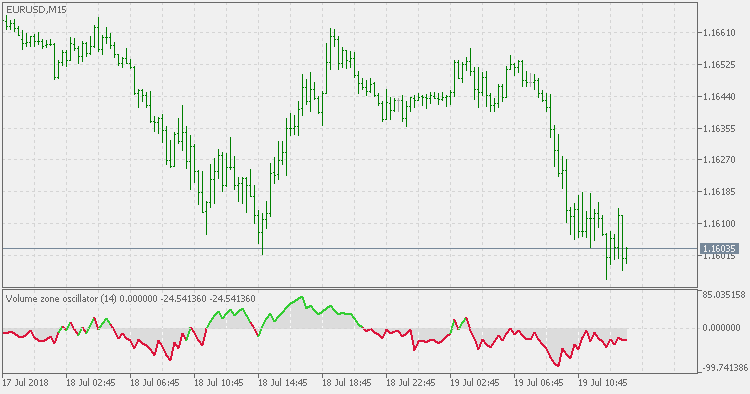

Indicator is based on the "In The Volume Zone" article by Walid Khalil and David Steckler.

An axiom of technical analysis states that with few exceptions, all technical indicators can be classified as either trending or oscillating (non-trending) in their design. This new indicator, the Volume Zone Oscillator (VZO), addresses both. In his book Technical Analysis Of The Financial Markets, John J. Murphy explains that using oscillators provides three benefits:

- Overbought and oversold conditions warn that price trend is overextended and vulnerable.

- Divergence between oscillator and price action shows hidden strength or weakness in the market, which is not apparent in the price action.

- The crossing of the zero line can give an important trading signal.

WPR Candles

WPR Candles

This indicator is a variation of a well known WPR (Williams Percent Range) indicator with 4 WPR values combined into "candles".

Heiken Ashi Smoothed - Binary

Heiken Ashi Smoothed - Binary

Unlike the Heiken Ashi Smoothed, this indicator is displaying 2 values only: +1 for trend up and -1 for trend down, thus making it suitable for usage from experts.

Volume Zone Oscillator - Floating Levels

Volume Zone Oscillator - Floating Levels

Compared to the Volume Zone Oscillator indicator, this version is additionally using floating levels to determine the trend.

QQE New

QQE New

Compared to the original QQE indicator, this version instead of using trailing levels uses fixed levels to estimate overbought and oversold conditions.